Hat Tip to Attorney Kenneth Eric Trent in Fort Lauderdale for sending this my way.

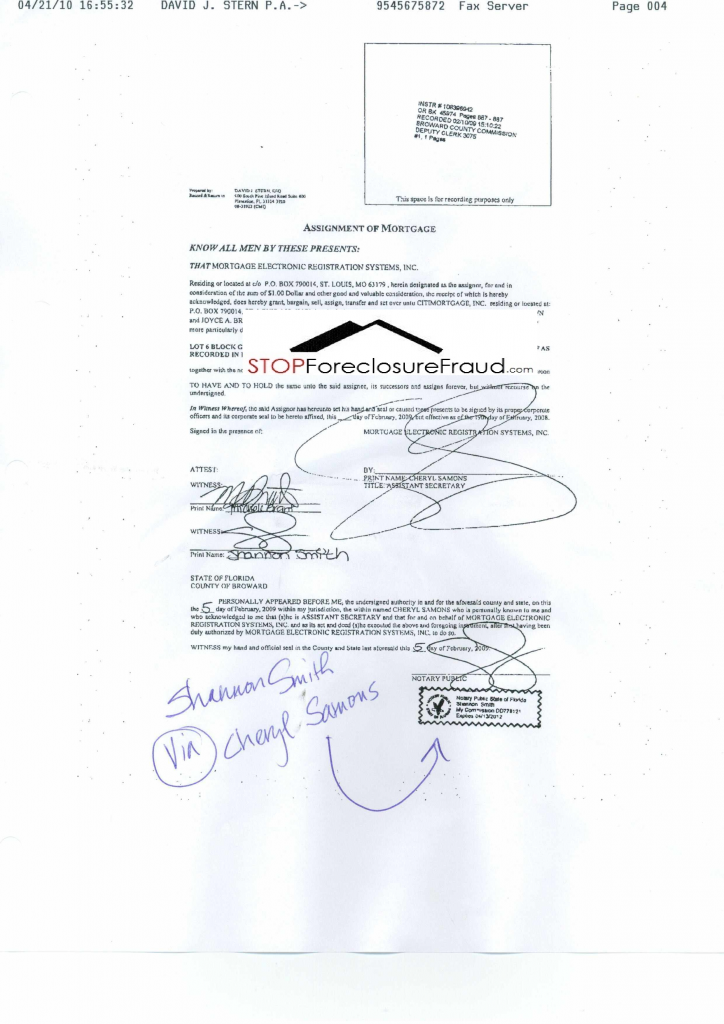

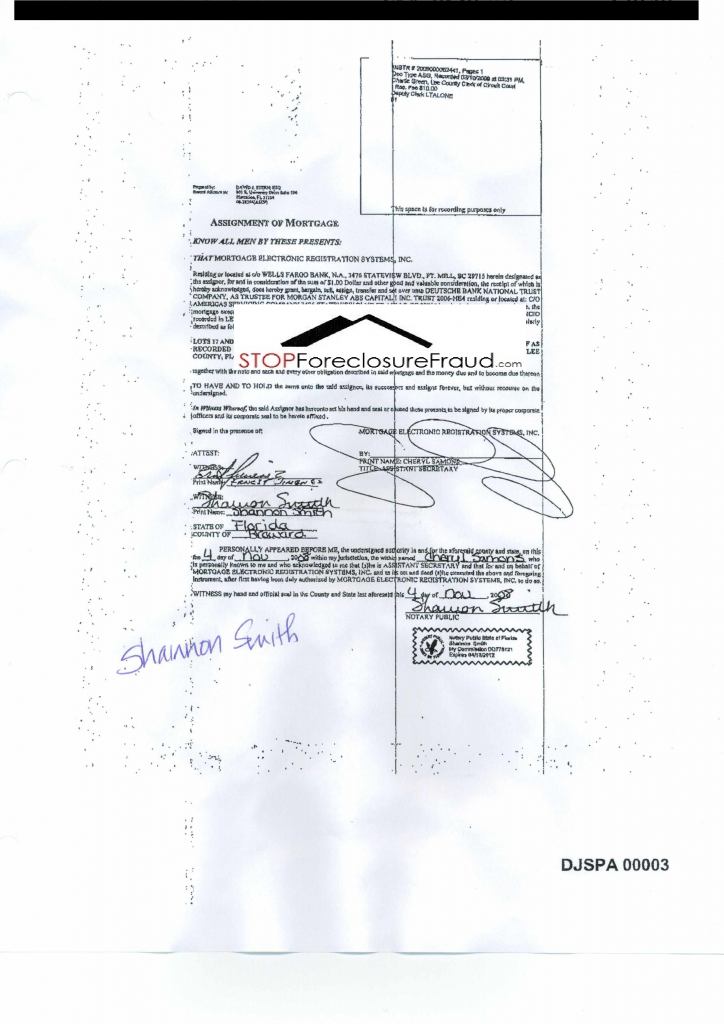

Below we have two Assignment of Mortgages created by David J. Stern Esq.

Take a look at the notary’s signature and compare it to Ms. Cheryl Samons…also make sure to see the printed names of Shannon Smith.

Archive | djsp enterprises

DAVID J. STERN’S CHERYL SAMONS| SHANNON SMITH Assignment Of Mortgage| NOTARY FRAUD!

Posted on 14 July 2010.

Posted in citimortgage, CONTROL FRAUD, corruption, deutsche bank, djsp enterprises, foreclosure, foreclosure fraud, foreclosures, Law Offices Of David J. Stern P.A., MERS, morgan stanley, mortgage, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC., Notary, notary fraud, robo signers, STOP FORECLOSURE FRAUD, trade secrets, wells fargo6 Comments

DJSP Enterprises Inc. hires Former GMAC Executive Richard D. Powers

Posted on 12 July 2010.

By DinSFLA 7/12/2010

DJSP Enterprises Inc. (DJSP) appointed mortgage-industry veteran Richard D. Powers as president and chief operating officer, overseeing day-to-day operations of the Florida-based provider of mortgage and real-estate processing services.

Chairman and Chief Executive David J. Stern said Powers’ extensive industry experience complements DJSP’s efforts to be a leader in the “default-services sector and beyond.”

“His strong management experience will help shape DJSP as we continue to establish ourselves as a provider of services to the mortgage industry for the life of the loan,” said Stern, who had held the president’s post.

Mr. Powers most recently was head of real-estate services at Altisource Portfolio Solutions SA (ASPS). Previously he was an executive in the mortgage operations of GMAC LLC, which has dealt with billions of dollars of losses the past several years, and was president at KB Home’s (KBH) mortgage unit.

DJSP Enterprises Inc. has recently caught the attention of several high profile law firms.

On June 14, 2010 the class action law firm of Statman, Harris & Eyrich, LLC announced it was investigating DJSP Enterprises, Inc. (“DJSP” or the “Company”) (DJSP 6.29, +0.04, +0.64%) for potential violations of state and federal securities laws. The affected stock was purchased between March 11, 2010 and May 27, 2010.

Then on June 28, 2010 Kaplan Fox & Kilsheimer LLP (www.kaplanfox.com) announced it has been investigating DJSP Enterprises (“DSJP” or the “Company”) (Symbol: DJSP) for potential violations of the federal securities laws. Investors who purchased Company securities since April 1, 2010 may be affected.

These investigations are still pending.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in djsp enterprises, foreclosure, foreclosures, investigation, Law Offices Of David J. Stern P.A.0 Comments

CLASS ACTION FORMING relating to LAW OFFICES of DAVID J. STERN in FLORIDA

Posted on 07 July 2010.

Gath Around!

Kenneth Eric Trent, Esq.

I am a Fort Lauderdale attorney. I get it! I am organizing a class action suit on behalf of Floridians who have lost their homes to foreclosure. I am looking for class members. To potentially qualify, one must have lost one’s home to foreclosure within the last three years; the plaintiff must have been represented by the Law Office of David J. Stern; and your mortgage must have included the standard MERS language.

Email me if you want to know more! foreclosuredestroyer@yahoo.com.

MR. Trent is currently working on his site www.foreclosuredestroyer.com

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in class action, djsp enterprises, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, Law Offices Of David J. Stern P.A., MERS, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC.1 Comment

VIDEO: DJSP Enterprises Chart 6/9/2010

Posted on 29 June 2010.

DJSP Video Chart

The DJSP video chart is more than a chart to watch; iIt is a basic lesson in combining 15 minute charts with daily charts in technical analysis.

SOURCE: QualityStocks.net

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in djsp enterprises, foreclosures, Law Offices Of David J. Stern P.A., stock0 Comments

DJSP Enterprises – Kaplan Fox Investigates Possible Securities Laws Violations NYTIMES ARTICLE TO FOLLOW!

Posted on 29 June 2010.

You DO NOT want to be on this firms radar…they investigate Corporate Fraud and this is the 2nd firm to launch an investigation against DJSP Enterprises.

New York – May 28, 2010 – Kaplan Fox & Kilsheimer LLP (www.kaplanfox.com) has been investigating DJSP Enterprises (“DSJP” or the “Company”) (Symbol: DJSP) for potential violations of the federal securities laws. Investors who purchased Company securities since April 1, 2010 may be affected.

On May 28, 2010, DJSP plunged by $2.59, or 29.2%, to $6.28 after the real-estate foreclosure services company posted weaker-than-expected first-quarter results and warned investors of a full-year earnings shortfall.

DJSP said it had a first-quarter adjusted profit of 35 cents a share, which was a nickel below the Thomson Reuters average estimate.

DJSP said that in April one of its largest bank clients initiated a foreclosure system conversion that cut the number of foreclosures. Because of the foreclosure system conversion and the U.S. government’s steps to prevent foreclosures, DJSP said it expects full-year earnings of $1.29 to $1.36 a share, which is below consensus. Volume topped 3.13 million shares, compared to the 50-day average daily volume of 190,000.

If you purchased DJSP publicly traded securities and would like to discuss our investigation, please e-mail us at mail@kaplanfox.com or contact:

Frederic S. Fox

Joel B. Strauss

Donald R. Hall

Hae Sung Nam

Jeffrey P. Campisi

Pamela A. Mayer

KAPLAN FOX & KILSHEIMER LLP

850 Third Avenue, 14th Floor

New York, New York 10022

(800) 290-1952

(212) 687-1980

Fax: (212) 687-7714

E-mail address: mail@kaplanfox.com

Laurence D. King

KAPLAN FOX & KILSHEIMER LLP

350 Sansome Street, Suite 400

San Francisco, California 94104

(415) 772-4700

Fax: (415) 772-4707

E-mail address: mail@kaplanfox.com

DinSFLA Here: —–>Heads Up! See Red Text!

According to www.seekingalpha.com’s contributor Glen Bradford on 5/28/2010 he states

“I listened into the conference call. Lowered guidance in most situations comes from future problems down the pipeline. That isn’t the case this time. Lowered guidance this time is just a temporary setback. Company prices should be a discount of their future earnings — and in this case, the discrepancy between price and value appears to be fairly large right now. The main points:

In the Q&A section, someone yelled at David Stern for not disclosing this setback through an 8-K earlier. In my opinion, taking all things into consideration, David Stern has been making the right judgment calls. The future for foreclosure processing is brighter than ever.

There is currently a rumor circulating suggesting that foreclosure processing is being pushed back another thirty (30) days for mid-summer election purposes.

David Stern has been getting phone calls from his customers on a daily basis to make sure that DJSP has the capacity to handle a future ramp up in capacity.

Two of their largest customers are merging, and in my opinion, this is going to make Q2 and maybe the beginning of Q3 temporarily weak. That said, I would argue that DJSP is incredibly likely to continue working with this new merged entity and get the backlog of foreclosures that they have built up.

Fannie Mae (FNM) and Freddie Mac (FRE) have been touring the facilities to make sure that DJSP has the capacity to ramp up processing.

They are in the process of picking up a second REO customer in my opinion, but the time that it takes to ramp up here might push those earnings into Q1 2011 at this point.

Posted in djsp enterprises, investigation, Law Offices Of David J. Stern P.A., stock0 Comments

Townhouse for sale…but with a catch

Posted on 17 June 2010.

Listen up Real Estate agents as you are well too familiar with this tale.

Previously I wrote a post ARE FORECLOSURE MILLS Coercing Buyers for BANK OWNED homes? ARE ALL THE MILLS? and just today I received another example of these foreclosure mills working hand in hand as title companies demanding you use their terms or else get NO CONTRACT.

Here is the example of this agent from Coldwell Banker who clearly states

“FannieMaeHomePath-Purchase this property for as little as 3% down. This property approved for HomePath Mortgage Financing. Approved for HomePath Renovation Mortgage Financing. Large 3 bedroom unit with two full baths. 2nd floor master suite has hardwood floors and a huge closet. Upgraded kitchen has granite countertops and cherry wood cabinets. Laundry Room. Fenced yard for added privacy.”

“REO Addendum not furnished until acceptance-See IMPORTANT attachments & Follow**Use FAR9 Contract-No Calls Please- EMAIL only: UNIT HAS NO APPLIANCES.”

Well here’s the catch, I got a sneak peek…read the last few sentences to discover the major RESPA VIOLATION among other serious issues.

I am sure Coldwell Banker would be estatic to see agents working in this fashion as well as Fannie Mae having their addendum crossed out in certain areas.

[ipaper docId=33202164 access_key=key-kovwb3di6vj5wqfk52w height=600 width=600 /]

RELATED STORY:

AGENTS BEWARE! HERE COME THE HAFA VENDORS aka LPS AFTER YOUR COMMISSION

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in coercion, concealment, conspiracy, CONTROL FRAUD, djsp enterprises, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, Law Offices Of David J. Stern P.A., law offices of Marshall C. Watson pa, respa, Violations0 Comments

OFFICIAL! CLASS ACTION FIRM Statman, Harris & Eyrich, LLC Announces Investigation of DJSP Enterprises, Inc.

Posted on 15 June 2010.

FL BROWARD COUNTY very own DJSP aka TOP FORECLOSURE FIRM Law Office of David J. Stern has alleged to have unloaded OVER 28% shares as it tanked!

CINCINNATI, Jun 14, 2010 (GlobeNewswire via COMTEX) — Attorney Advertising

The class action law firm of Statman, Harris & Eyrich, LLC announced today that it is investigating DJSP Enterprises, Inc. (“DJSP” or the “Company”) (DJSP 6.29, +0.04, +0.64%) for potential violations of state and federal securities laws. The affected stock was purchased between March 11, 2010 and May 27, 2010.

The firm’s investigation was triggered on May 27, 2010, when DJSP announced its operating results for the first quarter 2010. DJSP revealed that the Company would be unable to meet its earnings estimates and revised its earnings guidance from $1.83 to $1.29-1.36 EPS.

As a direct result, on May 28, 2010, DJSP’s stock fell to $6.38 per share, a decline of over 28% on unusually high trading volume.

Shareholders who purchased DJSP stock between March 11, 2010 and May 27, 2010 may have a claim against the Company and are encouraged to contact attorney Melinda Nenning at (513) 658-8867 or mnenning@statmanharris.com for further information without any obligation or cost to you.

Statman, Harris & Eyrich, LLC has offices in Chicago, Illinois; Cincinnati, Ohio; and Dayton, Ohio. www.statmanharris.com

This news release was distributed by GlobeNewswire, www.globenewswire.com

SOURCE: Statman, Harris & Eyrich, LLC

CONTACT: Statman, Harris & Eyrich, LLC Melinda S. Nenning, Esq. (513) 658-8867 Toll-Free: (888) 876-7881 mnenning@statmanharris.com 441 Vine Street, Suite 3700 Cincinnati, Ohio 45202 (C) Copyright 2010 GlobeNewswire, Inc. All rights reserved.© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Posted in djsp enterprises, foreclosure, foreclosure fraud, foreclosure mills, insider, investigation, Law Offices Of David J. Stern P.A., lawsuit, stock2 Comments

***BREAKING NEWS*** David J. Sterns “DJSP Enterprises, Inc” under INVESTOR INVESTIGATION

Posted on 13 June 2010.

I recently made a post about Shares of DJSP Enterprises Get SLAMMED….FALL 25%. Are we seeing a DownTrend?

Stock fell from $13.65 to $4.94 in 5 months!!!I guess now we know what may be happening…Stay tuned as I will be watching closely!

Investigation on behalf of investors in DJSP Enterprises, Inc (NASDAQ:DJSP) over possible securities laws violations – Contact the Shareholders Foundation, Inc

mail@shareholdersfoundation.com

FOR IMMEDIATE RELEASE

PRLog (Press Release) – Jun 01, 2010 – An investigation on behalf of investors in DJSP Enterprises, Inc (NASDAQ:DJSP) securities over possible violations of Federal Securities Laws by DJSP Enterprises was announced.

If you are an investor in DJSP Enterprises, Inc (NASDAQ:DJSP) securities, you have certain options and you should contact the Shareholders Foundation, Inc by email at mail@shareholdersfoundation.com or call +1 (858) 779 – 1554.

DJSP Enterprises, Inc., located in Plantation, Florida, through its subsidiary, DAL Group, LLC, engages in providing non-legal services supporting residential real estate foreclosure, other related legal actions, and lender owned real estate services in the United States. DJSP Enterprises, Inc reported in 2009 Total Revenue of $260.269million with a Net Income of $44.565million. According to the investigation by a law firm the investigation on behalf of investors in DJSP stock focuses on the following events. On May 28, 2010, DJSP Enterprises declined by $2.59, or 29.2%, to $6.28 after DJSP Enterprises posted weaker-than-expected first-quarter results and warned investors of a full-year earnings shortfall. DJSP Enterprises said it had a first-quarter adjusted profit of 35 cents a share, which was a nickel below the Thomson Reuters average estimate.

DJSP Enterprises said that in April one of its largest bank clients initiated a foreclosure system conversion that cut the number of foreclosures. Because of the foreclosure system conversion and the U.S. government’s steps to prevent foreclosures, DJSP Enterprises said it expects full-year earnings of $1.29 to $1.36 a share, which is below consensus. Volume topped 3.13 million shares, compared to the 50-day average daily volume of 190,000, so the investigation. Shares of DJSP Enterprises, Inc (DJSP) traded recently at $6.38 per share, down from its 52weekHigh of $13.65 per share.

Those who are investors in DJSP Enterprises, Inc (NASDAQ:DJSP) securities, you have certain options and you should contact the Shareholders Foundation, Inc by email at mail@shareholdersfoundation.com or call +1 (858) 779 – 1554.

# # #

RELATED STORY:

ARE FORECLOSURE MILLS Coercing Buyers for BANK OWNED homes? ARE ALL THE MILLS?

Law Firm of David J. Stern (DJSP) Appears to Be Under State And Federal Investigation For Fraud, Stern Law Firm Even Has It’s Own “Michael Clayton”.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Posted in djsp enterprises, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, insider, investigation, Law Offices Of David J. Stern P.A., stock0 Comments

FL 4th DCA FINAL SUMMARY FORECLOSURE JUDGMENT REVERSED!! LAZURAN vs. CitiMortgage Inc, Law Offices of David J. Stern PA et al

Posted on 10 June 2010.

When is someone going to really sanction these characters??

Time after time…I will say they’re days are numbered and we are getting closer and closer.

[ipaper docId=32848042 access_key=key-1pk7zslqcl70oojnax38 height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in citimortgage, djsp enterprises, foreclosure, foreclosure fraud, foreclosure mills, Law Offices Of David J. Stern P.A., reversed court decision0 Comments

Shares of DJSP Enterprises Get SLAMMED….FALL 25%. Are we seeing a DownTrend?

Posted on 30 May 2010.

Huge profits result from foreclosure procedure

By RICHARD WILNER NYPost

Last Updated: 1:03 AM, May 30, 2010

Posted: 1:03 AM, May 30, 2010

A new gold rush is sweeping the country — only this time the speculators are looking to get fat off the $4 billion home foreclosure industry by promising banks a streamlined and low-cost method to kick folks out of their homes. DinSFLA: Last time I heard the word “speculators” was in the CONDO BOOM!

In the last two years, as the mortgage meltdown intensified, four companies have gone public or filed papers to go public — each looking to get their hands on cash to help grow into a national powerhouse quickly to take advantage of the soft housing market.

Buying shares of these companies is like shorting the housing market — sort of giving the average investor a chance to be a mini-John Paulson, the hedge fund mogul who made billions betting against the housing market in 2007. There were roughly 2.9 million foreclosures in 2009 and there are currently 6 million homeowners 60 days or more delinquent on their mortgage.

The companies — DJSP Enterprises, which saw revenues grow 31 percent last year, Altisource Portfolio Solutions, which reported a 182 percent jump in profits last year, and Lender Processing Services, whose $2.4 billion in revenue was up 29 percent last year — each offer a technology platform that links mortgage lender clients on one end and law firms clients on the other.

A fourth company, Prommis Solutions, which swung to a $7.9 million profit in 2009 from a loss in 2008, recently filed papers to go public.

The four companies profit, in large part, from the high volume of mortgage defaults — collecting fees from banks for each referral and from law firms, which file the foreclosure actions. In fact, the companies warn that a turnaround in the housing market or additional mortgage-modification plans from Washington could chill their profits.

Last week, shares of DJSP Enterprises got slammed, falling 25 percent on Friday, to $6.46, a 52-week low, after the company lowered its guidance for 2010 in the wake of a drop in the number of foreclosures.

It’s a strange, new sector of the housing finance sector, where bad news for America fattens the bottom lines for these companies, and good news for beleaguered homeowners knocks the stuffing — and dollars — from their bottom lines.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in djsp enterprises, foreclosure fraud, Law Offices Of David J. Stern P.A.0 Comments

ARE FORECLOSURE MILLS Coercing Buyers for BANK OWNED homes? ARE ALL THE MILLS?

Posted on 30 May 2010.

MASTER_OFFER_PACKET_03-10-2010[1][1]

In the Master Packet above go to Page 7

Below is from an ad in Trulia

fannie mae owned.bank property. property is vacant.all offers requiring financing must have preapproval letter.all cash offer require proof of fund(see attachement).this property is eligible for home path renovation mortgage-as little as 3% down.buyer must close with seller closing agent(david j. stern law offices,p.a).investors not eligible for first 15days.*for showing instr please read broker remarks* note:offers must be submitted using attachment.close by 30 june and receive extra 3.5% in closing cost

Looking further into this I noticed the following:

- Still in the name of the owner

- NOT named under any REO

- Home last sold for 245K

- Now listed at 120K

Here is the BIGGEST:

I found a Bank-owned packet for this “SPECIALLY SELECTED” Agent/BROKER in many other REO’s and in this package it states the following: (SEE ABOVE LINK PACKET)

9) Which title companies are the sellers and who do I make out the earnest money deposit to once offer is verbally accepted?

ix. New House Title (This is registered with FDLG address 9119 CORPORATE LAKE DRIVE, SUITE 300 TAMPA FL 33634)

10) Can the buyer use their own title company or must they use the title company selected by seller?

NOW are we unleashing another dimension to this never ending SAGA?

We recently found out about WTF!!! DJSP Enterprises, Inc. Announces Agreement to Acquire Timios, Inc., Expand Presence Into 38 States , so is this a way for the Mills to Monopolize on the sales of these properties??

HERE IS same Agent/Broker for a FLORIDA DEFAULT LAW GROUP property:

THIS IS FANNIE MAE HOMEPATH PROPERTY.BANK OWNED.ALL OFFERS REQUIRING FINANCING MUST HAVE PREAPPROVAL LETTER. ALL CASH OFFERS REQUIRE PROOF OF FUNDS. THIS PROPERTY IS APPROVED FOR HOMEPATH AND HOMEPATH RENOVATION MORTGAGE FINANCING-AS LITTLE AS 3% DOWN,NO APPRAISAL OR MORTGAGE INSURANCE REQUIRED! ** FOR SHOWING INST PLEASE READ BROKER REMARKS** YOU MUST SUBMIT OFFER USING ATTACHMENT! INVESTORS NOT ELIGIBLE FOR FIRST 15DAYS.CLOSE BY JUNE 30 TO BE ELIGIBLE FOR EXTRA 3.5% SC. EMD: FL DEFAULT LAW GROUP.

Here is another same Agent/Broker for MARSHALL C. WATSON property:

FANNIE MAE OWNED.BANK PROPERTY. PROPERTY IS VACANT.ALL OFFERS REQUIRING FINANCING MUST HAVE PREAPPROVAL LETTER.ALL CASH OFFERS REQUIRE PROOF OF FUNDS(SEE ATTACHEMENT).THIS PROPERTY IS ELIGIBLE FOR HOME PATH RENOVATION MORTGAGE-AS LITTLE AS 3% DOWN.BUYER MUST CLOSE WITH SELLER CLOSING AGENT (LAW OFFICES OF MARSHALL C. WATSON).INVESTOR NOT ELIGIBLE FOR FIRST 15DAYS.*FOR SHOWING INSTR PLEASE READ BROKER REMARK* NOTE:OFFERS MUST BE SUBMITTED USING ATTACHMENT.CLOSE BY JUNE 30 TO GET 3.5% EXTRA IN CLOSING COST

Does the JUNE 30th Closing Day have any significance??

MAYBE it’s because of this? MERS May NOT Foreclose for Fannie Mae effective 5/1/2010 …I am just trying to make sense of this…Is there a grace period that followed?

- What “if” the BUYER selects their own Title company? Does this eliminate their chances of ever even being considered as a buyer?

- Why even bother to state this?

- Is this a way for the selected Agent/ Broker to find the buyer and discourage other agents or buyers from viewing?

- Was this at all even necessary to state?

- Is this verbiage to coerce agents to get a higher commission rather than pass down the incentive of 3.5% towards closing cost “if” under contract by 6/30?

- Why do investors have to refrain from buying for the first 15 days?

Coercion (pronounced /ko???r??n/) is the practice of forcing another party to behave in an involuntary manner (whether through action or inaction) by use of threats, intimidation, trickery, or some other form of pressure or force. Such actions are used as leverage, to force the victim to act in the desired way. Coercion may involve the actual infliction of physical pain/injury or psychological harm in order to enhance the credibility of a threat. The threat of further harm may lead to the cooperation or obedience of the person being coerced. Torture is one of the most extreme examples of coercion i.e. severe pain is inflicted until the victim provides the desired information.

RELATED STORY:

LENDER PROCESSING SERVICES (LPS) BUYING UP HOMES AT AUCTIONS? Take a look to see if this address is on your documents!

Posted in butler & hosch pa, conspiracy, djsp enterprises, fannie mae, FDLG, florida default law group, foreclosure, foreclosure fraud, foreclosure mills, hiatt & diaz PA, insider, investigation, Law Offices Of David J. Stern P.A., law offices of Marshall C. Watson pa, marshall watson, MERS, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC., Mortgage Foreclosure Fraud, new house title llc, Real Estate, REO, securitization, shapiro & fishman pa, short sale, spear & hoffman5 Comments

DJSP Enterprises, Inc. Reports Revenue of $71.6 Million and Adjusts Its 2010 Guidance AKA Law Offices of DAVID J. STERN

Posted on 27 May 2010.

PLANTATION, Fla., May 27 /PRNewswire-FirstCall/ — DJSP Enterprises, Inc. (Nasdaq: DJSP, DJSPW, DJSPU), one of the largest providers of processing services for the mortgage and real estate industries in the United States, today announced financial results for the three months ending March 31, 2010.

First Quarter Financial Highlights

Total revenue for the quarter increased 30.1% to $71.6 million from $55.0 million in last year’s comparable period.

Excluding client costs, revenue from the quarter increased to $30.8 million from $30.0 million compared to same period last year.

Adjusted Net Income was $8.7 million for the first quarter or $0.35 per share.

– the adjusted net income would have increased by $732 thousand but for one time

interest on bridge financing and other expenses related to the transaction in which

the company acquired its processing operations

Adjusted EBITDA for the first quarter was $14.4 million.

Continue here …

RELATED STORY:

NASDAQ, DJSP Enterprises Major Shareholders David J. Stern (Law office Foreclosure Mill) and Kerry S. Propper Subject of Department of Justice Investigation And SBA Law Suit.

Posted in djsp enterprises, Law Offices Of David J. Stern P.A.0 Comments

Banks and their RIDICULOUS Foreclosure tabs…Mills, REO's etc.

Posted on 21 May 2010.

You know from the ridiculous fees these banks pay from the Mills to the keeping up with the REOS’ (if they keep up with maintenance).

Does it make any $en$e why they DO NOT work it out with the homeowners?

I mean if you take a look at what they end up selling for at auction or in a short sale…Does it make any $en$e??

Again, does it make any freaking $en$e?

Now take a look at Foreclosure Mill Law Offices of David J. Stern in Plantation (DJSP) for example Small Foreclosure Firm’s Big Bucks: Back Office Grossed $260M in 2009:

and his assets below:

Source: AmericansUnitedForJustice.org

http://AmericansUnitedForJustice.org is working on Law Offices Of David J. Stern’s #2 Cheryl Samons stay tuned

DOES THIS MAKE ANY $EN$E?

DOJ are you watching?

Posted in djsp enterprises, foreclosure, foreclosure mills2 Comments

EXPOSED: DAVID J STERN and The Law Offices of David J Stern PA

Posted on 20 May 2010.

Do you wanna play a game?…

We will display his image, expose his assets and reveal how he has profited from the blood, sweat and tears of his fellow Americans.

HERE

Source: AmericansUnitedForJustice

DJSP Enterprises – Kaplan Fox Investigates Possible Securities Laws Violations NYTIMES ARTICLE TO FOLLOW!

Posted in djsp enterprises, foreclosure, foreclosure mills, foreclosures, Law Offices Of David J. Stern P.A.0 Comments

Law Firm of David J. Stern (DJSP) Appears to Be Under State And Federal Investigation For Fraud, Stern Law Firm Even Has It’s Own “Michael Clayton”.

Posted on 15 May 2010.

Forrest McSurdy Michael Clayton came to Stern’s rescue on my ordeal with the MILL! So I can vouch for what this article states about the “fixer” is 100% accurate !

Meticulously Written by Florida’s Very Own Bill Warner Private Detective, SARASOTA TO PANAMA CITY FL

Friday, May 14, 2010

Lender Processing Services Inc., (LPS) does work for the Law Firm of David J. Stern (DJSE) in Plantation Fl. Michelle Kersch, an LPS spokeswoman, said the subsidiary being investigated is Docx LLC. Docx processes and sometimes produces documents needed by banks to prove they own the mortgages. LPS’s annual report said that the processes under review have been “terminated,” and that the company has expressed its willingness to cooperate. Ms. Kersch declined to comment further on the probe.

A spokesman for the U.S. attorney’s office for the middle district of Florida, which the annual report says is handling the matter, declined to comment. The case follows on the dismissal of numerous foreclosure cases in which judges across the U.S. have found that the materials banks had submitted to support their claims were wrong. Faulty bank paperwork has been an issue in foreclosure proceedings since the housing crisis took hold a few years ago. It is often difficult to pin down who the real owner of a mortgage is, thanks to the complexity of the mortgage market. LPS was recently referenced in a bankruptcy case involving Sylvia Nuer, a Bronx, N.Y., homeowner who had filed for protection from creditors in 2008.

Diana Adams, a U.S. government lawyer who monitors bankruptcy courts, argued in a brief filed earlier this year in the Nuer case that an LPS employee signed a document that wrongly said J.P. Morgan Chase & Co. had owned Ms. Nuer’s loan. Documents related to the loan were “patently false or misleading,” according to Ms. Adams’s court papers. J.P. Morgan Chase, which has withdrawn its request to foreclose, declined to comment.

A Florida state-court judge, in a rare ruling, said a major national bank perpetrated a “fraud” in a foreclosure lawsuit filed by the Law Firm of David J. Stern, raising questions about how banks are attempting to claim homes from borrowers in default.

The ruling, made last month in Pasco County, Fla., comes amid increased scrutiny of foreclosures by the prosecutors and judges in regions hurt by the recession. Judges have said in hearings they are increasingly concerned that banks are attempting to seize properties they don’t own.

The Florida case began in December 2007 when U.S. Bank N.A. sued a homeowner, Ernest E. Harpster, after he defaulted on a $190,000 loan he received in January of that year. The Law Offices of David J. Stern, which represented the bank, prepared a document called an “assignment of mortgage” showing that the bank received ownership of the mortgage in December 2007. The document was dated December 2007.

But after investigating the matter, Circuit Court Judge Lynn Tepper ruled that the document couldn’t have been prepared until 2008. Thus, she ruled, the bank couldn’t prove it owned the mortgage at the time the suit was filed. The document filed by the plaintiff (through the Law Firm of David J. Stern), Judge Tepper wrote last month, “did not exist at the time of the filing of this action…was subsequently created and…fraudulently backdated, in a purposeful, intentional effort to mislead.” She dismissed the case.

Forrest McSurdy, a lawyer at the David Stern firm (McSurdy is General Councel for Stern law Firm) that handled the U.S. Bank case, said the mistake was due to “carelessness.” The mortgage document was initially prepared and signed in 2007 but wasn’t notarized until months later, he said. After discovering similar problems in other foreclosure cases, he said, the firm voluntarily withdrew the suits and later re-filed them using appropriate documents.

Foreclosure mill lawyer Forrest McSurdy calls truth a “technicality”. Lawyers operating foreclosure mills often are paid based on the volume of cases they complete. Some receive $1,000 per case, court records show. Firms compete for business in part based on how quickly they can foreclose. The David Stern law firm had about 900 employees as of last year, court records show.

“The pure volume of foreclosures has a tendency perhaps to encourage sloppiness, boilerplate paperwork or a lack of thoroughness” by attorneys for banks, said Judge Tepper of Florida, in an interview. The deluge of foreclosures makes the process “fraught with potential for fraud,” she said (Law Firm of the David J. Stern) .

At an unrelated hearing in a separate matter last week, Anthony Rondolino, a state-court judge in St. Petersburg, Fla., said that an affidavit submitted by the David Stern law firm on behalf of GMAC Mortgage LLC in a foreclosure case wasn’t necessarily sufficient to establish that GMAC was the owner of the mortgage. “I don’t have any confidence that any of the documents the Court’s receiving on these mass foreclosures are valid,” the judge said at the hearing.

Forrest G. McSurdy of Stern & McSurdy, P.A. Incorporated by David J Stern, Forrest G McSurdy, Stern and McSurdy, P.A. is located at 801 S University Dr Ste 500 Plantation, FL 33324. Stern and McSurdy, P.A. was incorporated on Friday, October 08, 1999 in the State of FL and is currently active. David J Stern represents Stern and McSurdy, P.A. as their registered agent.

Forrest McSurdy of the Law Firm of David J. Stern in Plantation Florida shows up as legal counsel for all of Stern’s attorneys when there is a Florida Bar complaint filed agasint them.

Chardan 2008 China Acquisition Corp. (CACA, CACAW, CACAU) signed a definitive?agreement for a business combination with DAL Group, LLC, a provider of processing services for mortgage lenders and servicers in Florida. At the closing of the business combination with Chardan, DAL will own 100% of the business and operations of Default Servicing, Inc. and Professional Title & Abstract Company of Florida and the non-legal operations supporting the foreclosure and other legal proceedings handled by the Law Offices of David J. Stern, P.A., collectively known as the Company. Default Servicing, Inc is now STERN HOLDING COMPANY – DS, INC see Florida Division of Corporations records click here.

Upon consummation of the transaction, Beijing, China-based Chardan will change its name to DJSP Enterprises, Inc. “DJSP” (David J. Stern Processing), and its stock is expected to trade on the Nasdaq under the symbols DJSP, DJSPU, and DJSPW. Assuming no redemptions by Chardan shareholders, the current owners of the company, the “Stern Parties” will receive approximately $111 million from DAL and the right to receive another $35 million in post-closing cash. In addition, “Stern Parties” will also hold equity interests. Kerry Propper, Chardan’s chief executive officer said, “The acquisition should generate significant value for our shareholders. David J. Stern, who will be DJSP’s CEO, has an impressive record building this business by continually strengthening the customer relationships on which it is based.”

Chardan 2008 China Acquisition was run by Kerry S. Propper he has had some problems with the SBA and the Department of Justice as did his father Dr. Richard D. Propper. Kerry S, Proper, Richard D. Propper and Royale Holdings own 1,151,128 shares of Chardan 2008 China Acquisition, they are the majority share holders of the company now directly linked to David J. Stern and DJSP Enterprises, Inc..

DAVID J. STERN LAW OFFICE is DJSP Enterprises on NASDAQ, Major Shareholders David J. Stern and Kerry S. Propper the Subject of Department of Justice Investigation And SBA Law Suit.

1). Kerry S. Propper was the subject of 2003 Federal law suit filed in Conn. by the Small Business Administration one of his co-defendants was Acorn Ct Investments LP, they all ended up paying the SBA $1,764,333 in total see link http://www.paed.uscourts.gov/documents/opinions/04D0487P.pdf

2). Kerry S. Propper was/is under Dept of Justice investigation with his father Richard Propper. One of their partners was convicted of defrauding the SBA and sent to Federal prison for 70 months. SBA seeks to recover $96 million from Richard Propper and the rest of the crew in yet another SBA lawsuit, see info below……

DEPARTMENT OF JUSTICE;

FRIDAY, DECEMBER 29, 2006, U.S. Files Suit Against John Torkelsen, Richard Propper, Daniel Beharry, & Sovereign Bank Alleging Fraud of $32 Million Against the Small Business Administration.

WASHINGTON – The Justice Department announced today that it has filed a lawsuit accusing John Torkelsen, Richard Propper, Daniel Beharry, and Sovereign Bank of defrauding the Small Business Administration’s Small Business Investment Company (SBIC) program of $32 million. The suit was filed in the Eastern District of Pennsylvania under the False Claims Act, which allows the United States to recover up to three times the amount of its losses plus civil penalties.

The government’s complaint alleges that Torkelsen, Propper and Beharry violated the conflict of interest and management fee rules of the SBIC program by engaging in multiple secret transactions that funneled government money into companies controlled by Propper and Beharry or Torkelsen and his family. The SBIC program has rules designed to prevent the unauthorized investment of government funds in companies controlled by those who act as managers of the SBICs. The alleged fraud is believed to be the largest perpetrated upon the program to date.

The SBIC program, administered by the U.S. Small Business Administration, was created in 1958 to fill the gap between the availability of venture capital and the needs of small businesses in start-up and growth situations. The government, itself, does not make direct investments or target specific industries. Rather, the SBIC program is a “fund of funds” – meaning that portfolio management and investment decisions are left to qualified private fund managers. Small businesses which qualify for assistance from the program are able to receive equity capital, long-term loans and expert management assistance.

The investigation of the fraud allegations against the defendants was conducted by the U.S. Attorney’s office in Philadelphia, Pa.; the U.S. Small Business Administration’s Office of Inspector General and Office of General Counsel; the Federal Bureau of Investigation; and the Justice Department’s Civil Division. The United States has settled with, or reached settlement in principle with, a number of other individuals or entities involved in the alleged fraud.

David J Stern Attorney, Related People:

•Adam S Gumsom

•Forrest G McSurdy

•Gibbons Cline

•Howard Bernstein

•James Rosen

•Nuccia McCormick

•Roger Wittenberns

•Spring Baldini

Related Companies:

•Attorneys’ Title Agency, P.A.

•Default Services, Inc.

•Default Servicing, Inc.

•Law Offices of David J. Stern, P.A.

•Professional Title and Abstract Company of Florida

•Stern and McSurdy, P.A.

•Sunset Servers of South Florida, Inc.

•The Harborage Association Inc.

Posted in concealment, conspiracy, corruption, djsp enterprises, foreclosure fraud, Law Offices Of David J. Stern P.A., Lender Processing Services Inc., LPS, Mortgage Foreclosure Fraud1 Comment

Judge Bashes Bank in Foreclosure Case: The Wall Street Journal

Posted on 17 April 2010.

Now you know when the Law Offices of David J. Stern reaches the Wall Street Journal, we certainly are getting our point A C R O S S! Thank You AMIR!

LAW APRIL 16, 2010, 11:20 P.M. ET

Judge Bashes Bank in Foreclosure Case

By AMIR EFRATI

A Florida state-court judge, in a rare ruling, said a major national bank perpetrated a “fraud” in a foreclosure lawsuit, raising questions about how banks are attempting to claim homes from borrowers in default.

The ruling, made last month in Pasco County, Fla., comes amid increased scrutiny of foreclosures by the prosecutors and judges in regions hurt by the recession. Judges have said in hearings they are increasingly concerned that banks are attempting to seize properties they don’t own.

Case Documents

Cases handled by the Law Offices of David Stern

The Florida case began in December 2007 when U.S. Bank N.A. sued a homeowner, Ernest E. Harpster, after he defaulted on a $190,000 loan he received in January of that year.

The Law Offices of David J. Stern, which represented the bank, prepared a document called an “assignment of mortgage” showing that the bank received ownership of the mortgage in December 2007. The document was dated December 2007.

But after investigating the matter, Circuit Court Judge Lynn Tepper ruled that the document couldn’t have been prepared until 2008. Thus, she ruled, the bank couldn’t prove it owned the mortgage at the time the suit was filed.

The document filed by the plaintiff, Judge Tepper wrote last month, “did not exist at the time of the filing of this action…was subsequently created and…fraudulently backdated, in a purposeful, intentional effort to mislead.” She dismissed the case.

Forrest McSurdy, a lawyer at the David Stern firm that handled the U.S. Bank case, said the mistake was due to “carelessness.” The mortgage document was initially prepared and signed in 2007 but wasn’t notarized until months later, he said. After discovering similar problems in other foreclosure cases, he said, the firm voluntarily withdrew the suits and later re-filed them using appropriate documents.

“Judges get in a whirl about technicalities because the courts are overwhelmed,” he said. “The merits of the cases are the same: people aren’t paying their mortgages.”

Steve Dale, a spokesman for U.S. Bank, said the company played a passive role in the matter because it represents investors who own a mortgage-securities trust that includes the Harpster loan. He said a division of Wells Fargo & Co., which collected payments from Mr. Harpster, initiated the foreclosure on behalf of the investors.

Wells Fargo said in a statement it “does not condone, accept, nor instruct counsel to take actions such as those taken in this case.” The company said it was “troubled” by the “conclusions the Court found as to the actions of this foreclosure attorney. We will review these circumstances closely and take appropriate action as necessary.”

Since the housing crisis began several years ago, judges across the U.S. have found that documents submitted by banks to support foreclosure claims were wrong. Mistakes by banks and their representatives have also led to an ongoing federal criminal probe in Florida.

Some of the problems stem from the difficulty banks face in proving they own the loans, thanks to the complexity of the mortgage market.

The Florida ruling against U.S. Bank was also a critique of law firms that handle foreclosure cases on behalf of banks, dubbed “foreclosure mills.”

Lawyers operating foreclosure mills often are paid based on the volume of cases they complete. Some receive $1,000 per case, court records show. Firms compete for business in part based on how quickly they can foreclose. The David Stern firm had about 900 employees as of last year, court records show.

“The pure volume of foreclosures has a tendency perhaps to encourage sloppiness, boilerplate paperwork or a lack of thoroughness” by attorneys for banks, said Judge Tepper of Florida, in an interview. The deluge of foreclosures makes the process “fraught with potential for fraud,” she said.

At an unrelated hearing in a separate matter last week, Anthony Rondolino, a state-court judge in St. Petersburg, Fla., said that an affidavit submitted by the David Stern law firm on behalf of GMAC Mortgage LLC in a foreclosure case wasn’t necessarily sufficient to establish that GMAC was the owner of the mortgage.

“I don’t have any confidence that any of the documents the Court’s receiving on these mass foreclosures are valid,” the judge said at the hearing.

A spokesman for GMAC declined to comment and a lawyer at the David Stern firm declined to comment.

Write to Amir Efrati at amir.efrati@wsj.com

Related Articles

U.S. Probes Foreclosure-Data Provider

4/3/2010

Two Different Plaintiffs Claim to Own Same Mortgage

11/14/2008

Some Judges Stiffen Foreclosure Standards

7/26/2008

The Court House: How One Family Fought Foreclosure

11/28/2007

Judges Tackle “Foreclosure Mills”

11/30/2007

Wells Fargo Is Sanctioned For Role in Mortgage Woes

4/30/2008

Judge reversed his own ruling that had granted summary judgment to GMAC Mortgage (DAVID J. STERN)

OVERRULED!!! Florida Judge Reverses His own Summary Judgment Order!

Posted in concealment, conspiracy, CONTROL FRAUD, corruption, djsp enterprises, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, forensic mortgage investigation audit, Law Offices Of David J. Stern P.A., MERS, us bank2 Comments

Move over GOLDMAN SACHS…WE have a New Player to this Housing "Betting" Crisis…NASDAQ Presenting the Law Offices of David J. Stern, P.A. ("DJS")

Posted on 28 February 2010.

Chardan 2008 Announces Its Acquisition

Chardan 2008 Announces Its Acquisition

Foreclosure News

Monday, 14 December 2009

TORTOLA, British Virgin Islands, Dec. 14 /PRNewswire-FirstCall/ —

Chardan 2008 China Acquisition Corp. (Nasdaq: CACA, CACAW, CACAU) (“Chardan”) today announced that it has signed a definitive agreement to enter into a business combination with DAL Group, LLC (“DAL”), which, following the closing, will be one of the largest providers of mortgage processing services in Florida. At the closing of the business combination with Chardan, DAL will own 100% of the business and operations of Default Servicing, Inc. (“DSI”) and Professional Title & Abstract Company of Florida (“PTA”) and the non-legal operations supporting the foreclosure and other legal proceedings handled by

the Law Offices of David J. Stern, P.A. (“DJS”) (collectively referred to as the “Company”).

Upon consummation of the transaction, Chardan will change its name to DJSP Enterprises, Inc. (“DJSP”), and its stock is expected to continue to trade on NASDAQ under the symbols DJSP, DJSPU, and DJSPW.

The closing of the acquisition is subject to customary closing conditions, including approval of the acquisition agreement by holders of a majority of Chardan’s outstanding ordinary shares.

Business Overview

Following the closing of the business combination, DJSP will be one of the largest providers of processing services for the mortgage and real estate industries in Florida and one of the largest in the United States. The Company provides a wide range of processing services in connection with mortgages, mortgage defaults, title searches and abstracts, REO (bank-owned) properties, loan modifications, title insurance, loss mitigation, bankruptcy, related litigation and other services. DJS’s clients include all of the top 10 and 17 of the top 20 mortgage servicers in the United States, many of which have been customers of DJS for more than 10 years. The Company has approximately 1000 employees and is headquartered in Plantation, Florida, with additional operations in Louisville, Kentucky and San Juan, Puerto Rico. In addition, the Company’s U.S. operations are supported by a scalable, low-cost back office operation in Manila, the Philippines that provides data entry and document preparation support at a low cost.

The Company has experienced rapid growth over the past four years, increasing revenues from approximately $40 million in 2006 to approximately $199 million in 2008, while increasing net income, on a pro forma basis, for the same two periods from approximately $7 million to approximately $39 million. The Company had revenues of approximately $117 million for the 6 months ended June 30, 2009 and an adjusted pro forma net income for that period of $22 million, signaling continued growth.

DJSP’s principal market, Florida, currently ranks second among the 50 states in the number of mortgage loan foreclosures according to September 2009 data from the Mortgage Bankers Association (“MBA”). According to RealtyTrac, 8 of the top 25 U.S. metropolitan areas ranked by foreclosure rates in the second quarter of 2009 were in Florida.

The Company has invested heavily in its infrastructure and state-of-the-art information technology systems in recent years, enabling it to manage effectively and efficiently the large volumes of data it needs to meet its customers’ needs. The Company’s highly skilled staff, scalable proprietary processes and more than decade long experience in large-scale, efficient processing services has uniquely positioned the Company to capitalize on the rapidly increasing demand for efficient loan default processing services as a result of the historically unprecedented default volumes

Mr. David J. Stern commented,

“I am very excited about becoming the CEO of a NASDAQ-listed company. This will enable us to leverage our well-developed platform and decade-long experience to capitalize on the increasing business opportunities we have at hand.

Today, approximately one in seven households with mortgages in the United States is behind on mortgage payments or is in foreclosure, up from one in ten households a year ago. In addition, about 25% of residential mortgage loans in the U.S. are currently “under water,” with homeowners owing more on their mortgage loan than their home is worth. We believe this trend will persist as other macro-economic trends, such as high unemployment, ongoing option ARM resets and high levels of consumer debt will continue to hinder the ability of homeowners to meet their mortgage obligations. We believe that home prices will remain near current depressed levels for at least the next few years and that foreclosure rates will remain at historically high levels for years to come.”

Mr. Stern continued, “We anticipate that our growth will come from a number of areas. First, we anticipate a significant increase in business next year from services related to REO (bank owned) properties. This business involves helping banks dispose of properties that they have come to own through foreclosure. In 2008 and 2009 we provided REO processing services to only one client, but we have begun actively marketing this service to other clients. As a result, we expect meaningful increases from this portion of our business to occur in 2010 and beyond.”

“Second, we expect growth in foreclosure file volumes in Florida due to declining home values, high unemployment rates and the forthcoming upward resets of adjustable rate mortgages. In addition, we believe the Company is well positioned to capitalize on the expanding loan modification efforts. As a large-scale operation, we plan to leverage our experience in mortgage default operations across multiple states and assist with broad loan modification efforts nationally.”

“Third, many of DJS’s customers, which include the top mortgage servicers in the United States, have expressed a preference to use fewer firms to handle their foreclosure files. We expect this will result in our being able to increase our market share substantially.”

“We are also planning to leverage our existing platform and customer base to expand geographically and to increase our service offerings to include additional ancillary revenue generating services. And finally, we are planning to add cyclical business lines such as mortgage origination processing services, other consumer lending services, and legal process outsourcing to our repertoire, all of which will further enhance our growth in the future. ”

DJSP Financial Outlook & Guidance

Chardan projects the following pro forma adjusted financial results for the years ending December 31, 2009 and 2010:

continue reading or to see the figures in dollar amounts….HERE

….Lets investigate some more. To Be CONTINUED.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

….Lets investigate some more. To Be CONTINUED.

Posted in djsp enterprises, foreclosure mills, Law Offices Of David J. Stern P.A.4 Comments

Recent Comments