Posted on 19 February 2013.

U.S. Department of Justice

Criminal Division

Washington, D.C. 20530

February 14, 2013

Paul J. McNulty, Esq.

Joan Meyer, Esq.

Baker & McKenzie LLP

815 Connecticut Ave,

NW Washington, DC 20006-4078

Re: Lender Processing Services, Inc.

Dear Mr. McNulty and Ms. Meyer:

On the understandings specified below, the United States Department of Justice, Criminal Division, Fraud Section and the United States Attorney’s Office for the Middle District of Florida (collectively, the “Government”) will not criminally prosecute Lender Processing Services, Inc. and its subsidiaries and affiliates (collectively, “LPS”), for any crimes (except for criminal tax violations, as to which the Government cannot and does not make any agreement) related to the preparation and recordation of mortgage-related documents as described in the attached Appendix A, which is incorporated in this Non-Prosecution Agreement (“Agreement”).

It is understood that LPS admits, accepts, and acknowledges responsibility for the conduct set forth in Appendix A, and agrees not to make any public statement contradicting Appendix A.

The Fraud Section enters into this Agreement based, in part, on its consideration of the following factors:

(a) LPS has made a timely, voluntary, and complete disclosure ofthe facts described in Appendix A.

(b) LPS conducted a thorough internal investigation ofthe misconduct described in Appendix A, reported its findings to the Government, cooperated with the Government’s investigation of this matter, and sought to effectively remediate any problems it discovered.

1. Although LPS’s self-disclosure and cooperation commenced after a whistleblower complaint brought the misconduct to the government’s attention, since the misconduct described in Appendix A was first reported, LPS has taken substantial remedial actions, including:

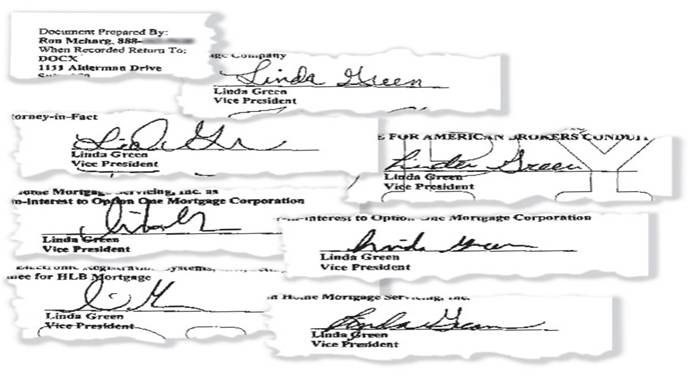

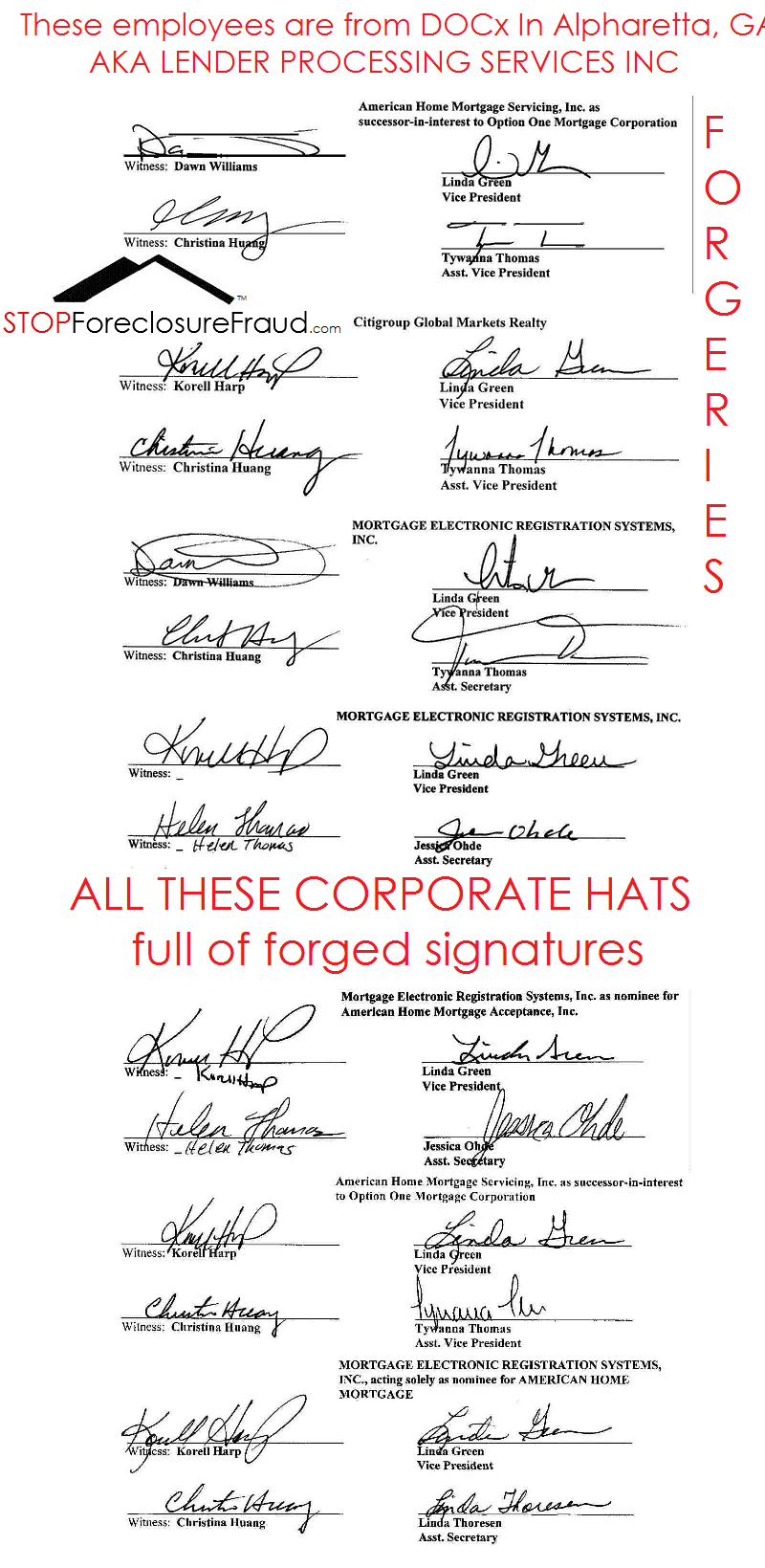

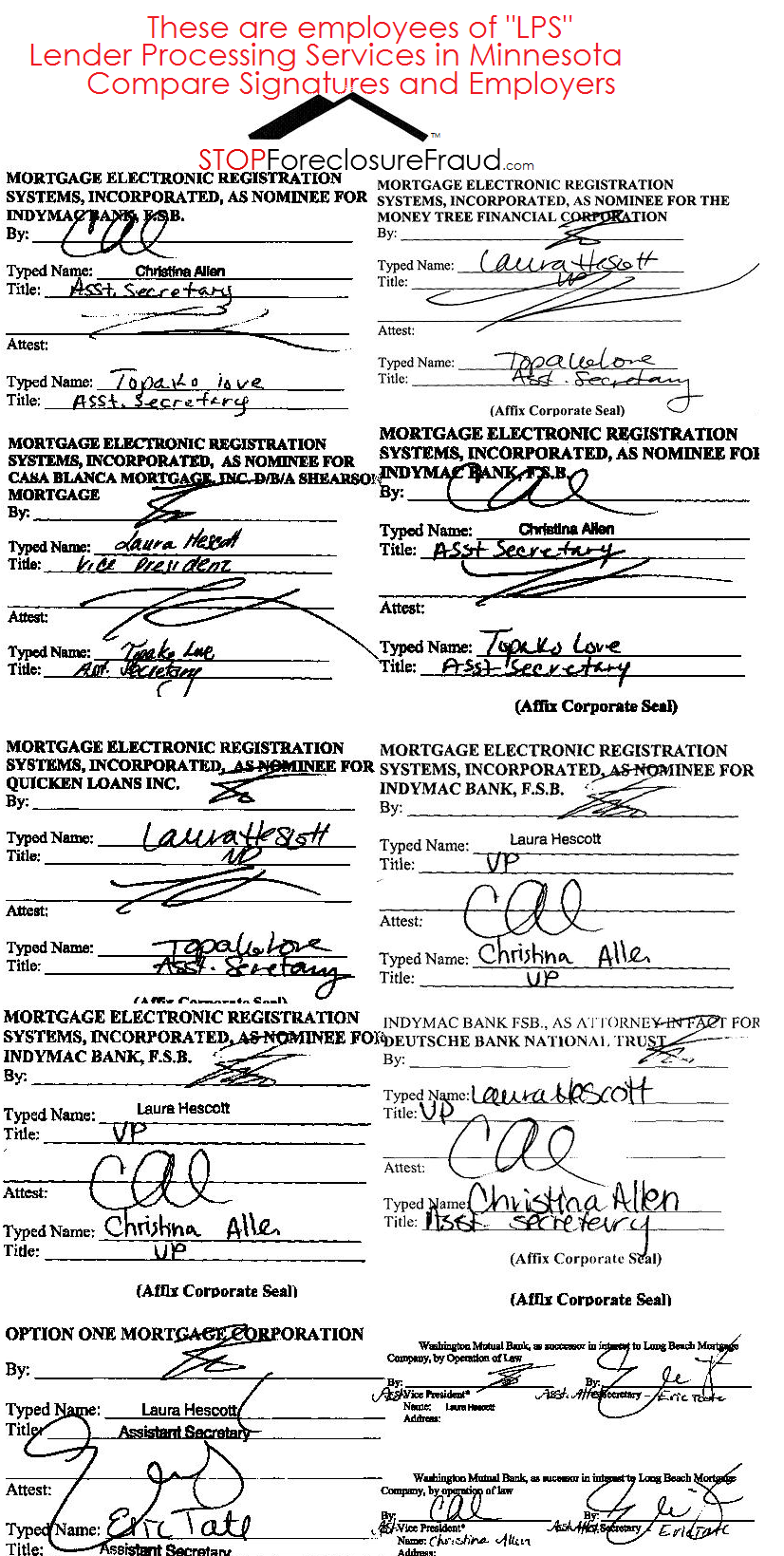

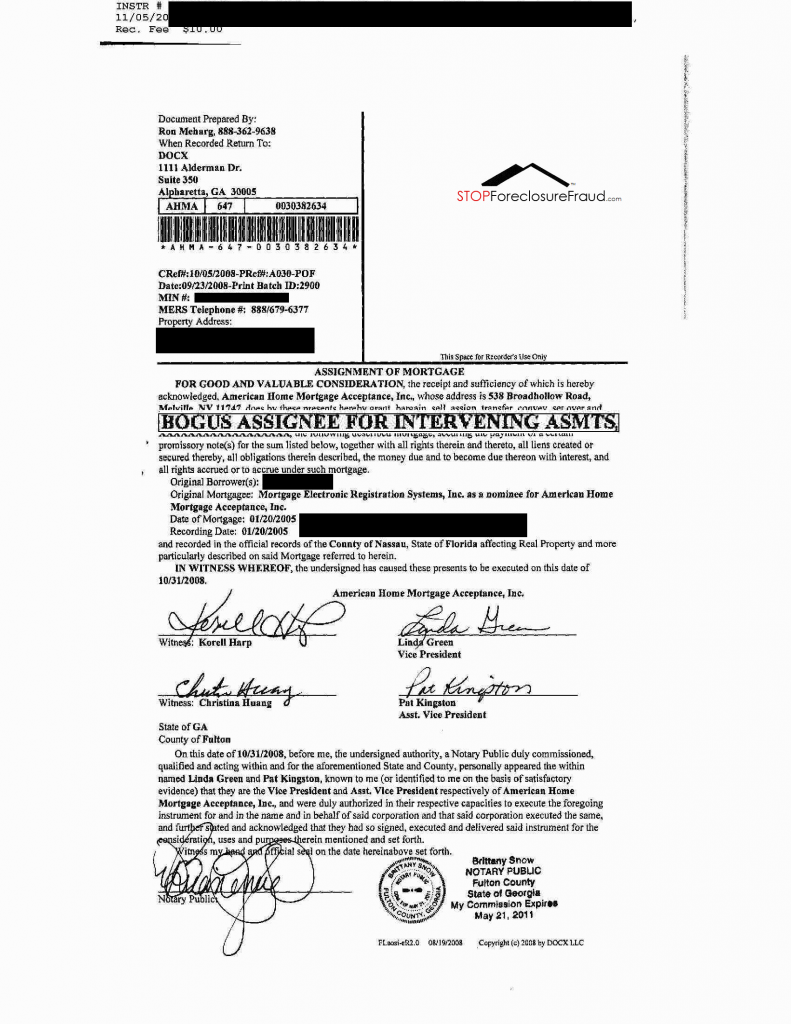

a. Within approximately six months of discovering the misconduct, LPS wound down all operations of its wholly-owned subsidiary DocX, LLC (“DocX”) in Alpharetta, Georgia, where the primary misconduct described in Appendix A took place.

b. LPS took action to remediate certain of the filings made by DocX from March to October 2009, including re-executing with proper signatures and notarizations, approximately 30,000 mortgage assignments.

c. Within weeks of the disclosure, LPS terminated DocX’s president, Lorraine Brown. Later, after conducting its internal investigation, LPS terminated Ms. Brown’s immediate supervisor at LPS for, among other reasons, failure to supervise Ms. Brown and the DocX operation.

2. The Government received substantial information from LPS, as well as from federal and state regulatory agencies, demonstrating LPS has recently made important and positive changes in its compliance, training, and overall approach to ensuring its adherence to the law.

a. On April 13, 2011, LPS entered into a consent order (the “2011 ” Consent Order”) with the Board of Governors ofthe Federal Reserve System, the Office ofthe Comptroller of the Currency, the Federal Deposit Insurance Corporation, and the Office of Thrift Supervision (collectively, the “Banking Agencies”). The 2011 Consent Order has a number of conditions with which LPS is required to comply, including:

(i) delineating a methodology for reviewing document execution practices and remediating identified issues;

(ii) establishing an acceptable compliance program and timeline for implementation;

(iii) acceptably enhancing its risk management program;

(iv) acceptably enhancing its internal audit program;

(v) retaining an independent consultant to review and report on LPS’s document execution practices, and assess related operational, compliance, legal, and reputational risks; and (vi) to the extent that the independent consultant identifies any financial harm stemming from the document execution practices to mortgage servicers or borrowers, establish a plan for reimbursing any such financial injury.

To date, LPS has complied with the conditions of the 2011 Consent Order. That work is ongoing and is subject to review and approval by the Banking Agencies.

b. LPS has agreed in a multi-state settlement with a number of state attorneys general (the “Multi-State Resolution”) to undertake additional steps, including assisting homeowners with remediating specific documents as necessary and appropriate.

c. Including this Agreement, LPS has paid to date over $160 million to state and federal authorities related to the DocX conduct.

This recent record is commendable, and partially mitigates the adverse implications of the prior history of misconduct at the DocX subsidiary.

3. The primary misconduct set forth in Appendix A took place at DocX, a subsidiary acquired by an LPS predecessor company in 2005, which constituted less than 1% of LPS’s overall corporate revenue.

4. The Government’s investigation has revealed, as set forth in Appendix A, that Lorraine Brown and others at DocX took various steps to actively conceal the misconduct taking place at DocX from detection, including from LPS senior management and auditors.

This Agreement does not provide any protection against prosecution for any crimes except as set forth above, and applies only to LPS and not to any other entities or to any individuals, including but not limited to employees or officers of LPS. The protections provided to LPS shall not apply to any acquirer or successor entities unless and until such acquirer or successor formally adopts and executes this Agreement.

This Agreement shall have a term of two years from the date of this Agreement, except as specifically provided below. It is understood that for the two-year term of this Agreement, LPS shall: (a) commit no crime whatsoever; (b) truthfully and completely disclose non-privileged information with respect to the activities of LPS, its officers and employees, and others concerning all matters about which the Government inquires of it, which information can be used for any purpose, except as otherwise limited in this Agreement; (c) bring to the Government’s attention all potentially criminal conduct by LPS or any of its employees that relates to violations of U.S. laws (i) concerning fraud or (ii) concerning mortgage or foreclosure document execution services; and (d) bring to the Government’s attention all criminal or regulatory investigations, administrative proceedings or civil actions brought by any governmental authority in the United States against LPS, its subsidiaries, or its employees that alleges fraud or violations of the laws governing mortgage or foreclosure document execution services.

Until the date upon which all investigations and prosecutions arising out of the conduct described in this Agreement are concluded, whether or not they are finished within the two-year term specified in the preceding paragraph, LPS shall, in connection with any investigation or prosecution arising out ofthe conduct described in this Agreement: (a) cooperate fully with the Government, the Federal Bureau of Investigation, and any other law enforcement or government agency designated by the Government; (b) assist the Government in any investigation or prosecution by providing logistical and technical support for any meeting, interview, grand jury proceeding, or any trial or other court proceeding; (c) use its best efforts promptly to secure the attendance and truthful statements or testimony of any officer, agent or employee at any meeting or interview or before the grand jury or at any trial or other court proceeding; and (d) provide the Government, upon request, all non-privileged information, documents, records, or other tangible evidence about which the Government or any designated law enforcement or government agency inquires.

It is understood that, if the Government determines in its sole discretion that LPS has committed any crime subsequent to the date of this Agreement, or that LPS has given false, incomplete, or misleading testimony or information at any time, or that LPS has otherwise violated any provision of this Agreement, LPS shall thereafter be subject to prosecution for any federal violation of which the Government has knowledge, including perjury and obstruction of justice. Any such prosecution that is not time-barred by the applicable statute of limitations on the date ofthe signing of this Agreement may be commenced against LPS, notwithstanding the expiration of the statute of limitations between the signing of this Agreement and the expiration of the term of the Agreement plus one year. Thus, by signing this Agreement, LPS agrees that the statute of limitations with respect to any prosecution based on the facts set forth in Appendix A that is not time-barred on the date that this Agreement is signed shall be tolled for the term of this Agreement plus one year.

It is understood that, if the Government determines in its sole discretion that LPS has committed any crime after signing this Agreement, or that LPS has given false, incomplete, or misleading testimony or information at any time, or that LPS has otherwise violated any provision of this Agreement:

(a) all statements made by LPS or any of its employees to the Government or other designated law enforcement agents, including Appendix A, and any testimony given by LPS or any of its employees before a grand jury or other tribunal, whether prior or subsequent to the signing of this Agreement, and any leads derived from such statements or testimony, shall be admissible in evidence in any criminal proceeding brought against LPS; and (b) LPS shall assert no claim under the United States Constitution, any statute, Rule 410 of the Federal Rules of Evidence, or any other federal rule that such statements or any leads derived therefrom are inadmissible or should be suppressed.

By signing this Agreement, LPS waives all rights in the foregoing respects.

The decision whether any public statement, made prospectively by LPS, contradicts Appendix A and whether it shall be imputed to LPS for the purpose of determining whether LPS has breached this Agreement shall be in the sole discretion ofthe Government. If the Government determines that a public statement contradicts in whole or in part a statement contained in Appendix A, the Government shall so notify LPS, and LPS may avoid a breach of this Agreement by publicly repudiating such statement(s) within five business days after notification. This paragraph is not intended to apply to any statement made by any former LPS officers, directors, or employees. Further, nothing in this paragraph precludes LPS from taking good-faith positions in litigation involving a private party that are not inconsistent with Appendix A. In the event that the Government determines that LPS has breached this Agreement in any other way, the Government agrees to provide LPS with written notice of such breach prior to instituting any prosecution resulting from such breach. LPS shall, within 30 days of receipt of such notice, have the opportunity to respond to the Government in writing to explain the nature and circumstances of such breach, as well as the actions LPS has taken to address and remediate the situation, which explanation the Government shall consider in determining whether to institute a prosecution.

It is understood that LPS agrees to pay a total monetary penalty of $35,000,000. LPS must pay $20 million of this sum to the United States Marshals Service, and $15 million to the United States Treasury, both within ten days of execution of this Agreement. The United States has provided LPS separately with wiring instructions to accomplish these payments.

LPS takes no position as to the disposition ofthe funds after payment and waives any statutory or procedural notice requirements with respect to the United States’ disposition ofthe funds. As a result of LPS’s conduct, including the conduct set forth in Appendix A, LPS agrees that the United States is entitled to forfeit the proceeds of the conduct pursuant to Title 18, United States Code, Section 981(a)(1)(C). Without admitting that LPS and/or its predecessors in interest received $20 million in proceeds, LPS agrees that by executing this Non-Prosecution Agreement it is releasing all claims it may have to the funds, including the right to challenge the civil forfeiture ofthe $20 million payment, as proceeds of such conduct. LPS further agrees to sign any additional documents necessary to complete civil forfeiture of the funds, including but not limited to a consent to forfeiture.

The $35 million total amount paid is final and shall not be refunded should the Government later determine that LPS has breached this Agreement and commence a prosecution against LPS. The Government agrees that in the event of a subsequent breach and prosecution, it will recommend to the Court that $20 million be offset against whatever forfeiture the Court shall impose as part of its judgment and $15 million be offset against whatever fine the Court shall impose as part of its judgment. LPS understands that such a recommendation will not be binding on the Court. LPS agrees that it shall not seek any tax deduction in connection with these payments, and shall not seek to have either ofthe payments applied as a set-off as to any other regulatory fine or other debt owed to the United States as of the date that this Agreement is executed.

It is further understood that, as noted above, LPS has strengthened its compliance and internal controls standards and procedures, and that it will further strengthen them as required by the Banking Agencies and any other regulatory or enforcement agencies that have addressed the misconduct set forth in Appendix A. In addition, in light of active investigations by various regulators ofthe conduct described in Appendix A, and the role that regulators such as those listed above will continue to play in reviewing LPS’s compliance standards, the Government has determined that adequate compliance measures have been and will be established. It is further understood that LPS will report to the Government, upon request, regarding its remediation and implementation of any compliance program and internal controls, policies, and procedures that relate to its mortgage or foreclosure document execution services. Moreover, LPS agrees that it has no objection to any regulatory agencies providing to the Government any information or reports generated by such agencies or LPS regarding this matter. Such information and reports will likely include proprietary, financial, confidential, and competitive business infonnation. Moreover, public disclosure of the information and reports could discourage cooperation, impede pending or potential governmental investigations, and thus undermine the objectives of the reporting requirement. For these reasons, among others, the information and reports and the contents thereof are intended to remain and shall remain non-public, except as otherwise agreed to by the parties in writing, or except to the extent that the Government determines in its sole discretion that disclosure would be in furtherance ofthe Government’s discharge of its duties and responsibilities or is otherwise required by law.

It is further understood that this Agreement does not bind any federal, state, local, or foreign prosecuting authority other than the Government. The Government will, however, bring the cooperation of LPS to the attention of other prosecuting and investigative authorities, if requested by LPS.

It is further understood that LPS and the Government may disclose this Agreement to the public.

With respect to. this matter, from the date of execution of tliis Agreement forward, this Agreement supersedes all prior, if any, understandings, promises and/or conditions between the Government and LPS. No additional promises, agreements, and conditions have been entered

into other than those set forth in this Agreement, and none will be entered into unless in writing and signed by all parties.

Sincerely,

DENIS J. McINERNEY

Chief, Fraud Section

Criminal Division

United States Department of justice

Glenn S. Leon, Assistant Chief

Ryan Rohlfsen, Trial Attorney

ROBERT E. O’NEILL United States Attorney

MarkB. Devereaux / Assistant United States Attorney

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Recent Comments