[ipaper docId=40293648 access_key=key-ewvrbg41h8im0oc3odn height=600 width=600 /]

2010 NY Slip Op 51791(U)

MASS OP LLC AND MASS ONE LLC, Plaintiffs,

v.

PRINCIPAL LIFE INSURANCE COMPANY, PRINCIPAL LIFE GLOBAL INVESTORS, LLC, WELLS FARGO BANK, N.A., CENTERLINE SERVICING, INC., BANK OF AMERICA NATIONAL ASSOCIATION, SUCCESSOR BY MERGER TO LA SALLE BANK NATIONAL ASSOCIATION, AS TRUSTEE FOR THE REGISTERED HOLDERS OF BEAR STEARNS COMMERCIAL MORTGAGE SECURITIES, INC. COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICATES SERIES 2006-PWR14, BEAR STEARNS COMMERCIAL MORTGAGE SECURITIES INC., AND “JOHN DOE” NO. 1 THROUGH “JOHN DOE” #7 INCLUSIVE, THE ACTUAL IDENTITIES OF THE LAST NAMED, defendants BEING UNKNOWN TO Plaintiffs, THE PARTIES INTENDED BEING PERSONS, CORPORATIONS, ASSOCIATIONS AND OTHER ENTITIES HAVING OR CLAIMING AN INTEREST IN THE LOAN DESCRIBED IN THIS COMPLAINT, Defendants.

Supreme Court, Nassau County.

Decided September 30, 2010.

IRA B. WARSHAWSKY, J.

PRELIMINARY STATEMENT

Defendants Bear Stearns and Principal Life Insurance move to dismiss the amended complaint. Bear Stearns, which first appears as a defendant in the amended complaint, assert that by entering into a settlement agreement with certain defendants, and have thereby reaffirmed the valuation of the shopping center and have recovered damages, bars them from further claims under the “one recovery” doctrine. They also claim that the breach of fiduciary duty claim against Bear Stearns is barred by the 3-year statute of limitations, which commenced with the refinancing on November 8, 2006, with service upon Bear Stearns on December 24, 2009. Bear Stearns also contends that the plaintiff has failed to allege a “relationship of higher trust”, essential to a claimed breach of a fiduciary duty; that the claim which plaintiff asserts against Bear Stearns is barred by the Martin Act; and, to the extent a claim of “joint venture” with Bear Stearns is asserted, recovery is also barred under the “one recovery” doctrine.

In similar fashion, Principal Life contends that plaintiffs’ settlement with the servicer defendants renders the amended complaint moot; there was no fiduciary relationship between plaintiffs and Principal Life; the Pooling and Servicing Agreement did not establish a joint venture; and plaintiffs have failed to state a claim for breach of a fiduciary duty.

BACKGROUND

This action arises from the refinancing of the Phillips at Sunrise Mall in Massapequa. Plaintiff, the owner of the mall, sought to borrow $65,000,000 from Principal Life to refinance the existing $40,000,000 mortgage on the mall. Plaintiff contends that prior to the November 8, 2006 refinancing transaction, Principal Life represented that the $65,000,000 represented no more than 80% of the value of the real estate. They claim that this was erroneous, based upon a defective appraisal performed by Cushman & Wakefield, allegedly based upon faulty data. Plaintiff claims to have expressed concern about repaying the loan, but were advised that Principal Life’s servicing entity, Principal Global Investors, LLC would be responsive to the needs of plaintiff.

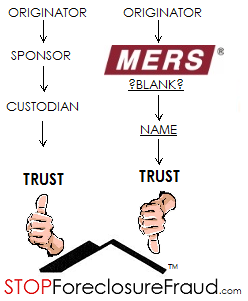

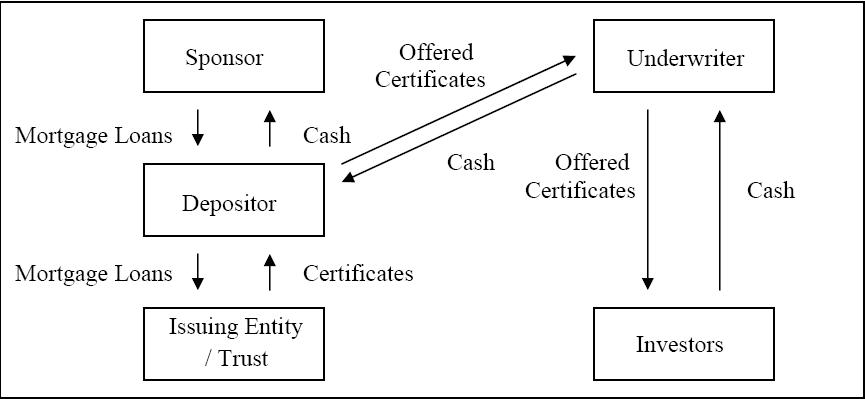

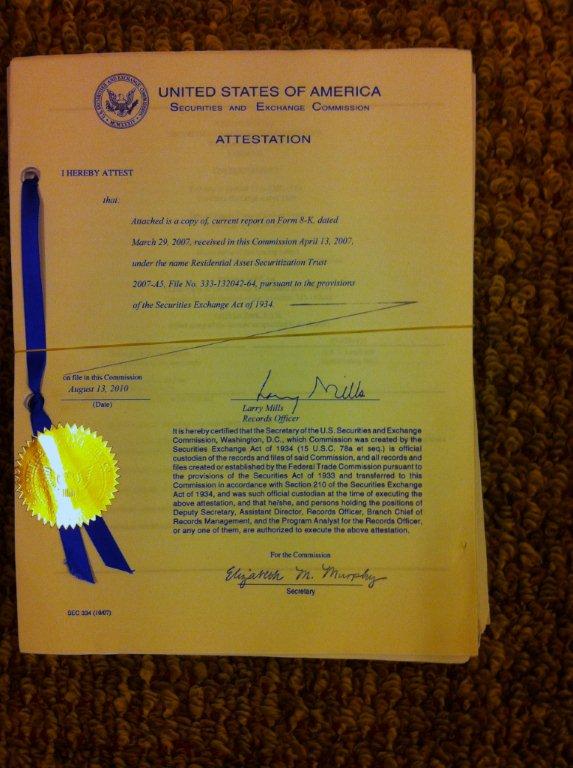

After the closing, Principal Life assigned the loan to Principal Commercial Funding, LLC, which then sold the loan to Bear Stearns as the “depositor” for a commercial mortgage-backed securities trust (“CMBT”). Plaintiff contended in part that the failure of Principal Life Insurance to divulge its fee arrangement with Bear Stearns, which encouraged them to inflate the amount of the mortgage, breached a duty to plaintiff. The mortgage was deposited along with many other mortgages in the securitization process. Through underwriters, commercial mortgage certificates were sold in the open market.

By December 2008, in the midst of a global economic crisis, plaintiffs had lost two major tenants, and were experiencing difficulty in making payments under the mortgage. Their efforts to modify the mortgage with Principal Global were not successful, and they were advised to contact Wells Fargo Bank, N.A., the “master servicer”. Plaintiffs contend that they were unable to make headway in such discussions with any servicer.

Plaintiffs commenced the original action on March 11, 2009, suing the maker and seller of the loan, the servicers and trustee for their roles in originating and servicing the loan. They did not sue Bear Stearns or any underwriters or other entities involved in bringing the commercial mortgage certificates to market. The complaint was dismissed by Order dated July 1, 2009, but the dismissal was without prejudice to plaintiffs’ seeking to replead to allege a breach of fiduciary duty.

Plaintiffs did so move on September 16, 2009, seeking to add Bear Stearns as a defendant. Defendant Bear Stearns notes that the moving papers included a copy of the proposed amended complaint, but not a summons, and that this is a significant factor in the claimed expiration of the statute of limitations. By Order of December 14, 2009, the Court granted plaintiffs’ motion in part and denied it in part. Plaintiff was permitted to allege a first cause of action in the Amended Complaint claiming a breach of fiduciary duty claim against Principal Life and Bear Stearns, and also permitted the assertion of a similar claim against Wells Fargo and Centerline Servicing, Inc. and Bank of America N.A. under a joint venture theory in the second cause of action. Plaintiff was also permitted to replead a cause of action against Principal Life.

On December 24, 2009 plaintiff made service of the Amended Complaint and Supplemental Summons upon Bear Stearns by service on the New York Secretary of State. By letter dated April 29, 2010 from June Diamant, Esq., Bear Stearns learned that plaintiff reached a settlement with defendants Centerline, Bank of America, Wells Fargo and Principal Global. While Bear Stearns has not seen the settlement agreement, a reading of the letter indicates that there has been no reduction in the principal amount of the loan, but interest is being deferred for some period of time.

Principal Life’s motion asserts that the only claim surviving against them after the Decision and Order of the Court and the settlement with Wells Fargo Bank, N.A. as “master servicer”, Centerline Servicing, Inc. as “special servicer”, Bank of America, N.A., and Principal Global Investors, LLC, are an alleged breach of fiduciary duty based upon its failure to reveal its compensation arrangement with Bear Stearns, and a second cause of action on the theory of a joint venture and breach of a fiduciary duty thereunder.

The Amended Complaint

The complaint alleges Five Causes of Action as follows:

First: Principal assigned an appraised value which would be relied upon by plaintiff to determine the amount of debt which they could safely assume. Principal and Bear Stearns, possessing superior knowledge and expertise than plaintiff in originating loans and issuing debt, placed the loan in a securitized pool. The undisclosed compensation agreements between Principal and Bear Stearns incentivized Principal to originate the loan and Bear Stearns to deposit it into the CMBS trust. The failure of Principal and Bear Stearns to advise plaintiff of the fee arrangement constituted a breach of fiduciary duty.

Second: Wells Fargo, Bank America and Centerline, as trustees and servicers of the loan, acted as joint venturers with Principal and Bear Stearns. In this capacity they owed a fiduciary duty to plaintiffs, which they breached.

Third: Principal failed to disclose the methodology by which it valued the property at an inflated price so as to benefit from undisclosed compensation agreements with Bear Stearns. Had plaintiffs been aware of the profit motive which caused Principal to misrepresent the value of the property, they would not have committed to the mortgage. Plaintiff seeks a reformation of the Loan by reducing the principal to 80% of the fair market value and a prohibition against defendants or other owner of the loan from declaring plaintiffs in default.

Fourth: In order to induce plaintiff to agree to the loan Principal made fraudulent misrepresentations of a material fact, that is, that the servicers would be responsive to plaintiff at a time when Principal knew that the loan would be transferred to others who would refuse to communicate with plaintiff, and whose preference was to have the loan go into default rather than resolve issues so as to maintain it as a performing loan.

Fifth: Despite the provision in the mortgage that communications to the lender were to be directed to Principal, neither Principal nor any other defendant notified plaintiff that the contact had been changed, resulting in a lack of communication from Principal in response to contacts from plaintiff. Principal’s servicing arm, Global, advised that communications must be directed to the Master Servicer, yet neither the Master Servicer nor any of the other defendants were willing to respond or carry out the obligations of the lender/mortgagee, although holding the powers of the mortgagee. Defendants thereby breached their obligations under the Mortgage Agreement and Loan Documents by failing to exercise the discretion granted in the Mortgage Agreement in a reasonable manner.

Plaintiffs demand damages of $28,000,000 on the First, Second, Fourth and Fifth Causes of Action, and reformation of the Mortgage in the Third Cause of Action.Plaintiffs oppose the motions of Bear Stearns and Principal, in part asserting that by virtue of the prior Order of the Court, after review of the proposed amended complaint, the Court directed an answer as opposed to a further motion to dismiss. They also contend that the prior settlement with servicer-defendants does not render the matter moot, that the claims against Bear Stearns are not time-barred, that the breach of fiduciary duty claim is sufficiently pleaded, the information that the moving defendants failed to disclose is material, that the action is not barred by the Martin Act, and that the breach of fiduciary claim is adequately pleaded against Bear Stearns on the theory of joint venture liability. Plaintiff asserts the same claims with respect to defendant Principal.

DISCUSSION

Defendants Principal and Bear Stearns move for dismiss pursuant to Civil Practice Law and Rules §§ 3211 (a)(1) and 3211 (a)(7).

CPLR § 3211 (a)(1) provides as follows:

(a) Motion to dismiss cause of action. A party may move for judgment dismissing one or more causes of action asserted against him on the ground that: 1. a defense is founded upon documentary evidence;

In order to succeed in a claim based upon documentary evidence, “. . . the defendant must establish that the documentary evidence which forms the basis of the defense be such that it resolves all factual issues as a matter of law and conclusively disposes of the plaintiff’s claim”. (Symbol Technologies, Inc. v. Deloitte & Touche, LLP, 69 AD3d 191, 194 [2d Dept. 2009]); (DiGiacomo v. Levine, 2010 WL 3583424 (N.Y.AD2d Dept.]).

When determining a motion to dismiss for failure to state cause of action pursuant to Civil Practice Law and Rules § 3211 (a)(7), the pleadings must be afforded a liberal construction, facts as alleged in the complaint are accepted as true, and the plaintiff is accorded the benefit of every favorable inference, and the court must determine only whether the facts as alleged fit within any cognizable legal theory. (Uzzle v. Nunzie Court Homeowners Ass’,. Inc. 55 AD3d 723[2d Dept. 2008]). A pleading will not be dismissed for insufficiency merely because it is inartistically drawn; rather, such pleading is deemed to allege whatever can be implied from its statements by fair and reasonable intendment; the question is whether the requisite allegations of any valid cause of action cognizable by the state courts can be fairly gathered from all the averments. (Brinkley v. Casablancas, 80 AD2d 815 [1st Dept. 1981]).

Defendants contention with respect to § 3211 (a)(1) is, in part, that the settlement agreement with servicing defendants belies the claims that the appraised value was inflated, or the interest rate too high. Aside from the fact that the Court has not seen the settlement agreement, defendants argument presumes that plaintiffs had the opportunity to reduce the principal balance or interest rate in conjunction with their settlement negotiations, and that their failure to do so is an acknowledgment on their part that the loan was not based upon an inflated appraisal and that the interest rate was appropriate. Instead, the settlement merely provided for a deferral of interest payments for some period of time in an effort to allow plaintiff to recover from the loss of two anchor tenants.

The Mortgage Consolidation, Extension and Modification Agreement between Mass Op, LLC and Mass One, LLC, as borrower, and Principal Life Insurance as lender, provides at ¶ 6.1 as follows:

The relationship between Borrower and Lender is solely that of debtor and creditor, and Lender has no fiduciary or other special relationship with Borrower and no term or condition of any of the Note, this Security Instrument and the other Loan Documents shall be construed so as to deem the relationship between Borrower and Lender to be other than that of debtor and creditor. Borrower is not relying on Lender’s expertise, business acumen or advice in connection with the Property”.

This is documentary evidence which clearly refutes any claim that plaintiff relied upon the expertise of Principal and was thereby in a relationship which required a higher level of trust than that between debtor and creditor. New York Courts have been reluctant to find a fiduciary relationship between lenders and borrowers, and the language of the security agreement simply amplifies this position. (Dobroshi v. Bank of America, N.A., 65 AD3d 882, 884 [1st Dept.2009]). There have been relatively rare circumstances in which a fiduciary relationship between a lender and a borrower has been found, but these inevitably involved certain unique circumstances, as when the Court concluded that the underlying motivation for a lender was to drive the borrower out of business. (In re Monahan Ford Corp. of Flushing, 340 B.R. 1 [Bankr. E.D.NY 2006]).

In the absence of such special circumstances, plaintiff did not have a fiduciary relationship with Principal. Principal’s motion to dismiss the First Cause of Action for Breach of Fiduciary Duty is granted.

The motion by Bear Stearns to dismiss is also granted as to the First Cause of Action. Plaintiff has no contractual relationship with Bear Stearns, and certainly no fiduciary responsibility on the part of Bear Stearns to advise plaintiff of its financial arrangement with Principal.

The Second Cause of Action is directed as the servicing defendants, claiming that they were joint venturers with Principal and Bear Stearns in that they divided responsibilities and compensation with respect to the loan, all without the knowledge of plaintiff. As such joint venturers, they all owed a fiduciary responsibility to plaintiff. As noted, however, neither Principal or Bear Stearns were in a fiduciary relationship with plaintiff, and, even if the subsequent servicing defendants were part of a joint venture, they did not assume a fiduciary responsibility from their assignors, who had none.

The Second Cause of Action is dismissed for failure to state a cause of action.

The Third Cause of Action seeks a reformation of the loan agreement based upon Principal’s failure to reveal to plaintiff the methodology by which the value of $82,000,000 was arrived at or its financial arrangement with Bear Stearns. In the absence of a fiduciary relationship, Principal had no obligation to reveal the methodology by which it estimated the value of the property; nor was it obligated to reveal its financial arrangement with Bear Stearns.

In fact, plaintiffs seem to have been fully apprised of the Cushman Wakefield appraisal, which is what formed the basis for Principal’s determination that the loan did not exceed 80% of the value of the property. The proposed terms of loan, described as an “application”, made it clear that the loan amount represented 80% of the appraised value pursuant to an appraisal approved by the Lender. Principal’s motion to dismiss the Third Cause of Action is granted.

The Fourth Cause of Action alleges fraud and fraudulent misrepresentation against Principal. In order to sustain a cause of action for actual fraud, plaintiff must prove:

• defendant made a representation, as to a material fact;

• the representation was false;

• the representation was known to be false by defendant;

• it was made to induce the other party to rely upon it;

• the other party rightfully relied upon the representation;

• the party relying upon the representation was ignorant of its falsity;

• the party suffered injury or damage based on its reliance. (Otto Roth & Co. Inc., v. Gourmet Pasta, Inc. 277 AD2d 293 [2d Dept. 2000]).

The Fourth Cause of Action in the Amended Complaint adds nothing to the claim of fraud which was previously dismissed. This is the law of the case, and the motion by Principal to dismiss the Fourth Cause of Action is granted.

In its earlier decision the Court determined that representations with respect to the servicer being “extraordinarily accessible in servicing the loan”, made to sophisticated investors, was a matter of puffery, not a representation of a material fact upon which plaintiffs were entitled to rely.

The Fifth Cause of Action alleges a breach of contract in that Principal is identified as the party to be contacted by mortgagor with respect to the mortgage; but after the securitization, neither Principal nor any other defendant advised Principal of the identity of the party with whom to make contact with respect to the mortgage. If there is any obligation on the part of Principal to advise the mortgagor of the identity of a special or master servicer, it would have to be contained in the only agreements between them, the Consolidation, Modification and Extension Agreement of November 8, 2006, and the Note and Mortgage executed in conformity with the Agreement.

The Consolidation Agreement is silent on the subject. The note in the amount of $65,000,000 calls for the payment to the order of Principal Life Insurance Company, at 711 High Street, Des Moines, Iowa 50392 (“Lender”) or at such other place as the holder hereof may from time to time designate, in writing, . . .”. This gives the lender the right to direct payment to the order of another, or to a different location, but places no obligation upon it to do so. To the contrary, ¶ 12 of the Promissory Note, Exh. “G” to the Affirmation of Joshua A. Zielinski, provides as follows:

(a) Upon the transfer of this Note, Borrower hereby waiving notice of any such transfer, Lender may deliver all the collateral mortgaged, granted, pledged or assigned pursuant to the Security Instrument and the other Loan Documents, or any part thereof, to the transferee who shall thereupon become vested with all the rights herein or under applicable law given to Lender with respect thereto, and Lender shall thereafter forever be relieved and fully discharged from any liability or responsibility in the matter accruing after said transfer; but Lender shall retain all rights hereby given to it with respect to any liabilities and the collateral not so transferred.

Lender, Principal Life, transferred the Note, notice of which Borrower (plaintiffs) waived, and upon such transfer of the Note and collateral, Lender was absolved from all further liability in the matter. (Exh. “K” to Affirmation of Joshua A. Zielinski).

The Fifth Cause of Action, as set forth in the Amended Complaint, is dismissed.

In light of the foregoing determinations as to each of the causes of action, the Court finds it unnecessary to address the claims of Bear Stearns that the failure of the plaintiff to annex a Supplemental Summons to their motion to amend the complaint caused service to be beyond the three year statute of limitations, that the claim is barred by the Martin Act, and that recovery is barred by the “one recovery” doctrine.

This constitutes the Decision and Order of the Court.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Recent Comments