Decided on January 10, 2012

Federal National Mortgage Association A/K/A FANNIE MAE, Petitioner(s)

against

Mary Williams, LISA WILLIAMS, “JOHN DOE” and “JANE DOE,” Respondent(s)

LT-003567-11

Rosicki, Rosicki & Associates, P.C., Attorneys for Petitioner, 51 East Bethpage Road, Plainview, NY 11803, 516-741-2585; Jeffrey A. Siegel, Esq., Volunteer Lawyers Project, Attorneys for Respondent, One Helen Keller Way, Hempstead, NY 11550, 516-292-8100.

Scott Fairgrieve, J.

Petitioner Federal National Mortgage Association a/k/a Fannie Mae (hereinafter referred to as petitioner) commenced this holdover action to recover possession of 74 a/k/a 72 Laurel Avenue, Hempstead, New York from the respondents Mary Williams and Lisa Williams.

Petitioner contends in paragraph 6 of the petition, dated June 16, 2011, that it became the owner of said premises pursuant to a public sale on March 2, 2010 when a referee’s deed was duly executed to petitioner.

Respondent Mary Williams has moved pursuant to CPLR Sec. 3211(A)(1), (3) and (7), and RPAPL Sections 713(5), 721 and 741 to dismiss the petition. Respondent Mary Williams contends that petitioner lacks standing to commence this summary proceeding due to defective assignment of the note and mortgage in the underlying foreclosure.

Respondent states that Michael Eastman and Veronica Eastman executed a note and mortgage, both dated May 12, 2006, in favor of Cambridge Home Capital LLC.

Cambridge Home Capital LLC appointed Mortgage Electronic Registration Systems, Inc. (MERS) as its nominee with respect to recording of said mortgage executed by Michael Eastman and Veronica Eastman; this language is reflected in said mortgage as follows:

FOR PURPOSES OF RECORDING THIS MORTGAGE, MERS IS THE MORTGAGEE OF RECORD.

On August 13, 2007, plaintiff Countrywide Home Loans filed the summons and verified complaint in the Office of the Nassau County Clerk. The verified complaint dated August 10, 2007 alleges in paragraph 3 that:

On or about May 12, 2006, MICHAEL EASTMAN; VERONICA EASTMAN executed and delivered to MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. ACTING SOLELY AS NOMINEE FOR CAMBRIDGE HOME CAPITAL, LLC., a note bearing date that day, whereby MICHAEL EASTMAN; VERONICA EASTMAN covenanted and agreed to pay the sum of $342900.00, with interest on the unpaid balance thereof, at the rate of 7.25 percent per annum, to be computed from the date of said note, by payments of $2,071.69 on July 1, 2006 For the first 120 months and thereafter in payments of $2,710.20 on the like date of each subsequent month, until said note is fully paid, except that the final payment of principal and interest remaining due, if not sooner paid, shall become due and payable on June 1, 2036.

A review of the note executed by Mr. & Mrs. Eastman reveals no reference of the note being executed and delivered to MERS or to Countrywide Home Loans, Inc. Paragraph 4 of the verified complaint alleges:

As collateral security for the payment of said indebtedness, the aforesaid defendant(s) MICHAEL EASTMAN; VERONICA EASTMAN, also executed, acknowledged and delivered to MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. ACTING SOLELY AS NOMINEE FOR CAMBRIDGE HOME CAPITAL, LLC., a mortgage dated May 12, 2006 and recorded in the County of Nassau on June 7, 2006 in Liber/Reel D30580 of Mortgages, at page 979-995. The mortgage tax was duly paid. The aforesaid instruments were thereafter assigned to Plaintiff.

Said mortgaged premises being known as and by street address: 72 Laurel Avenue, Hempstead, NY 11550 bearing tax map designation: Dist:Section: 34Block: 377Lot(s): 146-147

which premises are more fully described in Schedule “A,” annexed hereto and made a part hereof.

Plaintiff claims in paragraph 4 of the verified complaint that the note and mortgage were assigned to plaintiff prior to commencing the foreclosure action. This statement may be unfounded. The said note executed by the Eastmans was endorsed in blank by Craig J. Hyman, Vice President/Member of Cambridge:

Pay to the Order of Without Recourse

CAMBRIDGE HOME CAPITAL LLC [*2]

/s/ Craig J. Hyman

BY: CRAIG J. HYMAN

VICE PRESIDENT/MEMBER

However, there is no evidence to demonstrate that this note was in fact assigned to Countrywide Home Loans, Inc. prior to or at the time it commenced the foreclosure action.

The said mortgage was assigned from MERS as nominee for Cambridge Home Capital, LLC to Countrywide Home Loans, Inc. on January 8, 2008, which is 5 months after Countrywide began the foreclosure action.

The said property was purchased on March 2, 2010 at the foreclosure sale by Countrywide Home Loans, Inc. for the sum of $470,090.47.

On March 2, 2010, Rosicki, Rosicki and Associates, on behalf of Countrywide Home Loans, Inc., assigned the bid for said property to Federal National Mortgage Association a/k/a Fannie Mae. Rosicki, Rosicki and Associates accepted the bid on behalf of Federal National.

Petitioner became the owner pursuant to a referee’s deed in foreclosure dated March 8, 2010 and recorded on May 18, 2010.

Petitioner points out that respondent Mary Williams was served personally on September 11, 2007 with the summons and complaint in the foreclosure action, but was sued as a “Jane Doe No.1.” Respondent Mary Williams defaulted in answering the summons and complaint.

The evidence demonstrates that Mary Williams was originally sued as a Jane Doe with no effort being made to ascertain if she resided at the said premises as a tenant. Petitioner did a search of the Nassau County Clerk records but no recorded lease was found.

Petitioner moved to amend the pleadings in February of 2008 to substitute the name Mary Williams for Jane Doe by the submission of the affirmation of Josephine Sangiorgio, Esq., dated February 1, 2008. Thereafter, the judgment of foreclosure and sale was served upon the Eastmans and Mary Williams. No explanation is provided by Countrywide as to how it discovered that Mary Williams was a tenant at the premises and why this information was not ascertained when the action for foreclosure was commenced in the Supreme Court.

Respondent Mary Williams is a Section 8 tenant who has lived at the premises since July 2006. Ms. Williams recertified in June of 2011 and is effective until July 1, 2012.

The issue for this court to decide is whether it has jurisdiction to decide any of the issues raised by respondent in connection with the foreclosure. [*3]

The court agrees that service upon Mary Williams in the foreclosure action was probably invalid. It does not appear that Plaintiff Countrywide made “timely efforts” to ascertain the identity of Mary Williams prior to commencing the foreclosure action. See Porter v. Kingsbrook OB/Gyn Assoc., 209 AD 497, 618 NYS2d 837 (2nd Dept 1994); Tucker v. Lorieo, 291 AD2d 261, 738 NYS2d 33 (1st Dept 2002); and Countrywide Home Loans v. Williams, 20 Misc 3d 1111(A), 867 NYS2d 16 (NY Dist Ct 2008).

Furthermore, it is highly questionable whether Countrywide Home Loans, Inc. had a valid assignment of the note at the time of commencement of the suit. See Bank of New York v. Silverberg, 86 AD3d 274, 926 NYS2d 532 (2nd Dept 2011) holding that a plaintiff which never was an actual assignee or holder of note at the time of commencement of the suit lacked standing to commence the foreclosure action.

If Countrywide lacked standing to bring the foreclosure action due to not being an assignee of the note or holder of same, then any subsequent transfer of title to Federal National Mortgage Association a/k/a Fannie Mae would be a nullity.

However, the foregoing issues raised by respondent cannot be addressed in this court. See Nassau Homes Corp. v. Shuster, 33 Misc 3d 130(A), 2011 WL 4952990 (App Term, 9th & 10th Jud Dists 2011) holding that:

The District Court properly found that petitioner had established its ownership of the subject premises, as evidenced by a certified copy of the referee’s deed, and that petitioner had properly served occupant with a notice to quit. Occupant’s only challenge to this proceeding appeared to be based upon objections to the foreclosure proceeding itself. However, the judgment of foreclosure and sale was final as to all issues and defenses that might have been litigated in the foreclosure action (see Cherico v. Bank of NY, 211 AD2d 961 [1995]), and the Supreme Court’s determination is not subject to collateral attack in the District Court (see Banker’s Trust v. Corbin, 14 Misc 3d 136[A], 2007 NY Slip Op 50239[U] [App Term, 2d & 11th Jud Dists 2007]). Thus, as occupant has shown no basis to disturb the final judgment, the final judgment is affirmed.

Based upon the foregoing, since respondent has raised serious issues concerning the foreclosure, this court will stay these proceedings until March 15, 2012, to afford respondent an opportunity to address all issues in the Supreme Court Nassau County. Unless the Supreme Court has granted a stay to respondent Mary Williams or has vacated the foreclosure judgment, then this case will proceed to trial on March 19, 2012.

So Ordered:

/s/ Hon. Scott Fairgrieve

DISTRICT COURT JUDGE [*4]

Dated:January 10, 2012

CC:Volunteer Lawyers Project

Rosicki, Rosicki & Associates, P.C.

SF/mp

[ipaper docId=77980254 access_key=key-1r7j07874ki06go4pen height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

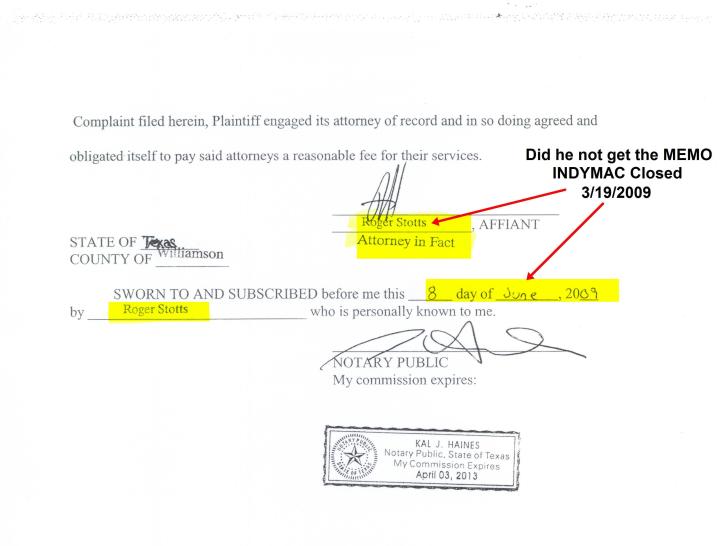

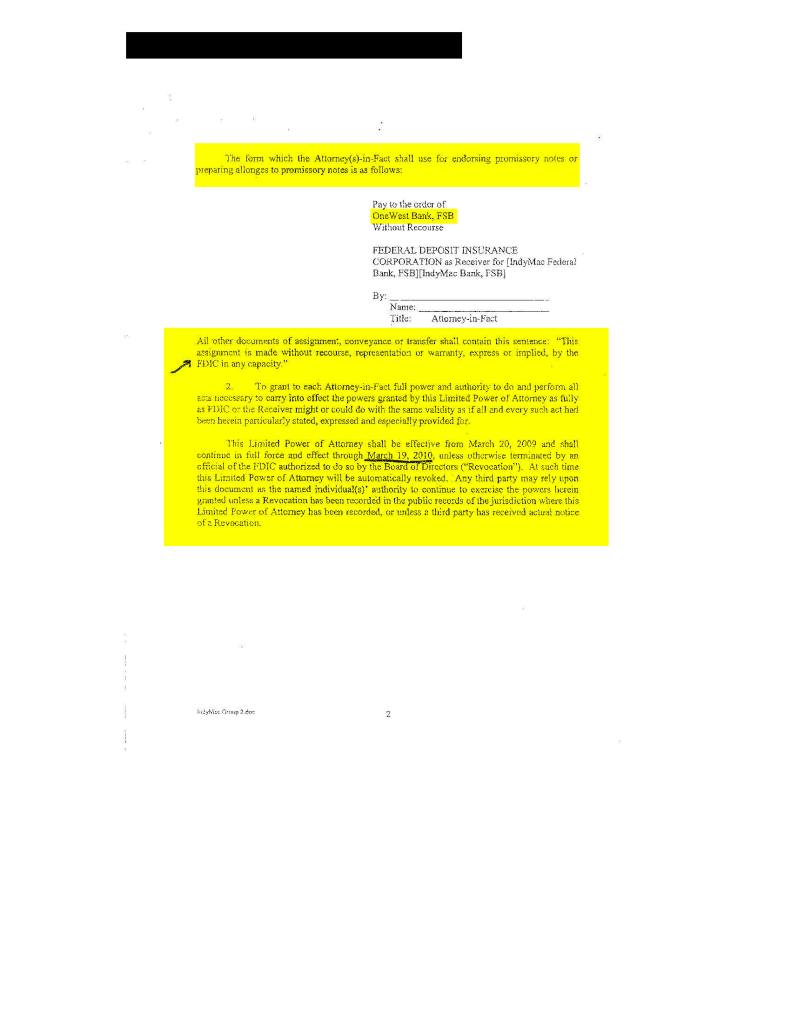

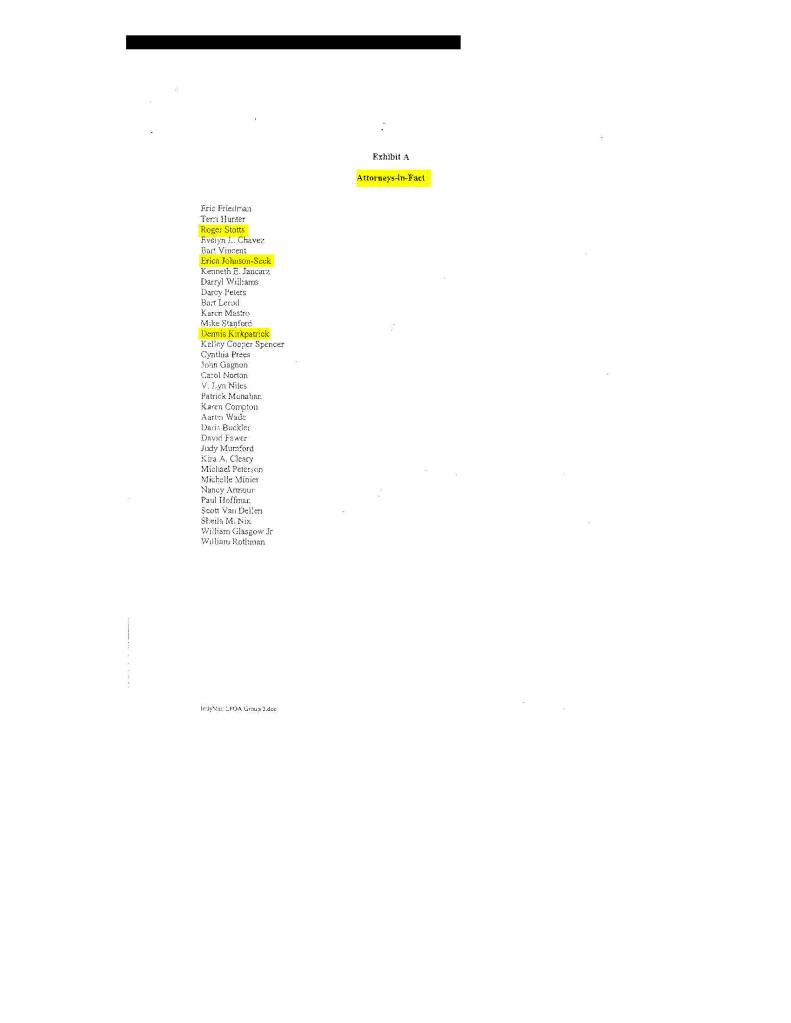

I EVEN HAVE THEM SIGNING onbehalf of the FDIC!

I EVEN HAVE THEM SIGNING onbehalf of the FDIC!

Recent Comments