Commonwealth of Massachusetts

Southern Essex District Registry of Deeds

Shetland Park

45 Congress Street

Suite 4100

Salem, Massachusetts 01970

JOHN L. O’BRIEN, JR.

Register of Deeds

Phone: 978-542-1704

Fax: 978-542-1706

website: www.salemdeeds.com

NEWS

FOR IMMEDIATE RELEASE

Salem, MA

June 9th, 2011

Contact:

Kevin Harvey, 1st Assistant Register

978-542-1724

kevin.harvey@sec.state.ma.us

Marie McDonnell, President McDonnell Property Analytics, Inc.

508-694-6866

marie@mcdonnellanalytics.com

Massachusetts Register of Deeds John O’Brien and Forensic Mortgage Fraud Examiner Marie McDonnell find former Vice-Presidential candidate Sarah Palin is victim of potential mortgage fraud; expert says chain of title to new Arizona home clouded by robo-signers.

In what is an ironic twist of fate today Register of Deeds John O’Brien and nationally renowned mortgage fraud examiner Marie McDonnell, President of McDonnell Property Analytics, Inc., announce that former Alaska Governor and Vice-Presidential nominee Sarah Palin is an unwitting victim of mortgage fraud and has purchased a home in Arizona that contains flaws in the chain of title.

Register O’Brien said, “If fundamental property principles still matter in this country, Sarah Palin may have legal issues that could affect the ownership of her home. Through no fault of her own, Sarah Palin has become a victim like thousands of others across the country that have the same problem with their chain of title. I feel bad for Governor Palin and all the homeowners who have been victimized by this scheme, it just goes to show you that no one is immune from this type of fraud and irresponsible behavior that these banks participated in.”

Marie McDonnell added, “Sarah Palin’s chain of title has been swept up into the eye of the ‘perfect storm’ where robo-signer Linda Green’s fraudulent Deed of Release on behalf of Wells Fargo Bank, N.A. is eclipsed by robo-signer Deborah Brignac’s fraudulent foreclosure documents. Brignac, a Vice President of California Reconveyance Company (a subsidiary of JPMorgan Chase Bank), assigned the homeowner’s Deed of Trust to JPMorgan Chase Bank in her capacity as a Vice President of Mortgage Electronic Registration Systems, Inc. (“MERS”); in the same breath, Brignac executed a document appointing California Reconveyance Company (her real employer) as Substitute Trustee in her alleged capacity as a Vice President of JPMorgan Chase.”

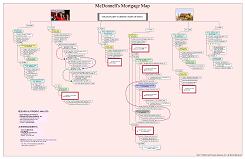

Sound confusing? McDonnell explained, “This is a shell game where Brignac purports to be Vice President of three (3) different entities so that she can manufacture the paperwork necessary for JPMorgan Chase Bank to hijack the mortgage and then foreclose on the property. This is an excellent example of how MERS is being used by its Members to perpetrate a fraud. I have laid out a timeline that illustrates the defects in Sara Palin’s chain of title which shows that it is seriously, if not fatally impaired.” McDonnell whose firm performed the extensive forensic analysis. (See McDonnell’s Mortgage Map)

O’Brien, who recently announced that he found 6047 fraudulent Linda Green documents recorded in the Essex Southern District Registry of Deeds which had 22 different variations of a Linda Green signature has been the National Leader in blowing the whistle on banks such as Bank of America, J.P. Morgan Chase, Wells Fargo for their business practices. O’Brien said “These banks have participated in a national epidemic of fraud that has clouded or damaged the chain of title of hundreds of thousands of American homeowners all across the country”. O’Brien further said “Sadly, Sarah Palin’s misfortune will however, hopefully shine the national spotlight on this issue. Given her position in the country, I am sure that she will use her influence to stand up for homeowners and their property rights”.

[Click image below to see McDonnell’s Palin Mortgage Map]

[ipaper docId=57497718 access_key=key-1w7fb7ufnsa0wsp7b4bl height=600 width=600 /]

[Sarah Image: VARIGHT.com]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Recent Comments