Today the Florida Attorney General issued Subpoenas Duces Tecum’s to both Lender Processing Services Inc. and to a subsidiary DOCX. This involves employees past or present, the four foreclosure firms currently being investigated.

Both Assistant AG’s “McCollum’s Angels” June Clarkson and Theresa Edwards are doing an outstanding job!

.

.

[click image for ]

STATE OF FLORIDA

OFFICE OF THE ATTORNEY GENERAL

DEPARTMENT OF LEGAL AFFAIRS

______________________________________

ECONOMIC CRIMES

INVESTIGATIVE SUBPOENA DUCES TECUM

“You,” “Your” or “DOC X” as used herein means DOCX, L.L.c. and any ofthe respondents, their agents and employees or any “affiliate” of the aforementioned entities, as that term is herein defined. Your agents include but are not limited to your officers, directors, attorneys, accountants, CPA’s, advertising consultants, or advertising account representatives. Any document in the possession ofyou, your affiliates, your agents or your employees is deemed to be within your possession or control. You have the affirmative duty to contact your agents, affiliates and employees and to obtain documentation from them, if such documentation is responsive to this subpoena.

B. Unless otherwise indicated, documents to be produced pursuant to this subpoena should include all original documents prepared, sent, dated, received, in effect, or which otherwise came into existence at any time. If your “original” is a photocopy, then the photocopy would be and should be produced as the original.

C. This subpoena duces tecum calls for the production of all responsive documents in your possession, custody or control without regard to the physical location ofsaid documents.

D. “And” and “or” are used as terms of inclusion, not exclusion.

E. The documents to be produced pursuant to each request should be segregated and specifically identified to indicate clearly the particular numbered request to which they are responsIve.

F. In the event that you seek to withhold any document on the basis that is properly entitled to some privilege or limitation, please provide the following information:

1. A list identifying each document for which you believe a limitation exists;

2. The name of each author, writer, sender or initiator of such document or thing, if any;

3. The name of each recipient, addressee or party for whom such document or thing was intended, ifany;

4. The date of such document, if any, or an estimate thereof so indicated if no date appears on the document;

5. The general subject matter as described in such document, or, if no such description appears, then such other description sufficient to identify said document; and

6. The claimed grounds for withholding the document, including, but not limited to, the nature of any claimed privilege and grounds in support thereof.

G. For each request, or part thereof, which is not fully responded to pursuant to a privilege, the nature of the privilege and grounds in support thereof should be fully stated.

H. If you possess, control or have custody of no documents responsive to any of the numbered requests set forth below, state this fact in your response to said request.

1. For purposes of responding to this subpoena, the term “document” shall mean all writings or stored data or information ofany kind, in any form, including the originals and all nonidentical copies, whether different from the originals by reason of any notation(s) made on such copies or otherwise, including, without limitation: correspondence, notes, letters, telegrams, minutes, certificates, diplomas, contracts, franchise agreements and other agreements, brochures, pamphlets, forms, scripts, reports, studies, statistics, inter-office and intra-office communications, training materials, analyses, memoranda, statements, summaries, graphs, charts, tests, plans, arrangements, tabulations, bulletins, newsletters, advertisements, computer printouts, teletype, telefax, microfilm, e-mail, electronically stored data, price books and lists, invoices, receipts, inventories, regularly kept summaries or compilations of business records, notations of any type of conversations, meetings, telephone or other communications, audio and videotapes; electronic, mechanical or electrical records or representations of any kind (including without limitation tapes, cassettes, discs, magnetic tapes, hard drives and recordings to include each document translated, if necessary, through detection devices into reasonably usable form).

1. For purposes of responding to this subpoena, the term “affiliate” shall mean: a corporation, partnership, business trust, joint venture or other artificial entity which effectively controls, or is effectively controlled by you, or which is related to you as a parent or subsidiary or sibling entity. “Affiliate” shall also mean any entity in which there is a mutual identity of any officer or director. “Effectively controls” shall mean having the status of owner, investor (if 5% or more of voting stock), partner, member, officer, director, shareholder, manager, settlor, trustee, beneficiary or ultimate equitable owner as defined in Section 607.0505(11)(e), Florida Statutes.

K. The term “Florida affiliates” shall mean those of your affiliates which do business in Florida or which are licensed to do business in Florida.

L. If production of documents or other items required by this subpoena would be, in whole or in part, unduly burdensome, or if the response to an individual request for production may be aided by clarification of the request, contact the Assistant Attorney General who issued this subpoena to discuss possible amendments or modifications of the subpoena, within five (5) days of receipt ofsame.

M. Documents maintained in electronic form must be produced in their native electronic form with all metadata intact. Data must be produced in the data format in which it is typically used and maintained. Moreover, to the extent that a responsive Document has been electronically scanned (for any purpose), that Document must be produced in an Optical Character Recognition (OCR) format and an opportunity provided to review the original Document. In addition, documents that have been electronically scanned must be in black and white and should be produced in a Group IV TIFF Format (TIF image format), with a Summation format load file (dii extension). DII Coded data should be received in a (Comma-Separated Values) CSV format with a pipe (I) used for multivalue fields. Images should be single page TIFFs, meaning one TIFF file for each page of the Document, not one .tifffor each Document. Ifthere is no text for a text file, the following should be inserted in that text file: “Page Intentionally Left Blank.”

Moreover, this Subpoena requires all objective coding for the production, to the extent it exists. For electronic mail systems using Microsoft Outlook or LotusNotes, provide all responsive emails and, if applicable, email attachments and any related Documents, in their native file format (i.e., .pst for Outlook personal folder, .nsf for LotusNotes). For all other email systems, provide all responsive emails and, if applicable, email attachments and any related Documents in OCR and TIFF formats as described above.

P. The relevant time period for the present request shall be from January 1, 2006 to present unless otherwise specifically stated. YOU ARE HEREBY COMMANDED to produce at said time and place all documents, as defined above, relating to the following subjects:

1. Copies ofall “Network Agreements” between DOCX and any law firm with offices located in the State of Florida.

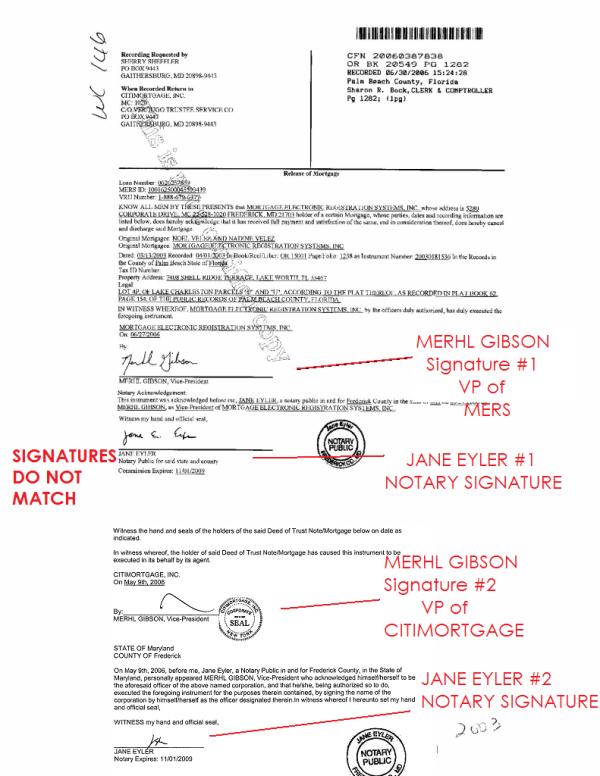

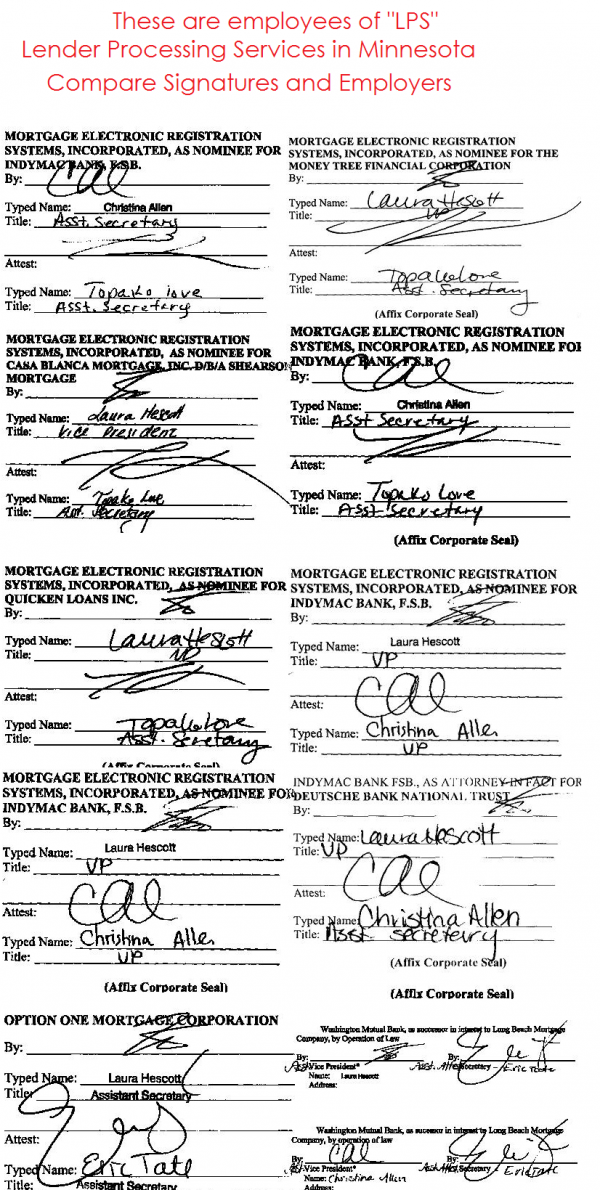

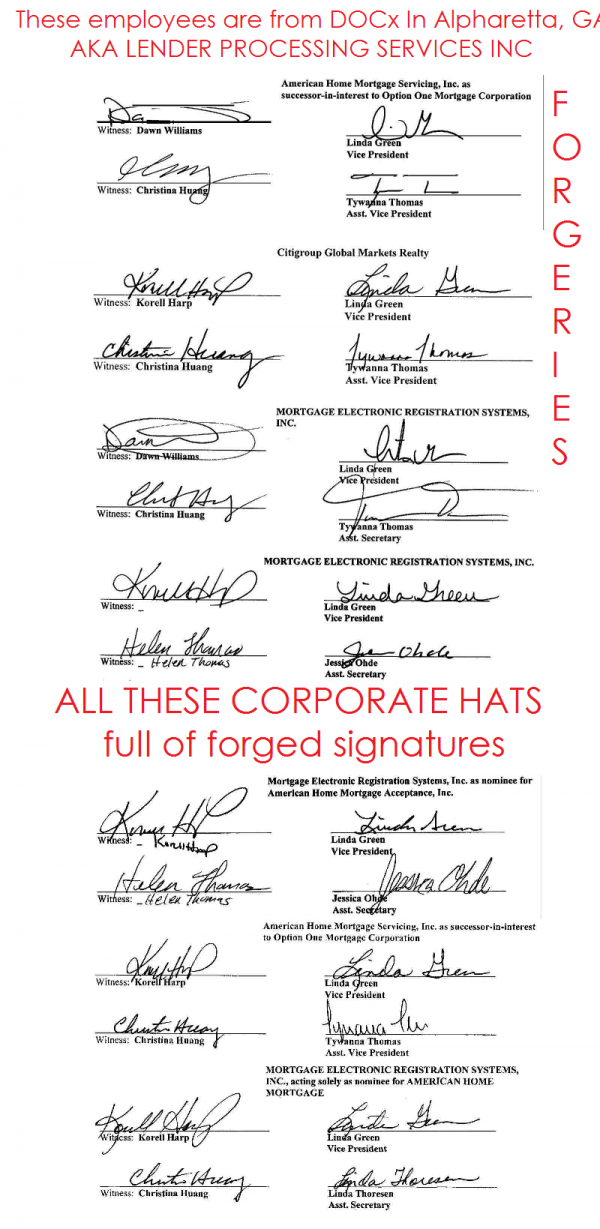

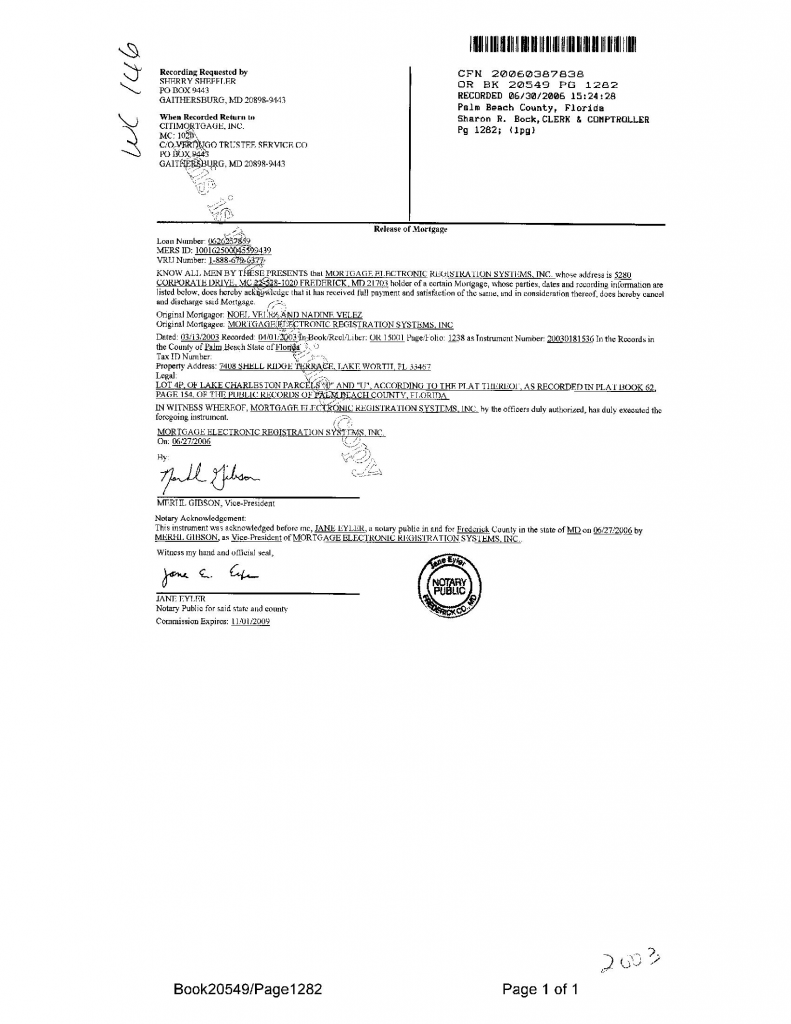

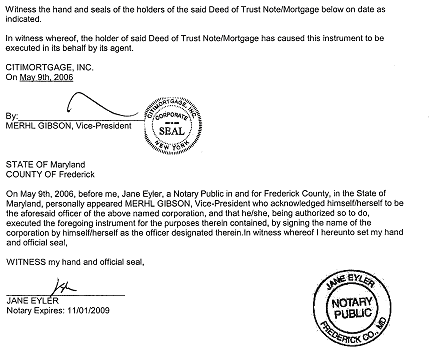

2. Copies of any and all underlying documentation that allows for your employee or ex-employee, Linda Green to sign documents in the following capacities:

a. Vice President of Loan Documentation, Wells Fargo Bank, N.A. successor by merger to Wells Fargo Home Mortgage, Inc.; ;

b. Vice President, Mortgage Electronic Registration Systems, Inc. as nominee for American Home Mortgage Acceptance, Inc.;

c. Vice President, American Home Mortgage Servicing as successor-in-interest to Option One Mortgage Corporation;

d. Vice President, Mortgage Electronic Registration Systems, Inc. as nominee for American Brokers Conduit;

e. Vice President & Asst. Secretary, American Home Mortgage Servicing, Inc., as servicer for Ameriquest Mortgage Corporation;

f. Vice President, Option One Mortgage Corporation;

g. Vice President, Mortgage Electronic Registration Systems, Inc. as nominee for HLB Mortgage;

h. Vice President, American Home Mortgage Servicing, Inc.;

1. Vice President, Mortgage Electronic Registration Systems, Inc. as nominee for Family Lending Services, Inc.;

J. Vice President, American Home Mortgage Servicing, Inc. as Successor -ininterest to Option One Mortgage Corporation;

k. Vice President, Argent Mortgage Company, LLC by Citi Residential Lending, Inc., attorney-in-fact;

1. . Vice President, Sand Canyon Corporation f/kJal Option One Mortgage Corporation;

m. Vice President, Amtrust Funsing (sic) Services, Inc., by American Home Mortgage Servicing, Inc., as Attorney-in -fact;

n. Vice President, Seattle Mortgage Company.

3. Copies of every document signed in any capacity by Linda Green.

4. Copies of any and all underlying documentation that allows for your employee or ex-employee, Korell Harp to sign documents in any capacity for any lender and/or servicing company.

5. Copies of any and all underlying documentation that allows for your employee or ex-employee, Jessica Ohde to sign documents in any capacity for any lender and/or servicing company.

6. Copies of any and all underlying documentation that allows for your employee or ex-employee, Pat Kingston to sign documents in any capacity for any lender and/or servicing company.

7. Copies of any and all underlying documentation that allows for your employee or ex-employee, Christina Huang to sign documents in any capacity for any lender and/or servicing company.

8. Copies of any and all underlying documentation that allows for your employee or ex-employee, Tywanna Thomas to sign documents in any capacity for any lender and/or servicing company.

9. All policy and procedure manuals and/or training materials regarding the methods and timing that DOCX uses, including without limitation relating to the drafting and/or execution of foreclosure and mortgage related documents, including but not limited to Assignments of Mortgage, Satisfactions ofMortgage and Affidavits ofany and all kind.

10. A list ofall employees, dates ofhire and termination, and their duties, including whether or not they provide any notary services for DOCX.

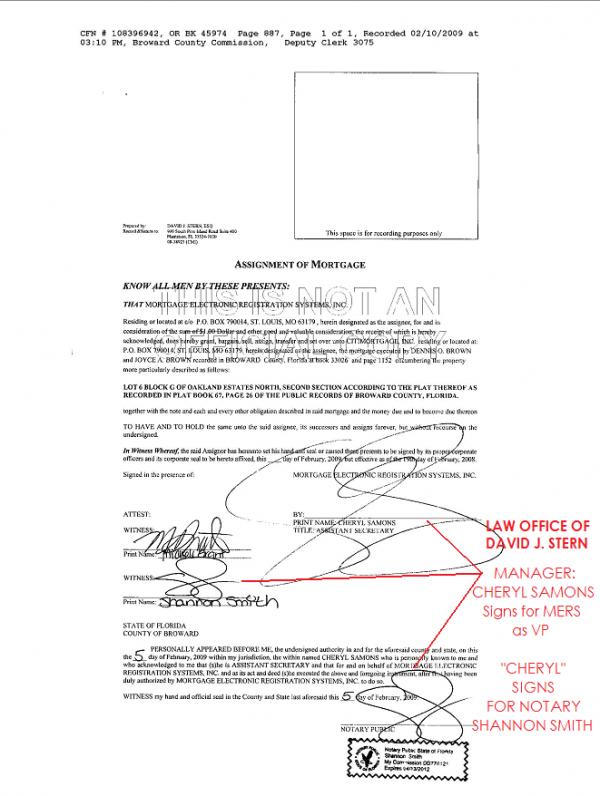

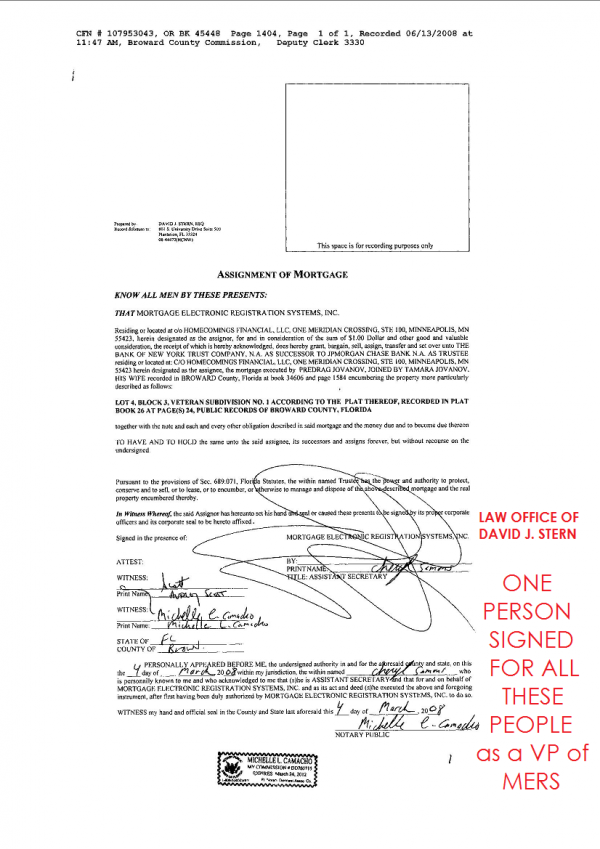

11. All documents in your possession regarding any contracts with Florida Default Law Group, P.L., The Law Offices of David J. Stem, P.A., Shapiro & Fishman, L.L.P. and The Law Offices of Marshall C. Watson, P.A., including contracts regarding payments to or from any of those entities.

12. Documents relating to the relationship between DOCX and NewTrac and/or NewInvoice, including but not limited to, documents relating to the types ofdocuments that are or can be generated or are requested to be generated.

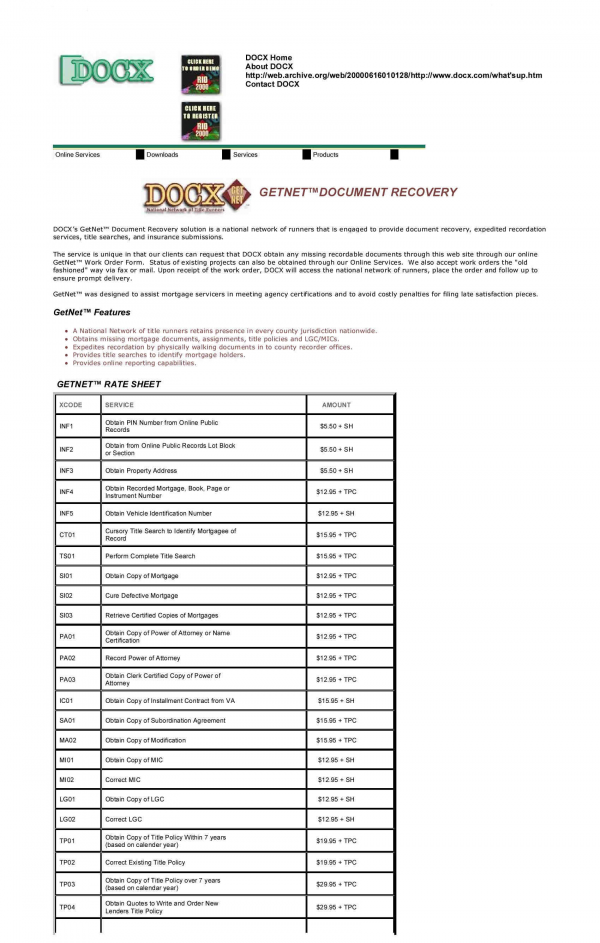

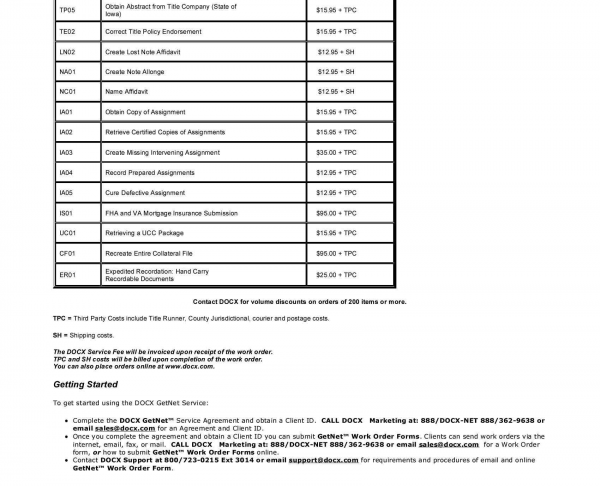

13. Any price lists published in any manner to prospective customers, whether by printed or electronic means.

14. All communications between DOCX and Florida Default Law Group, P.L., The Law Offices of David J. Stem, P.A., Shapiro & Fishman, L.L.P. or The Law Offices ofMarshall C. Watson, P.A. relating to procedures, policies, instructions or performance ofthe creation, backdating, modification, amendment, or other alteration ofany real property-related transactional document or records, including assignments, satisfactions ofmortgage, affidavits, notes, allonges, or other documents filed in any court.

15. Ledgers ofall financial transactions between DOCX and Florida Default Law Group, P.L., The Law Offices of David J. Stem, P.A., Shapiro & Fishman, L.L.P. or The Law Offices of Marshall C. Watson, P .A.

16. Ledgers ofall financial transactions between DOCX and any title company, recording service, process server, or any other entity that provides payments to DOCX in connection with any services rendered in connection with any residential foreclosure.

17. Ledgers ofall financial transactions between DOCX and any title company, recording service, process server, or any other entity to whom DOCX provides payment(s) in connection with any services rendered in connection with any residential foreclosure.

WITNESS the FLORIDA OFFICE OF THE ATTORNEY GENERAL in Fort Lauderdale, Florida, this 13th day of October, 2010.

June M. Clarkson

Assistant Attorney General

Florida Bar Number: 785709

OFFICE OF THE ATTORNEY GENERAL 110 S.E. 6th Street, 10th Floor

Fort Lauderdale, Florida 33301

Telephone: 954-712-4600

Facsimile: 954-712-4658

Theresa B. Edwards

Assistant Attorney General

Florida Bar Number: 252794

NOTE: In accordance with the Americans with Disabilities Act of 1990, persons needing a special accommodation to participate in this proceeding should contact George Rudd, Assistant Attorney General at (954) 712-4600 no later than seven days prior to the proceedings. Ifhearing impaired, contact the Florida Relay Service 1-800-955-8771 (TDD); or 1-800-955-8770 (Voice), for assistance.

AUTHORITY

Florida Statute 501.206

501.206 Investigative powers of enforcing authority.(

1) If, by his own inquiry or as a result ofcomplaints, the enforcing authority has reason to believe that a person has engaged in, or is engaging in, an act or practice that violates this part, he may administer oaths and affinnations, subpoena witnesses or matter, and collect evidence. Within 5 days excluding weekends and legal holidays, after the service ofa subpoena or at any time before the return date specified therein, whichever is longer, the party served may file in the circuit court in the county in which he resides or in which he transacts business and serve upon the enforcing authority a petition for an order modifying or setting aside the subpoena. The petitioner may raise any objection or privilege which would be available under this chapter or upon service of such subpoena in a civil action. The subpoena shall infonn the party served of his rights under this subsection.

(2) If matter that the enforcing authority seeks to obtain by subpoena is located outside the state, the person subpoenaed may make it available to the enforcing authority or his representative to examine the matter at the place where it is located. The enforcing authority may designate representatives, including officials ofthe state in which the matter is located, to inspect the matter on his behalf, and he may respond to similar requests from officials ofother states.

(3) Upon failure ofa person without lawful excuse to obey a subpoena and upon reasonable notice to all persons affected, the enforcing authority may apply to the circuit court for an order compelling compliance.

(4) The enforcing authority may request that the individual who refuses to comply with a subpoena on the ground that testimony or matter may incriminate him be ordered by the court to provide the testimony or matter. Except in a prosecution for perjury, an individual who complies with a court order to provide testimony or matter after asserting a privilege against selfincrimination to which he is entitled by law shall not have the testimony or matter so provided, or evidence derived there from, received against him in any criminal investigation proceeding.

(5) Any person upon whom a subpoena is served pursuant to this section shall comply with the tenns thereof unless otherwise provided by order of the court. Any person who fails to appear with the intent to avoid, evade, or prevent compliance in whole or in part with any investigation under this part or who removes, destroys, or by any other means falsifies any documentary material in the possession, custody, or control of any person subject to any such subpoena, or knowingly conceals any relevant infonnation with the intent to avoid, evade, or prevent compliance shall be liable for a civil penalty of not more than $5,000, reasonable attorney’s fees, and costs.

Affidavit of Service Attached

Continue Reading…

Continue Reading…

Recent Comments