More of MESCORPS “Shareholders”. Make sure you catch their “old evidence” below…and have a barf bag because this is going to make you sick!

.

By ABIGAIL FIELD Posted 6:29 PM 10/01/10

Documents submitted to a court are supposed to be true as submitted. As an attorney, If I file a document with a court in which I swore I personally verified that the information contained within the document is true, and I didn’t actually do that, I’d get in real trouble. It’s simple: That’s fraud in the eyes of the court.

GMAC, JPMorgan Chase and Bank of America recently admitted that their employees routinely sign thousands of documents without verifying what they’re signing. Those documents are then submitted to courts as if the documents were true, to enable the banks to foreclose on delinquent properties. Wells Fargo and CitiMortgage told the New York Times their employees do not engage in similar practices. Yet new evidence shows they do.

Confusion at Wells Fargo

Herman John Kennerty of Wells Fargo has given a deposition describing the department he oversees for Wells Fargo. It’s a department dedicated to simply signing documents. Kennerty testified that he signs 50 to 150 documents a day, verifying only the date on each. What else might he want to verify? Well, in one document he signed, he supposedly transferred the mortgage from Washington Mutual Bank FA to Wells Fargo on July 12, 2010. But that’s impossible, since Washington Mutual Bank FA changed its name in 2004, and by any name WaMu ceased to exist in 2008, when the FDIC took it over. Making the document even less comprehensible, the debtor had declared bankruptcy a month earlier, according to Linda Tirelli, who represented the debtor. Why would Wells Fargo want a mortgage from someone in bankruptcy? Finally, Tirelli pointed out that the papers Wells Fargo filed included a different transfer of the mortgage dated three days before the debtor took out the loan. The documents are a mess, yet Kennerty signed them regardless.

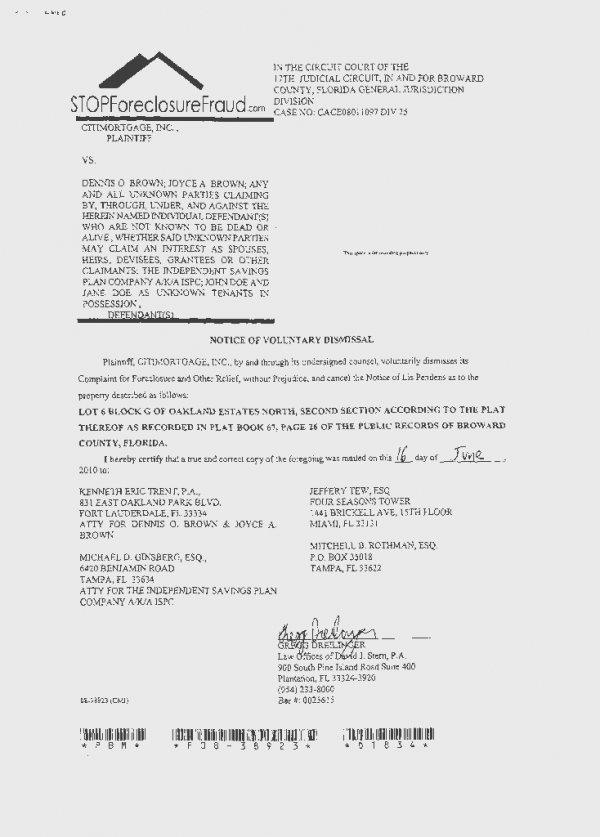

Legal Nonsense at CitiMortgage

Similarly, one M. Matthews signed a number of documents that CitiMortgage has used to try to foreclose on properties. While Matthews may or may not sign hundreds of documents a day — I have not yet found a deposition in which he swears that he does — he certainly does not verify the contents of the documents he’s signing. For example, he signed a document supposedly transferring a mortgage from Lehman Brothers to Citi in 2009. It’s hard to see how that’s possible, since Lehman had already ceased to exist. When confronted with its nonsensical filing, Citigroup decided not to foreclose. Instead, it gave the homeowner a meaningful mortgage modification–$15,000 principal reduction, plus a 30 year fixed mortgage at 3%. Tirelli, who represented the debtor in that case too, notes that she sees bad documents in the vast majority of cases, and she keeps files of “robosigned” documents.

It’s true that in both the WaMu and Lehman Brothers documents, the signers were officially representing an entity called MERS and acting as the “nominee” of WaMu and the “nominee” of Lehman Brothers. But that doesn’t change the fraudulent nature of the documents as filed. MERS can’t continue to be the nominee of an entity that doesn’t exist. Moreover, MERS can’t assign something it doesn’t have, and MERS itself will admit it doesn’t own the underlying note or mortgage.

Possible Sanctions for JPMorgan Chase

Wells Fargo and CitiMortgage aren’t the only big banks to misrepresent their practices in the media; JPMorgan Chase told the New York Times that it had not withdrawn any documents in a pending case. However, Chase has in fact withdrawn robosigned documents in a case Tirelli is currently defending. Chase now faces possible sanctions in the case.

Why are the big, sophisticated banks submitting such problematic documents to the courts? The key reason is that sometimes when a bank wants to foreclose, it has to prove it actually has the right to foreclose — that it owns the note and accompanying mortgage. Unfortunately for the banks, the securitization of mortgages and the changes in property ownership documentation that accompanied it make it hard for the banks to establish clean chains of title and produce original documents. Hard, that is, in an environment where a massive number of foreclosures must be started and completed in a timely manner.

See full article from DailyFinance: http://srph.it/amvWqK

See full article from DailyFinance: http://srph.it/amvWqK

.

RELATED:

HEY NY TIMES…’NO PROOF’ JEFFREY STEPHAN HAS AUTHORITY TO EXECUTE AFFIDAVIT FOR WELLS FARGO

.

Homeowner fights foreclosure in lawsuit claiming documents are fraudulent

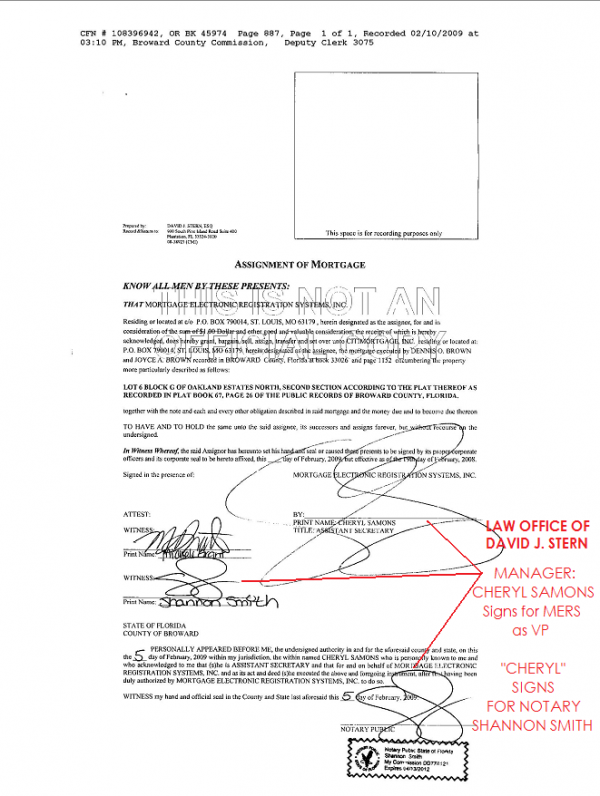

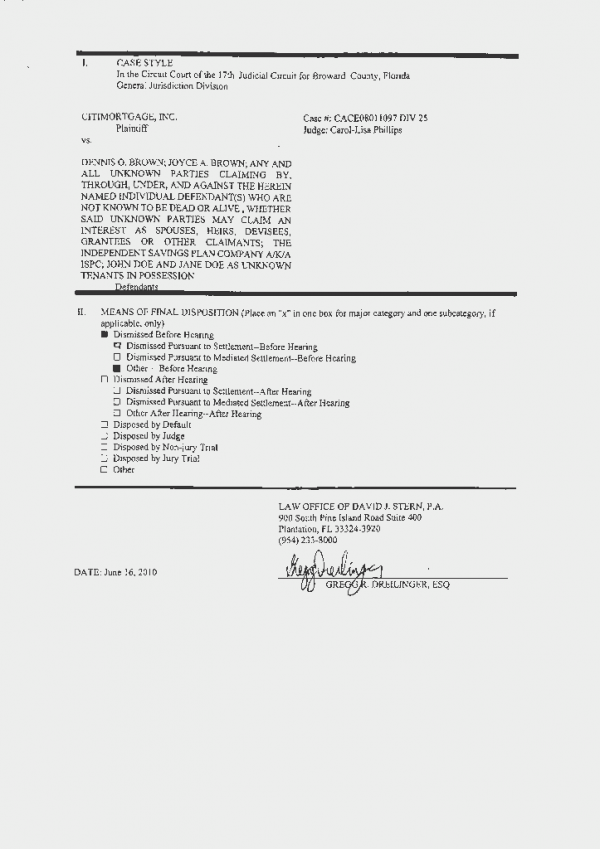

THE ACTUAL DEPOSITION IN THIS CASE CITMORTGAGE v. BROWN

DEPOSITION OF NOTARY SHANNON SMITH OF THIS CASE

[ipaper docId=34340050 access_key=key-1eb2fh5kgjs1rbxhfwhq height=600 width=600 /]

MORE ON THIS CASE & FIRM BELOW

_________________

Take Two: *New* Full Deposition of Law Office of David J. Stern’s Cheryl Samons

_________________

Law Offices of David J. Stern, MERS | Assignment of Mortgage NOT EXECUTED but RECORDED

_________________

Cheryl Samons | No Signature, No Notary, 1 Witness…No Problem!

_________________

STERN’S CHERYL SAMONS| SHANNON SMITH Assignment Of Mortgage| NOTARY FRAUD!

_________________________________________________

MAESTRO PLEASE…AND THE WINNER OF THE “MOST JOB TITLES” CONTEST IS…

JOHN KENNERTY, a/k/a HERMAN JOHN KENNERTY

JOHN KENNERTY a/k/a Herman John Kennerty has been employed for many years in the Ft. Mill, SC offices of America’s Servicing Company, a division of Wells Fargo Bank, N.A. He signed many different job titles on mortgage-related documents, often using different titles on the same day. He often signs as an officer of MERS (“Mortgage Electronic Registration Systems, Inc.”) On many Mortgage Assignments signed by Kennerty, Wells Fargo, or the trust serviced by ASC, is shown as acquiring the mortgage weeks or even months AFTER the foreclosure action is filed.

Titles attributed to John Kennerty include the following:

Asst. Secretary, MERS, as Nominee for 1st Continental Mortgage Corp.;

Asst. Secretary, MERS, as Nominee for American Brokers Conduit;

Asst. Secretary, MERS, as Nominee for American Enterprise Bank of Florida;

Asst. Secretary, MERS, as Nominee for American Home Mortgage;

Asst. Secretary, MERS, as Nominee for Amnet Mortgage, Inc. d/b/a American Mortgage Network of Florida;

Asst. Secretary, MERS, as Nominee for Bayside Mortgage Services, Inc.;

Asst. Secretary, MERS, as Nominee for CT Mortgage, Inc.;

Asst. Secretary, MERS, as Nominee for First Magnus Financial Corporation, an Arizona Corp.;

Asst. Secretary, MERS, as Nominee for First National Bank of AZ;

Asst. Secretary, MERS, as Nominee for Fremont Investment & Loan;

Asst. Secretary, MERS, as Nominee for Group One Mortgage, Inc.;

Asst. Secretary, MERS, as Nominee for Guaranty Bank;

Asst. Secretary, MERS, as Nominee for Homebuyers Financial, LLC;

Asst. Secretary, MERS, as Nominee for IndyMac Bank, FSB, a Federally Chartered Savings Bank (in June 2010);

Asst. Secretary, MERS, as Nominee for Irwin Mortgage Corporation;

Asst. Secretary, MERS, as Nominee for Ivanhoe Financial, Inc., a Delaware Corp.;

Asst. Secretary, MERS, as Nominee for Mortgage Network, Inc.;

Asst. Secretary, MERS, as Nominee for Ohio Savings Bank;

Asst. Secretary, MERS, as Nominee for Paramount Financial, Inc.;

Asst. Secretary, MERS, as Nominee for Pinnacle Direct Funding Corp.;

Asst. Secretary, MERS, as Nominee for RBC Mortgage Company;

Asst. Secretary, MERS, as Nominee for Seacoast National Bank;

Asst. Secretary, MERS, as Nominee for Shelter Mortgage Company, LLC;

Asst. Secretary, MERS, as Nominee for Stuart Mortgage Corp.;

Asst. Secretary, MERS, as Nominee for Suntrust Mortgage;

Asst. Secretary, MERS, as Nominee for Transaland Financial Corp.;

Asst. Secretary, MERS, as Nominee for Universal American Mortgage Co., LLC;

Asst. Secretary, MERS, as Nominee for Wachovia Mortgage Corp.;

Vice President of Loan Documentation, Wells Fargo Bank, N.A.;

Vice President of Loan Documentation, Wells Fargo Bank, N.A., successor by merger to Wells Fargo Home Mortgage, Inc. f/k/a Norwest Mortgage, Inc.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Recent Comments