I have the perfect solution…Why not give the current homeowner a “short sale” price modification and call it a happy ending to all? Buyers are too wise nowadays.

Besides most future homeowners will have a defective title or will have an F in the past!

Here’s an example why it makes sense to work with the current owner:

LPS using their MN address purchased my home at auction for 75% discount put it on the market for about 80% and made a few grand from the highest contract that was accepted. It benefited no one!

Now if they use my solution not only will the investors save on the fees they payout to the foreclosure mills but also on the late fees the homeowner accrues…see isn’t this economic sense for everyone?

By John Gittelsohn and Kathleen M. Howley – Sep 15, 2010 12:14 PM ET

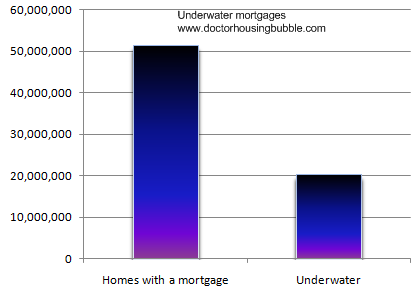

The slide in U.S. home prices may have another three years to go as sellers add as many as 12 million more properties to the market.

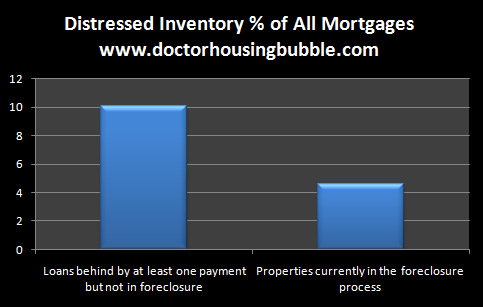

Shadow inventory — the supply of homes in default or foreclosure that may be offered for sale — is preventing prices from bottoming after a 28 percent plunge from 2006, according to analysts from Moody’s Analytics Inc., Fannie Mae, Morgan Stanley and Barclays Plc. Those properties are in addition to houses that are vacant or that may soon be put on the market by owners.

“Whether it’s the sidelined, shadow or current inventory, the issue is there’s more supply than demand,” said Oliver Chang, a U.S. housing strategist with Morgan Stanley in San Francisco. “Once you reach a bottom, it will take three or four years for prices to begin to rise 1 or 2 percent a year.”

Rising supply threatens to undermine government efforts to boost the housing market as homebuyers wait for better deals. Further price declines are necessary for a sustainable rebound as a stimulus-driven recovery falters, said Joshua Shapiro, chief U.S. economist of Maria Fiorini Ramirez Inc., a New York economic forecasting firm.

Sales of new and existing homes fell to the lowest levels on record in July as a federal tax credit for buyers expired and U.S. unemployment remained near a 26-year high. The median price of a previously owned home in the month was $182,600, about the level it was in 2003, the National Association of Realtors said.

Fannie Mae Forecast

Fannie Mae, the largest U.S. mortgage finance company, today lowered its forecast for home sales this year, projecting a 7 percent decline from 2009. A drop in demand after the April 30 tax credit expiration “suggests weakening home prices” in the third quarter, according to the report.

There were 4 million homes listed with brokers for sale as of July. It would take a record 12.5 months for those properties to be sold at that month’s sales pace, according to the Chicago- based Realtors group.

“The best thing that could happen is for prices to get to a level that clears the market,” said Shapiro, who predicts prices may fall another 10 percent to 15 percent. “Right now, buyers know it hasn’t hit bottom, so they’re sitting on the sidelines.”

About 2 million houses will be seized by lenders by the end of next year, according to Mark Zandi, chief economist of Moody’s Analytics in West Chester, Pennsylvania. He estimates prices will drop 5 percent by 2013.

‘Lost Decade’

After reaching bottom, prices will gain at the historic annual pace of 3 percent, requiring more than 10 years to return to their peak, he said.

“A long if not lost decade,” Zandi said.

Continue reading….BLOOMBERG

Continue reading….BLOOMBERG

.

.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Recent Comments