KABOOM!!! This will send out shock waves.

After last week’s lawsuit filed on behalf of investors for possible securities fraud violations against DJSP Enterprises and another pending. I present to you another Class Action filed 7/26/2010 this time against the Law Offices of David J. Stern P.A., David J. Stern and MERSCORP, Inc..

Mr. Trent totally “gets it” and in this complaint he outlines and points out what we all have a hard time piecing together.

Here are excerpts of the complaint:

Beginning in or about 1999, the Defendant Firm joined with Defendant Merscorp, Inc., and other conspirators in the fraudulent scheme and RICO enterprise herein complained of. The employees of the Defendant Firm, including many licensed attorneys, have become skilled in using the artifice of MERS to sabotage the judicial process to the detriment of borrowers, and, over the past several years, have routinely relied upon MERS to do just that.

As Stern boasted to a room of investors at a recent promotional event, recent “direct source initiatives” by the larger lenders increasingly enable the Defendant Firm, DJSP, and other entities recently formed by Stern to take mortgages “from cradle to the grave.”

The whole purpose of MERS is to allow “servicers” to pretend as if they are someone else: the “owners” of the mortgage, or the real parties in interest. In fact they are not. The standard MERS/Stern complaint contains a lie about this very subject. While the title of the standard complaint makes reference to “lost loan documents,” in the body of the standard complaint, the Defendant Firm alleges that the plaintiff is the “owner and holder” of the note and mortgage. Both cannot be true unless the words used are given new meanings.

With the oversight of Defendant Merscorp and its unknown principals, the MERS artifice and enterprise evolved into an “ultra-fictitious” entity, which can also be understood as a “meta-corporation.” To perpetuate the scheme, MERS was and is used in a way so that to the average consumer, or even legal professional, can never determine who or what was or is ultimately receiving the benefits of any mortgage payments. The conspirators set about to confuse everyone as to who owned what. They created a truly effective smokescreen which has left the public and most of the judiciary operating “in the dark” through the present time.

The preparation, filing, and prosecution of the complaints to “Foreclose Mortgage and to Enforce Lost Loan Documents” were each predicate acts in the pattern of racketeering activity herein complained of, and were actions taken in furtherance of the MERS enterprise. The actions could not have been brought by the Defendant Firm without the MERS artifice and the ability to generate any necessary “assignment” which flowed from it.

By engaging in a pattern of racketeering activity, specifically “mail or wire fraud,” the Defendants subject to this Count participated in a criminal enterprise affecting interstate commerce. In addition to the altered postmarks described below, the mail fraud is the sending of the fraudulent assignments and pleadings to the clerks of court, judges, attorneys, and defendants in foreclosure cases. These Defendants intentionally participated in a scheme to defraud others, including the Plaintiff and the other Class Members, and utilized the U.S. Mail to do so.

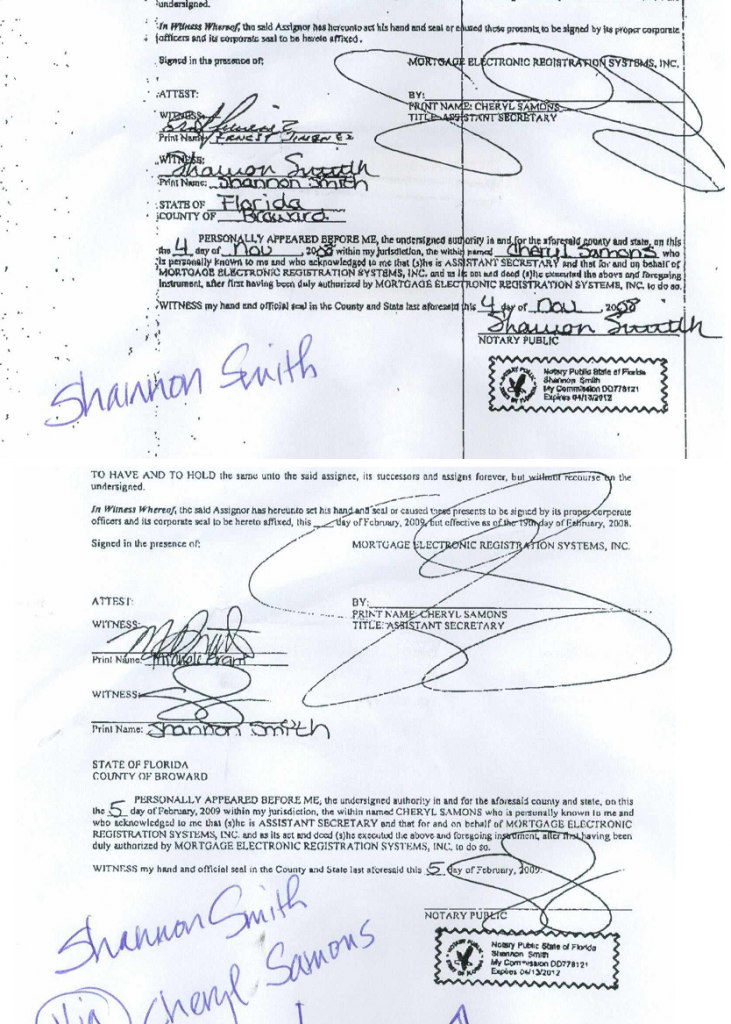

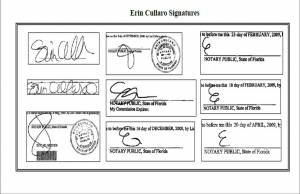

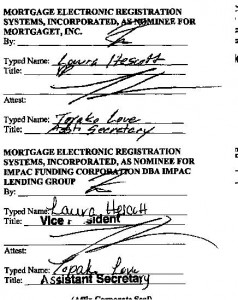

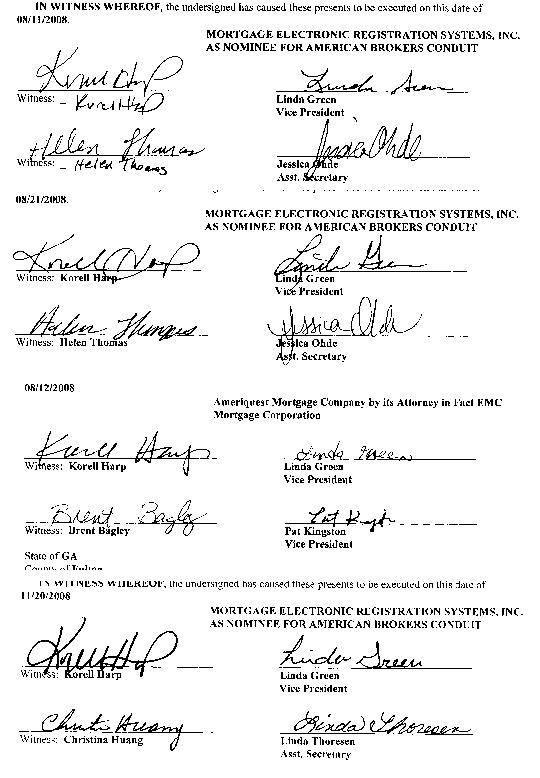

These documents were executed by an “Assistant Secretary” or “Vice President,” apparently of MERS. In reality, the person executing the assignments had no knowledge whatsoever of the truth of their contents, and was simply an employee of the Defendant Firm.

Altering common hardware and/or software used by the Defendant Firm so that envelopes used to mail important legal documents, such as final judgments, to defendants contain no date of mailing in the postmark and intentionally delaying in sending the mail until defendants have lost their rights. (Exhibit F). These predicate acts constitute “mail fraud.”

Here is an explanation from David J. Stern of the continuing foreclosure rout:

One of my favorite questions from one of my believers, one of my investors on the first call-in, “What inning are we in? If this was a baseball game, what inning are we in?” And my response is, we’re only in the 2nd inning. We still have 3 innings of foreclosures left, and after the foreclosures, we have 3 innings of REO liquidation and as the REO liquidations pan out, we get into the re-fi and we get into the origination.

[ . . . ]

So yeah, we’re in the 2nd inning, but guess what – when we get to the 9th inning, it’s going to be a doubleheader and we got a second game coming. So when people say, “Oh my God, the economy is bad!” I’m like, “Oh my God, it’s great.” I mean, I hate to hear people are losing their homes and credit isn’t available and credit is such that they can’t re-fi, but if you are in our niche, it’s what we do and it’s what we want to see.

[ipaper docId=34959419 access_key=key-zii1wo2j5d6enxmd05b height=600 width=600 /]

Thank you attorney Kenneth Eric Trent P.A. from Ft. Lauderdale , FL !