Image via CoreLogic

Forbearance measures are keeping foreclosures down despite increasing numbers of homeowners falling behind on their mortgages in Miami and in other cities, according to CoreLogic’s most recent Loan Performance Insights Report.

CoreLogic found that in August, delinquencies went up in every state and in every U.S. metro area except Dubuque, Iowa. In the Miami-Fort Lauderdale-West Palm Beach metropolitan area, 12% of mortgages were at least 30 days past due in August and 8.6% were in serious delinquency, defined as 60 to 89 days delinquent. Last August, 5% of mortgages in the Miami metro area were delinquent, with 1.9% in serious delinquency. The foreclosure rate in the Miami area was 0.7% this August, down slightly from 0.9% in August 2019.

Forbearance measures are keeping foreclosures down despite increasing numbers of homeowners falling behind on their mortgages in cities across the nation, according to CoreLogic’s most recent Loan Performance Insights Report.

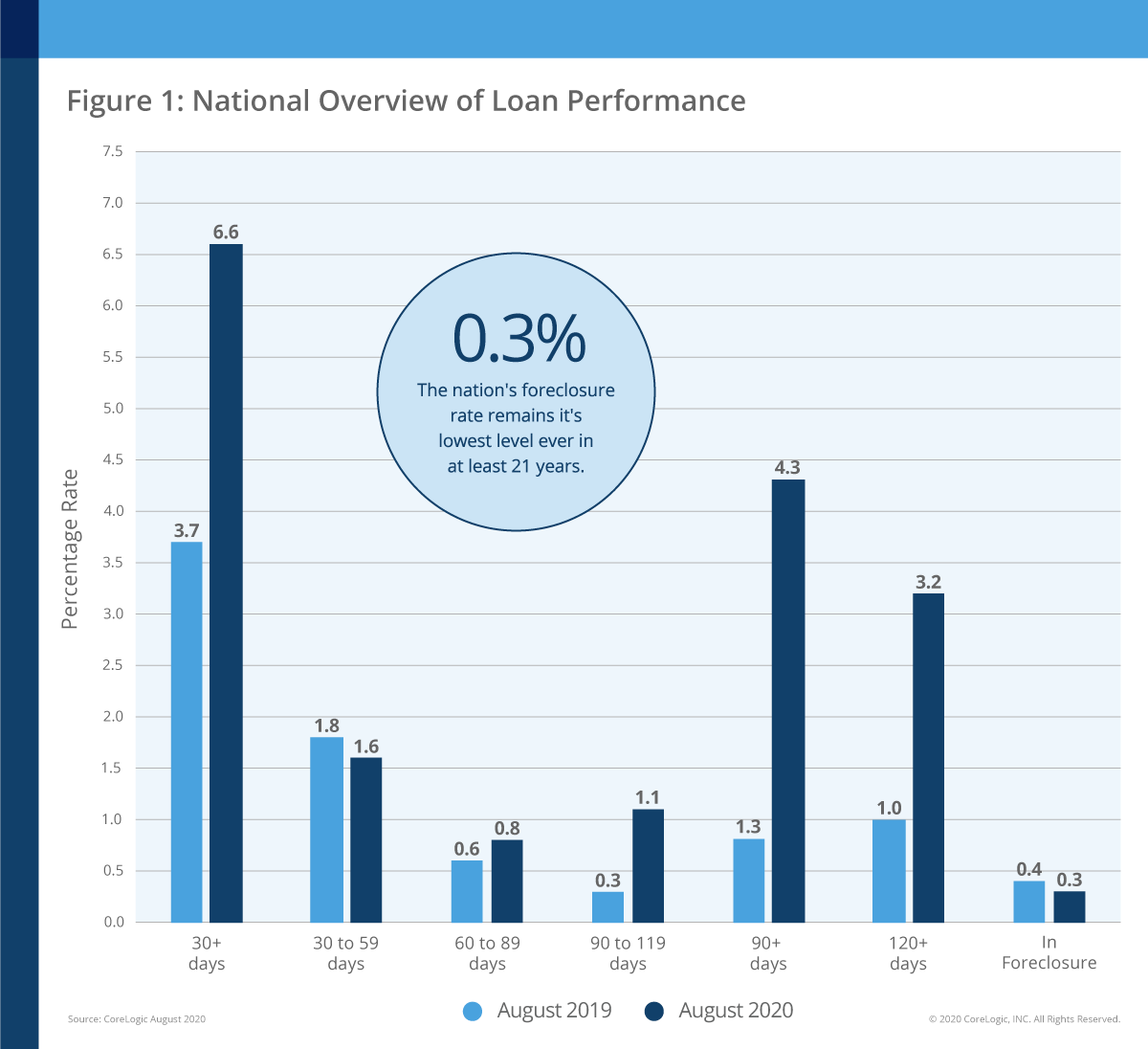

Nationally, 6.6% of mortgages were at least 30 days past due in August. That represents a 2.9% increase over the delinquency rates for August 2019, when 3.7% of all mortgages were delinquent. Those figures include homes in foreclosure.

To continue reading click on the source link of the article which was posted here(part of the article posted here).

https://miamiagentmagazine.com/2020/11/10/foreclosures-down-in-miami-but-mortgage-delinquencies-rising/