GMAC, one of the nation’s largest mortgage servicers, faced a quandary last summer. It wanted to foreclose on a New York City homeowner but lacked the crucial paperwork needed to seize the property.

GMAC has a standard solution to such problems, which arise frequently in the post-bubble economy. Its employees secure permission to create and sign documents in the name of companies that made the original loans. But this case was trickier because the lender, a notorious subprime company named Ameriquest, had gone out of business in 2007.

And so GMAC, which was bailed out by taxpayers [1] in 2008, began looking for a way to craft a document that would pass legal muster, internal records obtained by ProPublica [2]show.

“The problem is we do not have signing authority—are there any other options?” Jeffrey Stephan, the head of GMAC’s “Document Execution” team, wrote to another employee and the law firm pursuing the foreclosure action [2]. No solutions were offered.

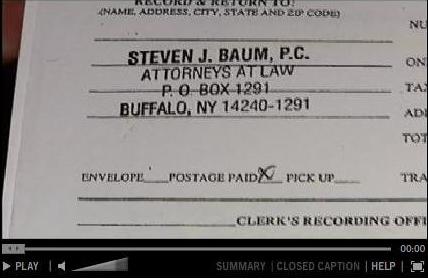

Three months later, GMAC had an answer. It filed a document with New York City authorities [3] that said the delinquent Ameriquest loan had been assigned to it “effective of” August 2005. The document [3] was dated July 7, 2010, three years after Ameriquest had ceased to exist and was signed by Stephan, who was identified as a “Limited Signing Officer” for Ameriquest Mortgage Company. Soon after, GMAC filed for foreclosure.

An examination by ProPublica suggests this transaction was not unique. A review of court records in New York identified hundreds of similar assignment documents filed in the name of Ameriquest after 2008 by GMAC and other mortgage servicers.

Get ProPublica’s stories delivered to your inbox [4]

The issue has attracted growing scrutiny in recent months as bloggers [5], consumer attorneys and media outlets [6] have identified what appears to be part of a pattern of questionable assignments filed across the country.

GMAC, which is still majority owned by the government, was at the center of what became known as the robo-signing scandal [7]. The uproar began last fall after revelations that mortgage servicing employees had produced flawed documents to speed foreclosures [8]. GMAC and other banks have acknowledged filing false affidavits in which bank officials claimed “personal knowledge” of the facts underlying thousands of mortgages. But GMAC and other servicers say they’ve since tightened their procedures. They insist that their records were largely accurate and the affidavits amounted to errors of form, not substance.

The issues surrounding the Ameriquest loan and others like it appear to be more serious.

“This assignment of mortgage has all of the markings of GMAC finding that it lacked a needed mortgage assignment in order to foreclose and just making it up,” said Thomas Cox, a Maine foreclosure defense attorney.

In New York, it’s a felony to file a public record with “intent to deceive.”

“It’s fraud,” said Linda Tirelli, a consumer bankruptcy attorney. “I want to know who’s going to do a perp walk for recording this.”

No criminal charges have been filed in the robo-signing cases.

Asked by ProPublica about the document, GMAC acknowledged Stephan did not have authority to sign on behalf of Ameriquest. The bank said it is still planning to push ahead with foreclosure on the homeowner, who remains in the property.

Company spokeswoman Gina Proia said an internal review last fall into “suspected documentation execution issues” had flagged the loan as problematic and that GMAC is “determining what needs to be done in order to receive the necessary authorization.”

“We will determine and complete the necessary steps to remediate and proceed with foreclosure,” Proia said.

GMAC also declined a request from ProPublica to interview Stephan.

Another GMAC document obtained by ProPublica shows that in at least one recent incident, GMAC employees were still discussing the possibility of fabricating evidence needed to facilitate a foreclosure.

The company once again lacked a document that would show it had been assigned the mortgage. Since the lender was defunct and no assignment had ever been made, GMAC again seemed to be stuck. But the employee proposed in June of this year that GMAC file a sworn statement that the assignment had once existed but had been lost. It’s unclear if such an affidavit was ultimately provided to a court.

Records also show that GMAC has continued to rely on documents signed by the very employee at the center of the robo-signing scandal—Jeffrey Stephan, the same employee who also signed the Ameriquest document in 2010. Stephan acknowledged in sworn testimony last year that he had been signing 400 documents each day [9], a revelation that helped kick off the scandal. According to a former employee and a consumer attorney, Stephan still works at GMAC, though he has been transferred to a different unit.

GMAC said it is still pursuing foreclosures based on assignments signed by Stephan. As part of a bid to rebrand itself, GMAC renamed its holding company Ally Financial last year.

“There is no reason or requirement to ‘withdraw’ valid assignments of mortgage that happened to have been signed by Mr. Stephan,” said GMAC spokeswoman Proia, because there’s “no requirement that [the assignment] be signed by a person with knowledge of any particular facts.” All that mattered, she said, was that the signer had received the proper authority.

Banks have little reason to worry about their documents being challenged, since homeowners rarely contest foreclosure actions. In a filing with the New Jersey Supreme Court, GMAC said that of the more than 4,000 foreclosures it has handled in the state only about 4 percent of homeowners had contested the action.

When homeowners do challenge banks’ documentation for foreclosures, they can have success. Late last week, the Vermont Supreme Court threw out a foreclosure case handled by GMAC due, in part, to a flawed assignment document signed by Stephan.

“It is neither irrational nor wasteful to expect the foreclosing party be actually in possession of its claimed interest,” the court said [10], “and have the proper supporting documentation in hand when filing suit.”

Since last fall, GMAC has added staff, increased training and added new procedures, said Proia. But some of those new hires have come from firms themselves accused of filing false foreclosure documents.

One manager at GMAC, Kevin Crecco, moved there from a position at the Law Offices of David Stern in Florida after the firm drew scrutiny from the state’s attorney general for allegedly filing forged documents. Stern’s office, once among Florida’s biggest foreclosure law firms and labeled a “foreclosure mill” by critics, ceased operations earlier this year.

An internal organization chart [11] from this spring for GMAC’s foreclosure department lists Crecco as a manager overseeing roughly two dozen employees. GMAC declined to make Crecco available for an interview. He hasn’t been accused of any wrongdoing.

Mortgage servicers like GMAC continue to be set up like assembly lines, with members of its “Document Execution” team responsible for signing documents. The organizational chart shows two “Document Execution” teams of 13 employees each.

The employees are tasked with, among other things, signing affidavits attesting to the accuracy of the basic facts of the loan, such as the mortgage amount, outstanding fees, etc. Affidavits are a necessary step to foreclosure in many states where banks have to go to court to seize a home.

During the robo-signing scandal, GMAC admitted that employees signing affidavits didn’t verify the underlying facts. The bank says it has fixed the problems.

But consumer attorneys said that while GMAC’s processes have improved, they haven’t corrected basic flaws with their process.

Cox, the attorney who questioned Stephan last year as part of a foreclosure case, said employees on the “Document Execution” team still aren’t truly checking the accuracy of the underlying information. Rather than digging for the original documents, employees on the team look at the numbers given by a GMAC database and double-check the math.

If the employee “just looks at a computer screen, that’s not sufficient in my view,” said Cox. He said he would soon be challenging affidavits GMAC recently filed in court.

Consumer attorneys also said the systems that servicers rely on are consistently plagued with inaccuracies, making a more thorough verification of the information necessary. “These days, homeowners are being forced to save every receipt, every letter, every statement, so that one day they can prove that their payment history is accurate and the bank is wrong,” said Jim Kowalski, a consumer attorney in Florida.

GMAC’s Proia said the company’s procedures—which amount to a review of information in the company’s computerized databases—were sufficient to file affidavits.

Recent Comments