2010 NY Slip Op 32007(U)

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC., “MERS” as Nominee for AMERICA’S WHOLESALE LENDER, its Successors and Assigns, Plaintiff,

v.

CAROLE FOLKES, NEW YORK CITY ENVIRONMENTAL CONTROL BOARD, NEW YORK CITY TRANSIT ADJUDICATION BUREAU, BARON ASSOCIATES, LLC, and JOHN DOE (said name being fictitious, it being the intention of plaintiff to designate any and all Occupants of premises being foreclosed herein and any parties, corporations or entities, if any, having or claiming an interest or lien upon the mortgaged premises), Defendants.

No. 109824/05, Motion Seq. No. 005.

Supreme Court, New York County.

July 29, 2010.

July 21, 2010.

ALICE SCHLESINGER, Judge.

This action commenced in 2005 sounds in foreclosure. Thus, it should be a relatively straightforward matter. However, It Is anything but that. By the time it reached this Court, the action had acquired an intervenor, Baron Associates, LLC (“Baron”), who filed cross-claims against a defendant, Carole Folkes and a counterclaim against the plaintiff, Mortgage Electronic Registration Systems, Inc. as Nominee for America’s Wholesale Lender, its Successors and Assignors (“MERS”).

Although the index number is 2005, a note of issue was not filed until December 2009. Before the Court now is a motion by defendant Folkes for summary judgment dismissing the cross-claims of defendant Baron and for an order recognizing that Folkes has superior title to the premises located at 468 West 146th Street in New York.

This motion is followed by a cross-motion by plaintiff MERS for summary judgment on its foreclosure claims regarding the subject property. Plaintiff previously requested and was denied this relief in a decision dated February 5, 2000 by Judge Kibble Payne. Plaintiff is asking for amounts due on their mortgage and note, as well as a declaration that no defendant has any lien, equitable or otherwise, on the property. Plaintiff MERS is also moving, pursuant to CPLR §3212 for summary judgment dismissing defendant Baron’s counterclaim, and pursuant to CPLR §603 severing Baron’s cross-claims against Folkes. Finally, pursuant to CPLR §3025, MERS seeks to amend its pleadings to substitute Zhou Ye, Lillian Herring and Marvin Herring in place of “John Doe”.

Baron opposes virtually all of this relief, although it does not speak to the amendment. Folkes the defendant here, does not oppose plaintiffs cross-motion.

The saga of the sale of this property, to the extent relevant to these motions, began on August 19, 2004 when this property, a three family dwelling in Harlem, was sold by Its owner Shelby Sullivan to 468 West 146th Street Corporation, whose principal was Paul Jaikaran. The purchaser took out a mortgage on the premises for $550,000 from intervenor Baron. Also at the closing, Baron paid off an existing mortgage lien of $46,369.74 to Champion Mortgage Co.

However, three months later, on November 23, 2004, presumably this same Shelby Sullivan sold the same premises to Carole Folkes for something in the neighborhood of $700,000, with a mortgage of $650,250.00.

Ms. Folkes who has disclaimed any knowledge of the prior sale, stated she purchased the property as a favor for her sister Cheron Ramphal and Ramphal’s boyfriend, the same Paul Jaikaran who is principal of 468 West 146th Street Corp. Folkes explains that she did this because her credit was better than Ramphal’s and Jaikaran’s, and because her sister was being nice to her, she agreed to do her this favor. Her understanding of the transaction, as testified to at a deposition, was that she would take title to the property, but otherwise would have nothing to do with it. (Although she testified she was a home owner herself and knew how mortgages work.) In other words, Ramphal and Jaikaran would actually pay the note. She believed their plan was to renovate the property and quickly resell it.

What is important here Is that these closing papers were filed on May 27, 2005. But the earlier transaction was not filed until August 31, 2005, or three months later and over a year after the earlier closing.

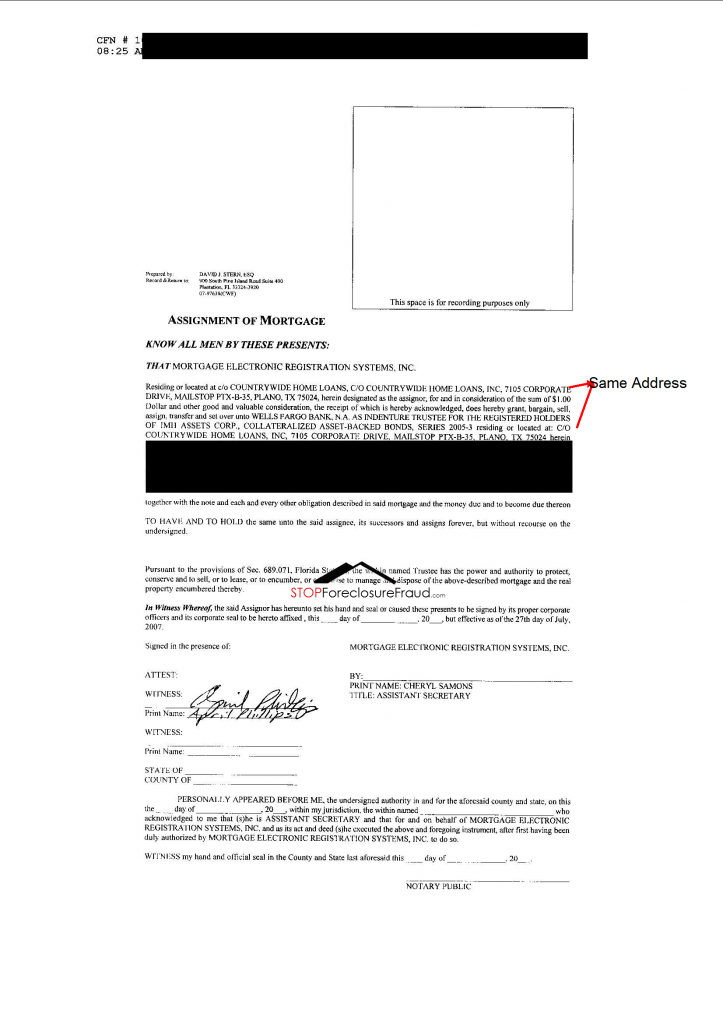

Both mortgages have been defaulted upon. The action here, as previously mentioned, was commenced five years ago. The mortgagee for the MERS transaction, or at least the entity noted on the recorded deed, is Country-Wide Home Loans, Inc., although elsewhere in these papers “America’s Wholesale Lender” is named as the “Mortgagee/Lender”. The mortgage document itself also states that MERS “is a separate corporation acting solely as a nominee for lender” and its successors. The lender again named as “America’s Wholesale Lender.” The nominee MERS Is given the right, among others, to foreclose on the mortgage. However, it should be noted that all the demands for payment included in the cross-motion are from Countrywide to Folkes.

Other items of interest regarding the MERS transaction include the following: the settlement statement identifying Carol Folkes as the borrower gave her address as 142 116th Road in South Ozone Park, New York, an address never referred to elsewhere and never explained. At her deposition, Ms. Folkes stated that she has lived at 2000 Serpentine Terrace in Silver Springs, MD for 10½ years. Yet on the mortgage itself, her address is listed as the property being sold, 468 West 146th Street, New York. (She is also identified as an unmarried woman, though again at her deposition, she stated she had been married for 12½ years to the same man).

After a default in payments, as mentioned above, demand letters were sent by Countrywide to Ms. Folkes at the subject premises 468 West 146th Street, a place she said she had never even seen, much less lived in. She states, not surprisingly, that she never received these notices.

The settlement agent on all of the MERS documents was listed as Peter Port, Esq., undeniably plaintiffs agent. According to an affidavit, with documents attached from Ms. Nichole M. Orr, identified as an Assistant Vice President and Senior Operational Risk Specialist for Bank of America Home Loans, the successor-in-interest to plaintiff America’s Wholesale Lender (April 1, 2010)[1] certain wire transfers were made on November 23, 2004 to Mr. Port. The money appears to have come from an account with JP Morgan, but one of the documents also shows, inexplicably, that Mr. Port then sent $435,067.73 of this money to Cheron A. Ramphal at 14917 Motley Road, Silver Springs, MD. It should also be noted, as it was in the decision of February 5, 2008 by Judge Payne, that Mr. Port pled guilty in March 2006 in Federal District Court in New Jersey to providing false documents in a scheme to commit mortgage fraud.

I am not prepared to grant plaintiffs cross-motion for summary judgment. Beyond that and despite the fact, as counsel points out, that Folkes does not oppose their motion, I am dismissing the action. I am doing this for essentially three reasons. Some of which has to do with deficiencies in documentation.

Even without opposition, a plaintiff in a foreclosure action must satisfy a court that it has proper standing or title to bring the action, that the mortgage and note was actually funded by the plaintiff, and that the transaction itself, the one sued upon, has the indicia of reliability and is free of fraud. Kluge v Fugazy, 145 AD2d 537 (2nd Dep’t 1988); Katz v East-Ville Realty Co, 249 AD2d 243 (1st Dep’t 1998).

None of those criteria have been satisfied here. Countrywide was the mortgagee and upon default made demands to Ms. Folkes, which it appears never reached her. Nowhere in the papers is there a satisfactory showing that the transfer of ownership or title was ever made to MERS. Ms. Orr never mentions any connection to Countrywide. But even if she were to submit still another affidavit, she certainly has no personal knowledge of the transfer of ownership, and no documents have been submitted. I do not find the language or the closing documents, identifying MERS as nominee for America’s Wholesale Lender, to sufficiently tie in the real party in Interest.

As to the second point, which was one basis for Judge Payne’s denial of summary judgment in February 2008, that there was “a complete failure to prove funding of the mortgage,” there continues to be such a failure in the motion before this Court today. The uncertified documents[2] do anything but convince. For example, there is no explanation given as to why one of the wire transactions shows that Mr. Port sent $435,067.23 to Cheron A. Ramphal. There is also nothing to show that Ms. Folkes received anything at all, although some check in the amount of $125,000 is made out to Shelby, the Seller. Therefore, I simply cannot rely on these uncertified documents created five years ago, that contain more questions than answers.

Which brings me to my last point. I am unable to say with any confidence that this was an honest transaction. Ms. Folkes’ credibility certainly is questionable. Therefore, the fact that she fails to oppose the motion Is meaningless. We also know that people close to her were involved in an earlier transaction with the same alleged seller, suggesting some kind of fraud. Also, Port, the agent acting on behalf of the plaintiff was later convicted of fraud involving similar transactions. Further, as mentioned above, the papers surrounding the transaction are filled with errors. Therefore, at the least, they were drawn up by Port and others without care or worse. Therefore, the action is dismissed without prejudice for plaintiff to bring again, if they can, with proper support and reliability. The counterclaim is also dismissed without prejudice.

With regard to the four cross-claims brought by Baron against Folkes, the subject of the first motion, I am in fact granting them, but only to the extent of dismissing with prejudice the second cross-claim, at paragraph 12, which speaks of unjust enrichment and the fourth cross-claim, at paragraph 32 which speaks of fraud. With regard to paragraphs, there Is simply no showing by Baron that Folkes herself was enriched, unjustly or not, in the amount of $46,369.74, the payment Baron made to Champion Mortgage. Regarding the allegation of friaud, there is nothing to show that Baron, by giving the earlier mortgage to 468 West 146th Street Corp., in any way relied upon the representations and actions of Folkes in purchasing the property months after the August 19, 2004 sale.

Accordingly, it is hereby

ORDERED, that the motion for summary judgment by defendant Baron Associates, LLC is granted to the extent of dismissing with prejudice the second cross-claim sounding in unjust enrichment and the fourth cross-claim sounding In fraud; and it is further

ORDERED that plaintiffs cross motion for summary judgment is denied; and it is further

ORDERED that this foreclosure action and the counterclaim by defendant Carol Folkes are dismissed without prejudice and without costs or disbursements to any party.

This constitutes the decision and order of this Court. The Clerk is directed to enter judgment accordingly.

[1] We also learn in papers dated April 28, 2010, that Ms. Orr is also an officer of plaintiff MERS.

[2] I am referring to these documents as “uncertified” because that is what they are. As part of plaintiffs cross motion, Ms. Nicole Orr presented an April 1, 2010 affidavit with certain exhibits which she described as copies of wire transfer, settlement agent’s receipt of wire transfers, checks and additional wire transfers paid. There was no certification as to their origin or authenticity. When this was challenged by counsel for Baron, Ms. Orr submitted a later affidavit of April 28, 2010 with another exhibit, an affidavit from Linda S. Lewis who states she is a Vice President of JP Morgan Chase Bank who was served with a subpoena for certain documents. She then says that to the best of her knowledge, those “records or copies thereof produced were accurate versions of the documents described.” All of this is not sufficient to serve as certified business records.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Recent Comments