Tag Archive | "din_sfla"

(MERS) MORTGAGE ELECTRONIC REGISTRATION SYSTEMS Inc.: Into The Mortgage Netherworld 101

Posted on 02 May 2010.

Posted in concealment, conspiracy, corruption, foreclosure, foreclosure fraud, foreclosure mills, forensic mortgage investigation audit, MERS, mortgage electronic registration system, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC., Mortgage Foreclosure FraudComments (0)

Florida Foreclosure Fraud Protection Law Enacted – Foreclosures / Mortgage Loan Modification

Posted on 02 May 2010.

Florida Foreclosure Fraud Protection Law Enacted.

The Attorney General clarified that this new law will not apply to the Attorney / Client relationship or the way attorneys are paid when they are hired to help distressed homeowners. This law brings much needed protection to those consumers / homeowners who have been taken advantage of by Mortgage Loan Modification Companies – many of which are scams…Effective October 1st, 2008

501.1377 Violations involving homeowners during the course of residential foreclosure proceedings.

(1) LEGISLATIVE FINDINGS AND INTENT.–The Legislature finds that homeowners who are in default on their mortgages, in foreclosure, or at risk of losing their homes due to nonpayment of taxes may be vulnerable to fraud, deception, and unfair dealings with foreclosure-rescue consultants or equity purchasers. The intent of this section is to provide a homeowner with information necessary to make an informed decision regarding the sale or transfer of his or her home to an equity purchaser. It is the further intent of this section to require that foreclosure-related rescue services agreements be expressed in writing in order to safeguard homeowners against deceit and financial hardship; to ensure, foster, and encourage fair dealing in the sale and purchase of homes in foreclosure or default; to prohibit representations that tend to mislead; to prohibit or restrict unfair contract terms; to provide a cooling-off period for homeowners who enter into contracts for services related to saving their homes from foreclosure or preserving their rights to possession of their homes; to afford homeowners a reasonable and meaningful opportunity to rescind sales to equity purchasers; and to preserve and protect home equity for the homeowners of this state.

(2) DEFINITIONS.–As used in this section, the term:

(a) “Equity purchaser” means any person who acquires a legal, equitable, or beneficial ownership interest in any residential real property as a result of a foreclosure-rescue transaction. The term does not apply to a person who acquires the legal, equitable, or beneficial interest in such property:

1. By a certificate of title from a foreclosure sale conducted under chapter 45;

2. At a sale of property authorized by statute;

3. By order or judgment of any court;

4. From a spouse, parent, grandparent, child, grandchild, or sibling of the person or the person’s spouse; or

5. As a deed in lieu of foreclosure, a workout agreement, a bankruptcy plan, or any other agreement between a foreclosing lender and a homeowner.

(b) “Foreclosure-rescue consultant” means a person who directly or indirectly makes a solicitation, representation, or offer to a homeowner to provide or perform, in return for payment of money or other valuable consideration, foreclosure-related rescue services. The term does not apply to:

1. A person excluded under s. 501.212.

2. A person acting under the express authority or written approval of the United States Department of Housing and Urban Development or other department or agency of the United States or this state to provide foreclosure-related rescue services.

3. A charitable, not-for-profit agency or organization, as determined by the United States Internal Revenue Service under s. 501(c)(3) of the Internal Revenue Code, which offers counseling or advice to an owner of residential real property in foreclosure or loan default if the agency or organization does not contract for foreclosure-related rescue services with a for-profit lender or person facilitating or engaging in foreclosure-rescue transactions.

4. A person who holds or is owed an obligation secured by a lien on any residential real property in foreclosure if the person performs foreclosure-related rescue services in connection with this obligation or lien and the obligation or lien was not the result of or part of a proposed foreclosure reconveyance or foreclosure-rescue transaction.

5. A financial institution as defined in s. 655.005 and any parent or subsidiary of the financial institution or of the parent or subsidiary.

6. A licensed mortgage broker, mortgage lender, or correspondent mortgage lender that provides mortgage counseling or advice regarding residential real property in foreclosure, which counseling or advice is within the scope of services set forth in chapter 494 and is provided without payment of money or other consideration other than a mortgage brokerage fee as defined in s. 494.001.

(c) “Foreclosure-related rescue services” means any good or service related to, or promising assistance in connection with:

1. Stopping, avoiding, or delaying foreclosure proceedings concerning residential real property; or

2. Curing or otherwise addressing a default or failure to timely pay with respect to a residential mortgage loan obligation.

(d) “Foreclosure-rescue transaction” means a transaction:

1. By which residential real property in foreclosure is conveyed to an equity purchaser and the homeowner maintains a legal or equitable interest in the residential real property conveyed, including, without limitation, a lease option interest, an option to acquire the property, an interest as beneficiary or trustee to a land trust, or other interest in the property conveyed; and

2. That is designed or intended by the parties to stop, avoid, or delay foreclosure proceedings against a homeowner’s residential real property.

(e) “Homeowner” means any record title owner of residential real property that is the subject of foreclosure proceedings.

(f) “Residential real property” means real property consisting of one-family to four-family dwelling units, one of which is occupied by the owner as his or her principal place of residence.

(g) “Residential real property in foreclosure” means residential real property against which there is an outstanding notice of the pendency of foreclosure proceedings recorded pursuant to s. 48.23.

(3) PROHIBITED ACTS.–In the course of offering or providing foreclosure-related rescue services, a foreclosure-rescue consultant may not:

(a) Engage in or initiate foreclosure-related rescue services without first executing a written agreement with the homeowner for foreclosure-related rescue services; or

(b) Solicit, charge, receive, or attempt to collect or secure payment, directly or indirectly, for foreclosure-related rescue services before completing or performing all services contained in the agreement for foreclosure-related rescue services.

(4) FORECLOSURE-RELATED RESCUE SERVICES; WRITTEN AGREEMENT.–

(a) The written agreement for foreclosure-related rescue services must be printed in at least 12-point uppercase type and signed by both parties. The agreement must include the name and address of the person providing foreclosure-related rescue services, the exact nature and specific detail of each service to be provided, the total amount and terms of charges to be paid by the homeowner for the services, and the date of the agreement. The date of the agreement may not be earlier than the date the homeowner signed the agreement. The foreclosure-rescue consultant must give the homeowner a copy of the agreement to review not less than 1 business day before the homeowner is to sign the agreement.

(b) The homeowner has the right to cancel the written agreement without any penalty or obligation if the homeowner cancels the agreement within 3 business days after signing the written agreement. The right to cancel may not be waived by the homeowner or limited in any manner by the foreclosure-rescue consultant. If the homeowner cancels the agreement, any payments that have been given to the foreclosure-rescue consultant must be returned to the homeowner within 10 business days after receipt of the notice of cancellation.

(c) An agreement for foreclosure-related rescue services must contain, immediately above the signature line, a statement in at least 12-point uppercase type that substantially complies with the following:

HOMEOWNER’S RIGHT OF CANCELLATION

YOU MAY CANCEL THIS AGREEMENT FOR FORECLOSURE-RELATED RESCUE SERVICES WITHOUT ANY PENALTY OR OBLIGATION WITHIN 3 BUSINESS DAYS FOLLOWING THE DATE THIS AGREEMENT IS SIGNED BY YOU.

THE FORECLOSURE-RESCUE CONSULTANT IS PROHIBITED BY LAW FROM ACCEPTING ANY MONEY, PROPERTY, OR OTHER FORM OF PAYMENT FROM YOU UNTIL ALL PROMISED SERVICES ARE COMPLETE. IF FOR ANY REASON YOU HAVE PAID THE CONSULTANT BEFORE CANCELLATION, YOUR PAYMENT MUST BE RETURNED TO YOU NO LATER THAN 10 BUSINESS DAYS AFTER THE CONSULTANT RECEIVES YOUR CANCELLATION NOTICE.

TO CANCEL THIS AGREEMENT, A SIGNED AND DATED COPY OF A STATEMENT THAT YOU ARE CANCELING THE AGREEMENT SHOULD BE MAILED (POSTMARKED) OR DELIVERED TO (NAME) AT (ADDRESS) NO LATER THAN MIDNIGHT OF (DATE) .

IMPORTANT: IT IS RECOMMENDED THAT YOU CONTACT YOUR LENDER OR MORTGAGE SERVICER BEFORE SIGNING THIS AGREEMENT. YOUR LENDER OR MORTGAGE SERVICER MAY BE WILLING TO NEGOTIATE A PAYMENT PLAN OR A RESTRUCTURING WITH YOU FREE OF CHARGE.

(d) The inclusion of the statement does not prohibit the foreclosure-rescue consultant from giving the homeowner more time in which to cancel the agreement than is set forth in the statement, provided all other requirements of this subsection are met.

(e) The foreclosure-rescue consultant must give the homeowner a copy of the signed agreement within 3 hours after the homeowner signs the agreement.

(5) FORECLOSURE-RESCUE TRANSACTIONS; WRITTEN AGREEMENT.–

(a) 1. A foreclosure-rescue transaction must include a written agreement prepared in at least 12-point uppercase type that is completed, signed, and dated by the homeowner and the equity purchaser before executing any instrument from the homeowner to the equity purchaser quitclaiming, assigning, transferring, conveying, or encumbering an interest in the residential real property in foreclosure. The equity purchaser must give the homeowner a copy of the completed agreement within 3 hours after the homeowner signs the agreement. The agreement must contain the entire understanding of the parties and must include:

a. The name, business address, and telephone number of the equity purchaser.

b. The street address and full legal description of the property.

c. Clear and conspicuous disclosure of any financial or legal obligations of the homeowner that will be assumed by the equity purchaser.

d. The total consideration to be paid by the equity purchaser in connection with or incident to the acquisition of the property by the equity purchaser.

e. The terms of payment or other consideration, including, but not limited to, any services that the equity purchaser represents will be performed for the homeowner before or after the sale.

f. The date and time when possession of the property is to be transferred to the equity purchaser.

2. A foreclosure-rescue transaction agreement must contain, above the signature line, a statement in at least 12-point uppercase type that substantially complies with the following:

I UNDERSTAND THAT UNDER THIS AGREEMENT I AM SELLING MY HOME TO THE OTHER UNDERSIGNED PARTY.

3. A foreclosure-rescue transaction agreement must state the specifications of any option or right to repurchase the residential real property in foreclosure, including the specific amounts of any escrow payments or deposit, down payment, purchase price, closing costs, commissions, or other fees or costs.

4. A foreclosure-rescue transaction agreement must comply with all applicable provisions of 15 U.S.C. ss. 1600 et seq. and related regulations.

(b) The homeowner may cancel the foreclosure-rescue transaction agreement without penalty if the homeowner notifies the equity purchaser of such cancellation no later than 5 p.m. on the 3rd business day after signing the written agreement. Any moneys paid by the equity purchaser to the homeowner or by the homeowner to the equity purchaser must be returned at cancellation. The right to cancel does not limit or otherwise affect the homeowner’s right to cancel the transaction under any other law. The right to cancel may not be waived by the homeowner or limited in any way by the equity purchaser. The equity purchaser must give the homeowner, at the time the written agreement is signed, a notice of the homeowner’s right to cancel the foreclosure-rescue transaction as set forth in this subsection. The notice, which must be set forth on a separate cover sheet to the written agreement that contains no other written or pictorial material, must be in at least 12-point uppercase type, double-spaced, and read as follows:

NOTICE TO THE HOMEOWNER/SELLER

PLEASE READ THIS FORM COMPLETELY AND CAREFULLY. IT CONTAINS VALUABLE INFORMATION REGARDING CANCELLATION RIGHTS.

BY THIS CONTRACT, YOU ARE AGREEING TO SELL YOUR HOME. YOU MAY CANCEL THIS TRANSACTION AT ANY TIME BEFORE 5:00 P.M. OF THE THIRD BUSINESS DAY FOLLOWING RECEIPT OF THIS NOTICE.

THIS CANCELLATION RIGHT MAY NOT BE WAIVED IN ANY MANNER BY YOU OR BY THE PURCHASER.

ANY MONEY PAID DIRECTLY TO YOU BY THE PURCHASER MUST BE RETURNED TO THE PURCHASER AT CANCELLATION. ANY MONEY PAID BY YOU TO THE PURCHASER MUST BE RETURNED TO YOU AT CANCELLATION.

TO CANCEL, SIGN THIS FORM AND RETURN IT TO THE PURCHASER BY 5:00 P.M. ON (DATE) AT (ADDRESS) . IT IS BEST TO MAIL IT BY CERTIFIED MAIL OR OVERNIGHT DELIVERY, RETURN RECEIPT REQUESTED, AND TO KEEP A PHOTOCOPY OF THE SIGNED FORM AND YOUR POST OFFICE RECEIPT.

I (we) hereby cancel this transaction.

Seller’s Signature

Printed Name of Seller

Seller’s Signature

Printed Name of Seller

Date

(c) In any foreclosure-rescue transaction in which the homeowner is provided the right to repurchase the residential real property, the homeowner has a 30-day right to cure any default of the terms of the contract with the equity purchaser, and this right to cure may be exercised on up to three separate occasions. The homeowner’s right to cure must be included in any written agreement required by this subsection.

(d) In any foreclosure-rescue transaction, before or at the time of conveyance, the equity purchaser must fully assume or discharge any lien in foreclosure as well as any prior liens that will not be extinguished by the foreclosure.

(e) If the homeowner has the right to repurchase the residential real property, the equity purchaser must verify and be able to demonstrate that the homeowner has or will have a reasonable ability to make the required payments to exercise the option to repurchase under the written agreement. For purposes of this subsection, there is a rebuttable presumption that the homeowner has a reasonable ability to make the payments required to repurchase the property if the homeowner’s monthly payments for primary housing expenses and regular monthly principal and interest payments on other personal debt do not exceed 60 percent of the homeowner’s monthly gross income.

(f) If the homeowner has the right to repurchase the residential real property, the price the homeowner pays may not be unconscionable, unfair, or commercially unreasonable. A rebuttable presumption, solely between the equity purchaser and the homeowner, arises that the foreclosure-rescue transaction was unconscionable if the homeowner’s repurchase price is greater than 17 percent per annum more than the total amount paid by the equity purchaser to acquire, improve, maintain, and hold the property. Unless the repurchase agreement or a memorandum of the repurchase agreement is recorded in accordance with s. 695.01, the presumption arising under this subsection shall not apply against creditors or subsequent purchasers for a valuable consideration and without notice.

(6) REBUTTABLE PRESUMPTION.– Any foreclosure-rescue transaction involving a lease option or other repurchase agreement creates a rebuttable presumption, solely between the equity purchaser and the homeowner, that the transaction is a loan transaction and the conveyance from the homeowner to the equity purchaser is a mortgage under s. 697.01. Unless the lease option or other repurchase agreement, or a memorandum of the lease option or other repurchase agreement, is recorded in accordance with s. 695.01, the presumption created under this subsection shall not apply against creditors or subsequent purchasers for a valuable consideration and without notice.

(7) VIOLATIONS. – A person who violates any provision of this section commits an unfair and deceptive trade practice as defined in part II of this chapter. Violators are subject to the penalties and remedies provided in part II of this chapter, including a monetary penalty not to exceed $15,000 per violation.

Posted in foreclosure, foreclosure fraud, forensic mortgage investigation audit, mortgage modificationComments (2)

Lawsuit Tied to Loan Commitment: Siller v. OPTION ONE MORTGAGE CORPORATION CA4/1

Posted on 01 May 2010.

REVERSED : OVERTURNED

“Play it back and rewind”

[ipaper docId=30774626 access_key=key-qfqhg7smvggxca73r9x height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Posted in case, forensic mortgage investigation audit, reversed court decisionComments (2)

NO STANDING: MORTGAGE ELECTRONIC REGISTRATION SYSTEM, INC., APPELLANT, VS. SOUTHWEST HOMES OF ARKANSAS, APPELLEE

Posted on 01 May 2010.

The Kansas appellate court noted that MERS received no funds and that the mortgage required the borrower to pay his monthly payments to the lender. just as in the case at hand, that the notice provisions of the mortgage “did not list MERS as an entity to contact upon default or foreclosure.” declaring that MERS did not have a “sort of substantial rights and interests” that had been found in a prior decision and noting that “a party with no beneficial interest is outside the realm of necessary parties,” the Kansas court concluded that “the failure to name and serve MERS as a defendant in a foreclosure action in which the lender of record has been served” was not such a fatal defect that the foreclosure judgment should be set aside. at 331, 192 P.3d at 181-82.

It is my opinion that the same holds true in the instant case. Here, Pulaski Mortgage, the lender for whom MERS served as nominee, was served in the foreclosure action. But, further, neither MERS’s holding of legal title, nor its status as nominee, demonstrates any interest that would have rendered it a necessary party pursuant to Ark. R. Civ. P. 19(a).

For these reasons, I concur that the circuit court’s order should be affirmed.

IMBER and WILLS, JJ., join.

[ipaper docId=30774283 access_key=key-13lkiaigfhjiknf5bhf2 height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in case, foreclosure, foreclosure fraud, MERS, mortgage electronic registration systemComments (0)

Law Office Of Ben-Ezra & Katz, Fort Lauderdale, FL Omits Postage Meter Date

Posted on 30 April 2010.

Keep sending these in…

940 18 U.S.C. Section 1341—Elements of Mail Fraud

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Posted in ben-ezra, conspiracy, envelope, foreclosure fraud, mail fraud, scamComments (0)

Foreclosure FRAUD?: Tell it to the Attorney General Bill McCollum 5/8 MIAMI

Posted on 30 April 2010.

PICKET…anyone??

Posted by Harriet Brackey on April 30, 2010 10:46 AM SunSentinel

If you want to speak to Florida’s Attorney General about foreclosure or loan modifications or mortgage fraud, here’s your chance.

Saturday, May 8, in Miami, Attorney General Bill McCollum will be on hand for a Mortgage Fraud Community Forum. He’s hosting the event with Florida’s Interagency Mortgage Task Force.

The session is on “The Housing Crisis, Who to Trust and Where to Turn.”

It’s open to the public and free, but reservations are required. Call 877-385-1621.

It will be held from 10 a.m. to 4 p.m. at Miami Dade College, Wolfson Campus, Chapman Conference Center, 300 N.E. Second Ave.

The AG’s office says you can get help on how to face foreclosure, housing scams, mortgage fraud, loan modifications and finding legal assistance.

Certified housing counselors, volunteer lawyers, as well as representatives of Bank of America, JP Morgan Chase, Wells Fargo/Wachovia and SunTrust will be on hand.

Also attending will be representatives of:

Florida Department of Law Enforcement, Office of Financial Regulation, Department of Business and Professional Regulation, Florida Bar, Dade County Bar Legal Aid Society, Cuban American Bar and the Collins Center Foreclosure Mediation Program.

For more information, go to www.myfloridalegal.com/mortgagefraud.

Posted in foreclosure fraudComments (0)

OPERATION "DARK CLOUD"

Posted on 30 April 2010.

Cannot Confirm “YET” but HIGH FORCES are possibly investigating fraud on this blog. To make it even more satisfying, shortly after I received an email from a person in DC, I began to see the light from this dark cloud that looms above our homes. I sense something happening soon.

Keep sending your letters and emails to anyone who may have the power to seek those that hide…eventually someone will take notice and you never know who you will hear from!

Please allow me to narrow your search: Click the links below

FRAUD1

FRAUD2

FRAUD3

FRAUD4

FRAUD5

FRAUD6

“Please Do Not Hesitate To Contact Me”

Posted in concealment, conspiracy, corruption, foreclosure fraudComments (0)

Attorney general investigating Tampa foreclosure firm: TBO.com

Posted on 30 April 2010.

By MICHAEL SASSO | The Tampa Tribune

Published: April 30, 2010

TAMPA – The Florida Attorney General’s Office is investigating a Tampa-based foreclosure law firm that has become one of the state’s largest foreclosure mills.

On the agency’s Web site, the attorney general showed it has an “active public consumer-related investigation” into Florida Default Law Group. The agency notes that it is a civil investigation, rather than a criminal one, and the fact that is has an investigation isn’t proof of any violation of law.

Without going into much detail, the attorney general’s Web site says Florida Default Law Group, “Appears to be fabricating and/or presenting false and misleading documents in foreclosure cases.

“These documents have been presented in court before judges as actual assignments of mortgages and have later been shown to be legally inadequate and/or insufficient. Presenting faulty bank paperwork due to the mortgage crisis and thousands of foreclosures per month.”

Attempts to reach the Attorney General’s Office and Michael Echevarria, the head of Florida Default Law Group, were unsuccessful Thursday.

Based in a business park just off the Veteran’s Expressway, Florida Default Law Group files hundreds of foreclosure lawsuits alone in Hillsborough County on behalf of banks and mortgage servicing companies. The Tribune profiled Florida Default Law Group in January.

According to the Tribune’s review of 1,994 circuit court records, the firm filed initial legal documents for 323 foreclosure lawsuits in October. That was second only to the Law Offices of David J. Stern, a Broward County-based foreclosure firm that filed 352 foreclosure cases in October.

Florida Default Law Group operates in numerous counties in Florida, but it’s not clear how many lawsuits it files outside of Hillsborough County.

Reporter Michael Sasso can be reached at (813) 259-7865.

Posted in concealment, conspiracy, corruption, DOCX, FDLG, florida default law group, foreclosure fraud, foreclosure mills, forensic mortgage investigation audit, Lender Processing Services Inc., LPS, MERS, Mortgage Foreclosure Fraud, scamComments (0)

In A Putative Class Action, The Third Circuit Holds That A Plaintiff Must Show Detrimental Reliance On Improper Loan Disclosure Statements To Obtain Actual Damages Under The Truth In Lending Act (TILA)

Posted on 29 April 2010.

By Shannon PetersenOn December 31, 2009, the Third Circuit held that a borrower must prove detrimental reliance to obtain actual damages for a violation of the federal Truth in Lending Act (“TILA”). See Vallies v. Sky Bank, —F.3d—, 2009 WL 5154473 (3rd Cir. 2009).

Under TILA, the federal government requires that lenders make certain disclosures to borrowers about the terms of their loans before lending them money. TILA claims are at the epicenter of the mortgage litigation crises. Over the past two years, TILA claims, including class action claims, have flooded the state and federal courts. Most of these claims involve allegations that some technical TILA disclosure violation has occurred.

Though not a mortgage case, the allegations of the borrower in Vallies v. Sky Bank are typical. The plaintiff alleged that the finance charge statement made by the bank for an auto loan was misleading in that it did not include $395 representing the amount of the debt cancellation insurance, which the plaintiff alleged should have been included in the finance charge statement under TILA. The district court granted summary judgment in favor of the bank because the borrower had failed to show that (1) he had read the TILA disclosure statement pertaining to finance charges, (2) he had understood the finance charges being disclosed, (3) had the disclosure been accurate by including an additional $395, he would have sought better terms or foregone the loan, and (4) if he had sought better terms, he would have obtained them.

The Third Circuit declined to state the specific facts or circumstances that constitute detrimental reliance under TILA, but affirmed the decision of the district court that detrimental reliance must be shown and had not been shown here. In so holding, the Third Circuit relied on the language of TILA itself, which provides for both actual damages and statutory damages. According to the Third Circuit, to obtain actual damages, a plaintiff must show causation by showing that he or she relied on a misleading or improper loan disclosure statement to his or her detriment. In contrast, to obtain statutory damages, a plaintiff must only show that a violation of TILA has occurred. (For class action suits, statutory damages under TILA are capped at the lesser of $500,000 or 1% of the defendant’s net worth.).

In reaching its decision, the Third Circuit considered but rejected as irrelevant the concerns of some legal commentators, who have noted that under a detrimental reliance standard actual damages for TILA loan disclosure violations may be difficult to prove. The court also disregarded the fact that “detrimental reliance may create obstacles for class certification because of the individualized fact-specific nature of the reliance inquiry.” The court distinguished other case law, holding that detrimental reliance under TILA is not necessary, on the grounds that those cases involved claims for statutory damages, not actual damages, under TILA.

Finally, the Third Circuit noted that it joined the holding of every other circuit court that has addressed the issue, including the First, Fifth, Sixth, Eighth, and Ninth Circuits. Citing United States v. Petroff-5 Kline, 557 F.3d 285, 297 (6th Cir. 2009) (“[A]ctual damages require a showing of detrimental reliance.”); McDonald v. Checks-N-Advance, Inc. (In re Ferrell), 539 F.3d 1186, 1192 (9th Cir. 2008) (finding no valid basis to overturn the rule of In re Smith requiring a showing of detrimental reliance to establish actual damages); Gold Country Lenders v. Smith (In re Smith), 289 F.3d 1155, 1157 (9th Cir. 2002) (“Wejoin with other circuits and hold that in order to receive actual damages for a TILA violation . . . a borrower must establish detrimental reliance.”); Turner v. Beneficial Corp., 242 F.3d 1023, 1028 (11th Cir. 2001) (en banc) (“We hold that detrimental reliance is an element of a TILA claim for actual damages . . . .”); Perrone v. Gen. Motors Acceptance Corp., 232 F.3d 433, 434–40 (5th Cir. 2000) (holding that detrimental reliance is an element of a claim for actual damages); Peters v. Jim Lupient Oldsmobile Co., 220 F.3d 915, 917 (8th Cir. 2000)(requiring a showing of proximate causation and adopting a four-prong reliance test for establishing actual damages); Bizier v. Globe Fin. Servs., Inc., 654 F.2d 1, 4 (1st Cir. 1981) (noting in dicta the need to show causation for an award of actual damages “in addition to a threshold showing of a violation of a TILA requirement”).

Under this law, it is not enough, as plaintiffs in TILA cases often do, to allege that a TILA loan disclosure violation has occurred. Instead, a plaintiff must also allege and prove that he or she relied on the misleading or improper statement and as a result of this reliance suffered actual damage. This recent decision of the Third Circuit also emphasizes the difficulty of certifying a class action for actual damages under TILA. Even where the named plaintiff has detrimentally relied on an improper loan disclosure statement, such reliance can rarely be universally inferred for other, unnamed class members. Instead, to determining detrimental reliance usually requires an individual inquiry about whether the class member read the disclosure statement, understood it, and relied on it to his or her detriment. For this reason, such cases are very difficult to certify for class treatment. See, e.g., Stout v. J.D. Byrider, 228 F.3d 709, 718 (6th Cir. 2000) (affirming the denial of class certification based on the need for individualized assessment of whether “each putative class member relied upon false representations or failures to disclose” under TILA).

Posted in concealment, foreclosure fraud, tilaComments (1)

Davies v. Ndex- Palintiff's Supplemental Reply to Defendants Objection for an Evidence Hearing 4-26-2010

Posted on 29 April 2010.

From: b.daviesmd6605

FIGHTING FOR EVIDENCE HEARING. PLAINITIFF HAS COPY OF NOTE ENDORSED IN BLANK AND EVIDENCE THE SECURITY INTEREST WAS ASSIGNED SEPARATELY. THIS IS A NULLITY. I WANT THE TRUTH TO SURFACE. CALIFORNIA IS A HARD STATE TO HAVE A FAIR HEARING. I HOPE THIS ONE WILL PUT PRESSURE BY EVIDENCE FOR THE NEED TO DIRECTLY VIEW SUCH DOCUMENTS.

[ipaper docId=30294401 access_key=key-14o033pqagf95s18ucxm height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in concealment, conspiracy, corruption, foreclosure fraudComments (0)

MERS CONTACTED StopForeclosureFraud.com

Posted on 29 April 2010.

Just to be clear SFF will post any correspondence from within those we mention on this blog and use it as a plat form to communicate.

Everyone is watching this site.

If you do comment please do so in a pleasant manner.

MERSCORP:

Posted in MERSComments (0)

WE CAN'T SPELL S_CCESS…WITHOUT U! "ASSIGNMENTS WANTED"

Posted on 29 April 2010.

WE NEED EVERYONE TO PARTICIPATE

THE MORE THE BETTER!

SEND ME YOUR ASSIGNMENTS! I AM COMPILING THESE WITH LYNN SZYMONIAK, ESQ (FraudDigest”)…WE ARE WORKING DAY IN, DAY OUT TO STOP THIS!

Send to info@stopforeclosurefraud.com

BUT WE NEED YOU!! NO MATTER WHERE YOU ARE!!

HELP PUT A STOP TO THIS.

Posted in concealment, conspiracy, corruption, foreclosure fraud, foreclosure mills, fraud digest, Lynn Szymoniak ESQComments (4)

!BAM! Foreclosure Lawyers Face New Heat In Florida: Wall Street Journal AMIR EFRATI

Posted on 29 April 2010.

Again…AMIR…SETS IT OFF!!

April 29, 2010, 12:46 PM ET

By Amir Efrati The Wall Street Journal

As we’ve noted before, the feds in Jacksonville recently started a criminal investigation of a company that is a top provider of the documentation used by banks in the foreclosure process. And a state-court judge ruled that a bank submitted a “fraudulent” document in support of its foreclosure case. That document was prepared by a local law firm.

For more Law Blog background on the foreclosure mess in our nation’s courts, this post will help.

The news today: the Florida Attorney General’s office said it has launched a civil investigation of Florida Default Law Group, based in Tampa, which is one of the largest so-called foreclosure-mill law firms in the state.

According to the AG’s website, it’s looking at whether the firm is “fabricating and/or presenting false and misleading documents in foreclosure cases.” It added: “These documents have been presented in court before judges as actual assignments of mortgages and have later been shown to be legally inadequate and/or insufficient.”

The issue: judges are increasingly running into situations in which banks are claiming ownership of properties they actually don’t own. Some of them end up chewing out the lawyers representing the banks.

The AG’s office said Florida Default Law Group appears to work closely with Lender Processing Services — the company we referenced earlier that is being investigated by the Justice Department.

LPS processes and sometimes produces documents needed by banks to prove they own the mortgages. LPS often works with local lawyers who litigate the foreclosure cases in court. Sometimes those same law firms produce documents that are required to prove ownership.

We’ve reached out to Florida Default Law Group and LPS and will let you know if we hear back.

Posted in concealment, conspiracy, corruption, DOCX, FDLG, florida default law group, foreclosure fraud, foreclosure mills, Lender Processing Services Inc., LPSComments (0)

*BREAKING NEWS* Economic Crimes Division in Ft. Lauderdale, Florida *INVESTIGATING* FLORIDA DEFAULT LAW GROUP “FORECLOSURE MILL” & LENDER PROCESSING SERVICES “DOCx, LLC”

Posted on 29 April 2010.

UPDATE: Cannot confirm YET but others might be as well! Stay Tuned!

FDLG, LPS’ DocX is being investigated…lets see who’s next!

If you have evidence of Fraud make sure you contact them.

Active Public Consumer-Related Investigation

| Case Number: | L10-3-1095 |

| Subject of investigation: | Florida Default Law Group, PL |

| Subject’s address: | 9119 Corporate Lake Drive, Suite 300, Tampa, Florida 33634 |

| Subject’s business: | Law Firm, Foreclosures |

| Allegation or issue being investigated: Appears to be fabricating and/or presenting false and misleading documents in foreclosure cases. These documents have been presented in court before judges as actual assignments of mortgages and have later been shown to be legally inadequate and/or insufficient. Presenting faulty bank paperwork due to the mortgage crisis and thousands of foreclosures per month. This firm is one of the largest foreclosure firms in the State. This firm appears to be one of Docx, LLC a/k/a Lender Processing Services’ clients, who this office is also investigating. |

|

| AG unit handling case: | Economic Crimes Division in Ft. Lauderdale, Florida |

MISSION: VOID Lender Processing Services “Assignments” (LPS)

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in DOCX, florida default law group, foreclosure fraud, Lender Processing Services Inc., LPSComments (4)

She’s 100 years old and facing foreclosure: CHICAGO TRIBUNE

Posted on 29 April 2010.

REMOVE YOUR MONEY 9/11/2010

An army of volunteers seeks to help “Aunt Aggie,” a 100-year-old Monee woman who raised 40 foster kids on her farm

April 27, 2010|By Colleen Mastony, Chicago Tribune reporter

Let the bankers come with their foreclosure notices. Invite the building inspectors, too. At 100 years old, Agnes Albinger has lived on her 70-acre patch of farmland longer than most of those people have been alive.

She has seen two world wars come and go, survived the Depression — in part by subsisting on minnow stew — and raised 40 foster children. Now, she has become a rallying point in this rural community as she fights to keep her Monee farm.

“I’ll never leave,” she said one recent morning, as she stood with a walker on her sagging front porch, looking out over the fields she tended for most of her life. “I’d like to stay here until I die. This is my home. This was my land. I owned everything once. I worked awful hard on this place to make it what it was.”

As Albinger faces foreclosure on the property where she has lived since 1949, a coalition of friends and strangers has mobilized to help the woman everyone calls “Aunt Aggie.” They have set up a , Web site, saveagnesfarm.com, and volunteered to help with cleaning and repairs. On a recent Saturday, nearly 100 people showed up to clear brush and haul away rusting farm equipment.

For many in Will County, helping Albinger seems to be one of the few ways they can push back against the waves of foreclosures and layoffs that have swept the nation.

“It goes further than what’s happening to Agnes. This same thing is happening all over. The value of American land is going down, homes are foreclosing. All these bankers think about is how much money they can make,” said Jim Armstrong, 59, a friend who helped organize volunteers. “They don’t care that there’s people who live on this land, people who love this land.”

As for Albinger, she says she’d rather die than leave. Her body is stooped with age and her hands are gnarled from decades of labor. But her mind seems sharp, and she fiercely defends her right to live independently. ” Nursing homes are made for people who cannot help themselves,” said Albinger, who uses a walker and who has a live-in caretaker to help with the heavier chores. “I can cook my own meals. I can do my own dishes. I can do everything myself.”

But the question of her best interests remains complicated. The farm has fallen into disrepair. The yard is strewn with cast-off furniture, stacks of old tractor tires, two abandoned cars. The porch is piled with junk. The roof leaks and, until recently, Albinger kept her last chicken inside the house, to protect it from raccoons.

And yet, when asked what the place means to her, Albinger replied simply: “Home. Don’t you have a home? Then you know what it means. It’s security. Love. Peacefulness.”

From 1 big family to another

The fifth of 11 children, Albinger was born in 1909 to Lithuanian immigrant farmers who cultivated land they rented near Kankakee. As a child, she attended class in a one-room school house, herded cows on the open prairie and helped plow fields with a team of horses. After a failed harvest, the family moved to Chicago, where in 1940 Albinger married her husband, Matthew. “A wonderful husband,” she said.

The couple couldn’t have children of their own, so they became foster parents, taking in the orphaned and abandoned. They bought the farm in Monee in 1949. Back then, Albinger said the land was still “all prairies, all over. Wild animals, everywhere you could see.” But, a few years after they purchased the property, Matthew died of a heart ailment, she and family members said.

“When my husband died, I had the four (foster) kids,” Albinger recalled. “And the welfare let me keep them. They said they’ll be company for me. As they grew up, I got more.”

Over the years, she raised 35 boys and five girls. In 1969, she was nominated for Cook County Foster Mother of the Year, according to news clippings.

“She taught me everything — how to live and survive,” said Michael Follmann, 54, who had bounced between more than a dozen “pretty brutal” foster homes by the time he came to Albinger’s farm. “I was a hot-headed young boy at the age of 9 after all the stuff that happened to me. I didn’t trust or believe in anybody. Then Agnes stepped into my life and taught me what it was like to trust people again, to have faith in people.”

“In my opinion, she saved my life,” said Greg Crosby, 54, who was 5 years old when his father abandoned him and five other siblings. The children had been malnourished and close to starvation, Crosby said, when Albinger took them in — all six kids — and made sure that the state didn’t split them up. “She taught us how to garden and things like that. She taught us to take care of animals. It meant everything.”

“I got my work ethic and, I think, my integrity through her,” said Greg’s brother, Ray Crosby, 57.

“I still call her ‘Mom,’ ” said Richard Rose, 49, who was 6 when he came to the farm. “Who knows where I would be if it wasn’t for her.”

Albinger introduced her foster children to the wonders of farm life. She showed them how to feed baby chicks by dripping water off a fingertip, and how to use a hand crank to separate the milk from the cream. She kept all sorts of animals including, at times, two peacocks, a pony and a monkey.

Life followed the rhythms of the seasons. They planted corn in the spring, cut hay in the summer and brought turnips into the cellar in the fall.

As years passed, the children grew up and moved away. But Albinger kept the farm going and, even well into her 80s, still milked the cows by hand and kept a few head of beef cattle. “I used to overhaul my own tractors. I did all my own field work,” she said. “I wasn’t afraid of work.”

The farm had been free of debt, family members said, until 2000, when court and land records show that Albinger took out a $100,000 mortgage on the property. Albinger then began to sign over parcels of land to a trust and also to a company called Phoenix Horizon LLC, which according to state records was formed by Albinger’s niece, Bridget Gruzdis, 47.

In an e-mailed response to questions from the Tribune, Gruzdis said Phoenix Horizon was created “for the sole purpose of land development and sale.”

Over six years, Albinger and Gruzdis took out a series of mortgages on the farm, eventually borrowing $700,000, according to court and land records.

Albinger says she might have signed some papers but never knew about the mortgage debt. In September, the bank initiated foreclosure proceedings. As recently as last week, a prospective buyer walked the property, which was put on the market a few years ago by Phoenix Horizon and is listed for $4.6 million, according to Ron Sales, a real estate agent in the area. But Albinger and other family members said they didn’t even know the farm was for sale.

Monee Deputy Police Chief John Cipkar said that the department is investigating and detectives are trying to determine if “Agnes was in full knowledge of what she was doing” when she signed. DinSFLA- Course she didn’t! They knew what they were doing was pulling a scam!

Gruzdis said in her e-mail that Albinger is suffering from dementia — an assertion that other family members dispute. She said that Albinger was involved in the formation of Phoenix Horizon and that the mortgages were taken to cover Albinger’s expenses and to “provide funds for Phoenix Horizon’s business objectives.”

“Agnes absolutely did know,” Gruzdis wrote. “Agnes was personally involved and signed all documents with her own hand.” DinSFLA- Not so fast “STAR”…your part of the investigation!

‘If I get to live here…’

In Will County, many hope that Albinger will somehow be able to stay on her land. In preparation for a May 1 deadline set by the Monee code enforcement department, volunteers have cleaned out Albinger’s basement, removed a crumbling shed from the yard and towed away the old tractors. Next, they hope to fix up the interior of the house.

“You’d have to be coldhearted not to have some compassion for her,” said Jim Frazier, 57, a volunteer. “I feel that she should be able to stay there at least to live out the days she has left.”

Meanwhile, Albinger’s extended family is struggling to decide if they should move her to a nursing home, a place where they believe she would be well-cared for, but where they fear she would be unhappy. “Myself, I would like to see her stay,” said Bob Szorc, 68, a nephew. “I would like to see her retain her independence. And once she goes to a nursing home, that’s not going to happen.”

“If she goes to a nursing home, her life will be cut short. I don’t think she’ll care to live anymore,” said Patricia Ritacco, 72, a niece. “You know, sometimes when you take away what’s important to people, they can’t exist any longer.”

As for Albinger, she is enjoying spring on the farm. The daffodils are blooming in her garden and the lilac bushes have begun to flower along the northern fence line.

Even at 100 years old, Albinger is thinking about farming and making plans for the future. On a recent morning, she stood on her porch and eyed her last chicken, clucking in a cage. “She’s a nice little girl,” Albinger said. “If I get to live here, I’m going to buy a rooster and see if I can raise a couple of chicks.”

Where is OPRAH??? Chicago hello???

Posted in foreclosure fraudComments (1)

POLICE RAID: Deutsche Bank And 50 Other Banks In Germany

Posted on 28 April 2010.

Gregory White | Apr. 28, 2010, 12:42 PM

Bild.de has broke the news of German police raids of Deutsche Bank and fifty other financial firms over tax-evasion charges.

The investigation involves 150 people suspected of evading VAT charges due in carbon trading schemes.

The taxes avoided add up to €1 billion, according to Bild.

Bild explains the tax scheme as this:

Dealers in different EU countries buy and sell permits which allow industrial enterprises to release a certain amount of greenhouse gases.

On the sale from dealer A to dealer B across a state border, no VAT is due. Upon the resale of the permits by dealer B to dealer C within the same country (i.e. Germany), VAT does become owed which dealer C can then claim back from the tax office.

Dealer B owes the authorities 19 per cent in VAT – it doesn’t pay, but pockets the 19 per cent and disappears off the market.

Posted in concealment, corruptionComments (1)

Take a STAND! REMOVE YOUR MONEY 9/11/2010

Posted on 28 April 2010.

Posted in concealment, conspiracy, corruption, securitizationComments (3)

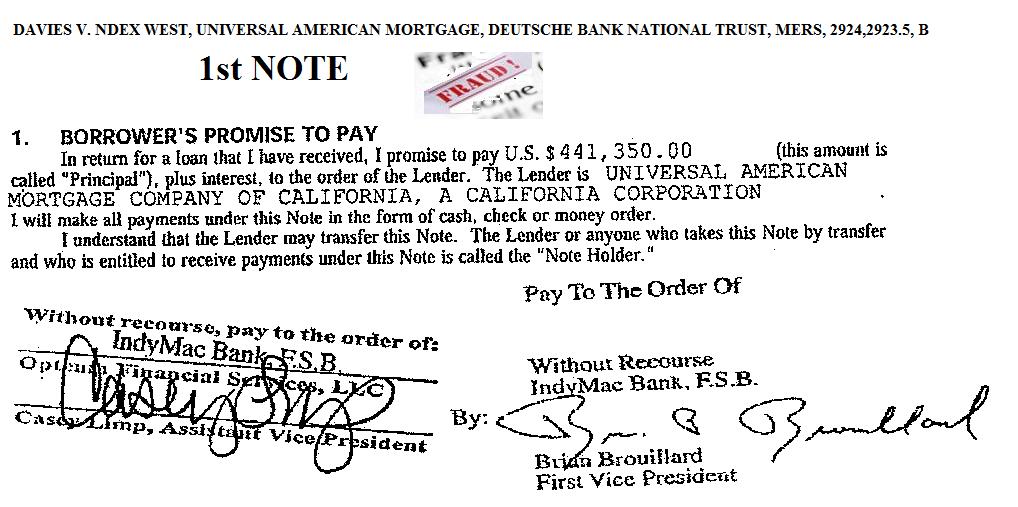

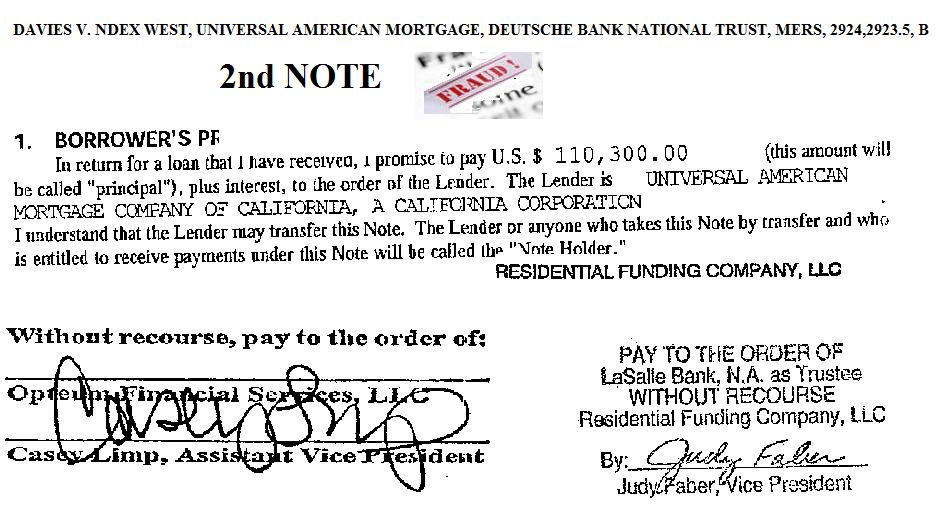

TILA VIOLATION "FRAUD": DAVIES V. NDEX WEST, UNIVERSAL AMERICAN MORTGAGE, DEUTSCHE BANK NATIONAL TRUST, MERS, 2924,2923.5, B

Posted on 28 April 2010.

Mr. Davies asked me to post this info for all you to see the FRAUD!

Especially Indymac FSB F/K/A Onewest

Why were any of these NOT signed over by Universal American Mortgage Corp??

The ONLY “lender” he knew at the time of closing was Universal American Mortgage Corp!

DISCLOSURE! DISCLOSURE! DISCLOSURE!

§ 226.18 Content of disclosures.

For each transaction, the creditor shall disclose the following information as applicable:

(a) Creditor. The identity of the creditor making the disclosures.

(a) Creditor. The identity of the creditor making the disclosures.

SEE CASEY LIMP as Vice President in each???

Now this is at the bottom of each page…but I bet these are “not” the originals.

Posted in concealment, conspiracy, corruption, foreclosure fraud, forensic mortgage investigation audit, Mortgage Foreclosure Fraud, scam, securitization, tilaComments (9)

WELLS FARGO to some…HELLS FARGOT to OTHERS! Tenants of foreclosed places with no heat or hot water, with bugs, with ceilings falling down, with mold, that's called a hole.

Posted on 27 April 2010.

Little do these people know…these banks do not care one bit! They surely didn’t care to help the owners when they had it. Only until the complaints pour in do they attempt “Damage control”!

Come here and voice your anger! … Everyone mentioned sure does stop here daily.

New Legal Push For Foreclosure Victims: CITYLIMITS

Tenants have a message for the bank that holds mortgages on 10 Bronx buildings that have gone into foreclosure and disrepair: You own it, you fix it.

Thursday, Apr 22, 2010

Tenants at 3018 Heath Avenue and nine other buildings in the The Bronx have had enough. After living for years with roaches, rats, sagging ceilings, broken plumbing and long stretches without heat or hot water, they are demanding the bank that owns their buildings make repairs. The city’s Department of Housing Preservation and Development lists 756 immediately hazardous C violations against the 10 buildings.

“When you live in a place with no heat or hot water, with bugs, with ceilings falling down, with mold, that’s called a hole. People should live in a home,” said Yorman Nunez, a board member of the NorthWest Bronx Community and Clergy Coalition, which helped organize the tenants. “Wells Fargo is just letting this happen.”

Wells Fargo, and its special servicer LNR Partners Inc., control the trust that holds the mortgage on the buildings. 3018 Heath Ave. and nine other buildings, formerly owned by private equity backed investor Milbank Real Estate, went into foreclosure in March 2009. Since then, tenants have been unable to get repairs, and uncertain who is in charge. So on Wednesday Legal Services NYC filed a motion in the ongoing foreclosure proceeding, begging the judge to make the bank take care of the building and its tenants while the foreclosure process continues.

The tenants position was neatly summed up in a hand-lettered sign that read: “You lend it, you mend it.”

Elected officials underscored the point.

“The lender is now the owner. They have a responsibility to maintain these buildings,” said Bronx Borough President Ruben Diaz Jr. “If Milbank couldn’t pay their mortgage, the lender, which is now the landlord, has to step up to the plate.”

In addition to Diaz, tenants were joined by City Council Speaker Christine Quinn, City Councilmember Fernando Cabrera and representatives from U.S. Rep. Jose Serrano’s office.

Stepping into a foreclosure case to seek relief for tenants is a new legal strategy, said Ed Josephson, housing coordinator for Legal Services NYC. He is one of the attorney’s working on the case. The idea is to go straight to the bank that gave the mortgage–or bought it via a mortgage-backed security–to push for repairs.

“We know what will happen when we get into court,” he said. “Everybody is going to say that they don’t have any responsibility. They structure things on purpose to avoid liability. But the point is there will be a lot of pressure on all these banks to fork of the money because they created this disaster.”

The Milbank properties are only a handful of the hundreds of rental buildings in the five boroughs that housing experts say are teetering near fiscal collapse. Bought in the heady days of the real estate boom for far more than their rents could support, and leveraged with sky-high mortgages, the buildings are going into foreclosure. Tenants, meanwhile, are left in a lurch. The Urban Homesteading Assistance Board, which has been working on issues of over-leveraged buildings since 2006, released a seven-page list of buildings it said are at risk of default.

Quinn said she knows the Milbank buildings are not isolated disasters. “We are working closely through the distressed property taskforce and we will look at other buildings where this type of lawsuit makes sense,” she said.

A hearing on the motion is scheduled for May 10 in Bronx Supreme Court.

LNR Partners declined, through a spokesperson, to comment.

Posted in foreclosure, wells fargoComments (0)

Hedge Funds and the Global Economic Meltdown: MUST WATCH VIDEOS!

Posted on 27 April 2010.

Do you know who is the next Lehman? Sit back and relax…ENJOY!

[youtube=http://www.youtube.com/watch?v=xUKSU1qahgE]

[youtube=http://www.youtube.com/watch?v=NcjssQSthNU]

[youtube=http://www.youtube.com/watch?v=Q48eSoTNByQ]

Source: writerjudd

Posted in bear stearns, concealment, conspiracy, corruption, naked short sellingComments (0)

Bankruptcy Stalls ‘Extreme Makeover’ Foreclosure: WSJ

Posted on 27 April 2010.

April 27, 2010, 1:30 PM ET

By Dawn Wotapka

Milton and Patricia Harper narrowly avoided foreclosure. Again.

Their 5,300-square-foot McMansion, built for the “Extreme Makeover” television show was set to be auctioned off in Atlanta earlier this month. But the Harpers averted that fate with a Chapter 13 bankruptcy filing–for the second time.

The couple had filed for their first Chapter 13 in early 2009, as foreclosure loomed on their supersized home. The bankruptcy halted the process. It’s possible that the family was unable to fulfill the payment plan set up under the bankruptcy and thus had to file again this year–a common occurrence says Jessica Gabel, a law professor with Georgia State University.

The Harpers didn’t return a call for comment. Lender JP Morgan Chase, which now needs court permission to proceed with a foreclosure sale, declined to comment.

As we’ve written, the Harper episode aired in the 2004-2005 season. The family’s modest home with septic-tank issues was replaced by a showpiece resembling an English castle. In addition to a new house, which they were given outright, the Harpers received a scholarship fund for their three sons.

Mortgage troubles came after the family used the house as collateral for a $450,000 loan, which was modified by Chase in 2008.

Meanwhile, the family still seems to be trying to raffle off the house. They’ve recently updating their raffle Web site, however, no auction date is listed.

“That is unusual,” said Ms. Gabel, the professor. “That doesn’t pass the smell test. They’re going to have to demonstrate to the court why they should proceed” with the raffle. Plus, she added, any post-bankruptcy petition income might have to go to creditors.

Posted in bankruptcy, jpmorgan chaseComments (0)

Lassiter Notwithstanding: The Right to Counsel in Foreclosure Actions

Posted on 27 April 2010.

Fast forward it’s getting much worse! Where are our rights heading??

ARTICLE: Lassiter Notwithstanding: The Right to Counsel in Foreclosure Actions

January / February, 2010

43 Clearinghouse Rev. 448

Author

Excerpt

The shortage of legal assistance during this crush of “foreclosure actions” compounds the due process concerns: no state provides a statutory right to counsel in any foreclosure proceedings, and consequently more than half of foreclosed homeowners are handling their cases without counsel. 4 Yet having an attorney is critical: while even a delinquent borrower may have a variety of options (e.g., mediation, modification, relief under federal law, various state-law claims and defenses) only an attorney can evaluate the options properly and advise the homeowner as to the most efficacious strategy.

Establishing a Fourteenth Amendment right to counsel in foreclosure actions requires an advocate to contend with the U.S. Supreme Court’s decision in Lassiter v. Department of Social Services. 5 Where there is no threat to “physical liberty,” by which the Court meant incarceration, …

Clearinghouse Review: Journal of Poverty Law and Policy

Posted in foreclosure fraudComments (0)

Recent Comments