Posted on 12 February 2013.

United States Court of Appeals

For the First Circuit

No. 11-2431

MELISSA A. JUÁREZ,

Plaintiff, Appellant,

v.

SELECT PORTFOLIO SERVICING, INC. AND

U.S. BANK NATIONAL ASSOCIATION, AS TRUSTEE, ON BEHALF OF

THE HOLDERS OF THE ASSET BACKED SECURITIES CORPORATION

HOME EQUITY LOAN TRUST, SERIES NC 2005-HE8,

ASSET BACKED PASS-THROUGH CERTIFICATES, SERIES NC 2005-HE8,

Defendants, Appellees.

APPEAL FROM THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF MASSACHUSETTS

[Hon. Denise J. Casper, U.S. District Judge]

Before

Torruella, Ripple, and Howard, *

Circuit Judges.

Glenn F. Russell, Jr., with whom Law Office of Glenn F.

Russell, Jr., was on brief for appellant.

Peter F. Carr, II, with whom Charlotte L. Bednar and Eckert

Seamans Cerin & Mellott, LLC, was on brief for appellees.

February 12, 2013

TORRUELLA, Circuit Judge. This appeal comes before us

after a dismissal of a complaint filed pro se by Melissa A. Juárez

against two entities she claims illegally foreclosed her home once

she defaulted on her mortgage payments. The district court

dismissed her complaint for failure to state a claim. Because we

find that the complaint states plausible claims for relief and that

the district court abused its discretion in deciding that it would

be futile to allow an amendment to the complaint, we reverse.

I.

A. Factual and Procedural Background

On October 29, 2010, Juárez, an attorney acting pro se, filed a complaint in Massachusetts state court against defendants U.S. Bank National Association as Trustee on Behalf of the Holders of the Asset Backed Securities Corporation Home Equity Loan Trust, Series NC 2005-HE8 (“U.S. Bank”) and Select Portfolio Servicing, Inc. (“SPS”), U.S. Bank’s servicer. Defendants removed the case from the Suffolk County Superior Court to the district court after Juárez, again acting pro se, filed an amended verified complaint.

1. The amended complaint

The facts as alleged by Juárez in her amended complaint are as follows.

Juárez purchased a house in Suffolk County, Massachusetts, on August 5, 2005. She financed the purchase by taking out two loans. The complaint, for reasons not stated in the record, relates exclusively to the first loan. Said loan consisted of a note in the amount of $280,800, which was secured by a mortgage on the property.1

After closing, the note and mortgage exchanged hands several times within the secondary mortgage market. The amended complaint states that, upon Juárez’s information and belief, the note and mortgage passed from New Century Mortgage, the original lender, to NC Capital Corporation and, later, from NC Capital Corporation to Asset Backed Securities Corporation. None of the transactions mentioned above were recorded in the Suffolk County Registry of Deeds after they occurred.

In order to pool and securitize loans, Asset Backed Securities established a trust in the form of a real estate mortgage investment conduit (“REMIC”), a special type of trust that receives favorable tax treatment. See 26 U.S.C. § 860A. The trust was governed by a Pooling and Servicing Agreement (“PSA”). The entities involved in the operations of the trust were: U.S. Bank as trustee; Asset Backed Securities Corporation as depositor and issuing entity; Wells Fargo as Master Servicer; SPS (the second defendant here) as servicer; and DLJ Mortgage Capital, Inc. as seller.

According to the amended complaint, the PSA and the federal tax code’s provisions regulating REMICs required that all assets, which in the secondary mortgage market consist of mortgage loans, be transferred or assigned to the trust by January 1, 2006 in order for the trust to qualify as a REMIC. The trust was thus required to stop receiving assets after said date in order to become a static pool of assets.

Juárez alleges that, even though Asset Backed Securities Corporation acquired her loan immediately after it was executed, the assignment of the loan to the trustee U.S. Bank occurred after January 1, 2006, meaning that it went into the trust in violation of the PSA. She alleges that the assignment was void because it was contrary to the trust’s governing document.

Juárez acknowledged in the amended complaint that she could not afford the payments on both mortgages and defaulted. Foreclosure proceedings began in the summer of 2008, culminating in the sale of her home at an auction on October 22, 2008. She claims, however, that defendants did not hold the note and the mortgage at the time they began the foreclosure proceedings against her, and that the foreclosure was therefore illegal under Massachusetts mortgage law.

Juárez attached as an exhibit to her amended complaint a copy of a document entitled “Corporate Assignment of Mortgage,” which was recorded in the corresponding registry of deeds on October 29, 2008, after the foreclosure had been completed. The document is the purported assignment of her loan from NC Mortgage to U.S. Bank as trustee. It is dated October 16, 2008, and states as part of the heading: “Date of Assignment: June 13, 2007.”

Juárez further alleged that no one entered her home on July 22, 2008, contrary to what the Certificate of Entry, which she also attached to her amended complaint, states. Said certificate reflects that an attorney-in-fact for U.S. Bank entered the mortgage premises on July 22, 2008.2

The amended complaint included one count for a violation of Mass. Gen. Laws ch. 244, § 14 (“Section 14”), for lack of legal standing to foreclose; one count under Mass. Gen. Laws ch. 244, § 2 (“Section 2”) for failure to comply with the entry requirement; one count of fraud based on defendants’ representations during foreclosure proceedings regarding their right to foreclose; and one count under Mass. Gen. Laws ch. 93A, § 9 (“Chapter 93A”) for unfair and deceptive practices in the conduct of trade or commerce.3 Juárez requested that it be determined: that defendants were not the legal owners of the mortgage and note at the time of the foreclosure; that the court declare the foreclosure invalid; that she be restored as the property’s legal owner; that she be allowed to move back into or place the home up for sale; and that she be awarded actual monetary damages and any other relief the court deemed proper.

2. Defendants’ motion to dismiss

After the removal of the complaint, Juárez, still acting pro se, sought to have the case remanded. Defendants on their part sought the dismissal of the complaint under Fed. R. Civ. P. 12(b)(6) for failure to state a claim.4 By this point, Juárez retained counsel and opposed the motion to dismiss.

In their motion to dismiss, defendants argued that Juárez is forever barred as a matter of law from litigating the foreclosure because she failed to enjoin the proceedings before they concluded. They also posited that the copy of the “Corporate Assignment of Mortgage” that Juárez attached to her amended complaint clearly indicates that the mortgage in question was assigned to U.S. Bank at the time the foreclosure began, and that it was immaterial that the document was executed after the foreclosure because the document is a confirmatory assignment.5 In any case, they argued, the amended complaint conceded that Asset Backed Securities acquired Juárez’s loan immediately after it was executed. Juárez, for her part, asserted that, when a foreclosure is carried out by one who lacks the power to do so, said foreclosure is null and void and may be challenged even if the foreclosure already took place. She denied that the “Corporate Assignment of Mortgage” is a confirmatory assignment and sustained that no assignment took place before the foreclosure. Accordingly, Juárez asserted that U.S. Bank did not hold the mortgage at the time foreclosure proceedings began and thus had no power of sale at that time. Regarding the note and mortgage, Juárez argued that defendants had not proffered that they had possession of the note at the time of the publication of her home’s auction.

Defendants presented a second set of arguments regarding Juárez’s standing to challenge the validity of the foreclosure. Specifically, they argued that Juárez could not challenge the assignment of the mortgage because she was neither a party nor a third-party beneficiary of the PSA. Juárez responded that she recognized that she was not a party to the PSA, but claimed that the case involves a trust governed only by the PSA, and that said document proscribed the assignment of assets into the trust after January 1, 2006.

Regarding the fraud claim, defendants argued that Juárez failed to plead fraud with the required degree of particularity and that she did not detail the specific acts carried out by defendants upon which she relied to her own detriment. Defendants also requested the dismissal of Juárez’s claim under Chapter 93A because Juárez defaulted on her payments and has neither alleged any unfair or deceptive practice on their part nor indicated how she was injured. Juárez’s response to the request for dismissal of her Chapter 93A claim was unclear. She appeared to argue that, because defendant SPS responded to her demand letter by stating that the foreclosure could not be rescinded, SPS was being deceptive. Juárez then asserted that, “[b]ased upon all of the foregoing, [she] had also pled her [f]raud claims with particularity”. Juárez also argued that New Century Mortgage Corporation could not have assigned her mortgage in 2008 or even June 2007, because it had gone bankrupt under Chapter 11 in April 2007. Finally, Juárez stated that she had raised a meritorious claim (without specifying which claim she was referring to) and that her complaint “does more than state legal conclusions of the `defendant did me wrong.'” She requested that the court grant her leave to amend the complaint “to add claims related to the willfully deceptive acts of creating appearance of ownership of her loan.”

Defendants filed a reply brief in which, among other things, they pointed out that Juárez did not allege in the complaint that the assignment was void because of New Century’s bankruptcy and that she “could have raised such defenses to the foreclosure in 2008 had she taken any action to contest the debt or the foreclosure.” They further stated that Juárez “never opposed the foreclosure, and actually asked Defendants to proceed with the foreclosure because she could not afford her financial obligations.”

The district court held a hearing, denied the motion to remand from the bench, and later issued a Memorandum and Order dismissing the case in its entirety.

3. The district court’s decision

The district court determined that the amended complaint failed to state any claim for which relief could be granted and dismissed the case. It found that the “Corporate Assignment of Mortgage” evidenced that a valid pre-closure assignment had taken place because the document specifies June 13, 2007, as the “Date of Assignment.” “Such confirmatory assignment,” the court said, “is entirely consistent with the [Supreme Judicial Court of Massachusetts’ (“SJC”) decision in Ibáñez.” It also found that the fact that the assignment was not recorded before the foreclosure took place was immaterial, and that Juárez’s argument that U.S. Bank had to hold both the mortgage and the note in order to foreclose was meritless. The district court further determined that Juárez lacked standing to challenge the assignment because she is neither a party to nor a third-party beneficiary of the PSA.

The district court also found that New Century Mortgage Corporation’s Chapter 11 bankruptcy did not, on its own, mean that it was without authority to assign the mortgage since Chapter 11 allows petitioners to continue operating in their normal course of business. Moreover, it determined that Juárez’s allegation that no one entered her home was not enough to challenge the validity of the Certificate of Entry signed by two witnesses. Finally, the fraud claim and the Chapter 93A claims suffered a similar fate as the district court found that Juárez had not pled with particularity the actions she took to her own detriment after relying on purported fraudulent conduct by the defendants, and that Juárez failed to identify any unfair or deceptive practices.

The court then turned to Juárez’s request for leave to amend the complaint and found that an amendment would be futile because the “Corporate Assignment of Mortgage” shows that U.S. Bank was the mortgagee’s assignee at the time foreclosure began. It thus characterized said document as “the exact type of confirmatory assignment the Court in Ibáñez noted was sufficient.” The court also noted briefly in a footnote that it would be futile to allow Juárez to amend the complaint to re-plead those two claims, and that its conclusion was supported by its analysis of the Section 14 claim.

Juárez filed this timely appeal. She sets forth a large number of interrelated issues essentially contending that the district court erred in dismissing her complaint for failure to state plausible claims for lack of legal standing to foreclose under Section 14, fraud, Chapter 93A, and for failure to do a proper entry under Section 2. She also argues that the district court erred in dismissing as conclusory her allegation that New Century was bankrupt and could not have validly made an assignment of her mortgage. In her brief, Juárez focuses mainly on the district court’s interpretation of Ibáñez and its finding that a bona fide confirmatory assignment had taken place. Defendants for their part reiterate that Juárez defaulted and that her failure to enjoin the foreclosure forever bars any claim regarding its validity. They insist that a valid assignment took place before the foreclosure began, as the “Corporate Assignment of Mortgage” evidences, and that, in any case, she lacks standing to challenge its validity.

II.

A. Standards of Review

We review dismissals under Rule 12(b)(6) de novo. Feliciano-Hernández v. Pereira-Castillo, 663 F.3d 527, 532 (1st Cir. 2011). We separate the factual allegations from the conclusory statements in order to analyze whether the former, if taken as true, set forth a “plausible, not merely a conceivable, case for relief.” Ocasio-Hernández v. Fortuño-Burset, 640 F.3d 1, 12 (1st Cir. 2011) (quoting Sepúlveda-Villarini v. Dep’t of Educ. of P.R., 628 F.3d 25, 29 (1st Cir. 2010)). In reviewing Juárez’s complaint, we cannot “disregard properly pled factual allegations” nor “attempt to forecast a plaintiff’s likelihood of success on the merits.” Id. at 12-13 (quoting Ashcroft v. Iqbal, 556 U.S. 662, 678 (2009)). If the facts alleged in her amended complaint “`allow[] the court to draw the reasonable inference that the defendant[s] [are] liable for the misconduct alleged,’ the claim has facial plausibility.” Id. at 12. “The relevant inquiry focuses on the reasonableness of the inference of liability that the plaintiff is asking the court to draw from the facts alleged in the complaint.” Id. at 13.

Finally, we review both grants and denials of motions to amend complaints for abuse of discretion. Hatch v. Dep’t for Children, 274 F.3d 12, 19 (1st Cir. 2001). A district court’s exercise of discretion will be left untouched if “the record evinces an arguably adequate basis for the court’s decision,” such as futility of the amendment. Id. A request for leave to amend filed before discovery is complete and before a motion for summary judgment has been filed is “gauged by reference to the liberal criteria of Federal Rule of Civil Procedure 12(b)(6).” Id.

B. Analysis.

1. Lack of power of sale under Section 14

In the case at bar it is evident that the amended complaint Juárez filed while acting pro se is by no means a model of clarity. However, a reading in the light most favorable to her leads us to conclude that it establishes a plausible claim for violation of Section 14.

Based on a comprehensive reading of the amended complaint, the crux of Juárez’s contention appears to be that defendants lacked authority to foreclose her property under Section 14 because U.S. Bank did not have the power of sale at the time they foreclosed.6 The amended complaint puts forth two theories to support said contention.7 First, the complaint claims that the PSA did not authorize the transfer of Juárez’s loan into the trust after January 1, 2006 and that no valid assignment had taken place before that. Alternatively, the complaint contends that no assignment had taken place by the time foreclosure proceedings began in 2008.

We need not address the first theory, which challenges the assignment of the loan into the trust after January 1, 2006, in violation of the PSA because we find that Juárez has alleged enough facts to set forth a plausible claim for violations of Section 14 under the second theory. We thus need not address the question of whether Juárez has standing to challenge the assignment under the terms of the PSA given that she is neither a party nor a third-party beneficiary to the PSA. We nonetheless note without deciding that many of the district courts that have addressed the issue have found no standing on the part of a mortgagor to challenge the validity of the assignment of their mortgage under a PSA. See, e.g., Oum v. Wells Fargo, N.A., 842 F.Supp.2d 407, 413 (D. Mass. 2012); Wenzel v. Sand Canyon Corp., 841 F.Supp.2d 463, 478-479 (D. Mass. 2012); Culhane v. Aurora Loan Servs. of Neb., 826 F.Supp.2d 352, 378 (D. Mass. 2011). But it is certainly one thing to question whether an assignment took place pursuant to the terms of a loan trust’s governing documents (in this case, the PSA), and quite another to question whether the assignment took place before the foreclosure began, as Section 14 requires.

Juárez’s second theory does the latter. That is, rather than question the transactions that led to the assignment to U.S. Bank, it questions whether the assignment in fact properly took place before the foreclosure. In other words, she questions whether the entity that foreclosed her property actually had the power of sale at the time the foreclosure took place. It is, therefore, not a question of the validity of the assignment under the PSA, but a question of the timing of the assignment in relation to the initiation of the foreclosure proceedings.

Juárez repeatedly alleges throughout the amended complaint that defendants in this case did not hold the mortgage at the time they foreclosed and, therefore, had no right to exercise the power of sale under Section 14. She attached to the amended complaint the “Corporate Assignment of Mortgage” and, immediately following its introduction in the pleading, made several allegations to challenge its validity. Among them, she included the following assertion: “[t]he recorded assignment was dated and notarized on October 16, 2008, but has a `Date of Assignment’ notation on the top of the document with a date of June 13, 2007.” Read in conjunction with her allegations that U.S. Bank lacked legal standing to foreclose, the amended complaint can be read to state a plausible claim that the “Corporate Assignment of Mortgage” took place after the foreclosure had been finalized, and that it was not a confirmatory assignment. We believe this to be a reasonable inference that follows from taking as true Juárez’s factual allegations regarding the discrepancy in the dates and the fact that said discrepancy clearly and independently emerges from the document in question. Here, “[t]he reference by attachment, though perhaps technically deficient, was sufficient to alert the court and [defendants] to the specific basis” of Juárez’s claim regarding the timing of the assignment. Instituto de Educación Universal Corp., 209 F.3d at 23.

Defendants have argued all along that, despite its title, the document is in fact a confirmatory assignment of the kind recognized by the SJC in Ibáñez as a valid means of documenting that a bona fide assignment had taken place before the foreclosure. Defendants assert that, “[o]n its face, the assignment of the Mortgage attached to Juárez’s Verified Complaint is a confirmatory assignment, executed on October 16, 2008 to confirm the June 13, 2007 assignment.” As stated above, the district court agreed with defendants’ arguments, and found it would be futile to allow Juárez to amend the complaint because it was clear from the document itself that it embodied precisely the type of confirmatory assignment Ibáñez recognized. We cannot so agree. As will be more fully explained below, we are unable to find at this time, when no discovery has been conducted, that the document alone evidences a confirmatory agreement of the kind sufficient under Ibáñez took place before the foreclosure.

Ibáñez consisted of two consolidated appeals of cases arising out of quiet title actions brought by U.S. Bank and Wells Fargo, respectively, after they each bought back a property they had foreclosed. The SJC found that the entities had failed to show they held the mortgages at the time they foreclosed, and thus their titles were null and void. Even though the cases that gave rise to the Ibáñez decision were filed by entities who foreclosed and bought the properties back, and thus the burden of showing that their title was valid was on said entities, Ibáñez clearly held that a foreclosure carried out by an entity that does not hold the power of sale is void.8 See 941 N.E.2d at 50, 53.

As Ibáñez explained, the Massachusetts statutory foreclosure scheme affords a mortgagee possessing a power of sale under Section 14 substantial authority. Only those listed in that section (i.e. “the mortgagee or his executors, administrators, successors or assigns”) can exercise it. This power, of course, comes with great responsibility and “[o]ne who sells under a power [of sale] must follow strictly its terms. If he fails to do so there is no valid execution of the power and the sale is wholly void.” Ibáñez, 941 N.E.2d at 49-50 (some alterations in original). That is, “[a]ny effort to foreclose by a party lacking `jurisdiction and authority’ under these statutes is void.” Id. at 50 (citations omitted). The power of sale can only be exercised if the foreclosing entity is the “assignee[] of the mortgage[] at the time of the notice of sale and the subsequent foreclosure sale.” Id. at 51.

In Ibáñez, the SJC also went over other basic principles of Massachusetts mortgage law. It explained that, Massachusetts is a “title theory” state where “a mortgage is a transfer of legal title to secure a debt.” Id. “Like a sale of land itself, the assignment of a mortgage is a conveyance of an interest in land that requires a writing signed by the grantor.” Id. (emphasis added). Even if the written assignment need not be in recordable form at the time of the notice of sale or the subsequent foreclosure sale, an assignment must take place before the foreclosure begins. See id. at 54. This, because “[a] valid assignment of a mortgage gives the holder of that mortgage the statutory power to sell after a default regardless whether the assignment has been recorded.” Id. at 55. If a valid pre-foreclosure assignment took place, a “confirmatory assignment may be executed and recorded after the foreclosure, and doing so will not make the title defective.” Id. But a confirmatory assignment “cannot confirm an assignment that was not validly made earlier or backdate an assignment being made for the first time.” Id. In order to determine whether valid assignments had taken place, the SJC scrutinized the documents submitted by U.S. Bank and Wells Fargo, respectively, to see if valid assignments or valid confirmatory assignments sustained the plaintiffs’ claims to clear titles. It found that they did not.

In this case, even a perfunctory scrutiny of the “Corporate Assignment of Mortgage” attached by Juárez to her amended complaint reveals that we are before a document that was executed after the foreclosure and that it purports to reference, by virtue of its heading, a pre-foreclosure assignment. Specifically, the heading reads “Date of Assignment: June 13, 2007,” and it states that the document was executed “[o]n October 16, 2008.” However, nothing in the document indicates that it is confirmatory of an assignment executed in 2007. Nowhere does the document even mention the phrase “confirmatory assignment.” Neither does it establish that it confirms a previous assignment or, for that matter, even make any reference to a previous assignment in its body. Except for the “June 13, 2007” date indicated in the heading, the document reads as if the assignment were executed on October 16, 2008. It states:

Know all men by these presents that in consideration of the sum of . . . paid to the above name Assignor [New Century Mortgage Corporation] . . . the said Assignor hereby assigns unto the above-named Assignee [U.S. Bank] the said Mortgage together with the note. . . together with all moneys now owing or that may hereafter become due . . ., and the said assignor hereby grants and conveys unto the said Assignee, the Assignor’s beneficial interest under the mortgage.

This Court cannot, based solely on a reading of the document, as the district court did, assert that this is “the exact type of confirmatory assignment the Court in Ibáñez noted was sufficient.”

For there to be a valid confirmatory assignment here, a valid written assignment must have taken place before foreclosure proceedings began. That previous assignment, as explained in Ibáñez, need not be in recordable form, but it should exist in written form. Since defendants have not produced that document, we cannot assert without further discovery that a valid confirmatory assignment took place. We thus find that the district court erred in holding that a valid confirmatory assignment had taken place and that no plausible claim could be made to the contrary. Whether that is in fact true and whether Juárez will prevail on the merits will have to be decided when all the facts surrounding the pre-foreclosure transactions have been properly ventilated.

Having found that Juárez’s complaint states sufficient facts for a plausible Section 14 claim, we now turn to the other claims asserted in her amended complaint.

2. Juárez’s fraud and Chapter 93A claims

In order to state a claim for fraud under Massachusetts law, a complaint must plead:

(1) that the statement was knowingly false; (2) that [defendants] made the false statement with the intent to deceive; (3) that the statement was material to the plaintiffs’ decision . . .; (4) that the plaintiffs reasonably relied on the statement; and (5) that the plaintiffs were injured as a result of their reliance.

Doyle v. Hasbro, Inc., 103 F.3d 186, 193 (1st Cir. 1996) (citations omitted). Of course, the complaint must also pass muster under Fed. R. Civ. P. 9(b), which imposes a so-called particularity requirement. A complaint must, therefore, include specifics about “the time, place, and content of the alleged false representations.” United States ex rel. Rost v. Pfizer, Inc., 507 F.3d 720, 731 (1st Cir. 2007) (quoting Doyle v. Hasbro, Inc., 103 F.3d at 194 (additional citations omitted).

In her amended complaint, Juárez states that defendants knew they were not the legal owners of her mortgage and nevertheless initiated and conducted foreclosure proceedings in which they represented as much. She states that defendants made such representations, which were material to the foreclosure proceedings, in three distinct instances: (1) their advertisement of her property for sale at auction; (2) their repurchase of the property in July 2008; and (3) their subsequent sale of the property to a third party in October 2008. She further alleges that she relied on defendants’ representations that they owned the note and mortgage, and as a result of that reliance, she suffered substantial injury.

Regarding the substantial injury, the amended complaint says little. It is certainly possible that the entity which she alleges illegally foreclosed her home caused her substantial harm. It is also quite possible that the an illegal foreclosure per se caused her substantial harm. Likewise, it is possible that she relied upon defendants’ representations of ownership and that, if she had known about their alleged falsity, she would have acted to prevent the foreclosure. At the very least, it is possible that she would not have, as defendants explain in their reply brief before the district court, “actually asked defendants to proceed with the foreclosure.” But establishing that something possibly happened is far distant from the threshold particularity requirements that must be pled under Fed. R. Civ. P. 9(b). Much more would be required, for example, in the way of allegations regarding Juárez’s reliance on defendants’ allegedly false statements during the foreclosure proceedings. More could also be alleged concerning who she was in contact with, when and what was said to her in the alleged misrepresentations. Because the amended complaint is devoid of those specifics, we affirm the district court’s dismissal of the fraud claim.

Juárez’s claim under Chapter 93A was also properly dismissed as insufficiently pled. Massachusetts consumer protection law proscribes “unfair methods of competition and unfair or deceptive acts or practices in the conduct of any trade or commerce.” Mass. Gen. Laws ch. 93A, § 2. We have noted, and the SJC has explained that the statute does not define “unfair” and “deceptive,” but that “[a] practice is unfair if it is within the penumbra of some common-law, statutory, or other established concept of unfairness; is immoral, unethical, oppressive, or unscrupulous; and causes substantial injury to other businessmen.” Kenda Corp. v. Pot O’Gold Money Leagues, 329 F.3d 216, 234 (1st Cir. 2003) (quoting Linkage Corp. v. Trs. of Bos. Univ., 679 N.E.2d 191, 209 (Mass. 1997)). We have also noted that, “Chapter 93A liability is decided case-by-case, and Massachusetts courts have consistently emphasized the `fact-specific nature of the inquiry.'” Arthur D. Little, Inc. v. Dooyang Corp., 147 F.3d 47, 55 (1st Cir. 1998) (quoting Linkage Corp., 679 N.E.2d at 209). Ordinarily, however, good faith disputes over billing, simple breaches of contract, or failures to pay invoices, for example, do not constitute violations of Chapter 93A. Id. (citations omitted).

Juárez’s amended complaint stated that defendants engaged in trade or commerce in Massachusetts within the meaning of Chapter 93A; that their unfair and deceptive practices occurred primarily in Massachusetts; that she sent them a demand letter as required by the statute in question, copy of which she attached to the complaint; and that their unfair and deceptive acts consisted of foreclosing her home without complying with the requirements of Section 14 and Section 2, foreclosing her home without a legal right to do so, and selling her home a second time without any legal right to do so. As a consequence, she asserted, she suffered harm.

The amended complaint indeed alleges some of the basic facts necessary to establish a claim under Chapter 93A, such as defendants’ connection with commerce in Massachusetts. It fails, however, to give notice to defendants regarding the discrete acts she alleges were unfair or deceptive “within the penumbra of some. . . concept of unfairness [or deceptiveness].” Kenda Corp., 329 F.3d at 234 (quoting Linkage Corp., 679 N.E.2d at 209). It is not enough in the context of Chapter 93A for Juárez to allege that defendants foreclosed on her property in violation of Massachusetts foreclosure law. Something more is required for Juárez to establish that the violation “`has an extortionate quality that gives it the rancid flavor[s] of unfairness [and deceptiveness].'” Arthur D. Little, Inc., 147 F.3d at 55 (quoting Atkinson v. Rosenthal, 598 N.E.2d 666, 670 (Mass. App. Ct 1993)).

We find, however, that the district court abused its discretion in determining, in passing and in a footnote, that its analysis of the Section 14 claim supports its conclusion that an amendment to re-plead the fraud and the consumer protection law claims would be futile. To the extent that the district court relied on its erroneous findings regarding the Section 14 claim in its analysis of the fraud and Chapter 93A claims, it erred.

Juárez should be allowed to amend her complaint to re-plead her fraud and Chapter 93A claims. The totality of the circumstances specific to this case support our decision to allow it to survive this first procedural stage and allow for a second amendment. Juárez filed her case in state court acting pro se, and it was removed to the district court almost immediately thereafter. We are thus presented with a very different case than one where a plaintiff has filed several fatally flawed complaints and nevertheless sought amendment, without explaining which new allegations she would bring or how any new facts could save prior complaints already deemed deficient. Indeed, “complaints cannot be based on generalities, but some latitude has to be allowed where a claim looks plausible based on what is known.” Pruell v. Caritas Christi, 678 F.3d 10, 15 (1st Cir. 2012) (finding that a second amendment should be allowed and remanding to give plaintiffs a final opportunity to file a sufficient complaint). In sum, we are satisfied that the result here is in accord with Fed. R. Civ. P.8(e)’s mandate that “[p]leadings . . . be construed as to do justice,” and with Fed. R. Civ. P. 15(a), which “reflects a liberal amendment policy.” United States ex rel. Rost, 507 F.3d at 731.

3. Juárez’s Section 2 claim

Juárez’s claim for failure to make a proper entry under Section 2, however, was correctly dismissed. Section 2 requires that,

[i]f an entry for breach of condition is made without a judgment, a memorandum of the entry shall be made on the mortgage deed and signed by the mortgagor or person claiming under him, or a certificate, under oath, of two competent witnesses to prove the entry shall be made.

Mass. Gen. Laws ch. 244, § 2. The amended complaint states that no one entered Juárez’s home the day the certificate of entry was executed, that no power of attorney was recorded with it and that it does not list two witnesses, as required by the statute. We agree with the district court in finding that Juárez has failed to state a claim because: (1) Section 2 does not require that a power of attorney be recorded with the certificate; (2) the certificate contains the signatures of two witnesses and is notarized; and (3) merely stating that no one entered her home is conclusory.

Finally, we see no reason to dwell at this juncture on Juárez’s argument that New Century had already filed a Chapter 11 bankruptcy at the time defendants alleged the assignment took place. As Juárez herself acknowledges, bankruptcy law allows a debtor in possession to continue operating in the normal course of business and she has not set forth any evidence that this Chapter 11 bankruptcy in particular was somehow different.

III.

The case is remanded to the district court for further proceedings consistent with this opinion.

Remanded.

Footnotes

* Of the Seventh Circuit, sitting by designation.

1. The second mortgage was in the amount of $70,200.

2. Massachusetts mortgage law prescribes the procedure to be followed by a mortgagee who seeks to foreclose by entry, rather than by power of sale, and requires that the entry be recorded in a certificate. See Mass. Gen. Laws ch. 244, § 2.

3. Juárez also included a count in which she charged defendants with not notifying her via mail of the foreclosure sale as required in Section 14. The district court dismissed that count because it found that said section only requires that the notices be sent, not that they be received. Juárez seems to have abandoned said claim because it was not briefed before this Court. We will therefore not address it further. See DeCaro v. Hasbro, Inc., 580 F.3d 55, 64 (1sr Cir. 2009) (stating that “contentions not advanced in an appellant’s opening brief are deemed waived.”).

4. Defendants’ motion to dismiss was also based on Fed. R. Civ. P. 12(b)(7) for failure to join necessary and indispensable parties pursuant Fed. R. Civ. P. 19. Defendants argued that New Century Mortgage Corporation, the entity which according to defendants assigned the mortgage to U.S. Bank, and the current owners of the foreclosed property were both necessary and indispensable parties. The district court ultimately dismissed the case based on its conclusion that the amended complaint failed to state any claim and it did not reach the joinder issue. It stated in a footnote: “In light of the Court’s conclusion that the amended complaint fails to state a plausible claim, the Court need not reach whether the dismissal is warranted under Rule 12(b)(7).” The parties did not brief the matter before this Court and we will therefore not address it, as joinder issues under Fed. R. Civ. P. 19 “turn on specific facts, will not recur in identical form and the district judge is closer to the facts . . . and has a comparative advantage over a reviewing court.” Picciotto v. Cont’l Cas. Co., 512 F.3d 9, 15 (1st Cir. 2008) (quoting Tell v. Trs. of Dartmouth Coll., 145 F.3d 417, 418 n.1 (1st Cir. 1998)).

5. As will be discussed in great detail below, in Massachusetts, a “confirmatory assignment” of a mortgage is a written document that may be executed and recorded after the foreclosure of the mortgaged property, when the written assignment of the mortgage was executed before the foreclosure, but was not in recordable form. See U.S. Bank Nat’l Ass’n v. Ibáñez, 941 N.E.2d 40 (Mass. 2011).

6. The foreclosure in this case took place before the SJC issued Eaton v. Fed. Nat’l Mort. Ass’n, 469 N.E.2d 1118 (Mass. 2012), where the court “construe[d] the term [“mortgagee”] to refer to the person or entity . . . holding the mortgage [at the time the foreclosure initiates] and also either holding the mortgage note or acting on behalf of the note holder.” Id. at 1121. Before Eaton, it was understood that the mortgagee seeking to execute only had to possess the mortgage to initiate the procedures. The SJC expressly made that ruling prospective, and we therefore only address whether defendants held the mortgage, and not both the note and the mortgage, at the time they foreclosed.

7. The district court found a third ground under which the complaint challenges defendants’ authority to foreclose: “that assignments of the mortgage were not recorded prior to the notice of sale or subsequent [to] the foreclosure sale.” We do not separately address this issue and instead address it in our discussion of Ibáñez.

8. Defendants insist that Juárez is forever barred from litigating the legality of her foreclosure because she did not file a complaint to enjoin the foreclosure before it was finalized. They cite to the following expressions in Ibáñez: “Even where there is a dispute as to whether the mortgagor was in default or whether the party claiming to be the mortgage holder is the true mortgage holder, the foreclosure goes forward unless the mortgagor files an action and obtains a court order enjoining the foreclosure.” Ibáñez, 941 N.E.2d at 49. We believe those expressions stand for the proposition that only an injunction can halt a foreclosure, not that a void foreclosure turns valid and can never be challenged if it is not enjoined. In fact, the cases cited by the SJC in Ibáñez, while discussing the nullity of foreclosures carried out by those lacking the power of sale, were in fact cases brought by mortgagors after the foreclosures had ended. See, e.g., Moor v. Dick, 72 N.E. 967 (1905).

[ipaper docId=125182928 access_key=key-bxhgtlukdgc9t4ah9ep height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

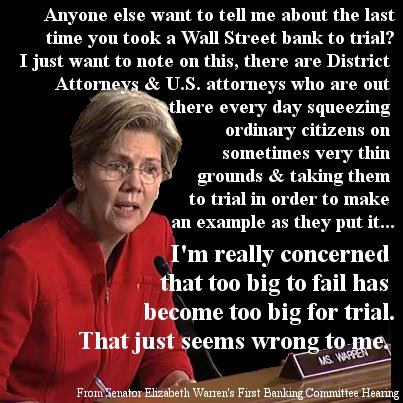

![[VIDEO] Sen. Warren stumps regulators by asking very simple question: “When did you last take a Wall Street bank to trial?”](https://stopforeclosurefraud.com/wp-content/themes/gazette/thumb.php?src=wp-content/uploads/2013/02/neverever.jpg&w=100&h=57&zc=1&q=90)

Recent Comments