Since they all seem to be talking out of their asses…let me be frank and speaketh Le Face! Not in 5 yrs…not in 10 years…maybe in 20 years from now!

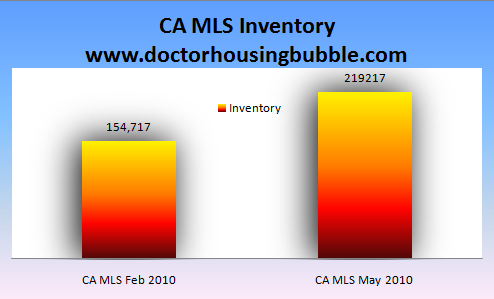

Seeing the inventory of shadow “hidden” reo’s there is no near in sight!

Now why give any loans today? The housing market is going down, these homes will continue to head under water? Buy today…Loose Tomorrow mentality? Especially the FHA loans??

Description: A sign advertising new homes for sale is seen on March 24 in Davie, Florida. (Getty Images)

May 27, 2010 | From theTrumpet.com

Not any time soon.

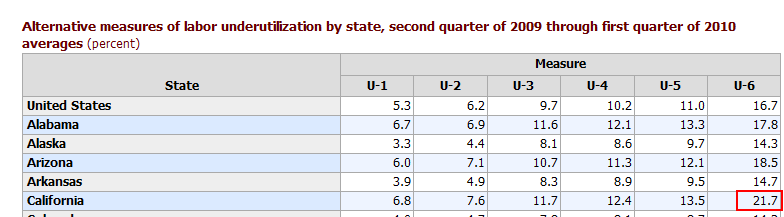

Remember when all those government economists and National Association of Realtors analysts were saying that housing prices wouldn’t recover until the first half of 2009? Then it was by 2010? Now the truth is coming out. No one knows when housing prices will recover—if ever.

According to mortgage-bond legend Lewis Ranieri, don’t expect a meaningful rebound in house prices for at least three to five years: “There is another big leg down and the question is how long does it stay.”

Don’t be quick to dismiss what Ranieri says, because he is possibly the one individual who is arguably just as responsible for America’s great housing bubble as former Federal Reserve Chairman Alan Greenspan (who lowered interest rates to record lows to try to get us to spend our way out of a recession), the politicians (who forced banks to lend to unqualified individuals) and the investment ratings agencies (that rated subprime mortgages as triple-A safe).

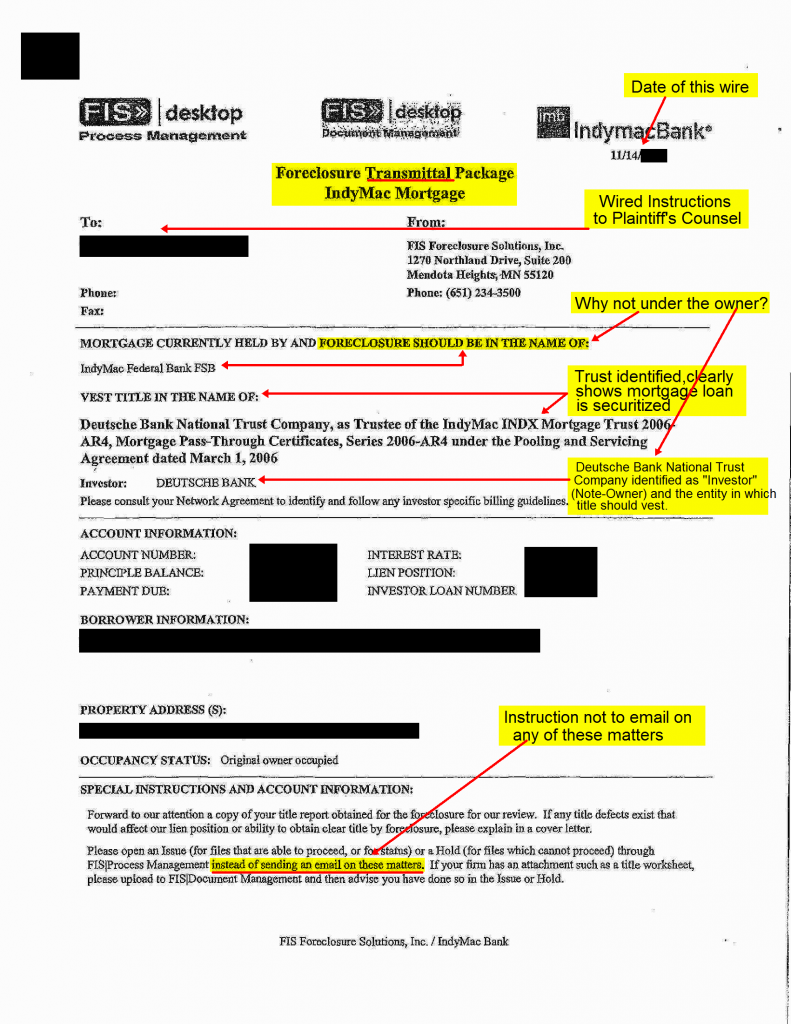

Ranieri was the high-flying Salomon Brothers trader who first packaged mortgages into bundles that could be sold and traded as securities on a national and international level. He was the man who institutionalized mass mortgage investing. His innovations back in the 1980s helped reduce the cost of mortgages for millions of people. But they also paved the way for the junk subprime lending that helped fuel the housing bubble.

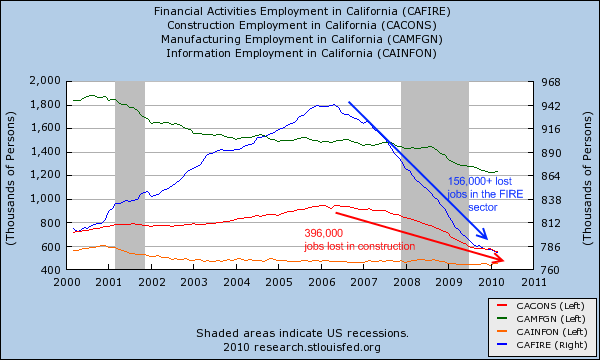

Now Ranieri is saying to get set for more trouble ahead. Over the next 18 months, at least 3 million more properties will join the 5 million already in some stage of distress. “It’s an immense problem” that risks “flooding the market,” he said.

The market for mortgage-backed securities has virtually dried up since 2008. With so many people falling behind on their payments, investors have not been able to rely on the steady streams of income that mortgage bonds historically produce. Plus, with house prices plummeting, investors don’t even have the protection of collateral.

With such adverse conditions, investors don’t want to touch American mortgages with a 10-foot pole.

Normally this lack of investment demand would drive up mortgage rates and weed out weaker borrowers—thus allowing the housing market to return to investable conditions.

However, due to government intervention to prop up the housing market, there has been an unforeseen side effect. America’s pool of mortgages has actually become riskier for investors.

In an effort to prop up house prices in America and thus keep the big banks solvent, the government began massively encouraging more people to invest in homes: It changed tax laws, it used taxpayer money to modify loans for people who had borrowed too much, it offered first-time home buyers credits, and then extended the buyers’ credits again once they expired.

It even used taxpayer dollars to ramp up subprime lending—the same kind of risky lending that got the banks into trouble in the first place.

It was one massive taxpayer-backed effort to increase the pool of home buyers and thus demand for houses and house prices.

But the scheme largely backfired.

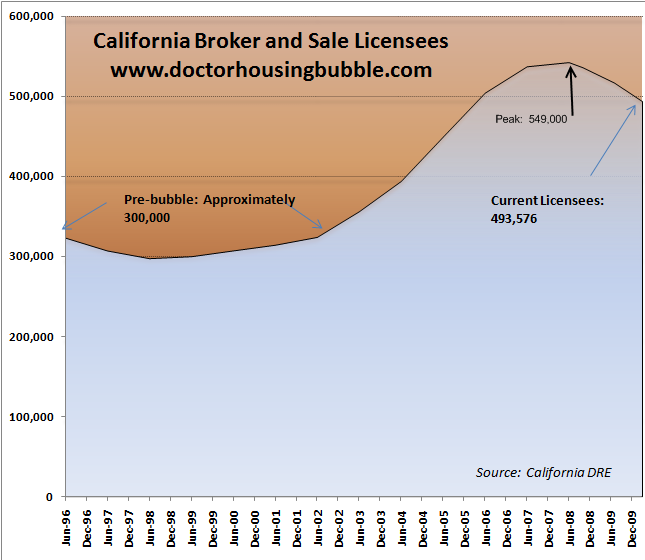

The government subsidies and handouts did encourage more people to buy homes—but mostly people who couldn’t normally afford homes on their own.

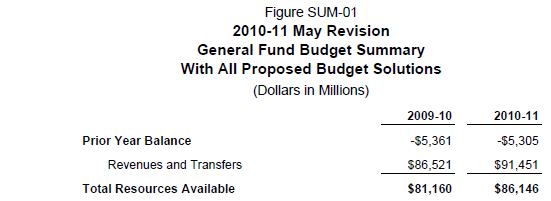

Look at the numbers. About 95 percent of the money used to buy homes in America today comes from the government. And guess which government organization issues the most loans. Is it Fannie Mae and Freddie Mac, the two government mortgage giants notorious for their low lending standards? No, it is a new government agency with even lower standards.

Meet the Federal Housing Authority (fha). You can get an fha-backed loan for a house with as little as 3.5 percent down. This is the most common loan in America today. If you include the government’s $8,000 first-time buyer’s credit (that just expired), the government was actually paying people to borrow taxpayer dollars to purchase homes.

“This is a market purely on life support, sustained by the federal government,” admits fha president David Stevens. “Having fha do this much volume is a sign of a very sick system.”

The fha backed more loans during the first quarter of this year than the $6 trillion Fannie Mae and Freddie Mac mortgage giants did! Those were your dollars being given to subprime borrowers.

If you were an investor, would you want to lend money to someone who could not save up a down payment? Would you lend to a family that required two incomes to afford the loan and still couldn’t save up a down payment?

Thus, the government is stuck with all the mortgages. It can’t stop giving money for loans, or the market will collapse, the economy will head down again and politicians will look incompetent. Yet at the same time, how long can the government afford to provide money for 95 percent of all home-buying activity in the country?

With America’s ballooning budget deficits, the days of government handouts may soon come to an end. When they do, don’t be surprised if house prices fall a whole lot further.

So when will a recovery come? No one knows for sure, but even Lewis Ranieri will likely be proved an optimist.

For the real reason America’s housing market exploded, and how to fix it, read “The Cause of the Crisis People Won’t Face.” •

Don’t make a fool of Miami-Dade Circuit Court Judge Jennifer Bailey!

Don’t make a fool of Miami-Dade Circuit Court Judge Jennifer Bailey!

Recent Comments