MERS is an artifice and they are going to blow up!

Read this carefully…Judge Schack knows exactly where this is going and where he is taking it!

Decided on August 25, 2010

Supreme Court, Kings County

The Bank of New York, AS TRUSTEE FOR THE CERTIFICATEHOLDERS CWALT, INC. ALTERNATIVE LOAN TRUST 2006-OC1 MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2006-OC1, Plaintiff,

against

Denise Mulligan, BEVERLY BRANCHE, et. al., Defendants.

Plaintiff:

McCabe Weisberg Conway PC

Jason E. Brooks, Esq.

New Rochelle NY

Defendant:

No Appearances.

Arthur M. Schack, J.

Plaintiff’s renewed application, upon the default of all defendants, for an order of reference for the premises located at 1591 East 48th Street, Brooklyn, New York (Block 7846, Lot 14, County of Kings) is denied with prejudice. The complaint is dismissed. The notice of pendency filed against the above-named real property is cancelled.

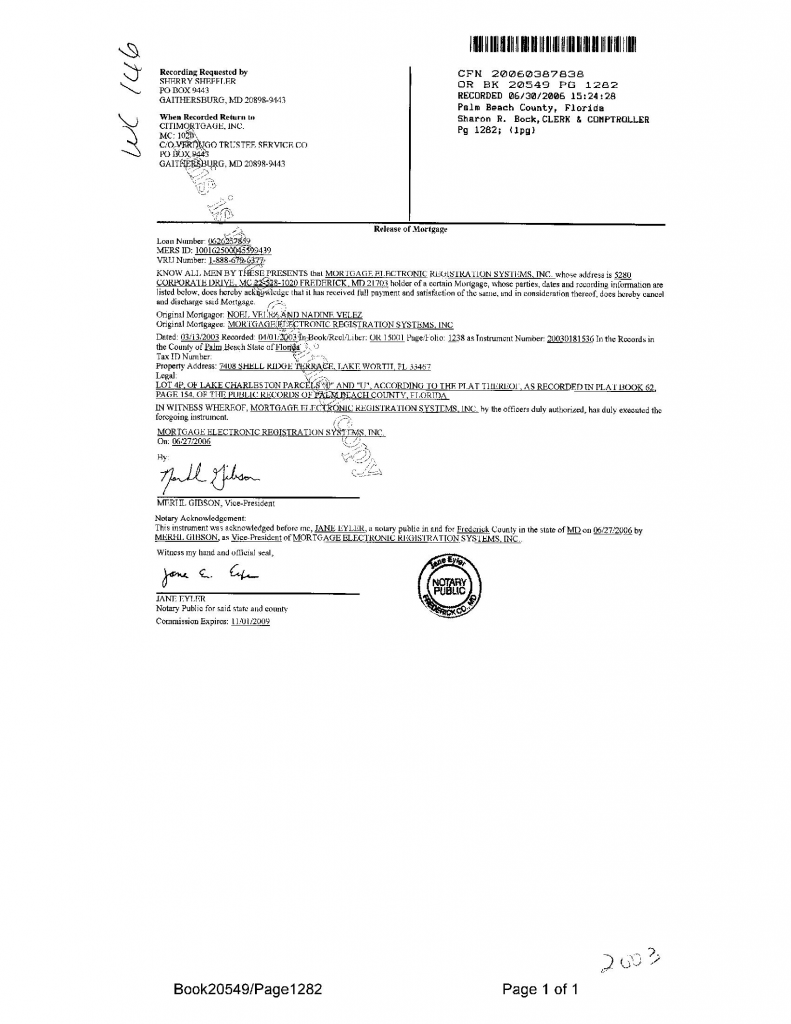

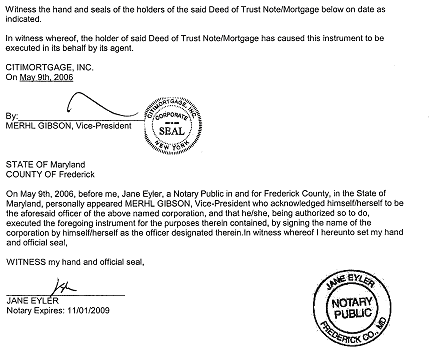

In my June 3, 2008 decision and order in this matter, I granted leave to plaintiff, THE BANK OF NEW YORK, AS TRUSTEE FOR THE CERTIFICATEHOLDERS CWALT, INC. ALTERNATIVE LOAN TRUST 2006-OC1 MORTGAGE PASS-THROUGH CERTIFICATES, [*2]SERIES 2006-OC1 (BNY), to renew its application for an order of reference within forty-five (45) days, until July 18, 2008, if it complied with three conditions. However, plaintiff did not make the instant motion until May 4, 2009, 335 days after June 3, 2008, and failed to offer any excuse for its lateness. Therefore, the instant motion is 290 days, almost ten months, late. Further, the instant renewed motion failed to present the three affidavits that this Court ordered plaintiff BNY to present with its renewed motion for an order of reference: (1) an affidavit of facts either by an officer of plaintiff BNY or someone with a valid power of attorney from plaintiff BNY and personal knowledge of the facts; (2) an affidavit from Ely Harless describing his employment history for the past three years, because Mr. Harless assigned the instant mortgage as Vice President of MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. (MERS) and then executed an affidavit of merit for assignee BNY as Vice President of BNY’s alleged attorney-in-fact without any power of attorney; and, (3) an affidavit from an officer of plaintiff BNY explaining why it purchased the instant nonperforming loan from MERS, as nominee for DECISION ONE MORTGAGE COMPANY, LLC (DECISION ONE).

Moreover, after I reviewed the papers filed with this renewed motion for an order of reference and searched the Automated City Register Information System (ACRIS) website of the Office of the City Register, New York City Department of Finance, I discovered that plaintiff BNY lacked standing to pursue the instant action for numerous reasons. Therefore, the instant action is dismissed with prejudice.

Background

Defendant DENISE MULLIGAN (MULLIGAN) borrowed $392,000.00 from

DECISION ONE on October 28, 2005. The mortgage to secure the note was recorded by MERS, “acting solely as a nominee for Lender [DECISION ONE]” and “FOR PURPOSES OF RECORDING THIS MORTGAGE, MERS IS THE MORTGAGEE OF RECORD,” in the Office of the City Register of the City of New York, New York City Department of Finance, on February 6, 2006, at City Register File Number (CRFN) 2006000069253.

Defendant MULLIGAN allegedly defaulted in her mortgage loan payments with her May 1, 2007 payment. Subsequently, plaintiff BNY commenced the instant action, on August 9, 2007, alleging in ¶ 8 of the complaint, and again in ¶ 8 of the August 16, 2007 amended complaint, that “Plaintiff [BNY] is the holder of said note and mortgage. said mortgage was assigned to Plaintiff, by Assignment of Mortgage to be recorded in the Office of the County Clerk of Kings County [sic].” As an aside, plaintiff’s counsel needs to learn that mortgages in New York City are not recorded in the Office of the County Clerk, but in the Office of the City Register of the City of New York. However, the instant mortgage and note were not assigned to plaintiff BNY until October 9, 2007, 61 days subsequent to the commencement of the instant action, by MERS, “as nominee for Decision One,” and executed by Ely Harless, Vice President of MERS. This assignment was recorded on October 24, 2007, in the Office of the City Register of the City of New York, at CRFN 2007000537531.

I denied the original application for an order of reference, on June 3, 2008, with leave to renew, because assignor Ely Harless also executed the March 20, 2008-affidavit of merit as Vice President and “an employee of Countrywide Home Loans, Inc., attorney-in-fact for Countrywide Home Loans, Inc.” The original application for an order of reference did not present any power of attorney from plaintiff BNY to Countrywide Home Loans, Inc. Also, the Court pondered how [*3]Countrywide Home Loans, Inc. could be its own an attorney-fact?

In my June 3, 2008 decision and order I noted that Real Property Actions and Proceedings Law (RPAPL) § 1321 allows the Court in a foreclosure action, upon the default of defendant or defendant’s admission of mortgage payment arrears, to appoint a referee “to compute the amount due to the plaintiff” and plaintiff BNY’s application for an order of reference was a preliminary step to obtaining a default judgment of foreclosure and sale. (Home Sav. Of Am., F.A. v Gkanios, 230 AD2d 770 [2d Dept 1996]). However, plaintiff BNY failed to meet the clear requirements of CPLR § 3215 (f) for a default judgment, which states:

On any application for judgment by default, the applicant shall file proof of service of the summons and the complaint, or a summons and notice served pursuant to subdivision (b) of rule 305 or subdivision (a) of rule 316 of this chapter, and proof of the facts constituting the claim, the default and the amount due by affidavit made by the party . . . Where a verified complaint has been served, it may be used as the affidavit of the facts constituting the claim and the amount due; in such case, an affidavit as to the default shall be made by the party or the party’s attorney. [Emphasisadded].

Plaintiff BNY failed to submit “proof of the facts” in “an affidavit made by the party.” (Blam v Netcher, 17 AD3d 495, 496 [2d Dept 2005]; Goodman v New York City Health & Hosps. Corp. 2 AD3d 581[2d Dept 2003]; Drake v Drake, 296 AD2d 566 [2d Dept 2002]; Parratta v McAllister, 283 AD2d 625 [2d Dept 2001]; Finnegan v Sheahan, 269 AD2d 491 [2d Dept 2000]; Hazim v Winter, 234 AD2d 422 [2d Dept 1996]). Instead, plaintiff BNY submitted an affidavit of merit and amount due by Ely Harless, “an employee of Countrywide Home Loans, Inc.” and failed to submit a valid power of attorney for that express purpose. Also, I required that if plaintiff renewed its application for an order of reference and provided to the Court a valid power of attorney, that if the power of attorney refers to a servicing agreement, the Court needs a properly offered copy of the servicing agreement to determine if the servicing agent may proceed on behalf of plaintiff. (EMC Mortg. Corp. v Batista, 15 Misc 3d 1143 (A), [Sup Ct, Kings County 2007]; Deutsche Bank Nat. Trust Co. v Lewis, 14 Misc 3d 1201 (A) [Sup Ct, Suffolk County 2006]).

I granted plaintiff BNY leave to renew its application for an order of reference within forty-five (45) days of June 3, 2008, which would be July 18, 2008. For reasons unknown to the Court, plaintiff BNY made the instant motion to renew its application for an order of reference on May 4, 2009, 290 days late. Plaintiff’s counsel, in his affirmation in support of the renewed motion, offers no explanation for his lateness and totally ignores this issue.

Further, despite the assignment by MERS, as nominee for DECISION ONE, to plaintiff BNY occurring 61 days subsequent to the commencement of the instant action, plaintiff’s counsel claims, in ¶ 17 of his affirmation in support, that “[s]aid assignment of mortgage [by MERS, as nominee for DECISION ONE to BNT] was drafted for the convenience of the court in establishing the chain of ownership, but the actual assignment and transfer had previously occurred by delivery.” The alleged proof presented of physical delivery of the subject MULLIGAN mortgage is a computer printout [exhibit G of motion], dated April 30, 2009, from [*4]Countrywide Financial, which plaintiff’s counsel calls a “Closing Loan Schedule,” and claims, in ¶ 21 of his affirmation in support, that this “closing loan schedule is the mortgage loan schedule displaying every loan held by such trust at the close date for said trust at the end of January 2006. The closing loan schedule is of public record and demonstrates that the Plaintiff was in possession of the note and mortgage about nineteen (19) months prior to the commencement of this action.” There is an entry on line 2591 of the second to last page of the printout showing account number 1232268089, which plaintiff’s counsel, in ¶ 22 of his affirmation in support, alleges is the subject mortgage. Plaintiff’s counsel asserts, in ¶ 23 of his affirmation in support, that “[t]he annexed closing loan schedule suffices to proceed in granting Plaintiff’s Order of Reference in this matter proving possession prior to any default.” This claim is ludicrous. The computer printout, printed on April 30, 2009, just prior to the making of the instant motion, has no probative value with respect to whether physical delivery of the subject mortgage was made to plaintiff BNY prior to the August 9, 2007 commencement of the instant action.

Further, even if the mortgage was delivered to BNY prior to the August 9, 2007 commencement of the instant action, this claim is in direct contradiction to plaintiff’s claim previously mentioned in ¶ 8 of both the complaint and the amended complaint, that “Plaintiff [BNY] is the holder of said note and mortgage. said mortgage was assigned to Plaintiff, by Assignment of Mortgage to be recorded in the Office of the County Clerk of Kings County [sic].” Both ¶’s 8 allege that the assignment of the subject mortgage took place prior to August 9, 2007 and the recording would subsequently take place. The only reality for the Court is that the assignment of the subject mortgage took place 61 days subsequent to the commencement of the action on October 9, 2007 and the assignment was recorded on October 24, 2007.

Moreover, plaintiff’s counsel alleges, in ¶ 18 of his affirmation in support, that “[p]ursuant to a charter between Mortgage Electronic Registrations Systems, Inc. ( MERS’) and Decision One Mortgage Company, LLC, all officers of Decision One Mortgage Company, LLC, a member of MERS, are appointed as assistant secretaries and vice presidents of MERS, and as such are authorized” to assign mortgage loans registered on the MERS System and execute documents related to foreclosures. ¶ 18 concludes with “See Exhibit F.” None of this appears in exhibit F. Exhibit F is a one page power of attorney from “THE BANK OF NEW YORK, as Trustee” pursuant to unknown pooling and servicing agreements appointing “Countrywide Home Loans Servicing LP and its authorized officers (collectively CHL Servicing’)” as its “attorneys-in-fact and authorized agents” for foreclosures “in connection with the transactions contemplated in those certain Pooling and Servicing Agreements.” The so-called “charter” between MERS and DECISION ONE was not presented to the Court in any exhibits attached to the instant motion.

Further, attached to the instant renewed motion [exhibit D] is an affidavit of merit

by Keri Selman, dated August 23, 2007 [47 days before the assignment to BNY], in which Ms. Selman claims to be “a foreclosure specialist of Countrywide Home Loans, Inc. Servicing agent for BANK OF NEW YORK, AS TRUSTEE FOR THE CERTIFICATEHOLDERS CWALT, INC. ALTERNATIVE LOAN TRUST 2006-OC1 MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2006-OC1 . . . I make this afidavit upon personal knowledge based on books and records of Bank of New York in my possession or subject to my control [sic]” Countrywide Home Loans, Inc. is not Countrywide Home Loans Servicing LP, referred to in the power of attorney attached to the renewed motion [exhibit F]. Moreover, plaintiff failed to [*5]present to the Court any power of attorney authorizing Ms. Selman to execute for Countrywide Home Loans, Inc. her affidavit on behalf of plaintiff BNY. Also, Ms. Selman has a history of executing documents presented to this Court while wearing different corporate hats. In Bank of New York as Trustee for Certificateholders CWABS, Inc. Asset-Backed Certificates, Series 2006-22 v Myers (22 Misc 3d 1117 [A] [Sup Ct, Kings County 2009], in which I issued a decision and order on February 3, 2009, Ms. Selman assigned the subject mortgage on June 28, 2008 as Assistant Vice President of MERS, nominee for Homebridge Mortgage Bankers Corp., and then five days later executed an affidavit of merit as Assistant Vice President of plaintiff BNY. I observed, in this decision and order, at 1-2, that:

Ms. Selman is a milliner’s delight by virtue of the number of hats she wears. In my November 19, 2007 decision and order (BANK OF NEW YORK A TRUSTEE FOR THE NOTEHOLDERS OF CWABS, INC. ASSET-BACKED NOTES, SERIES 2006-SD2 v SANDRA OROSCONUNEZ, et. al. [Index No., 32052/07]),

I observed that:

Plaintiff’s application is the third application for an order of reference received by me in the past several days that contain an affidavit from Keri Selman. In the instant action, she alleges to be an Assistant Vice President of the Bank of New York. On November 16, 2007, I denied an application for an order of reference (BANK OF NEW YORK A TRUSTEE FOR THE CERTIFICATEHOLDERS OF CWABS, INC. ASSET-BACKED CERTIFICATES, SERIES 2006-8 v JOSE NUNEZ, et. al., Index No. 10457/07), in which Keri Selman, in her affidavit of merit claims to be “Vice President of COUNTRYWIDE HOME LOANS, Attorney in fact for BANK OF NEW YORK.” The Court is concerned that Ms. Selman might be engaged in a subterfuge, wearing various corporate hats. Before granting an application for an order of reference, the Court requires an affidavit from Ms. Selman describing her employment history for the past three years. This Court has not yet received any affidavit from Ms. Selman describing her employment history, whether it is with MERS, BNY, COUNTRYWIDE HOME LOANS, or any other entity. [*6]

Further, the Court needs to address the conflict of interest in the June 20, 2008 assignment by Ms. Selman to her alleged employer, BNY.

I am still waiting for Ms. Selman’s affidavit to explain her tangled employment relationships. Interestingly, Ms. Selman, as “Assistant Vice President of MERS,” nominee for “America’s Wholesale Lender,” is the assignor of another mortgage to plaintiff BNY in Bank of New York v Alderazi (28 Misc 3d 376 [Sup Ct, Kings County 2010]), which I further cite below.

It is clear that plaintiff BNY failed to provide the Court with: an affidavit of merit by an officer of plaintiff BNY or someone with a valid power of attorney from BNY; an affidavit from Ely Harless, explaining his employment history; and, an explanation from BNY of why it purchased a nonperforming loan from MERS, as nominee of DECISION ONE. Moreover, plaintiff BNY did not own the subject mortgage and note when the instant case commenced. Even if plaintiff BNY owned the subject mortgage and note when the case commenced, MERS lacked the authority to assign the subject MULLIGAN mortgage to BNY, as will be explained further. Plaintiff’s counsel offers a lame and feeble excuse for not complying with my June 3, 2008 decision and order, in ¶ 23 of his affirmation in support, claiming that “[t]he affidavits requested in Honorable Arthur M. Schack’s Decision and Order should not be required, given the annexed closing loan schedule.”

Plaintiff BNY lacked standing

The instant action must be dismissed because plaintiff BNY lacked standing to bring this action on August 9, 2007, the day the action commenced. “Standing to sue is critical to the proper functioning of the judicial system. It is a threshold issue. If standing is denied, the pathway to the courthouse is blocked. The plaintiff who has standing, however, may cross the threshold and seek judicial redress.” (Saratoga County Chamber of Commerce, Inc. v Pataki, 100 NY2d 801 812 [2003], cert denied 540 US 1017 [2003]). Professor Siegel (NY Prac, § 136, at 232 [4d ed]), instructs that:

[i]t is the law’s policy to allow only an aggrieved person to bring a lawsuit . . . A want of “standing to sue,” in other words, is just another way of saying that this particular plaintiff is not involved in a genuine controversy, and a simple syllogism takes us from there to a “jurisdictional”

dismissal: (1) the courts have jurisdiction only over controversies; (2) a plaintiff found to lack “standing”is not involved in a controversy; and (3) the courts therefore have no jurisdiction of the case when such a plaintiff purports to bring it.

“Standing to sue requires an interest in the claim at issue in the lawsuit that the law will recognize as a sufficient predicate for determining the issue at the litigant’s request.” (Caprer v Nussbaum (36 AD3d 176, 181 [2d Dept 2006]). If a plaintiff lacks standing to sue, the plaintiff may not proceed in the action. (Stark v Goldberg, 297 AD2d 203 [1st Dept 2002]). [*7]

Plaintiff BNY lacked standing to foreclose on the instant mortgage and note when this action commenced on August 7, 2007, the day that BNY filed the summons, complaint and notice of pendency with the Kings County Clerk, because it did not own the mortgage and note that day. The instant mortgage and note were assigned to BNY, 61 days later, on October 7, 2007. The Court, in Campaign v Barba (23 AD3d 327 [2d Dept 2005]), instructed that “[t]o establish a prima facie case in an action to foreclose a mortgage, the plaintiff must establish the existence of the mortgage and the mortgage note, ownership of the mortgage, and the defendant’s default in payment [Emphasis added].” (See Witelson v Jamaica Estates Holding Corp. I, 40 AD3d 284 [1st Dept 2007]; Household Finance Realty Corp. of New York v Wynn, 19 AD3d 545 [2d Dept 2005]; Sears Mortgage Corp. v Yahhobi, 19 AD3d 402 [2d Dept 2005]; Ocwen Federal Bank FSB v Miller, 18 AD3d 527 [2d Dept 2005]; U.S. Bank Trust Nat. Ass’n Trustee v Butti, 16 AD3d 408 [2d Dept 2005]; First Union Mortgage Corp. v Fern, 298 AD2d 490 [2d Dept 2002]; Village Bank v Wild Oaks, Holding, Inc., 196 AD2d 812 [2d Dept 1993]).

Assignments of mortgages and notes are made by either written instrument or the assignor physically delivering the mortgage and note to the assignee.

“Our courts have repeatedly held that a bond and mortgage may be transferred by delivery without a written instrument of assignment.” (Flyer v Sullivan, 284 AD 697, 699 [1d Dept 1954]). The written October 7, 2007 assignment by MERS, as nominee for DECISION ONE, to BNY is clearly 61 days after the commencement of the action. Plaintiff’s BNY’s claim that the gobblygook computer printout it offered in exhibit G is evidence of physical delivery of the mortgage and note prior to commencement of the action is not only nonsensical, but flies in the face of the complaint and amended complaint, which both clearly state in ¶ 8 that “Plaintiff [BNY] is the holder of said note and mortgage. said mortgage was assigned to Plaintiff, by Assignment of Mortgage to be recorded in the Office of the County Clerk of Kings County [sic].” Plaintiff BNY did not own the mortgage and note when the instant action commenced on August 7, 2007.

“[A] retroactive assignment cannot be used to confer standing upon the assignee in a foreclosure action commenced prior to the execution of an assignment.”

(Wells Fargo Bank, N.A. v Marchione, 69 AD3d 204, 210 [2d Dept 2009]). The Marchione Court relied upon LaSalle Bank Natl. Assoc. v Ahearn (59 AD3d 911 [3d Dept 2009], which instructed, at 912, “[n]otably, foreclosure of a mortgage may not be brought by one who has no title to it’ (Kluge v Fugazy, 145 AD2d 537 [2d Dept 1988]) and an assignee of such a mortgage does not have standing unless the assignment is complete at the time the action is commenced).” (See U.S. Bank, N.A. v Collymore, 68 AD3d 752 [2d Dept 2009]; Countrywide Home Loans, Inc. v Gress, 68 AD3d 709 [2d Dept 2009]; Citgroup Global Mkts. Realty Corp. v Randolph Bowling, 25 Misc 3d 1244 [A] [Sup Ct, Kings County 2009]; Deutsche Bank Nat. Trust Company v Abbate, 25 Misc 3d 1216 [A] [Sup Ct, Richmond County 2009]; Indymac Bank FSB v Boyd, 22 Misc 3d 1119 [A] [Sup Ct, Kings County 2009]; Credit-Based Asset Management and Securitization, LLC v Akitoye,22 Misc 3d 1110 [A] [Sup Ct, Kings County Jan. 20, 2009]; Deutsche Bank Trust Co. Americas v Peabody, 20 Misc 3d 1108 [A][Sup Ct, Saratoga County 2008]).

The Appellate Division, First Department, citing Kluge v Fugazy, in Katz v East-Ville Realty Co., (249 AD2d 243 [1d Dept 1998]), instructed that “[p]laintiff’s attempt to foreclose upon a mortgage in which he had no legal or equitable interest was without foundation in law or [*8]fact.” Therefore, with plaintiff BNY not having standing, the Court lacks jurisdiction in this foreclosure action and the instant action is dismissed with prejudice.

MERS had no authority to assign the subject mortgage and note

Moreover, MERS lacked authority to assign the subject mortgage. The subject DECISION ONE mortgage, executed on October 28, 2005 by defendant MULLIGAN, clearly states on page 1 that “MERS is a separate corporation that is acting solely as a nominee for Lender [DECISION ONE] and LENDER’s successors and assigns . . . FOR PURPOSES OF RECORDING THIS MORTGAGE, MERS IS THE MORTGAGEE OF RECORD.”

The word “nominee” is defined as “[a] person designated to act in place of another, usu. in a very limited way” or “[a] party who holds bare legal title for the benefit of others.” (Black’s Law Dictionary 1076 [8th ed 2004]). “This definition suggests that a nominee possesses few or no legally enforceable rights beyond those of a principal whom the nominee serves.” (Landmark National Bank v Kesler, 289 Kan 528, 538 [2009]). The Supreme Court of Kansas, in Landmark National Bank, 289 Kan at 539, observed that:

The legal status of a nominee, then, depends on the context of the relationship of the nominee to its principal. Various courts have interpreted the relationship of MERS and the lender as an agency relationship. See In re Sheridan, 2009 WL631355, at *4 (Bankr. D.

Idaho, March 12, 2009) (MERS “acts not on its own account. Its capacity is representative.”); Mortgage Elec. Registrations Systems, Inc. v Southwest, 2009 Ark. 152 ___, ___SW3d___, 2009 WL 723182 (March 19, 2009) (“MERS, by the terms of the deed of trust, and its own stated purposes, was the lender’s agent”); La Salle Nat. Bank v Lamy, 12 Misc 3d 1191 [A], at *2 [Sup Ct, Suffolk County 2006]) . . .

(“A nominee of the owner of a note and mortgage may not effectively assign the note and mortgage to another for want of an ownership interest in said note and mortgage by the nominee.”)

The New York Court of Appeals in MERSCORP, Inc. v Romaine (8 NY3d 90 [2006]), explained how MERS acts as the agent of mortgagees, holding at 96:

In 1993, the MERS system was created by several large participants in the real estate mortgage industry to track ownership interests in residential mortgages. Mortgage lenders and other entities, known as MERS members, subscribe to the MERS system and pay annual fees for the electronic processing and tracking of ownership and transfers of mortgages. Members contractually agree to appoint [*9] MERS to act as their common agent on all mortgages they register in the MERS system. [Emphasis added]

Thus, it is clear that MERS’s relationship with its member lenders is that of agent with the lender-principal. This is a fiduciary relationship, resulting from the manifestation of consent by one person to another, allowing the other to act on his behalf, subject to his control and consent. The principal is the one for whom action is to be taken, and the agent is the one who acts.It has been held that the agent, who has a fiduciary relationship with the principal, “is a party who acts on behalf of the principal with the latter’s express, implied, or apparent authority.” (Maurillo v Park Slope U-Haul, 194 AD2d 142, 146 [2d Dept 1992]). “Agents are bound at all times to exercise the utmost good faith toward their principals. They must act in accordance with the highest and truest principles of morality.” (Elco Shoe Mfrs. v Sisk, 260 NY 100, 103 [1932]). (See Sokoloff v Harriman Estates Development Corp., 96 NY 409 [2001]); Wechsler v Bowman, 285 NY 284 [1941]; Lamdin v Broadway Surface Advertising Corp., 272 NY 133 [1936]). An agent “is prohibited from acting in any manner inconsistent with his agency or trust and is at all times bound to exercise the utmost good faith and loyalty in the performance of his duties.” (Lamdin, at 136).

Thus, in the instant action, MERS, as nominee for DECISION ONE, is an agent of DECISION ONE for limited purposes. It only has those powers given to it and authorized by its principal, DECISION ONE. Plaintiff BNY failed to submit documents authorizing MERS, as nominee for DECISION ONE, to assign the subject mortgage to plaintiff BNY. Therefore, even if the assignment by MERS, as nominee for DECISION ONE, to BNY was timely, and it was not, MERS lacked authority to assign the MULLIGAN mortgage, making the assignment defective. Recently, in Bank of New York v Alderazi, 28 Misc 3d at 379-380, my learned Kings County Supreme Court colleague, Justice Wayne Saitta explained that:

A party who claims to be the agent of another bears the burden of proving the agency relationship by a preponderance of the evidence (Lippincott v East River Mill & Lumber Co., 79 Misc 559 [1913]) and “[t]he declarations of an alleged agent may not be shown for the purpose of proving the fact of agency.” (Lexow & Jenkins, P.C. v Hertz Commercial Leasing Corp., 122 AD2d 25 [2d Dept 1986]; see also Siegel v Kentucky Fried Chicken of Long Is. 108 AD2d 218 [2d Dept 1985]; Moore v Leaseway Transp/ Corp., 65 AD2d 697 [1st Dept 1978].) “[T]he acts of a person assuming to be the representative of another are not competent to prove the agency in the absence of evidence tending to show the principal’s knowledge of such acts or assent to them.” (Lexow & Jenkins, P.C. v Hertz Commercial Leasing Corp., 122 AD2d at 26, quoting 2 NY Jur 2d, Agency and Independent Contractors § 26). [*10]

Plaintiff has submitted no evidence to demonstrate that the original lender, the mortgagee America’s Wholesale Lender, authorized MERS to assign the secured debt to plaintiff [the assignment, as noted above, executed by the multi-hatted Keri Selman].

In the instant action, MERS, as nominee for DECISION ONE, not only had no authority to assign the MULLIGAN mortgage, but no evidence was presented to the Court to demonstrate DECISION ONE’s knowledge or assent to the assignment by MERS to plaintiff BNY.

Cancellation of subject notice of pendency

The dismissal with prejudice of the instant foreclosure action requires the cancellation of the notice of pendency. CPLR § 6501 provides that the filing of a notice of pendency against a property is to give constructive notice to any purchaser of real property or encumbrancer against real property of an action that “would affect the title to, or the possession, use or enjoyment of real property, except in a summary proceeding brought to recover the possession of real property.” The Court of Appeals, in 5308 Realty Corp. v O & Y Equity Corp. (64 NY2d 313, 319 [1984]), commented that “[t]he purpose of the doctrine was to assure that a court retained its ability to effect justice by preserving its power over the property, regardless of whether a purchaser had any notice of the pending suit,” and, at 320, that “the statutory scheme permits a party to effectively retard the alienability of real property without any prior judicial review.”

CPLR § 6514 (a) provides for the mandatory cancellation of a notice of pendency by:

The Court, upon motion of any person aggrieved and upon such notice as it may require, shall direct any county clerk to cancel a notice of pendency, if service of a summons has not been completed within the time limited by section 6512; or if the action has been settled, discontinued or abated; or if the time to appeal from a final judgment against the plaintiff has expired; or if enforcement of a final judgment against the plaintiff has not been stayed pursuant to section 551. [emphasis added]

The plain meaning of the word “abated,” as used in CPLR § 6514 (a) is the ending of an action. “Abatement” is defined as “the act of eliminating or nullifying.” (Black’s Law Dictionary 3 [7th ed 1999]). “An action which has been abated is dead, and any further enforcement of the cause of action requires the bringing of a new action, provided that a cause of action remains (2A Carmody-Wait 2d § 11.1).” (Nastasi v Natassi, 26 AD3d 32, 40 [2d Dept 2005]). Further, Nastasi at 36, held that the “[c]ancellation of a notice of pendency can be granted in the exercise of the inherent power of the court where its filing fails to comply with CPLR § 6501 (see 5303 Realty Corp. v O & Y Equity Corp., supra at 320-321; Rose v Montt Assets, 250 AD2d 451, 451-452 [1d Dept 1998]; Siegel, NY Prac § 336 [4th ed]).” Thus, the [*11]dismissal of the instant complaint must result in the mandatory cancellation of plaintiff BNY’s notice of pendency against the property “in the exercise of the inherent power of the court.”

Conclusion

Accordingly, it is ORDERED, that the renewed motion of plaintiff, THE BANK OF NEW YORK, AS TRUSTEE FOR THE CERTIFICATEHOLDERS CWALT, INC. ALTERNATIVE LOAN TRUST 2006-OC1 MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2006-OC1, for an order of reference, for the premises located at 1591 East 48th Street, Brooklyn, New York (Block 7846, Lot 14, County of Kings), is denied with prejudice; and it is further ORDERED, that the instant action, Index Number 29399/07, is dismissed with prejudice; and it is further ORDERED that the Notice of Pendency in this action, filed with the Kings County Clerk on August 9, 2007, by plaintiff, THE BANK OF NEW YORK, AS TRUSTEE FOR THE CERTIFICATE HOLDERS CWALT, INC. ALTERNATIVE LOAN TRUST 2006-OC1 MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2006-OC1, to foreclose a mortgage for real property located at 1591 East 48th Street, Brooklyn, New York (Block 7846, Lot 14, County of Kings), is cancelled.

This constitutes the Decision and Order of the Court.

ENTER

________________________________HON. ARTHUR M. SCHACK

J. S. C.

~

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Continue reading…

Continue reading…

Recent Comments