I disagree with the judge’s motion words below and see video below as to why even attorney’s have a difficult time.

“I have a lot of problems with saying that all that’s going, with all this evidence of [c]ourt process for over a year, to just rely on trying to negotiate something with the bank was like sticking your head in the sand.

This wasn’t going to go away and they

didn’t get any assurance from the bank that

they were succeeding in their negotiation

efforts or that an answer to the complaint

was not required. I mean they just focused

on one path. And they ignored the

negotiation path and they ignored the

litigation side of things. You can’t do

that.And I have to say that . . . Mrs.

Guillaume was being so aggressive and so

persistent in trying to negotiate and going

to all these different places to get help,

but the one place she wasn’t going was a

member of the bar, a lawyer which is usually

what you do when you get [c]ourt papers.Or if you absolutely can’t afford a

lawyer and that’s the case of many

foreclosures, a very heavy self-represented

area of the law to at least contact the

[c]ourt yourself and you send in some

rudimentary answer. And it doesn’t have to

be fancy. I mean you write a letter to the

foreclosure unit, they’ll stamp contested on

it.Because I’ve seen so many of them long

hand. But nothing was done. And I don’t

regard that as excusable neglect. So that

prong is lacking.”(emphasis added).

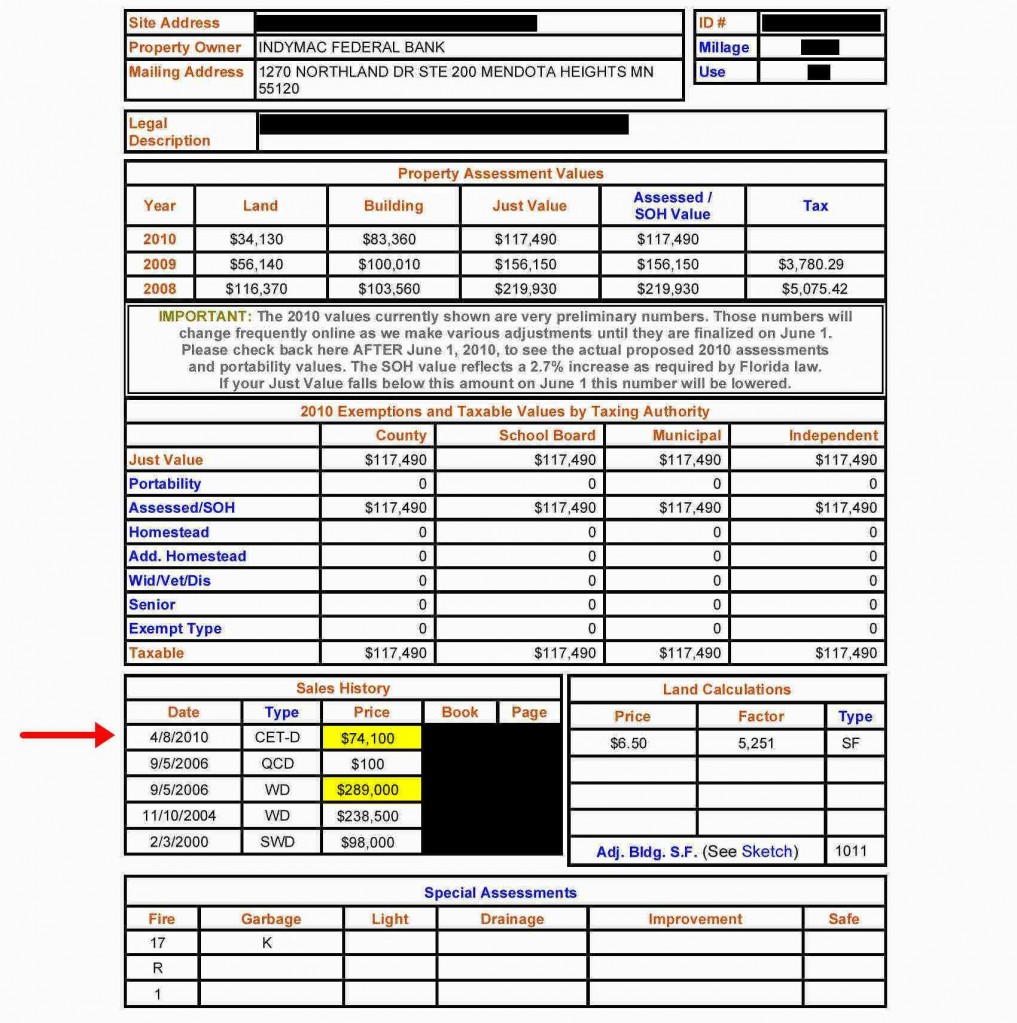

Simply wrong, one does NOT understand how frustrating it is to even try to get anyone from the “bank” on the phone, attempting a modification as we have read time and time again were nothing but DISASTROUS and GOING ABSOLUTELY NO PLACE!

[Please watch Michigan Atty Vanessa Fluker and you’ll understand why].

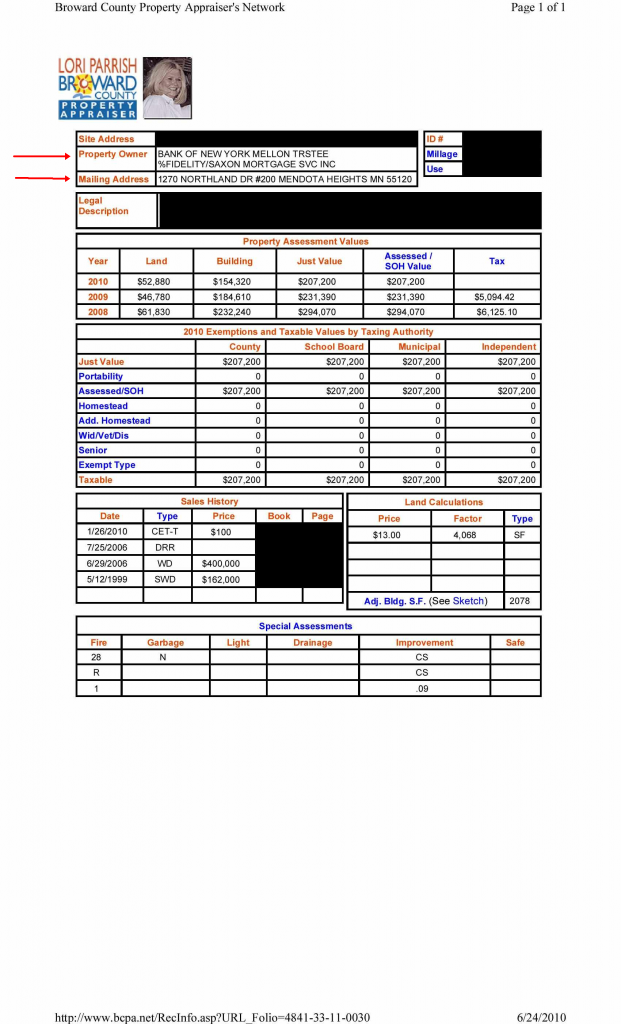

Lets not forget, this reversal that goes to the heart of this from out of New Jersey: BANK OF NEW YORK vs. LAKS | NJ Appeals Court Reversal “A notice of intention is deficient…if it does not provide the name and address of the lender”

NJ.COM-

In the nearly five months since the state Supreme Court effectively allowed six of the country’s biggest banks to begin filing foreclosures again, attorneys and court officials have been expecting a flood of new filings to hit the courts.

Except it hasn’t happened. Foreclosure filings are down 83 percent as of October this year, compared with the same time period last year, according to court figures, and there are at least 100,000 cases either pending in the system or waiting to be submitted.

Attorneys involved in the work in New Jersey point to at least one reason for the significant delay: a court case that has reached the state Supreme Court, with oral arguments on Wednesday.

The case, US Bank National Association v. Guillaume, is important because the court …

[NJ.COM]

[ipaper docId=74692087 access_key=key-1xrvd0kemha1r7mycu2h height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Recent Comments