Woman’s Media Center-

In the first of a two-part series, the author describes the origins of the mortgage crisis and its impact on women. This feature is based on her March article in the University of Chicago’s journal Social Service Review.

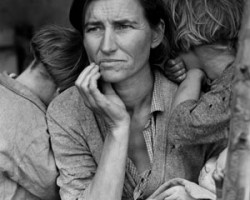

The housing crisis is not over. The largest U.S. mortgage securities firm projects that by the end of 2014, one in every five homeowners will be in default. The AARP reports that one out every 30 Americans over 80 are currently experiencing foreclosure, and 3.5 million Americans over 50 owe more on their homes than their properties are worth. Embedded in this ongoing crisis are the lives of single women, who are more likely than anyone in the U.S. to have risky loans that are highly likely to default. Even when controlling for credit score, income, and wealth, women are 30 percent more likely than their male peers to own a risky mortgage, and single black women are 259 times more likely than white men with the same financial characteristics to have a risky subprime loan. Although research shows that women take fewer financial risks than men, their ability to remain financially stable is evaporating under the weight of subprime lending. If women are more cautious than men, why do they bear the burden of risk in the current economy?

In 1986 Eve, a black homeowner from Philadelphia, purchased a small row house with her new husband. They were, she said, “the first of our people to own property. Being a black family and buying your own house—other than my kids it was the greatest thing I’ve ever done. We didn’t get to go to college, but we still put together that down payment.” Like most home buyers at the time, they signed what is commonly known as a traditional, prime mortgage, meaning the interest was fixed. The new couple had full confidence that the terms and costs of their home loan would not rise and fall over time. Unbeknownst to Eve and the rest of the public, the stable mortgage market this couple shopped in would soon be a relic of the past. Gaps in protective housing laws, deregulation, and financial innovations like securitization were creating a toxic combination that left a generation of women at risk.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.