HSBC BANK USA v. THOMPSON

2010 Ohio 4158

HSBC Bank USA, N.A., as Indenture Trustee for the Registered Noteholders of Renaissance Home Equity Loan Trust 2007-1, Plaintiff-Appellant,

v.

Jamie W. Thompson, et al., Defendants-Appellees.

Appellate No. 23761.

Court of Appeals of Ohio, Second District, Montgomery County.

Rendered on September 3, 2010.

Benjamin D. Carnahan, Atty. Reg. #0079737, Shapiro, Van Ess, Phillips & Barragate, LLP, 4805 Montgomery Road, Norwood, OH 45212 and Brian P. Brooks, (pro hac vice), O’Melveny & Myers LLP, 1625 Eye Street, N.W., Washington, DC 20006-4001, Attorneys for Plaintiff-Appellant, HSBC Bank.

Amy Kaufman, Atty. Reg. #0073837, 150 East Gay Street, 21st Floor, Columbus, Ohio 43215, Attorney for Appellee, Department of Taxation.

Andrew D. Neuhauser, Atty. Reg. #0082799, and Stanley A. Hirtle, Atty. Reg. #0025205, 525 Jefferson Avenue, Suite 300, Toledo, OH 43604, Attorneys for Amici Curiae, Advocates for Basic Legal Equality, et al.

Richard Cordray, Atty. Reg. #0038034, by Susan A. Choe, Atty. Reg. #0067032, Mark N. Wiseman, Atty. Reg. #0059637, and Jeffrey R. Loeser, Atty. Reg. #0082144, Attorney General’s Office, 30 E. Broad Street, 14th Floor, Columbus, OH 43215, Attorneys for Amicus Curiae, Ohio Attorney General Richard Cordray.

Andrew M. Engel, Atty. Reg. #0047371, 3077 Kettering Boulevard, Suite 108, Moraine, Ohio 45439, Attorney for Defendant-Appellee Jamie W. Thompson.

Colette Carr, Atty. Reg. #00705097, 301 W. Third Street, Fifth Floor, Dayton, OH 45422, Attorney for Appellee, Montgomery County Treasurer.

OPINION

FAIN, J.

{¶ 1} Plaintiff-appellant HSBC Bank USA, N.A., as Indenture Trustee for the Registered Noteholders of Renaissance Home Equity Loan Trust 2007-1 (HSBC), appeals from a judgment of the trial court, which rendered summary judgment and dismissed HSBC’s complaint for foreclosure, without prejudice. HSBC contends that the trial court improperly treated the date the assignment of mortgage was executed as dispositive of the claims before it. HSBC further contends that the trial court’s decision is erroneous, because it is premised on the court’s having improperly struck the affidavit of Chomie Neil, and having failed to consider Neil’s restated affidavit.

{¶ 2} Two briefs of amicus curiae have been filed in support of the position of defendants-appellees Jamie W. Thompson, Administratrix of the Estate of the Estate of Howard W. Turner, and Jamie W. Thompson (collectively Thompson). One brief was filed by the Ohio Attorney General Richard Cordray (Cordray). The other brief was filed by the following groups: Advocates for Basic Legal Equality; Equal Justice Foundation; Legal Aid Society of Southwest Ohio; Northeast Ohio Legal Aid Services; Ohio Poverty Law Center; and Pro Seniors, Inc. (collectively Legal Advocates). We have considered those briefs, all of which have been helpful, in deciding this appeal.

{¶ 3} We conclude that the trial court did not abuse its discretion in striking Neil’s affidavit, because of defects in the affidavit. We further conclude that the trial court did not abuse its discretion in failing to consider Neil’s restated affidavit, in the course of deciding objections to the magistrate’s decision, because HSBC failed to indicate why it could not have properly submitted the evidence, with reasonable diligence, before the magistrate had rendered a decision in the matter. Finally, we conclude that the trial court did not err in rendering summary judgment against HSBC, and dismissing the foreclosure action for lack of standing. HSBC failed to establish that it was the holder of a promissory note secured by a mortgage. Accordingly, the judgment of the trial court is Affirmed.

I

{¶ 4} On January 27, 2007, Howard Turner borrowed $85,000 from Fidelity Mortgage, a division of Delta Funding Corporation (respectively, Fidelity and Delta). Turner signed a note promising to repay Fidelity in monthly payments of $786.44 for a period of thirty years. The loan number on the note is 0103303640, and the property listed on the note is 417 Cushing Avenue, Dayton, Ohio, 45429.

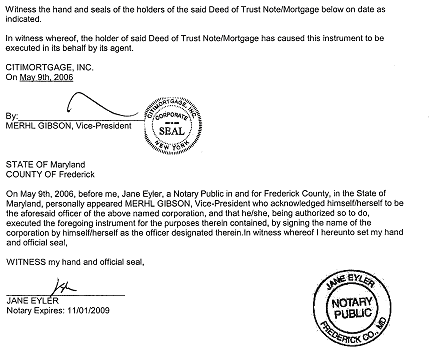

{¶ 5} In order to secure the loan, Turner signed a mortgage agreement, which names Fidelity as the “Lender,” and Mortgage Electronic Registration Systems, Inc. (MERS) as a nominee for Fidelity and Fidelity’s successors and assigns. The mortgage states that Turner, as borrower, “does hereby mortgage, grant and convey to MERS (solely as nominee for Lender and Lender’s successors and assigns) and to the successors and assigns of MERS, the following described property in the County of Montgomery, * * * which currently has the address of 417 Cushing Avenue, Dayton, Ohio 45429.” The mortgage was recorded with the Montgomery County Recorder on February 20, 2007, as MORT-07-014366.

{¶ 6} The entire amount of the loan proceeds was not disbursed. Fidelity placed $5,000 in escrow after closing, until certain repairs (roofing and heating) were made to the house. The required deposit agreement indicated that Turner had three months to make the repairs, and that if the items were not satisfactorily cleared, Fidelity had the option of satisfying the items from the funds held, of extending the time to cure, or of taking any other steps Fidelity felt necessary to protect the mortgage property, including but not limited to, paying down the principal of the loan with the deposit.

{¶ 7} Turner made timely payments through June 2007. However, he died in late July 2007, and no further payments were made. HSBC filed a foreclosure action on November 8, 2007, alleging that it was the owner and holder of Turner’s promissory note and mortgage deed and that default had occurred. HBSC sued Thompson, as administratrix of her father’s estate, and individually, based on her interest in the estate.

{¶ 8} HSBC attached purported copies of the note and mortgage agreement to the complaint. The note attached to the complaint is also accompanied by two documents that are each entitled “Allonge.” The first allonge states “Pay to the Order of _________ without recourse,” and is signed on behalf of Delta Funding Corporation by Carol Hollman, Vice-President. The second allonge states “Pay to the Order of Delta Funding Corporation” and is signed by Darryl King, as “authorized signatory” for Fidelity Mortgage.

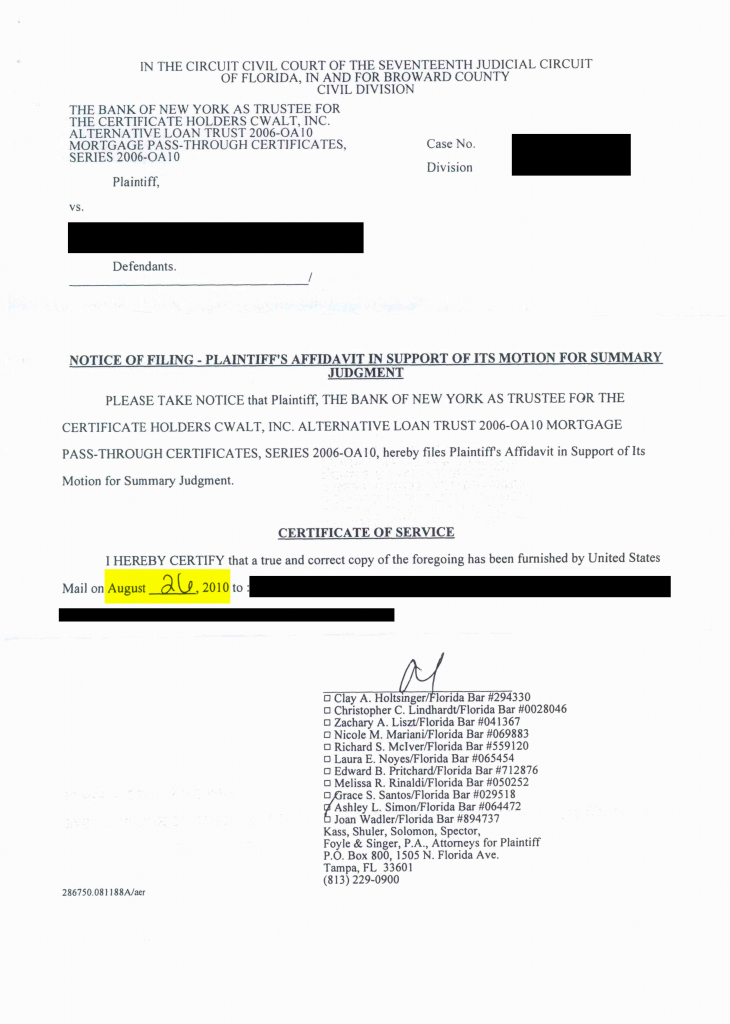

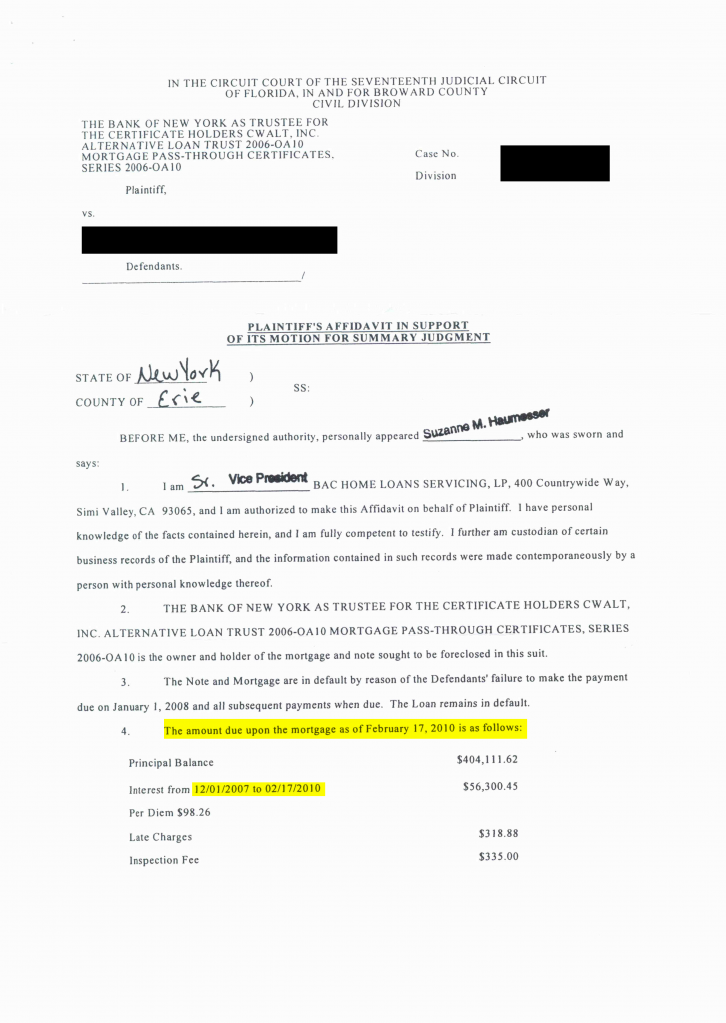

{¶ 9} In January 2008, Thompson filed an answer, raising, among other defenses, the fact that the action was not being prosecuted in the name of the real party in interest. HSBC subsequently filed a motion for summary judgment in February 2007, supported by the affidavit of an officer of Ocwen Loan Servicing, LLC (Ocwen), which was a servicing agent for HSBC.

{¶ 10} Thompson filed a response to the summary judgment motion, pointing out various deficiencies in the affidavit and documents. Thompson further contended that HSBC was not the holder of the mortgage and note, and was not the real party in interest. In addition, Thompson filed an amended answer and counterclaim, contending that HSBC was not the real party in interest, and that HSBC had made false, deceptive, and misleading representations in connection with collecting a debt, in violation of Section 1692, Title 15, U.S. Code (the Fair Debt Collection Practices Act, or FDCPA).

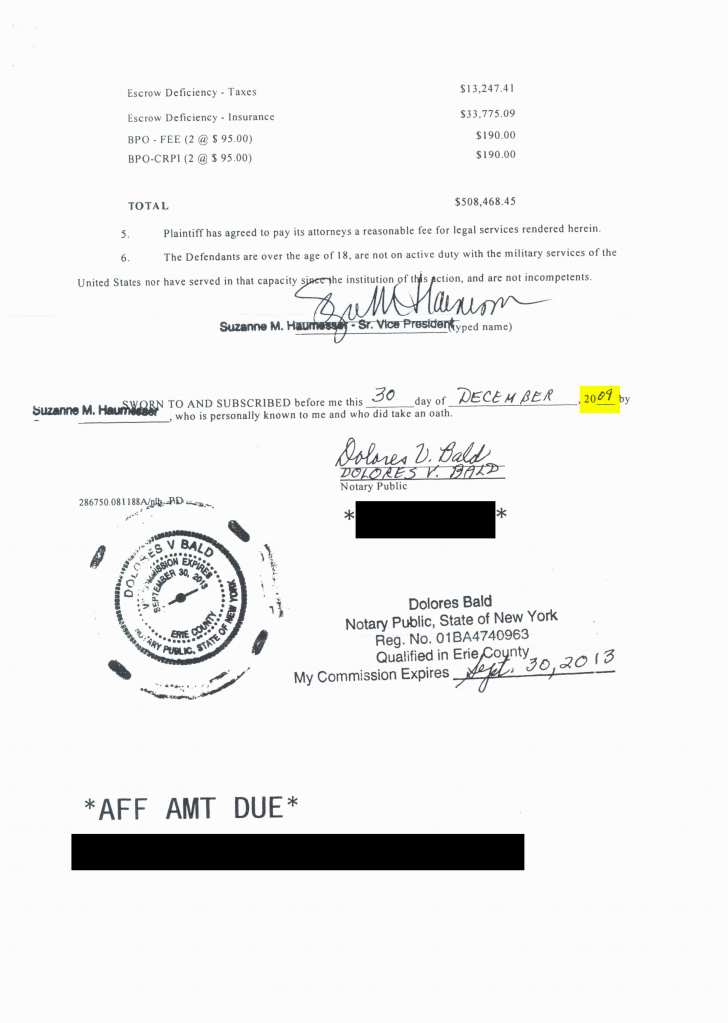

{¶ 11} HSBC withdrew its motion for summary judgment in March 2008. In November 2008, the trial court vacated the trial date and referred the matter to a magistrate. HSBC then filed another motion for summary judgment in January 2009. This motion was supported by the affidavit of Chomie Neil, who was employed by Ocwen as a manager of trial preparation and discovery. Neil averred in the affidavit that he had executed it in Palm Beach, Florida. However, the notation at the top of the first page of the affidavit and the jurat both state that the affidavit was sworn to and subscribed to in New Jersey, before a notary public.

{¶ 12} Thompson moved to strike the affidavit, contending that it was filled with inadmissible hearsay, contained legal conclusions, and purported to authenticate documents, when no proper documentation had been offered. Thompson also questioned when the affidavit was executed, and whether it had been properly acknowledged, due to the irregularities in execution and acknowledgment. In addition, Thompson responded to the summary judgment motion, contending that HSBC was not the real party in interest and was not the holder of the note, because HSBC’s name was not on the note, and HSBC had failed to provide evidence that it was in possession of the note. In responding to the motion to strike, HSBC contended that the defects in the affidavit were the result of a scrivener’s error. HSBC did not attempt to correct the affidavit.

{¶ 13} In late March 2009, Thompson filed a motion for partial summary judgment against HSBC. The motion was based on the fact that under the allonges, Delta Funding Corporation was the payee of the note. Thompson also noted that MERS failed to assign the mortgage note to HSBC before the action was commenced. Thompson contended that HSBC was not the real party in interest when it filed the lawsuit, and lacked standing to invoke the court’s jurisdiction.

{¶ 14} In May 2009, the magistrate granted Thompson’s motion to strike the affidavit, because the affidavit stated that it had been sworn to in New Jersey, and the affiant declared that the affidavit was executed in Florida. The magistrate also overruled HSBC’s motion for summary judgment, and granted Thompson’s partial motion for summary judgment. The magistrate concluded that HSBC lacked standing because it was not a mortgagee when the suit was filed and could not cure its lack of standing by subsequently obtaining an interest in the mortgage. The magistrate further concluded that there was no evidence properly before the court that would indicate that HSBC was the holder of the promissory note originally executed by Turner. Accordingly, the magistrate held that HSBC’s foreclosure claim should be dismissed without prejudice. Due to factual issues regarding Thompson’s FDCPA counterclaim, HSBC’s motion for summary judgment on the counterclaim was denied.

{¶ 15} HSBC filed objections to the magistrate’s decision, and attached the “restated” affidavit of Neil. The affidavit was identical to what was previously submitted, except that the first page indicated that the affidavit was being signed in Palm Beach County, Florida. The jurat is signed by a notary who appears to be from Florida, although the notary seals on the original and copy that were submitted are not very clear. HSBC did not offer any explanation for the mistake in the original affidavit.

{¶ 16} In November 2009, the trial court overruled HSBC’s objections to the magistrate’s report. The court concluded that the errors in the affidavit were more than format errors. The court further noted that the document became an unsworn statement and could not be used for summary judgment purposes, because the statements were sworn to a notary in a state outside the notary’s jurisdiction. The court also held that, absent Neil’s affidavit, HSBC had failed to provide support for its summary judgment motion. Finally, the court concluded that HSBC failed to provide evidence that it was in possession of the note prior to the filing of the lawsuit, because the Neil affidavit had been struck, and a prior affidavit only verified the mortgage and note as true copies; it did not verify the undated allonges. Accordingly, the trial court dismissed HSBC’s action with prejudice, and entered a Civ. R. 54(B) determination of no just cause for delay.

{¶ 17} HSBC appeals from the judgment dismissing its action without prejudice.

II

{¶ 18} We will address HSBC’s assignments of error in reverse order. HSBC’s Second Assignment of Error is as follows:

{¶ 19} “THE LOWER COURT’S DECISION IS PREMISED ON IMPROPERLY STRIKING MR. NEIL’S AFFIDAVIT AND FAILING TO CONSIDER THE RESTATED AFFIDAVIT.”

{¶ 20} Under this assignment of error, HSBC contends that the errors in Neil’s affidavit were scrivener’s errors that have no bearing on the content of the affidavit. HSBC contends, therefore, that the trial court erred in refusing to consider the affidavit.

{¶ 21} The error, as noted, is that Neil averred that he signed the affidavit in Florida, while the first page and the jurat indicate that the affidavit was executed before a notary public in New Jersey.

{¶ 22} Thompson, Cordray, and Legal Advocates argue that the defect is not merely one of form, because the errors transform the affidavit into an unsworn statement that cannot be used to support summary judgment. The trial court agreed with this argument.

{¶ 23} Legal Advocates also stresses that HSBC was notified of problems with Neil’s affidavit, but made no attempt to cure the defect until after the magistrate had issued an unfavorable ruling. In addition, Cordray notes that the integrity of evidence in foreclosure cases is critical, due to the imbalance between access to legal representation of banks and homeowners. Thompson, Cordray, and Legal Advocates further contend that even if Neil’s affidavit could be considered, it is replete with inadmissible hearsay and legal conclusions, and is devoid of evidentiary value.

{¶ 24} Concerning the form of affidavits, Civ. R. 56(E) provides that:

{¶ 25} “Supporting and opposing affidavits shall be made on personal knowledge, shall set forth such facts as would be admissible in evidence, and shall show affirmatively that the affiant is competent to testify to the matters stated in the affidavit. Sworn or certified copies of all papers or parts of papers referred to in an affidavit shall be attached to or served with the affidavit. The court may permit affidavits to be supplemented or opposed by depositions or by further affidavits. * * *”

{¶ 26} The Supreme Court of Ohio has held that “An affidavit must appear, on its face, to have been taken before the proper officer and in compliance with all legal requisites. A paper purporting to be an affidavit, but not to have been sworn to before an officer, is not an affidavit.” In re Disqualification of Pokorny (1992), 74 Ohio St.3d 1238 (citation omitted). Accord, Pollock v. Brigano (1998), 130 Ohio App.3d 505, 509.

{¶ 27} The affidavit submitted to the magistrate contains irreconcilable conflicts, because the affiant, Neil, states that he executed the affidavit in Florida. In contrast, the jurat, as well as the first page of the affidavit, indicate that the affidavit was signed in New Jersey.

{¶ 28} In Stern v. Board of Elections of Cuyahoga Cty. (1968), 14 Ohio St.2d 175, the Supreme Court of Ohio noted that in common use, a jurat “is employed to designate the certificate of a competent administering officer that a writing was sworn to by the person who signed it. It is no part of the oath, but is merely evidence of the fact that the oath was properly taken before the duly authorized officer.” Id. at 181 (citations omitted).

{¶ 29} In light of the inconsistencies, Neil’s oath could not have been properly taken before a duly authorized officer. Under New Jersey law, a notary public commissioned in New Jersey may perform duties only throughout the state of New Jersey. See N.J. Stat. Ann. 52:7-15. Therefore, a New Jersey notary public could not properly have administered the oath in Florida. A New Jersey notary public also could not properly have certified that the writing was sworn to, when the person signed it in another jurisdiction.

{¶ 30} As support for admission of Neil’s affidavit, HSBC cites various cases that have overlooked technical defects in affidavits. See, e.g., State v. Johnson (Oct. 24, 1997), Darke App. No. 96CA1427 (holding that a “scrivener’s error” was inconsequential and did not invalidate an affidavit), and Chase Manhattan Mtg. Corp. v. Locker, Montgomery App. No. 19904, 2003-Ohio-6665, ¶ 26 (holding that omission of specific date of month on which affidavit was signed was “scrivener’s error” and did not invalidate affidavit, because notary public did include the month and year).

{¶ 31} In Johnson, the error involved a discrepancy between the preamble and the jurat.

{¶ 32} The preamble said the site of the oath was in a particular county, but the notary swore in the jurat that the affidavit had been signed in a different county. The trial court concluded that this was a typographical error, and we agreed. This is consistent with the fact that in Ohio, a notary public may administer oaths throughout the state. See R.C. 147.07. Therefore, even if a discrepancy exists between the location listed in the preamble and the notary’s location, the official status of the affidavit is not affected. In contrast, the affiant in the case before us stated that he signed the affidavit in a different state, where the notary did not have the power to administer oaths. The difference is not simply one of form.

{¶ 33} HSBC contends that the trial court should have accepted the “restated” affidavit that it attached to HSBC’s objections to the magistrate’s decision. The trial court did not specifically discuss the restated affidavit when it overruled HSBC’s objections. We assume, therefore, that the court rejected the affidavit. See, e.g., Maguire v. Natl. City Bank, Montgomery App. No. 23140, 2009-Ohio-4405, ¶ 16, and Takacs v. Baldwin (1995), 106 Ohio App.3d 196, 209 (holding that where a trial court fails to rule on a motion, an appellate court assumes that the matter was overruled or rejected).

{¶ 34} The trial court was not required to consider the restated affidavit, because HSBC failed to explain why the affidavit could not have been properly produced for the magistrate. In this regard, Civ. R. Rule 53(D)(4)(d) provides that:

{¶ 35} “If one or more objections to a magistrate’s decision are timely filed, the court shall rule on those objections. In ruling on objections, the court shall undertake an independent review as to the objected matters to ascertain that the magistrate has properly determined the factual issues and appropriately applied the law. Before so ruling, the court may hear additional evidence but may refuse to do so unless the objecting party demonstrates that the party could not, with reasonable diligence, have produced that evidence for consideration by the magistrate.”

{¶ 36} Well before the magistrate ruled, HSBC was aware that objections had been raised to the affidavit. HSBC made no attempt to submit a corrected document to the magistrate, nor did it provide the trial court with an explanation for the cause of the problem. Accordingly, the trial court did not abuse its discretion in refusing to consider the original or restated affidavit. See Hillstreet Fund III, L.P. v. Bloom, Montgomery App. No. 23394, 2010-Ohio-2267, ¶ 49 [noting that trial courts have discretion to accept or refuse additional evidence under Civ. R. 53(D)(4)(d).]

{¶ 37} Because the trial court did not abuse its discretion in rejecting the Neil affidavits, we need not consider whether the contents of the affidavits are inadmissible.

{¶ 38} HSBC’s Second Assignment of Error is overruled.

III

{¶ 39} HSBC’s First Assignment of Error is as follows:

{¶ 40} “THE COURT OF COMMON PLEAS IMPROPERLY TREATED THE DATE THE ASSIGNMENT OF MORTGAGE WAS EXECUTED AS DISPOSITIVE OF THE CLAIMS BEFORE IT.”

{¶ 41} Under this assignment of error, HSBC contends that the trial court committed reversible error by disregarding the ruling in State ex rel. Jones v. Suster, 84 Ohio St.3d 70, 1998-Ohio-275, that defects in standing may be cured at any time before judgment is entered. According to HSBC, an assignment of mortgage recorded with the Montgomery County Recorder establishes that HSBC is the current holder of the mortgage interest, because the interest was transferred about one week after the action against Thomson was filed. HSBC further contends that the trial court improperly disregarded evidence that HSBC legally owned the note before its complaint was filed. Before addressing the standing issue, we note that the case before us was resolved by way of summary judgment. “A trial court may grant a moving party summary judgment pursuant to Civ. R. 56 if there are no genuine issues of material fact remaining to be litigated, the moving party is entitled to judgment as a matter of law, and reasonable minds can come to only one conclusion, and that conclusion is adverse to the nonmoving party, who is entitled to have the evidence construed most strongly in his favor.” Smith v. Five Rivers MetroParks (1999), 134 Ohio App.3d 754, 760. “We review summary judgment decisions de novo, which means that we apply the same standards as the trial court.” GNFH, Inc. v. W. Am. Ins. Co., 172 Ohio App.3d 127, 2007-Ohio-2722, ¶ 16.

{¶ 42} To decide the real-party-in-interest issue, we first turn to Civ. R. Rule 17(A), which states that:

{¶ 43} “Every action shall be prosecuted in the name of the real party in interest. * * * * No action shall be dismissed on the ground that it is not prosecuted in the name of the real party in interest until a reasonable time has been allowed after objection for ratification of commencement of the action by, or joinder or substitution of, the real party in interest. Such ratification, joinder, or substitution shall have the same effect as if the action had been commenced in the name of the real party in interest.”

{¶ 44} “Standing is a threshold question for the court to decide in order for it to proceed to adjudicate the action.” Suster, 84 Ohio St.3d at 77. The issue of lack of standing “challenges the capacity of a party to bring an action, not the subject matter jurisdiction of the court.” Id. To decide whether the requirement has been satisfied that an action be brought by the real party in interest, “courts must look to the substantive law creating the right being sued upon to see if the action has been instituted by the party possessing the substantive right to relief.” Shealy v. Campbell (1985), 20 Ohio St.3d 23, 25.

{¶ 45} “In foreclosure actions, the real party in interest is the current holder of the note and mortgage.” Wells Fargo Bank, N.A. v. Sessley, Franklin App. No. 09AP-178, 2010-Ohio-2902, ¶ 11 (citation omitted). Promissory notes are negotiable, and may be transferred to someone other than the issuer. That person then becomes the holder of the instrument. R.C. 1303.21(A). R.C. 1303.21(B) provides, however, that:

{¶ 46} “Except for negotiation by a remitter, if an instrument is payable to an identified person, negotiation requires transfer of possession of the instrument and its indorsement by the holder. If an instrument is payable to bearer, it may be negotiated by transfer of possession alone.”

{¶ 47} R.C, 1301.01(T)(1) also states that a holder with regard to a negotiable instrument means either of the following:

{¶ 48} “(a) If the instrument is payable to bearer, a person who is in possession of the instrument;

{¶ 49} “(b) If the instrument is payable to an identified person, the identified person when in possession of the instrument.”

{¶ 50} In the case before us, the promissory note identifies Fidelity as the holder. The note, therefore, could have been negotiated only by Fidelity, through transfer of possession, and by either endorsing the note to a specific person, or endorsing the note to “bearer.”

{¶ 51} HSBC contends that it is the legal holder of the promissory note, and is entitled to enforce it, because it obtained the note as a bearer. A “bearer” is “the person in possession of an instrument, document of title, or certificated security payable to bearer or endorsed in blank.” R.C. 1301.01(E). HSBC’s claim that it is the bearer of the note is based on the “allonges” that were included as part of the exhibits to the complaint.

{¶ 52} The rejected affidavits of Neil do not refer to the allonges, nor were any allonges included with the promissory note that was attached to Neil’s affidavit. During oral argument, HSBC referred frequently to the Jiminez-Reyes affidavit, which was attached to a February 2008 summary judgment motion filed by HSBC. Jiminez-Reyes identified the exhibits attached to the complaint, but did not refer to the allonges. HSBC withdrew the summary judgment motion in March 2008, after Thompson had identified various deficiencies in the affidavit, including the fact that Jiminez-Reyes had incorrectly identified Thompson as the account holder. Since the motion was withdrawn, it is questionable whether the attached affidavit of Jiminez-Reyes was properly before the trial court. Byers v. Robinson, Franklin App. No. 08AP-204, 2008-Ohio-4833, ¶ 16 (effect of withdrawing motion is to leave the record as it stood before the motion was filed).

{¶ 53} Nonetheless, shortly after the complaint was filed, and prior to its first summary judgment motion, HSBC filed an affidavit of Jessica Dybas, who is identified in the affidavit as an “agent” of HSBC. The exact status of Dybas’s agency or connection to HSBC is not explained in the affidavit.

{¶ 54} Dybas states in the affidavit that she has personal knowledge of the history of the loan, that she is the custodian of records pertaining to the loan and mortgage, and that the records have been maintained in the ordinary course of business. See “Exhibit A attached to Plaintiff’s Notice of Filing of Loan Status, Military, Minor and Incompetent Affidavit and Loan History,” which was filed with the trial court in February 2008. Dybas’s affidavit also identifies Exhibits A and B of the complaint as true and accurate copies of the originals. Exhibit A to the complaint includes a copy of the promissory note of the decedent, Howard Turner, made payable to Fidelity, and a copy of two documents entitled “Allonge,” that are placed at the end of the promissory note. Exhibit B is a copy of the mortgage agreement, which names Fidelity as the “Lender” and MERS as “nominee” for Fidelity and its assigns. Dybas’s affidavit does not specifically mention the allonges. Like the affidavit of Jiminez-Reyes, Dybas’s affidavit incorrectly identifies Thompson as the borrower on the note. Thompson was not the borrower; she is the administratrix of the estate of the borrower, Howard Turner.

{¶ 55} Assuming for the sake of argument that Dybas’s affidavit is sufficient, or that the affidavit of Jiminez-Reyes was properly before the court, we note that Ohio requires endorsements to be “on” an instrument, or in papers affixed to the instrument. See R.C. 1303.24(A)(1) and (2), which state that “For the purpose of determining whether a signature is made on an instrument, a paper affixed to the instrument is a part of the instrument.”

{¶ 56} “The use of an allonge to add indorsements to an instrument when there is no room for them on the instrument itself dates from early common law.” Southwestern Resolution Corp. v. Watson (Tex. 1997), 964 S.W.2d 262, 263. “An allonge is defined as `[a] slip of paper sometimes attached to a negotiable instrument for the purpose of receiving further indorsements when the original paper is filled with indorsements.'” Chase Home Finance, LLC v. Fequiere (2010), 119 Conn.App. 570, 577, 989 A.2d 606, quoting from Black’s Law Dictionary (9th Ed. 2009).

{¶ 57} In Watson, a note and allonge produced at trial were taped together and had several staple holes. The president of the noteholder testified that when his company received the note, “the allonge was stapled to it and may also have been clipped and taped, but that the note and allonge had been separated and reattached five or six times for photocopying.” 964 S.W.2d at 263. The lower courts agreed with a jury that the allonge was not so firmly affixed as to be part of the note. But the Supreme Court of Texas disagreed.

{¶ 58} The Supreme Court of Texas recounted the history of allonges throughout various versions of the Uniform Commercial Code (UCC). The court noted that an early provision had provided that an endorsement must be written on the note or on a paper attached thereto. Id., citing Section 31 of the Uniform Negotiable Instruments Law. Under this law, an allonge could be attached by a staple. Id (citation omitted). The Supreme Court of Texas also noted that:

{¶ 59} “When the UCC changed the requirement from `attached thereto’ to `so firmly affixed thereto as to become a part thereof’, * * * the drafters of the new provision specifically contemplated that an allonge could be attached to a note by staples. American Law Institute, Comments & Notes to Tentative Draft No. 1-Article III 114 (1946), reprinted in 2 Elizabeth Slusser Kelly, Uniform Commercial Code Drafts 311, 424 (1984) (`The indorsement must be written on the instrument itself or on an allonge, which, as defined in Section ___, is a strip of paper so firmly pasted, stapled or otherwise affixed to the instrument as to become part of it.’).” Id. at 263-64 (citation omitted).

{¶ 60} The Supreme Court of Texas further observed that:

{¶ 61} “The attachment requirement has been said to serve two purposes: preventing fraud and preserving the chain of title to an instrument. * * * * Still, the requirement has been relaxed in the current code from `firmly affixed’ to simply `affixed’. Tex. Bus. & Com.Code § 3.204(a). As the Commercial Code Committee of the Section of Business Law of the State Bar of Texas concluded in recommending adoption of the provision, `the efficiencies and benefits achieved by permitting indorsements by allonge outweigh[] the possible problems raised by easily detachable allonges.'” Id. at 264 (citations omitted).

{¶ 62} The Supreme Court of Texas, therefore, concluded that a stapled allonge is “firmly affixed” to an instrument, and that the allonge in the case before it was properly affixed. In this regard, the court relied on the following evidence:

{¶ 63} “In the present case, Southwestern’s president testified that the allonge was stapled, taped, and clipped to the note when Southwestern received it. There was no evidence to the contrary. The fact that the documents had been detached for photocopying does not raise a fact issue for the jury about whether the documents were firmly affixed. If it did, the validity of an allonge would always be a question of the finder of fact, since no allonge can be affixed so firmly that it cannot be detached. One simply cannot infer that two documents were never attached from the fact that they can be, and have been, detached. Nor could the jury infer from the staple holes in the two papers, as the court of appeals suggested, that the two documents had not been attached. This would be pure conjecture.” Id. at 264.

{¶ 64} Like Texas, Ohio has adopted the pertinent revisions to the UCC. In All American Finance Co. v. Pugh Shows, Inc. (1987), 30 Ohio St.3d 130, the Supreme Court of Ohio noted that under UCC 3-302, “a purported indorsement on a mortgage or other separate paper pinned or clipped to an instrument is not sufficient for negotiation.” Id. at 132, n. 3. At that time, R.C. 1303.23 was the analogous Ohio statute to UCC 3-202, which required endorsements to be firmly affixed.

{¶ 65} Ohio subsequently adopted the revisions to the UCC. R.C. 1303.24(A)(2) now requires that a paper be affixed to an instrument in order for a signature to be considered part of the instrument. R.C. 1303.24 is the analogous Ohio statute to UCC. 3-204. The 1990 official comments for UCC 3-204 state that this requirement is “based on subsection (2) of former Section 3-202. An indorsement on an allonge is valid even though there is sufficient space on the instrument for an indorsement.” This latter comment addresses the fact that prior to the 1990 changes to the UCC, the majority view was that allonges could be used only if the note itself contained insufficient space for further endorsements. See, e.g., Pribus v. Bush (1981), 118 Cal.App.3d 1003, 1008, 173 Cal.Rptr. 747. See, also, All American Finance, 30 Ohio St.3d at 132, n.3 (indicating that while the court did not need to reach the issue for purposes of deciding the case, several jurisdictions “hold that indorsement by allonge is permitted only where there is no longer room on the instrument itself due to previous indorsements.”)

{¶ 66} The current version of the UCC, codified as R.C. 1303.24(A)(2), allows allonges even where room exists on the note for further endorsements. However, the paper must be affixed to the instrument in order for the signature to be considered part of the instrument. As the Supreme Court of Texas noted in Watson, the requirement has changed from being “firmly affixed” to “affixed.” However, even the earlier version, which specified that the allonge be “attached thereto,” was interpreted as requiring that the allonge be stapled. Watson, 964 S.W.2d at 263.

{¶ 67} In contrast to Watson, no evidence was presented in the case before us to indicate that the allonges were ever attached or affixed to the promissory note. Instead, the allonges have been presented as separate, loose sheets of paper, with no explanation as to how they may have been attached. Compare In re Weisband, (Bkrtcy. D. Ariz., 2010), 427 B.R. 13, 19 (concluding that GMAC was not a “holder” and did not have ability to enforce a note, where GMAC failed to demonstrate that an allonge endorsement to GMAC was affixed to a note. The bankruptcy court noted that the endorsement in question “is on a separate sheet of paper; there was no evidence that it was stapled or otherwise attached to the rest of the Note.”)

{¶ 68} It is possible that the allonges in the case before us were stapled to the note at one time and were separated for photocopying. But unlike the alleged creditor in Watson, HSBC offered no evidence to that effect. Furthermore, assuming for the sake of argument that the allonges were properly “affixed,” the order of the allonges does not permit HSBC to claim that it is the possessor of a note made payable to bearer or endorsed in blank.

{¶ 69} The first allonge is endorsed from Delta to “blank,” and the second allonge is endorsed from Fidelity to Delta. If the endorsement in blank were intended to be effective, the endorsement from Fidelity to Delta should have preceded the endorsement from Delta to “blank,” because the original promissory note is made payable to Fidelity, not to Delta. Delta would have had no power to endorse the note before receiving the note and an endorsement from Fidelity.

{¶ 70} HSBC contends that the order of the allonges is immaterial, while Thompson claims that the order is critical. At the oral argument of this appeal, HSBC appeared to be arguing that the order of allonges would never be material. This is easily refuted by the example of two allonges, one containing an assignment from the original holder of the note to A, and the other containing an assignment from the original holder of the note to B. Whichever allonge was first would determine whether the note had been effectively assigned to A, or to B.

{¶ 71} Thompson contends that because the last-named endorsement is made to Delta, Delta was the proper holder of the note when this action was filed, since the prior, first-named endorsement was from an entity other than the current holder of the note. In Adams v. Madison Realty & Development, Inc. (C.A.3, 1988), 853 F.2d 163, the Third Circuit Court of Appeals stressed that from the maker’s standpoint:

{¶ 72} “it becomes essential to establish that the person who demands payment of a negotiable note, or to whom payment is made, is the duly qualified holder. Otherwise, the obligor is exposed to the risk of double payment, or at least to the expense of litigation incurred to prevent duplicative satisfaction of the instrument. These risks provide makers with a recognizable interest in demanding proof of the chain of title.” Id. At 168.

{¶ 73} The Third Circuit Court of Appeals further observed that:

{¶ 74} “Financial institutions, noted for insisting on their customers’ compliance with numerous ritualistic formalities, are not sympathetic petitioners in urging relaxation of an elementary business practice. It is a tenet of commercial law that `[h]oldership and the potential for becoming holders in due course should only be accorded to transferees that observe the historic protocol.'” 853 F.2d at 169 (citation omitted).

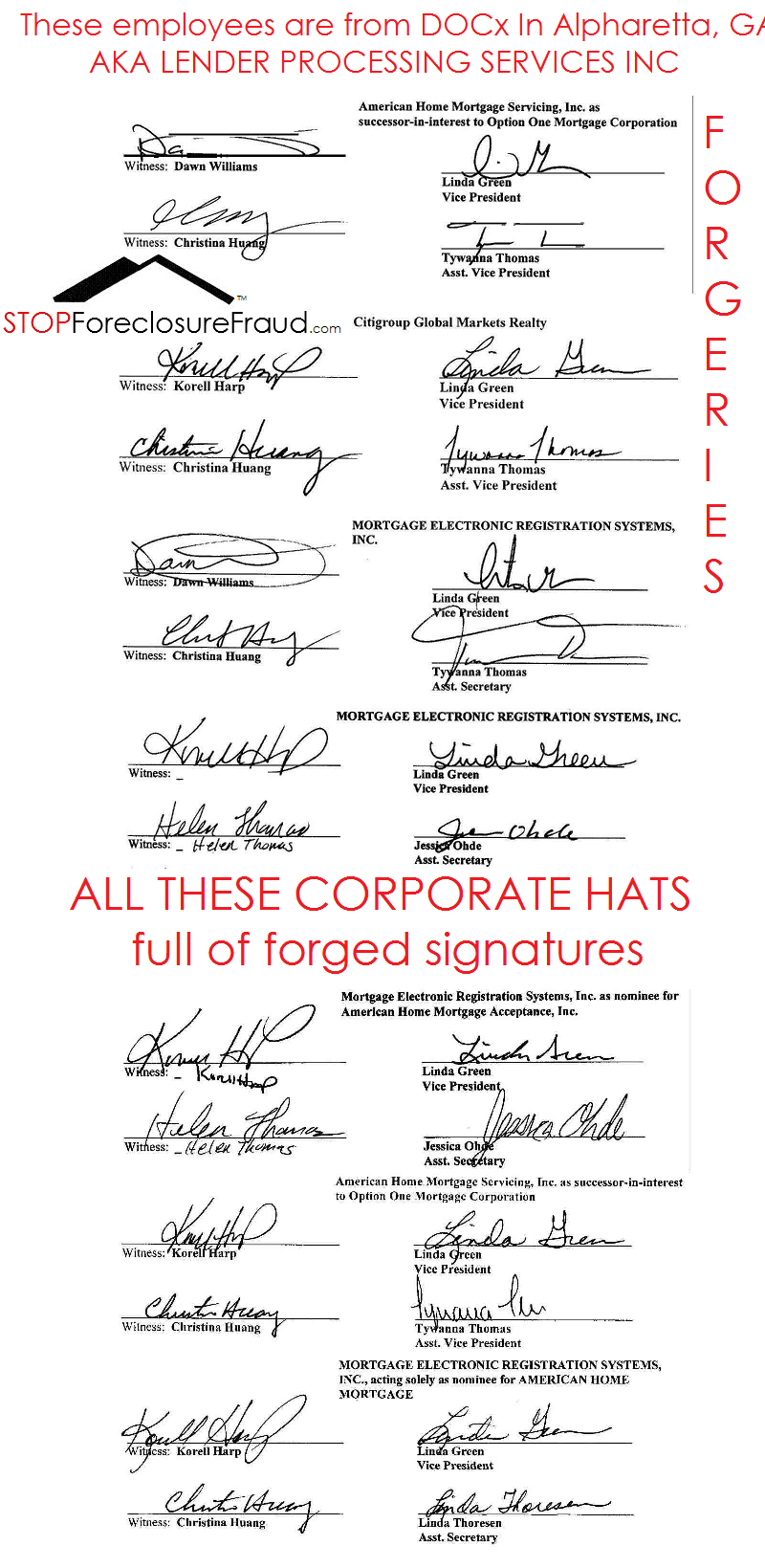

{¶ 75} Consistent with this observation, recent decisions in the State of New York have noted numerous irregularities in HSBC’s mortgage documentation and corporate relationships with Ocwen, MERS, and Delta. See, e.g., HSBC Bank USA, N.A. v. Cherry (2007), 18 Misc.3d 1102(A), 856 N.Y.S.2d 24 (Table), 2007 WL 4374284, and HSBC Bank USA, N.A. v. Yeasmin (2010), 27 Misc.3d 1227(A), 2010 N.Y. Slip Op. 50927(U)(Table), 2010 WL 2080273 (dismissing HSBC’s requests for orders of reference in mortgage foreclosure actions, due to HSBC’s failure to provide proper affidavits). See, also, e.g., HSBC Bank USA, N.A. v. Charlevagne (2008), 20 Misc.3d 1128(A), 872 N.Y.S.2d 691 (Table), 2008 WL 2954767, and HSBC Bank USA, Nat. Assn. v. Antrobus (2008), 20 Misc.3d 1127(A), 872 N.Y.S.2d 691,(Table), 2008 WL 2928553 (describing “possible incestuous relationship” between HSBC Bank, Ocwen Loan Servicing, Delta Funding Corporation, and Mortgage Electronic Registration Systems, Inc., due to the fact that the entities all share the same office space at 1661 Worthington Road, Suite 100, West Palm Beach, Florida. HSBC also supplied affidavits in support of foreclosure from individuals who claimed simultaneously to be officers of more than one of these corporations.).

{¶ 76} Because the last allonge endorses the note to Delta, and no further endorsement to HSBC was provided, the trial court did not err in concluding that HSBC was not the holder of the note when the litigation was commenced against Thompson.

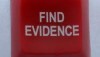

{¶ 77} As an alternative position, HSBC contended at oral argument that it had standing to prosecute the action, because assignment of the mortgage alone is sufficient. In this regard, HSBC notes that the mortgage was transferred to HSBC by MERS on November 14, 2007. This was about one week after HSBC commenced the mortgage foreclosure action.

{¶ 78} HSBC did not argue this position in its briefs, and did not provide supporting authority for its position at oral argument. In fact, HSBC relied in its brief on the contrary position that HSBC “was the legal holder of the note and, accordingly, entitled to enforce the mortgage loan regardless of the date the Mortgage was assigned, and under Marcino, even if the Mortgage had never been separately assigned to HSBC.” Brief of Appellant HSBC Bank USA, N.A., pp. 15-16 (bolding in original).

{¶ 79} The Marcino case referred to by HSBC states as follows:

{¶ 80} “For nearly a century, Ohio courts have held that whenever a promissory note is secured by a mortgage, the note constitutes the evidence of the debt and the mortgage is a mere incident to the obligation. Edgar v. Haines (1923), 109 Ohio St. 159, 164, 141 N.E. 837. Therefore, the negotiation of a note operates as an equitable assignment of the mortgage, even though the mortgage is not assigned or delivered.” U.S. Bank Natl. Assn. v. Marcino, 181 Ohio App.3d 328, 2009-Ohio-1178, ¶ 52.

{¶ 81} Even if HSBC had provided support for the proposition that ownership of the note is not required, the evidence about the assignment is not properly before us. The alleged mortgage assignment is attached to the rejected affidavits of Neil. Furthermore, even if we were to consider this “evidence,” the mortgage assignment from MERS to HSBC indicates that the assignment was prepared by Ocwen for MERS, and that Ocwen is located at the same Palm Beach, Florida address mentioned in Charlevagne and Antrobus. See Exhibit 3 attached to the affidavit of Chomie Neil. In addition, Scott Anderson, who signed the assignment, as Vice-President of MERS, appears to be the same individual who claimed to be both Vice-President of MERS and Vice-President of Ocwen. See Antrobus, 2008 WL 2928553, * 4, and Charlevagne, 2008 WL 2954767, * 1.

{¶ 82} In support of its argument that a subsequent mortgage assignment can confer standing on a noteholder, HSBC cites some Ohio cases in which “courts have rejected claims that the execution of an assignment subsequent to the filing of a complaint necessarily precludes a party from prosecuting a foreclosure action as the real party in interest.” Deutsche Bank Natl. Trust Co. v. Cassens, Franklin App. No. 09-AP-865, 2010-Ohio-2851, ¶ 17. Accordingly, at least in the view of some districts in Ohio, if the note had been properly negotiated to HSBC, HSBC may have been able to claim standing, based on equitable assignment of the mortgage, supplemented by the actual transfer of the mortgage after the complaint was filed.

{¶ 83} In contrast to the Seventh District, other districts take a more rigid view. See Wells Fargo Bank v. Jordan, Cuyahoga App. No. 91675, 2009-Ohio-1092 (holding that Civ. R. 17(A) does not apply unless a plaintiff has standing in the first place to invoke the jurisdiction of the court. Accordingly, a bank that is not a mortgagee when suit is filed is not the real party in interest on the date the complaint is filed, and cannot cure its lack of standing by subsequently obtaining an interest in the mortgage). Accord Bank of New York v. Gindele, Hamilton App. No. C-090251, 2010-Ohio-542.

{¶ 84} In Gindele, the First District Court of Appeals commented as follows:

{¶ 85} “We likewise reject Bank of New York’s argument that the real party in interest when the lawsuit was filed was later joined by the Gindeles. We are convinced that the later joinder of the real party in interest could not have cured the Bank of New York’s lack of standing when it filed its foreclosure complaint. This narrow reading of Civ.R. 17 comports with the intent of the rule. As other state and federal courts have noted, Civ.R. 17 generally allows ratification, joinder, and substitution of parties `to avoid forfeiture and injustice when an understandable mistake has been made in selecting the parties in whose name the action should be brought.’ * * * * `While a literal interpretation of * * * Rule 17(a) would make it applicable to every case in which an inappropriate plaintiff was named, the Advisory Committee’s Notes make it clear that this provision is intended to prevent forfeiture when determination of the proper party to sue is difficult or when an understandable mistake has been made. When determination of the correct party to bring the action was not difficult and when no excusable mistake was made, the last sentence of Rule 17(a) is inapplicable and the action should be dismissed.'” Id. at ¶ 4 (footnotes omitted).

{¶ 86} We need not decide which approach is correct, because the alleged assignment of mortgage is attached to Neil’s rejected affidavits. Since the trial court’s disregard of the affidavits was not an abuse of discretion, there is currently no evidence of a mortgage “assignment” to consider. Moreover, we would reject HSBC’s position even if we considered the alleged assignment, because HSBC failed to establish that it was the holder of the note. Therefore, no “equitable assignment” of the mortgage would have arisen. All that HSBC might have established is that the mortgage was assigned to it after the action was filed. However, as we noted, the matters pertaining to that fact were submitted with an affidavit that the trial court rejected, within its discretion.

{¶ 87} Accordingly, the trial court did not err in dismissing the action without prejudice, based on HSBC’s failure to prove that it had standing to sue.

{¶ 88} HSBC’s First Assignment of Error is overruled.

IV

{¶ 89} The final matter to be addressed is Thompson’s motion to dismiss the part of HSBC’s appeal which assigns error in the trial court’s denial of HSBC’s motion for summary judgment. HSBC filed a motion for summary judgment on Thompson’s counterclaim, which alleged violations of the Fair Debt Practices Collection Act. The trial court denied the motion for summary judgment, and filed a Civ. R. 54(B) certification regarding the summary judgment that had been rendered in Thompson’s favor.

{¶ 90} Thompson contends that denial of summary judgment is not a final appealable order, and that HSBC’s argument regarding the FDCPA should not be considered on appeal. In response, HSBC maintains that it is not appealing the denial of its motion for summary judgment. HSBC argues instead, that if we reverse the trial court order granting Thompson’s motion to strike the affidavit of Neil, or if we reverse the order dismissing HSBC’s foreclosure complaint, we would then be entitled under App. R. 12(B) to enter a judgment dismissing the FDCPA claims.

{¶ 91} App. R. 12(B) provides that:

{¶ 92} “When the court of appeals determines that the trial court committed no error prejudicial to the appellant in any of the particulars assigned and argued in appellant’s brief and that the appellee is entitled to have the judgment or final order of the trial court affirmed as a matter of law, the court of appeals shall enter judgment accordingly. When the court of appeals determines that the trial court committed error prejudicial to the appellant and that the appellant is entitled to have judgment or final order rendered in his favor as a matter of law, the court of appeals shall reverse the judgment or final order of the trial court and render the judgment or final order that the trial court should have rendered, or remand the cause to the court with instructions to render such judgment or final order. In all other cases where the court of appeals determines that the judgment or final order of the trial court should be modified as a matter of law it shall enter its judgment accordingly.”

{¶ 93} App. R. 12(B) does not apply, because the trial court did not commit error prejudicial to HSBC. Furthermore, HSBC admits that it is not appealing the denial of its summary judgment motion. Accordingly, Thompson’s motion to dismiss is without merit and is overruled.

V

{¶ 94} All of HSBC’s assignments of error having been overruled, the judgment of the trial court is Affirmed. Thompson’s motion to dismiss part of HSBC’s appeal is overruled.

Brogan and Froelich, JJ., concur.

This copy provided by Leagle, Inc.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

![Fair Debt Collection Practices Act § 803. § 812. [15 USC 1692a/j]](https://stopforeclosurefraud.com/wp-content/themes/gazette/thumb.php?src=wp-content/uploads/2010/08/fdcpa.jpg&w=100&h=57&zc=1&q=90)

![SHAPIRO and FISHMAN Corrective+Assignment[2]-1](https://stopforeclosurefraud.com/wp-content/uploads/2010/08/SHAPIRO-and-FISHMAN-Corrective+Assignment2-11.png)

![SHAPIRO and FISHMAN Corrective+Assignment[2]-1 (4)](https://stopforeclosurefraud.com/wp-content/uploads/2010/08/SHAPIRO-and-FISHMAN-Corrective+Assignment2-1-42.png)

Recent Comments