Ok… before we get to the transcript below I want to point out a few issues I found.

The question that remains is how did EVERHOME “ever” get a hold of any mortgage? It has no assignment in PB records.

EVERHOME is a Shareholder/ Owner of MERS. There is also a connection between CitiMortgage and a Verdugo Trustee Service Corporation.

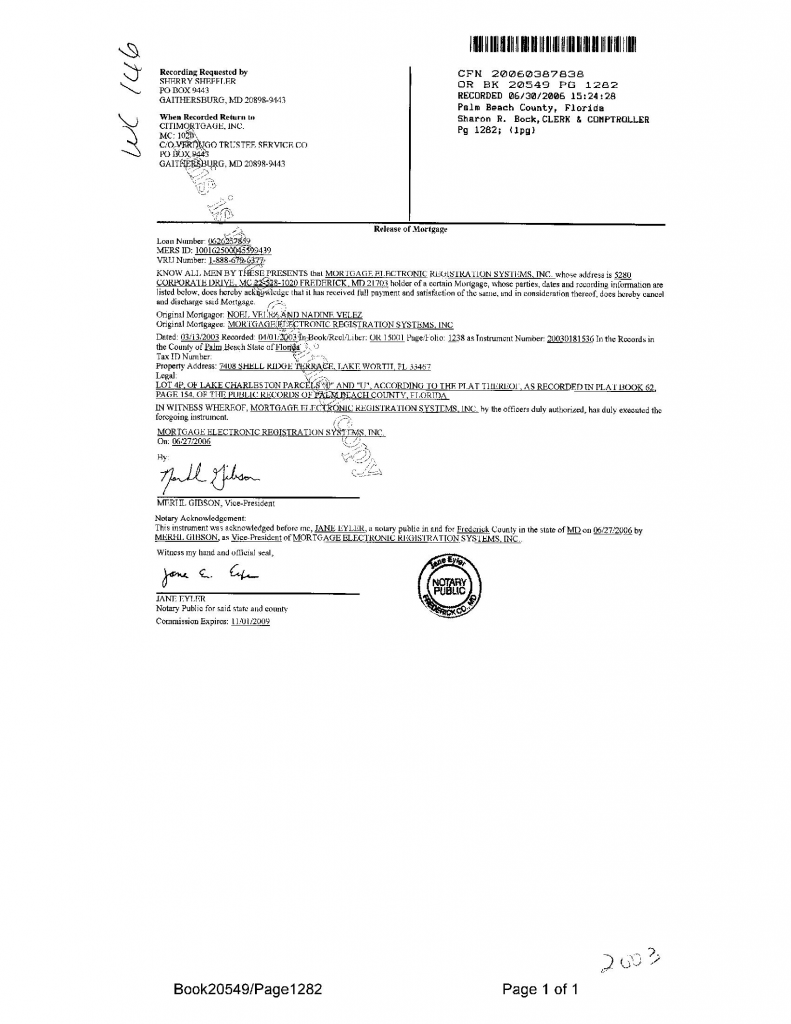

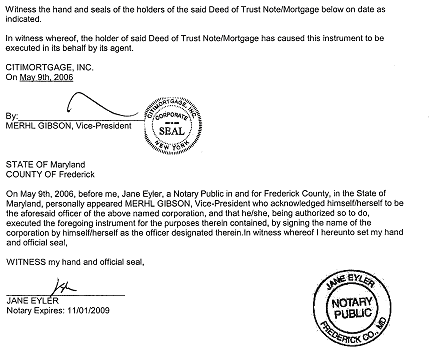

In 2006 MERS released a mortgage belonging to the Velez’s. MERS Vice President name is Merhl Gibson and the notary is Jane Eyler. Both from Maryland. It appears that the same individual signed the entire document. See exhibit below.

Now these same individuals are signing this document below as Vice President and Notary for CitiMortgage. But take a close look and compare the signatures to the release above.Both of these are about a few weeks apart. Merhl’s stamp is from New York.

Thank you to 4ClosureFraud for this info below.

Comment from a reader of this site…

Lori Bangor says:

“On 8/30, I had a Summary Judgment Foreclosure hearing on Palm Beach County’s “Rocket Docket”. The judge spoke for 14 minutes to the crowd, of mostly pro se defendants, about how they should just agree to the summary judgment and the plaintiffs, (whose attorneys (Shapiro & Fishman had a dedicated courtroom and to whom he referred to as “my attorneys”) would be gracious (Ha!) enough to allow them to stay in their homes for 120 days if needed (even though the statute says he only has to give them 30). When it came to hearing arguments which were fully briefed and provided to the court (pursuant to the instructions of the Divisions head judge) he only allowed 30-60 seconds for argument, failed to read any of the papers, failed to review the plaintiff’s foreclosure package,flatly ignored the Affidavit filed in Opposition, ignored my plea for a trial, signed the judgment and dismissed me. I never was permitted to even read the proposed judgment or to examine the “newly discovered” allonge which Shapiro’s counsel said I had no right to see. Thank God I had a court reporter!”

Well it just happens to be that Lori is an Attorney and got a transcript of what went down…

This is what happens everyday…

I have seen it first hand…

Horrifying…

Full transcript below…

[ipaper docId=36808660 access_key=key-23og4xre46fgbtqgcorz height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

If you would like I TOO have a release from our find forgery friends dated 03/26/2006 to add to your pages just tell me how to send it!

Thanks~ Merhl is VP of Principal Residential Mortgage along with Jane his side kick! and We are in AZ, yet ours is NOT SIGNED its typed… hmmm is THAT in itself legal??? I rather doubt it as I have a road map of Mortgage Fraud, Not only since 2006 but now I have also uncovered it since the INCEPTION of our Loan /////////// and we have ALL THE MAJOR PLAYERS such fun, I WILL BRING THEM DOWN they WILL HATE MY NAME!!!!

Rebecca

If you search for more recent releases of mortgage from CitiMortgage using Verdugo Trustee signed by Kenneth C. Balogh, you will find that he signs his name the EXACT way that Mr. Merhl does in the second example.

Some info I read on another blog stated the info below about Verdugo Trustee Service. Also, on most of the recent release of mortgages, they will CROSS out the “return to owner” portion and have the original note/mortgage sent back to Verdugo. After all, it would be easy to call out fraud if owners had the original note showing NONE of the necessary indorsements that were supposed to correspond to the mortgage assignments into the trusts. DEMAND YOUR ORIGINAL CANCELLED NOTE AND MORTGAGE – otherwise your title is likely clouded somehow.

“GOOGLE: VERDUGO TRUSTEE SERVICE CORPORATION. They claim to be A FOREIGN CORP. FILE # C13333-1996 D/B/A The Corporate Trust Company of Nevada. Did you know THESE SO CALLED TRUSTS can get a substitute trustee, (agent, listing, loan, short sale) at City-Data.com for that TRUST?.FICTITOUS CHARACTERS TO COVER THEIR ASSES FOR THEIR FRAUD. VERDUGO TRUSTEE SERVICE CORPORATION records loans into MERS for CITIMORTAGE,INC. and who knows how they acquire them. I never got a mortgage from CITIMORTGAGE. I believe this is a fictitious trust and where the money goes, hell only knows.”

One last question, does anyone know what the Lender ID on the release of mortgage means? If there a way to figure out who the “lender” is based on this value when you have a MERS mortgage that gets released? Any information about figuring out the lender ID is much appreciated!

Also, Verdugo is a subsidiary of CitiMortgage. If you call the phone number they list on the bottom of the release of mortgage, it rings to the CitiMortgage main line.

Verdugo Trustee Service Corporation sent me a letter with my mortgage release. Great, right? At the bottom of the letter, it tells ME to file it. What am I paying them for? I’ve never hear of such a thing!

Hey , they did the same to me ! Please contact me and give me any info you can . Please … My whole life has been destroyed by them