U.S. House of Representatives

Committee on Oversight and Government Reform

Darrell Issa, Chairman

How Countrywide Used its VIP Loan Program

To Influence Washington Policymakers

Staff Report

Prepared for Chairman Darrell Issa

U.S. House of Representatives

112th Congress

Committee on Oversight and Government Reform

July 5, 2012

I. Executive Summary

Bank of America (the Bank) produced more than 120,000 pages of documents in

response to the subpoenas issued by Committee Chairmen Darrell Issa and Edolphus

Towns. The documents produced by the Bank shed additional light on the scope and

purpose of Countrywide’s VIP program, particularly as it related to the company’s

strategic partnership with Fannie Mae.

In 1999, Countrywide reached an exclusive agreement to sell Fannie Mae billions

of dollars in mortgages at a discounted rate. The agreement led to a period of

codependence and mutual growth. Countrywide gave preferential treatment to Fannie

Mae executives and employees. Loans being financed for Fannie Mae employees

through an Employee Assistance Program were often transferred to Countrywide’s VIP

unit for processing.

Between January 1996 and June 2008, Countrywide’s VIP loan unit made

hundreds of loans to current and former Members of Congress, congressional staff, highranking

government officials, and executives and employees of Fannie Mae, including

Chairmen James “Jim” Johnson, Franklin Raines, and Daniel Mudd. VIPs who worked

at Fannie Mae enjoyed expedited loan processing and pricing discounts. Countrywide

also waived company guidelines for Fannie Mae’s senior executives to a greater extent

than it did for “regular” VIPs.

Fannie Mae and Countrywide lobbied against government-sponsored enterprise

(GSE) reform legislation that would have diminished Fannie Mae’s ability to acquire and

hold subprime mortgages originated by Countrywide. Countrywide also lobbied against

predatory lending bills. Documents obtained by the Committee show that several

Members of Congress and congressional staff positioned to affect the legislation received

VIP loans. In fact, Countrywide lobbyists – and CEO Angelo Mozilo himself – referred

several Members and staff from the Senate Committee on Banking and the House

Committee on Financial Services to the VIP unit. Those are the committees of primary

jurisdiction for consideration of legislation related to the mortgage industry and the

GSEs.

Countrywide’s VIP unit processed loans for key Senators and Senate staff who

could be helpful when legislation that affected the company was drafted or up for a vote.

Countrywide gave VIP loans to former Senate Banking Committee Chairman Christopher

Dodd; Senate Budget Committee Chairman Kent Conrad; and Mary Jane Collipriest,

Communications Director for former Senator Robert Bennett, who served on the Banking

Committee. Dodd referred Collipriest to the VIP unit.

Countrywide also forged relationships with Members and staff of the U.S. House

of Representatives. The VIP unit processed loans for Congressmen Howard “Buck”

McKeon; Pete Sessions; Edolphus Towns; and Elton Gallegly.

Documents show Countrywide enrolled House Financial Services Committee

Staff Director Joseph Ventrone and General Counsel Clinton Jones in the VIP loan

program. Jones was a trusted ally of Fannie Mae during GSE reform deliberations.

Documents also show that in early 2005, Countrywide gave a discounted loan to a staffer

in the office of Rep. Ruben Hinojosa, who has served on the Financial Services

Committee since 2001. Former Rep. Tom Campbell received a VIP loan in 1997.

Fannie Mae’s targeted lobbying campaign supplemented Countrywide’s outreach

to Committee Members and staff. The GSE assigned as many as 70 lobbyists to the

Financial Services Committee while it considered GSE reform legislation in 2000 – 2005.

During the 108th Congress, four GSE reform bills were introduced in the House. None

made it out of the Financial Services Committee.

Countrywide also had favorable relationships with key decision makers in the

Executive Branch. Two former Secretaries of Housing and Urban Development received

VIP loans – Alphonso Jackson and Henry Cisneros. The VIP unit processed Cisneros’s

loan after he joined the company’s Board of Directors. Jim Johnson referred former

Secretary of Health and Human Services Donna Shalala to the VIP unit.

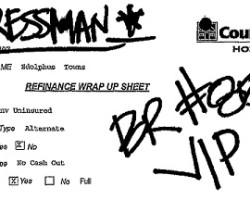

The documents produced by the Bank show that VIP borrowers received

paperwork from Countrywide that clearly identified the VIP unit as the point of contact.

The conspicuous markings on documents provided to VIP borrowers made it clear that

Countrywide’s VIP unit was processing their loans. It was also the practice of staff in the

VIP unit to identify themselves as such on the phone.

[…]

[ipaper docId=99200605 access_key=key-1nrqpnzto5vva3v4i4at height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

This is great finger pointing, but Fannie Mae, Wall Street and the Banksters worked on designing and implementing the destructive fraud together. Issa is such a dirtbag, he made big money on foreclosures. (No offense to dirtbags)