This should send a powerful message to each and every Foreclosure Mill out there! You are NEXT!

September 24, 2010

Michael J. Williams

President and Chief Executive Officer

Fannie Mae

3900 Wisconsin Avenue, N.W.

Washington, D.C. 20016

Dear Mr. Williams,

We are disturbed by the increasing reports of predatory ‘foreclosure mills’ in Florida working for Fannie Mae servicers. Foreclosure mills are law firms representing lenders that specialize in speeding up the foreclosure process, often without regard to process, substance, or legal propriety. According to the New York Times, four of these mills are both among the busiest of the firms and are under investigation by the Attorney General of Florida for fraud. The firms have been accused of fabricating or backdating documents, as well as lying to conceal the true owner of a note.

Several of the busiest of these mills show up as members of Fannie Mae’s Retained Attorney Network, a set of legal contractors on whom Fannie relies to represent its interests as a note-holder. The network also serves as a pool of legal talent that represents Fannie in its pre-filing mediation program, a program designed to facilitate communication between borrowers and servicers prior to foreclosure. In other words, Fannie Mae seems to specifically delegate its foreclosure avoidance obligations out to lawyers who specialize in kicking people out of their homes.

The legal pressure to foreclose at all costs is leading to a situation where servicers are foreclosing on properties on which they do not even own the note. This practice is blessed by a legal system overwhelmed with foreclosure cases and unable to sort out murky legal details, and a set of law firms who mass produce filings to move foreclosures as quickly as possible. At the very least, we would encourage you to remove foreclosure mills under investigation for document fraud from the Fannie Mae’s Retained Attorney Network. We also believe that Fannie should have guidelines allowing servicers to proceed on a foreclosure only when its legal entitlement to foreclose is clearly documented. In addition, these charges raise a number of questions for us about the foreclosure process as it pertains to Fannie Mae’s holdings.

Why is Fannie Mae using lawyers that are accused of regularly engaging in fraud to kick people out of their homes? Given that Fannie Mae is at this point a government entity, and it is the policy of the government that foreclosures are a costly situation best avoided if there are any lower cost alternatives, what steps is Fannie Mae taking to avoid the use of foreclosure mills? What additional steps is Fannie Mae going to take to ensure that foreclosures are done only when necessary and only in accordance with recognized law? How do your servicer guidelines take into account the incentives for fraud in the fee structure of foreclosure attorneys and others engage in the foreclosure process? What mechanisms do you employ to monitor legal outsourcing?

We look forward to your responses and to understanding more about these disturbing dynamics in future hearings.

Sincerely,

Alan Grayson

Member of Congress

Barney Frank

Member of Congress

Corrine Brown

Member of Congress

[ipaper docId=38085026 access_key=key-16a2ffn67hrkd71ga6q0 height=600 width=600 /]

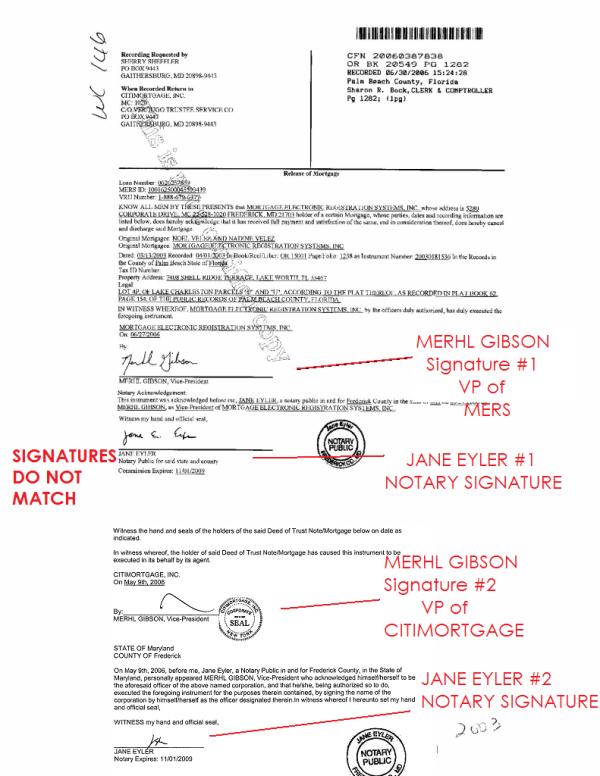

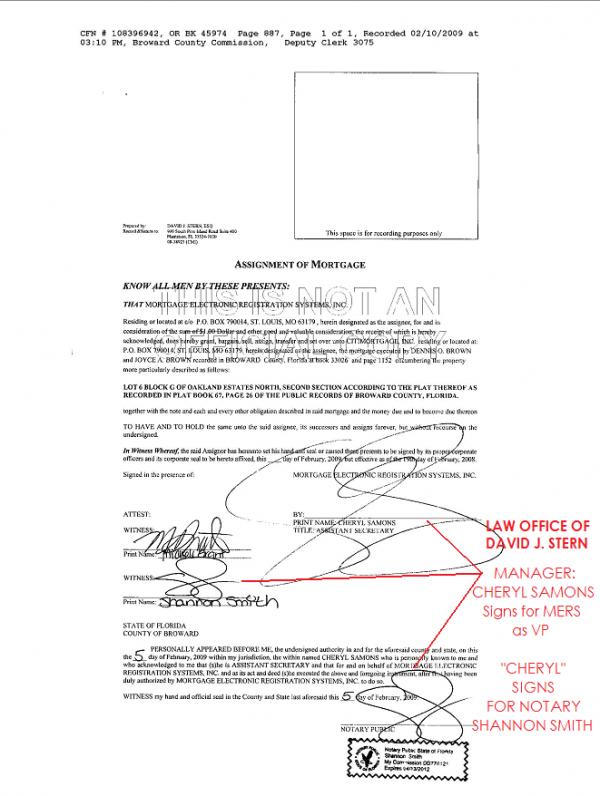

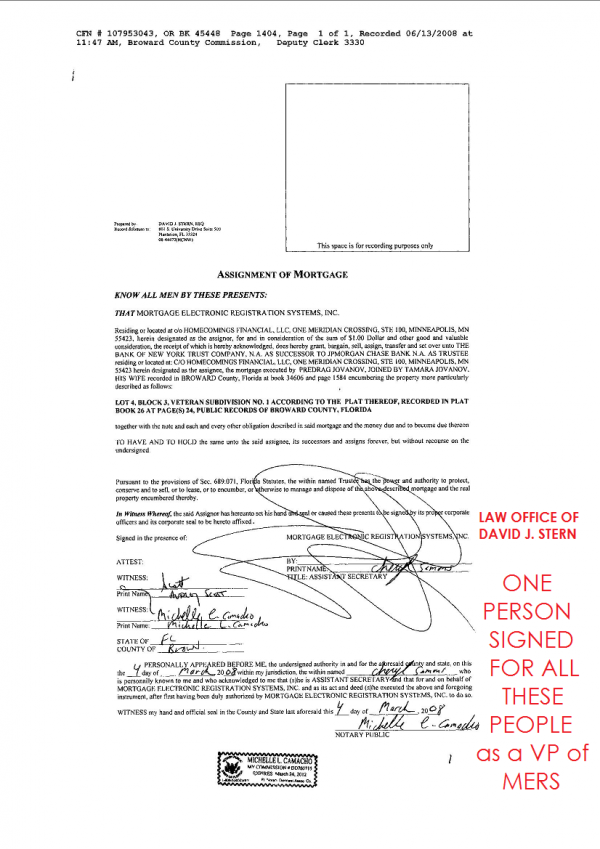

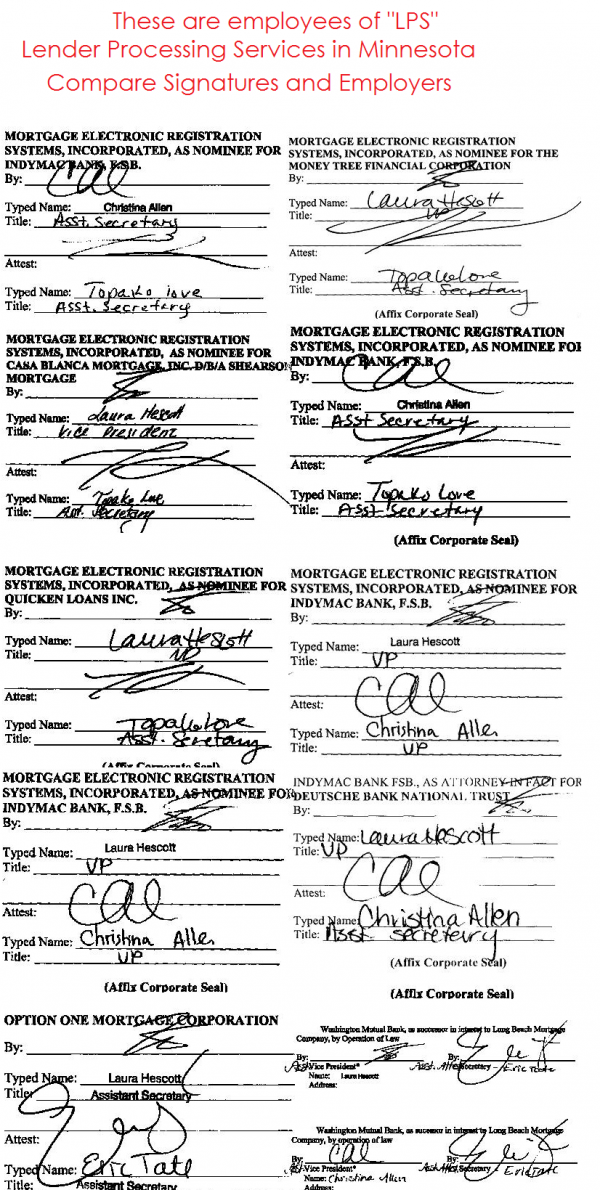

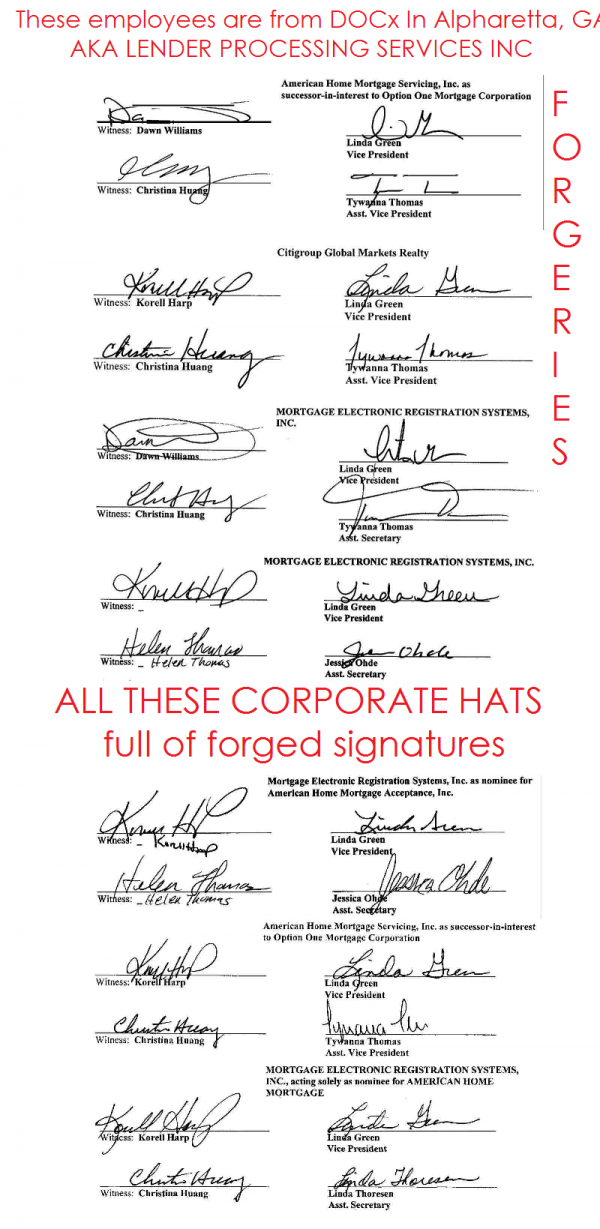

BELOW ARE EXAMPLES OF THE WORK COMING

FROM FANNIE/FREDDIE/MERS/LPS

FORECLOSURE MILL BARON’S

THERE IS MORE OF THESE

Dear Senators, I hope this response reaches you as soon as possible. I have personally been a victim of EXTREME foreclosure fraud by a Fannie Mae Servicer, it’s attorneys which are one of the 4 major law firms under investigation by the Florida Attorney General (and, yes, the firm used “fake/forged” documents attached to the court pleadings among numerous other extreme violations, all reported to the Court repeatedly which ALSO did NOT follow rules and procedures BUT has finally “stayed” all action pending response to my motion for fraud and sanctions pending for about 4 months now while the Ocourt” awaits a response to my allegations from the offending attorney) and, upon new information received, ALSO by Fannie Mae who always owned my mortgage Note but was never a party to the foreclosureaction, therefore, the entire matterhad no standing and the “fake copy of the Note was intended to indicate the “servicer” owned both as represented in the pleadings, however, after all was “rushed” through the system, the originalNote was located right in the court file showing (and servicer now admits) that Fannie Mae ALWAYS owned my Note. For your information and investigation (and please consider this my reporting of Fannie Mae’s fraud together with the same law firm the servicer used, Shapiro & Fishman), the law firm signed transferdocuments “for no consideration” transferring the foreclosure sale bidto Fannie Mae (as though they never had an interest like they were trying to get away withthroughoutthe proceedingsknowing allalongthat Fannie Mae already ownedmy loan), the reason behindwhy they did such “creative” work on my matter and that Fannie Mae refuses to stopusing them is because they are ignoring all of the rules in order to collect the “lump sum reimbursement” fromPMI, investors, and other government agencies. Despite my matter having been “stayed” months ago and my repeated calls and emails to Fannie Mae & HUD fo rimmediate assistance due to the very late discovery of the fradulent foreclosure without standing as I had discovered too late the hidden fact that Fannie Mae was actually the true owner of my Note and I was desperately trying to save my home but was consistently defrauded with notices of modification approved notices, their law firm refusing to provide copies of documents they were filing with the court (a completely sham “mediation granted “after” the court already gave them summary judgment (over my objection and notice of counterclaim) AND a sale date & then I found out the mediator used was affiliated with the law firm & had no “knowledge” of real estate whatsoever) and the hiding of the fact that the entire proceeding had nostanding and was riddled with fraud as outlined in my motion still pending. I desperately need help and am overwhelmed to find out that the servicer and Fannie Mae, both unknowingly to me, were actually using the same firm to accomplish the goal of a quick foreclosure so that Fannie Mae could collect their lump sum. My entire matter is very heavily documented and an absolute nightmare (so much more but I’m sure you see the picture now). Any assistance there may be to bring some justice to this matter (and any other victims) would be greatly appreciated.

Barney Frank is an Asshole and this is a complete reversal of his previous position. He has been trying to protect the banks from the beginning. About the only good thing Obama has done was to reject Barneys Bank protection bill.