At an lAS Term, Part 29 of the Supreme

Court of the state of New York, held in· and

for the County of Kings, at the Courthouse,

at Civic Center, Brooklyn, New York, on

the 5th day of May, 2015.

PRESENT:

Hon. Wayne P. Saitta, Justice.

———————————-)(

DEUTSCHE BANK TRUST COMPANY AMERICAS AS

TRUSTEE,

Plaintiff,

v.

DOMINIC CODIO; JP MORGAN CHASE BANK, N.A.;

MORTGAGE ELECTRONIC REGISTRATION SYSTEM, INC.,

AS NOMINEE FOR AEGIS FUNDING D/B/A AEGIS HOME

EQUITY; NEW YORK CITY ENVIRONMENTAL CONTROL

BROAD; NEW YORK CITY PARKING VIOLATION BUREAU;

NEW YORK CITY TRANSIT ADJUDICATION BUREAU;

JOHN DOE, (Said name being fictitious, it being the intention

of Plaintiff to designate any and all occupants of premises

being foreclosed herein, and any parties, corporations or

entities, if any, having or claiming an interest or lien upon

the mortgaged premises),

Defendants.

—————————————-)(

Plaintift DEUTSCHE BANK TRUST COMPANY AMERICAS AS TRUSTEE, (hereinafter

“Plaintiff”), moves this Court for an Order pursuant to CPLR §3212 for Summary Judgment

against the Defendant and granting further relief as this Court deems just and proper.

Upon reading the Notice of Motion by Michel Lee, Esq., Attorney for Plaintift DEUTSCHE

BANK TRUST COMPANY AMERICAS AS TRUSTEE, dated June 6th, 2013 together with the

Affirmation in Support of Plaintiff’s Motion for Summary Judgment and Reference of Michel

Lee, Esq., dated June 6th, 2013 and all exhibits annexed thereto; the Memorandum of Law in

Support of Plaintiff’s Motion for Summary Judgment and Reference of Michel Lee, Esq., dated

June 6th, 2013; the Affirmation of Michel Lee, Esq., dated June 6th, 2013; the Reply Affirmation

of Jason J. Oliveri, Esq., Attorney for Plaintiff, DEUTSCHE BANK TRUST COMPANY AMERICAS AS

TRUSTEE, dated June 6th, 2013 and all exhibits annexed thereto; the Attorney’s Affirmation in

Opposition to Plaintiff’s Motion for Summary Judgment and Reference of S. John Lenoir, Esq.,

Attorney for Defendant, DOMINIC CODIO, dated November 25th, 2013, together with the

Defendant’s, DOMINIC CODIO, affidavit in Opposition to Plaintiff’s Motion for Summary

Judgment and Reference, dated November 25th, 2013 and all exhibits annexed thereto; the

Memorandum of Law in Further Support of Plaintiff’s Motion for Summary Judgment by Jason J.

Oliveri, Esq., dated December 18th, 2013; and after argument of counsel and due deliberation

thereon, Plaintiff’s motion for Summary Judgment and an Order of Reference is denied for the

reasons set forth below.

FACTS

Plaintiff moves for summary judgment, striking Defendant DOMINIC CODIO’s answer,

granting a default judgment against all other Defendants, amending the caption to substitute

“Deborah Thomas”, “Andre F Codio”, and “Alex Codio” for “John Doe”, and for Order

appointing a Referee to compute the amounts owing to Plaintiff.

Plaintiff brings this motion after the Second Department’s March 2, 2012 reversal of this

Court’s order of June 23, 2011, which granted dismissal of Plaintiff’s complaint based upon lack

of standing. The Second Department held that by producing an “allonge to note”, Plaintiff

made a sufficient showing to warrant denial of that branch of Defendant’s motion which had

sought dismissal based upon lack of standing.

Plaintiff brought this action to foreclose on a mortgage on the premises located at 631

East 32nd Street in Brooklyn, NY. The mortgage secured a note in the amount of $528,000.00,

executed by Defendant CODIO, in favor of AEGIS WHOLESALE CORPORATION.

Plaintiff states that on June 1, 2007, the note was “transferred” to Plaintiff and that the

mortgage was subsequently assigned to Plaintiff on March 16, 2010.

Defendant DOMINIC CODIO filed an answer containing a general denial, an affirmative

defense of lack of standing to sue, as well as asserting that Plaintiff failed to allege that it is the

legal owner and holder of the Note.

In response to this motion, Defendant CODIO submits an affidavit dated November 25,

2013, in which he states that on June 28, 2012, Plaintiff’s former counsel, Fincey Johns, Esq. of

Knuckles, Komosinski & Elliott, LLP, appeared at the office of his counsel and showed him and

his counsel an original promissory note with an allonge on a separate page following the note.

Johns provided Defendant and his counsel with copies of the promissory note and allonge he

presented that day.

Defendant states that the signature on the note shown to him by Johns on June 28,

2012, did not bear his signature.

ARGUMENTS

Plaintiff argues that because the Defendant defaulted on his obligation under the

mortgage, it is entitled to summary judgment and an Order of Reference to calculate the

amounts owing to it. Plaintiff argues that it has been in possession of the note indorsed in its

favor and mortgage since the commencement of the underlying action. Plaintiff also argues

that because Defendant CODIO did not respond to a notice to admit the authenticity of the

note Plaintiff claims he signed, he is now precluded from challenging the signature on the note.

Defendant CODIO argues that Plaintiff’s motion must be denied as it has not eliminated

all questions of fact as to each element of its right to foreclose on the mortgage. Defendant

argues that the affidavit of merit of Stephen Maxwell submitted by Plaintiff in support of its

motion fails to establish that Plaintiff has the legal right to bring the underlying action against

Defendant. Defendant also argues that issues contained in Plaintiff’s purported notice to

admit, which include the underlying elements of Plaintiff’s alleged claims, were issues in

dispute and therefore inappropriate for a notice to admit. Defendant’s counsel further argues

that he never received the notice to admit and therefore it should be deemed a nullity.

ANALYSIS

Where, as in this case, a plaintiffs standing to commence a foreclosure action is placed

in issue by the defendant in his answer, it is the plaintiff’s burden to prove that it has standing

to be entitled to relief. Wells Fargo Bank, N.A. v. Arias, 121 A.D.3d 973, 995 N.Y.S.2d 118, 118-

19 (2nd Dept 2014). In order to prove standing, Plaintiff must demonstrate that it was assigned

the note or was in possession of the note prior to the commencement of the action on March

18, 2010.

Plaintiff is incorrect in its assertion that the order of the Appellate Division, which

reversed dismissal of this action, precludes Defendant’s challenge to Plaintiff’s standing. The

Appellate Division did not hold that Plaintiff established that it was the transferee prior to the

commencement of the action, but only that it made a sufficient showing to warrant denial of

Defendant’s motion to dismiss for lack of standing. To be entitled to summary judgment in the

face of Defendant’s affirmative defense of lack of standing, Plaintiff must eliminate all

questions of fact as to its standing.

Assignment of the Mortgage

Plaintiff submits an assignment of mortgage, dated March 16, 2010, in which the

Defendant’s mortgage was assigned by MERS, as nominee for Aegis Wholesale Corporation, to

the Plaintiff. The assignment on its face purports to assign the mortgage only and not the note.

“[T]he mere assignment of the mortgage without an effective assignment of the underlying

note is a nullity .. “. U.S. Bank, N.A. v. Adrian Collymore, 68 A.D.3d 752, 754, 890 N.Y.S.2d 578,

580 (2nd Dept 2009).

Plaintiff also fails to offer any proof of authority of MERS to assign the mortgage on behalf

of Aegis Wholesale Corporation. The mortgage did not authorize MERS to assign the mortgage

or note. In the section entitled (/Borrower’s Transfer to Lender of Rights in the Property”, the

mortgage only gave MERS right as a nominee, and it did not give MERS the right to assign the

underlying mortgage, or the note. Plaintiff has submitted no evidence of MERS’ authority to

assign the mortgage or note. Bank of New York v. Silverberg, 86 A.D.3d 274, 281, 926 N.Y.S.2d

532, 538 (2nd Dept 2011).

A more serious problem with the assignment is that it is inconsistent with the allonge.

The assignment purports to be from MERS as nominee of Aegis Wholesale Corporation to

Plaintiffs. However, the purported allonge contains special endorsements from Aegis

Wholesale Corporation to Aegis Mortgage Corporation; then from Aegis Mortgage Corporation

to Residential Funding Company, LLC; and then from Residential Funding LLC to Plaintiff

DEUTSCHE BANK TRUST COMPANY, LLC.

Aegis Wholesale Corporation could not both negotiate the note to Aegis Mortgage

Corporation and assign the note to Deutsche Bank. Similarly the note could not be both

negotiated by Residential Funding Co., LLC to Deutsche Bank and assigned by Aegis Wholesale

Corporation to Deutsche Bank.

Negotiation of the Note

In addition to the purported assignments, Plaintiff also claims that the note was indorsed

and negotiated to it prior to the commencement of the action.

Plaintiff relies on the affidavit of Stephen Maxwell, Senior Litigation Analyst of Ocwen Loan

Servicing, LLC, the servicer of the Plaintiff, to establish that Plaintiff was in possession of the

note at the time the action was commenced.

Maxwell states that on or about June 1, 2007, the loan was transferred to Plaintiff as

trustee for Residential Funding Company, LLC and appends a copy of portions of a Pooling-and

Servicing Agreement dated June 1, 2007.

However, Maxwell does not state in his affidavit when the original note was physically

delivered to Plaintiff. The Pooling and Servicing Agreement is not evidence of the date of

physical delivery of the note.

Where an affidavit, in this case of the Plaintiff’s servicing agent, fails to give any factual

details as to the physical delivery of the note, it fails to establish that the Plaintiff had physical

possession of the note prior to commencement of the action. US Bank Nat. Ass’n v. Weinman,

123 A.D.3d 1108, 2 NYS3d 128 (2nd Dept 2014).

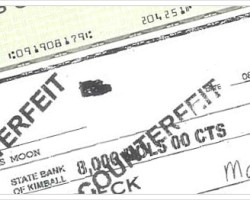

Furthermore, in examining the records appended to Plaintiff’s papers, there are two

different versions of the note annexed, one annexed as 11Exhibit A”, which includes a purported

allonge, and one annexed as part of 11Exhibit B”, which does not.

Defendant, in his affidavit, states that the signature on the note annexed as 11Exhibit A”

is not his, while the signature on the note annexed as 11Exhibit B”, which does not have an

allgone, bears his signature. Neither signature is acknowledged.

Defendant further attests that prior counsel for Plaintiff, Fincey John, Esq. of Knuckles,

Komosinski & Elliott, LLP, came to Defendant’s attorney’s office on June 28, 2012 and showed

them an original note, with an allonge, which corresponds to the version of the note annexed

as “Exhibit A”. Defendant states the signature, which appears on the note shown to them by

Plaintiff’s attorney, is not his.

In addition, Defendant submits a report of a Roger Rubin, a “Question Document

Examiner”, together with an affidavit of Rubin swearing to the truth of the contents of his

report. Rubin states that he examined handwriting exemplars provided to him by Defendant

and a copy of the note filed with the City Register, which Defendant admits bears his signature.

Rubin concluded, based on the exemplars and the note filed with the City Register, that the

signature on the note which was shown to Defendant by Plaintiff’s prior counsel, (which

corresponds to the version annexed as 11 Exhibit A”), is not CODIO’s signature.

Plaintiff produced an original note in court which had an allonge attached to it and

corresponded to the version annexed as “Exhibit A”.

The allonge contained the three endorsements, two purportedly signed by Lynn Harris as

secretary of Aegis Wholesale Corporation and Aegis Mortgage Corporation, respectively. The

Court observed that the two signatures on the allonge by Lynn Harris are clearly different

signatures. The Court gave Plaintiff the opportunity to produce Lynn Harris to attest to the

authenticity of her signatures. Counsel for Plaintiff stated he attempted to locate Harris but

was unable to do so.

Defendant’s denial of the signature on the note with the allonge, and report of Rubin

are sufficient to raise a question of fact as to whether Defendant signed the note to which the

allonge was attached.

Plaintiff argues that because Defendant failed to respond to a notice to admit dated

April 3, 2013, he is deemed to have admitted the genuineness of the copy of the note annexed

to the notice to admit. The copy of the note attached to the notice to admit included the

allonge.

Defendant’s counsel states in his affirmation that the notice to admit was never

received at his office. Plaintiff has submitted no affidavit of service or other proof that the

notice to admit was in fact served.

Further, it is not proper to use a notice to admit as to facts that are in contention. In his

answer, CODIO challenged the Plaintiff’s claim to have been assigned the note, and submitted a

copy of what he alleged to be the note he signed, which did not contain an allonge. Thus,

whether the note he signed was the version to which the allonge was attached was put in

dispute long before Plaintiff sent the notice to admit.

Also, the copy of the note sent with the notice to admit contains a certification by Aegis

Mortgage Corporation that it is a true and accurate copy. This copy contained the purported

allonge bearing an endorsement of the note from Residential Funding Company, LLC to Plaintiff.

As Aegis Mortgage Corporation endorsed the note to Residential Funding Company, LLC,

the endorsement by Residential Funding to Plaintiff necessarily occurred after the note was out

of Aegis’ possession, and in the possession of Residential Funding Company, LLC. At the time

Aegis certified the copy of the note, there would not have been an endorsement by Residential

· on the purported allonge.

This raises a question as to whether the “certified” copy of the note annexed to the

notice to admit was genuine, or whether the allonge was added to that copy of the note after it

had been certified by Aegis.

By reason of the foregoing, Defendant cannot be precluded on the basis of the notice to

admit from challenging whether the signature on the note that has the allonge attached, is his.

Defendant has raised a question of fact as to whether the note with the allonge bears his

signature .. Further, the different signatures of Lynn Harris and the discrepancies between the

allonge and the assignment raise questions about the genuineness of the allonge, precluding

summary judgment.

Plaintiff annexed affidavits of service on the remaining Defendants, who have failed to

appear in this matter, and seeks to amend the caption to name DEBORAH THOMAS, ANDRE

CODIO and ALEX CODIO as Defendants. However, Plaintiff had not provided an affidavit of

merit as to its complaint against the JOHN DOEs or even alleged whether the JOHN DOEs have a

claim against the property, or what the claim is. At this point default judgment against the

JOHN DOEs is not warranted.

WHEREFORE, Plaintiff’s motion seeking summary judgment against DOMINIC CODIO, to

amend the caption and for a default judgment against Deborah Thomas, Andre Codio and Alex

Codio is denied.

This shall constitute the decision and order of this Court.

ENTER,

HON. WAYNE P. SAI1TA

J s c J.S.C.

Seems they can’t quite figure out who needs to be fabricating the evidence, or in whose name it needs to be fabricated.