By Lynn E. Szymoniak, Ed., Fraud Digest

The crash of the housing market has left families with an insurmountable debt problem. Palm Beach County, Florida, is one of the counties hardest hit by falling home prices.

In many cases, the Palm Beach County homes are now selling for less than 50% of the home prices in 2005-2006. Even when families are willing to forfeit their homes to their lenders, they still face significant deficiency judgments – the difference between the total amount owed and the amount “recovered” by the bank by a resale.

Bankruptcy is the only way to escape a deficiency judgment, but a bankruptcy will disqualify a family from eligibility for another mortgage. With fewer eligible borrowers, and an increasing number of homes being sold by the lenders, the price of homes continues to plummet and even more homeowners find themselves owing more than the current value of their home.

This cycle will only be ended by principal reductions by banks, for families willing to stay in their homes. More foreclosures will exacerbate this problem and prevent any real widespread economic recovery.

To prevent further deterioration of neighborhood home values, banks must demolish abandoned, moldy homes that have been gutted of plumbing, wiring and appliances. Banks must also limit their home sales in any one neighborhood so that prices may stabilize.

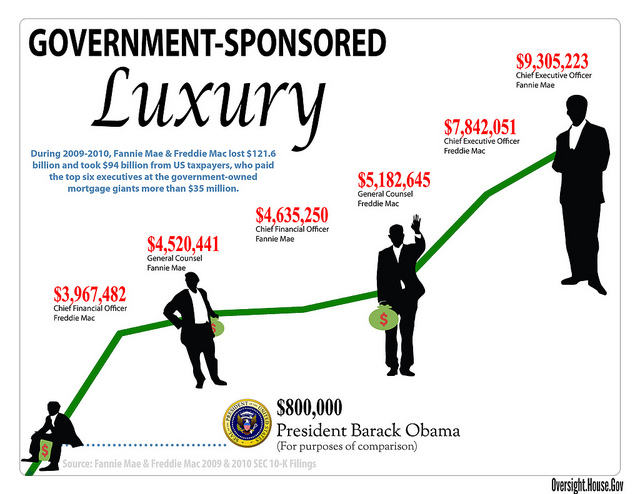

Fannie, Freddie, securitization, predatory lending, and extreme profiteering destroyed economic hope for the majority of Americans.

It is time for the banks to implement a policy of principal reductions to fair market value, with low-rate, fixed rate mortgages, and responsible home sales.

The following Palm Beach County homes were listed for sale in November, 2011. The price in 2005-2006 is listed after the current price.

12935 North 57th Road, The Acreage, West Palm Beach

11/11 Sale Price: $150,000

Sold for $335,000 on 4/20/2005

312 Putnam Ranch Road, West Palm Beach

11/11 Sale Price: $150,000

Sold for $360,000 on 4/22/2005

1135 Imperial Lake Road, West Palm Beach

11/11 Sale Price: $99,900

Sold for $270,000 on 7/31/2006

142 Rowley Drive, West Palm Beach

11/11 Sale Price: $99,000

Sold for $250,000 on 6/15/2006

4818 Poseidon Place, Hypoluxo West, Lake Worth

11/11 Sale Price: $150,000

Sold for $240,000 on 8/30/2005

5436 Gene Circle, Summit Run, West Palm Beach

11/11 Sale Price: $95,000

Sold for $250,000 on 8/24/2005

5254 West Canal Circle, Lake Worth

11/11 Sale Price: $94,900

Sold for $252,000 on 6/2/2005

400 Superior Place, West Palm Beach

11/11 Sale Price: $95,000

Sold for $205,000 on 2/14/2005

3706 Shoma Drive, West Palm Beach

11/11 Sale Price: $95,000

Sold for $269,000 on 4/28/2006

952 32nd Street, West Palm Beach

11/11 Sale Price: $95,000

Sold for $340,000 on 5/27/2005

6263 Blue Baneberry Lane, Buttonwood West, Greenacres

11/11 Sale Price: $99,999

Sold for $160,000 on 7/20/2004

10735 LaStrada, Ibis, Palm Beach Gardens

11/11 Sale Price: $299,900

Sold for $473,207 on 8/18/2006

6315 Bischoff Road, West Palm Beach

11/11 Sale Price: $98,500

Sold for $235,000 on 11/17/2006

313 North Ware Drive, West Palm Beach

11/11 Sale Price: $99,900

Sold for $209,000 on 6/21/2006

1005 SW 17th Street, Boynton Beach

11/11 Sale Price: $99,000

Sold for $172,500 on 6/30/2006

2859 Kentucky Street, West Palm Beach

11/11 Sale Price: $99,000

Sold for $179,000 on 7/20/2005

1701 Village Blvd., West Palm Beach

9/11 Sale Price: $53,000

Sold for $188,900 on 3/28/2005

8679 Falcon Green Drive, Palm Beach Gardens

11/11 Sale Price: $299,000

Sold for $550,000 on 7/24/2006

2912 South Olive Avenue, West Palm Beach

11/11 Sale Price: $299,000

Sold for $520,000 on 10/19/2005

10241 Orchard Reserve Drive, #1D, Ibis, Palm Beach Gardens

11/11 Sale Price: $299,000

Sold for $478,577 on 7/29/2005

616 Westwood Road, West Palm Beach

11/11 Sale Price: $299,000

Sold for $449,000 on 5/18/2005

There are many more examples of home with significantly reduced

value. Most of these homes have been on the market for over six

months. In November, 2011, there were 659 homes listed for sale in

Palm Beach County for less than $75,000, and nearly 2,000 homes for

sale for less than $500,000.

It is time to find ways to keep families in their homes.

[ipaper docId=73274531 access_key=key-1ie9piclczemun0s0mdb height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Recent Comments