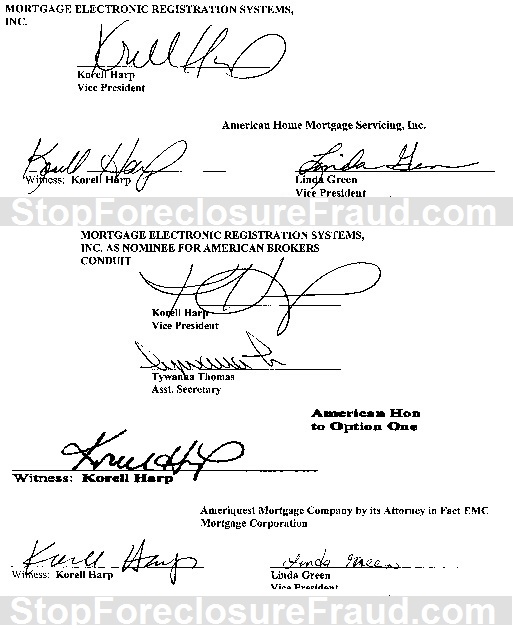

NOTE: Korell Harp misspelled, also see signature variations below.

In re: RICHARD AND KAREN CHALGREN, Chapter 13, Debtors.

RICHARD AND KAREN CHALGREN, Plaintiffs,

v.

DEUTSCHE BANK NATIONAL TRUST COMPANY, ET AL., Defendants.

MEMORANDUM DECISION ON MOTIONS TO DISMISS

ARTHUR S. WEISSBRODT, Bankruptcy Judge.

Before this Court are two motions to dismiss the First Amended Complaint of debtors Richard Scott Chalgren and Karen Chalgren (” Plaintiffs”). For the following reasons, this Court grants Defendants’ motions with leave to amend with regard to the first, second, third, and sixth causes of action. This Court denies Defendants’ motions to dismiss with regard to the fifth cause of action and grants the motions in part with regard to the fourth cause of action.

This Memorandum Decision constitutes the Court’s findings of fact and conclusions of law, pursuant to Rule 7052 of the Federal Rules of Bankruptcy Procedure.

A. PROCEDURAL HISTORY

Plaintiffs initiated this adversary proceeding on February 25, 2010. On July 27, 2010, defendants American Home Mortgage Corp. d/b/a American Brokers Conduit and AHM SV, Inc. f/k/a American Home Mortgage Servicing, Inc. filed a Suggestion of Bankruptcy in this adversary proceeding. Prior motions to dismiss were granted in part and denied in part at a hearing on September 20, 2010. Plaintiffs filed an amended complaint on November 2, 2010 (“First Amended Complaint”). The First Amended Complaint alleges six causes of action. The first cause of action is for violation of California Civil Code section 2923.5. The second cause of action is for violation of Real Estate Settlement Procedures Act, 12 U.S.C. §§ 2601-2617 (“RESPA”). The third cause of action is for violation of the automatic stay of the Bankruptcy Code. The fourth cause of action is for declaratory relief. The fifth cause of action is for injunctive relief. The sixth cause of action is for cancellation of the deed of trust and other instruments and records.

On November 16, 2010, Defendants Deutsche Bank National Trust Company, Deutsche Bank National Trust Company as Trustee of the GSR Mortgage Loan Trust 2006-OA1 (“Deutsche Bank as Trustee”), and American Home Mortgage Servicing, Inc. (“AHMSI”) filed a motion to dismiss the First Amended Complaint (“First Motion to Dismiss”). On November 29, 2010, Defendants Fidelity National Title Company and Default Resolution Network filed a motion to dismiss the First Amended Complaint (“Second Motion to Dismiss”).

The First Motion to Dismiss asserts that Plaintiffs’ response to the First Motion to Dismiss should not be considered by this Court because the response is late-filed, and that Plaintiffs have failed to meet the pleading requirements of Federal Rule of Civil Procedure 8(a). Both motions to dismiss also allege that the First Amended Complaint should be dismissed on the merits for various reasons.

Regarding the purported late-filing of Plaintiffs’ response to the First Motion to Dismiss, the hearing on the First Motion to Dismiss was originally set for December 16, 2010, meaning that Plaintiffs’ response should have been filed by December 2, 2010. No such response was filed. On December 6, 2010, Plaintiffs filed an opposition to a motion for relief from stay with a caption containing this adversary proceeding’s number. On December 10, 2010, pursuant to an amended notice of hearing, the hearing on the First Motion to Dismiss was continued to January 14, 2011. Plaintiffs’ response was filed on December 30, 2010, which is timely under the local rules with respect to the continued hearing date. While Plaintiffs should abide in the future with the deadlines set out in the local rules, there is no prejudice such that the First Amended Complaint should be dismissed and the merits of Plaintiffs’ opposition ignored.

In Plaintiff’s opposition filed on December 30, 2010, Plaintiffs agreed to amend the First Amended Complaint with regard to the first, second, and third causes of action in response to the motions of defendants Fidelity National Title Company, Default Resolution Network, Deutsche Bank National Trust Company, Deutsche Bank as Trustee, and AHMSI (collectively,” Defendants”), as well as to delete the sixth cause of action. The Court held a hearing on both motions to dismiss on January 14, 2011.

At the hearing on January 14, 2011, the Court provided the parties with the Suggestion of Bankruptcy filed by American Brokers Conduit and American Home Mortgage Servicing, Inc. in this adversary proceeding and asked the parties to submit supplemental briefs regarding why the motions to dismiss should proceed notwithstanding the automatic stay of the bankruptcy case of Defendant American Brokers Conduit. The matter was continued to March 1, 2011 with the parties to file a joint statement prior to the hearing.

On February 18, 2011, the parties filed a joint statement which the Court reviewed. The Court subsequently issued an order on February 23, 2011 taking the motions to dismiss off calendar without prejudice to being restored upon the filing of appropriate legal authority and/or declarations showing that this Court can proceed notwithstanding the automatic stay in Defendant American Brokers Conduit’s bankruptcy case.

On May 2, 2011, Plaintiffs dismissed American Brokers Conduit from this adversary proceeding. The motions to dismiss were re-set for hearing on June 30, 2011 at a Case Management Conference held on May 6, 2011. The June 30, 2011 hearing was continued to July 14, 2011 by stipulation of the parties. The July 14, 2011 hearing was taken off calendar to allow the Court to issue a written decision.

Meanwhile, on May 18, 2011, attorney Mitchell Abdallah substituted in as counsel for Plaintiffs.

On July 11, 2011, Plaintiffs filed a Second Amended Complaint.[1] The Second Amended Complaint named American Brokers Conduit as a defendant and did not make any substantive changes to the third, fourth, or sixth causes of action that Plaintiffs had said would be made. The Court suggests that if Plaintiffs file another amended complaint, Plaintiffs should consider that it appears to the Court that the bankruptcy case of American Brokers Conduit, case number 07-11051, is still pending in the District of Delaware. Plaintiffs should also consider that: (1) a cause of action under the Real Estate Settlement Procedures Act, 12 U.S.C. §§ 2601-2617 (” RESPA”) should specify which section(s) of RESPA Defendants allegedly violated; and (2) Plaintiffs should allege sufficient facts about the contents of Plaintiffs’ alleged letters to AHMSI to show that the letters qualify as “qualified written requests” under RESPA.

B. FACTUAL BACKGROUND

The following facts are drawn from the First Amended Complaint, as alleged by Plaintiffs, but have not yet been proven. On or about April 4, 2006, Plaintiffs obtained a home loan and executed a promissory note in favor of American Brokers Conduit. The note was secured by a deed of trust on 411 Quail Run in Aptos, California (the “Property”). Defendant Mortgage Electronic Registration Systems (“MERS”) was listed as the beneficiary of the deed of trust, but MERS never held the note.

On February 1, 2009, Plaintiff Richard Chalgren became unable to work due to a physical disability and suffered a loss of income. Plaintiffs were unable to make the monthly payment on the note. Plaintiffs wrote letters to the loan servicer, AHMSI, requesting the name, address, and telephone number of the holder of the note and the name and address of any agent of the holder of the note which could discuss loan modification options with Plaintiffs. However, AHMSI did not respond to Plaintiffs’ letters and still, to this day, has failed to respond to Plaintiffs’ letters. The failure of AHMSI to respond caused Plaintiffs to suffer emotional distress.

On May 5, 2009, AHMSI, Default Resolution Network, and Fidelity National Title Company acted in concert to cause a notice of default to be recorded in the official records of the county of Santa Cruz. The notice of default falsely stated that Default Resolution Network had contacted Plaintiffs before the notice of default was recorded as required by California Civil Code section 2923.5.

On June 25, 2009, MERS as nominee for defendant American Brokers Conduit assigned the deed of trust to Deutsche Bank as Trustee. Kolrell Harper signed this document on June 30, 2009 as Vice President of MERS. The assignment was produced by defendant DOCX, LLC which is a subsidiary of defendant Lender Processing Services. Lender Processing Services has admitted that there were faults in the documents produced by the DOCX office and Plaintiffs are informed and believe that there was widespread document fraud.

The note was bundled into a pool of home mortgages which were securitized and sold to investors. At the time the note was assigned to the trust, the trust was closed. Also, at the time of the assignment, American Brokers Conduit was in a Chapter 11 bankruptcy proceeding, but the assignment was made without approval from the bankruptcy court overseeing the American Brokers Conduit bankruptcy case.

On July 6, 2009, an instrument was recorded in the official records of the county of Santa Cruz purporting to be an assignment of the deed of trust from MERS to Deutsche Bank National Trust Company.

On July 17, 2009, Plaintiffs sent demand letters via certified mail to Defendants pursuant to RESPA, wherein Plaintiffs requested the name of the holder of the note or the agent for such holder with authority to discuss loan modifications. Defendants have failed to respond to those demand letters, causing Plaintiffs to be unable to communicate with anyone with the authority to modify Plaintiffs’ loan and threatening Plaintiffs with the loss of Plaintiffs’ home of 15 years.

On August 14, 2009, Plaintiffs filed this chapter 13 bankruptcy petition.

On September 4, 2009, defendants Fidelity National Title Company, AHMSI, and Power Default Services acted in concert to cause a notice of trustee’s sale to be recorded in the official records of the county of Santa Cruz in violation of the automatic stay. This recordation caused Plaintiffs emotional distress.

C. LEGAL STANDARD

The Ninth Circuit has stated that the standard of review for motions to dismiss is:

The nature of dismissal requires us to accept all allegations of fact in the complaint as true and construe them in the light most favorable to the plaintiffs. However we are not required to accept as true conclusory allegations which are contradicted by documents referred to in the complaint, and we do not . . . necessarily assume the truth of legal conclusions merely because they are cast in the form of factual allegations.

Warren v. Fox Family Worldwide, Inc., 328 F.3d 1136, 1139 (9th Cir. 2003) (citations and internal quotations omitted).

D. ANALYSIS

The First Motion to Dismiss asserts that the First Amended Complaint fails to differentiate between Defendants in violation of Federal Rule of Civil Procedure 8 (a), as incorporated by Federal Rule of Bankruptcy Procedure 7008. The Court has reviewed the First Amended Complaint and has determined that the First Amended Complaint identifies the transactions giving rise to the causes of action and puts each Defendant on notice of each Defendant’s alleged conduct. The First Motion to Dismiss is denied on this basis.

(1) Plaintiffs’ First Cause of Action

The first cause of action is against AHMSI, Default Resolution Network, and Fidelity National Title Company for violation of California Civil Code section 2923.5. Plaintiffs assert that Default Resolution Network did not contact Plaintiffs about alternatives to foreclosure prior to recording the notice of trustee’s sale. The First Amended Complaint only requests damages for this statutory violation.

The First Motion to Dismiss asserts that Plaintiffs need to allege tender before obtaining a postponement of the foreclosure sale. However, the case of Mabry v. Superior Court, 185 Cal. App. 4th 208, 214 (2010), relied on by Defendants, explicitly held that tender was not required to postpone a foreclosure sale under California Civil Code section 2923.5. Mabry, 185 Cal. App. 4th at 213. In any event, Plaintiffs are only required to allege that Plaintiffs attempted to tender — or were capable of tendering — the value of the property, or that such equitable circumstances existed that conditioning rescission on any tender would be inappropriate. Mangindin v. Washington Mutual Bank, 637 F. Supp. 2d 700, 706 (N.D. Cal. 2009).

However, as conceded by Plaintiffs, the remedy for a violation of California Civil Code section 2923.5 is not damages, but a postponement of the foreclosure sale to allow such communications to take place. Mabry, 185 Cal. App. 4th at 214. Because the requested damages are not available, this Court dismisses this cause of action with leave to amend.

(2) Second Cause of Action

The second cause of action is against AHMSI for violation of RESPA for failure to respond to Plaintiffs’ letters requesting information relating to the identity of the holder of the note and such holder’s authorized agent. Plaintiffs have not provided copies of the letters to this Court. The First Motion to Dismiss asserts that Plaintiffs need to specify which section of RESPA AHMSI allegedly violated, and Plaintiffs have indicated, in Plaintiffs’ opposition to that motion, that Plaintiffs plan to specify 12 U.S.C. section 2605(f)(1) in any amended complaint.

While the First Motion to Dismiss asserts that the First Amended Complaint fails to allege damages caused by AHMSI’s failure to respond, the First Amended Complaint’s statement of facts alleges that the failure of AHMSI to respond caused Plaintiffs great emotional distress. This Court notes that the courts are divided on whether emotional distress damages are recoverable under section 2605(f)(1). Compare Allen v. United Financial Mortg. Corp., 660 F. Supp. 2d 1089, 1097 (N.D. Cal. 2009), with Espinoza v. Recontrust Co., N.A., 2010 WL 2775753, *4 (S.D. Cal. July 13, 2010). However, this Court will not decide this legal issue at the pleading stage. Therefore, the cause of action is not dismissed on this basis.

The First Motion to Dismiss also asserts that Plaintiffs’ letters do not qualify as “Qualified Written Requests” under RESPA. The statute defines a Qualified Written Request as either (1) a letter saying that the account is in error, or (2) a letter requesting other information. 12 U.S.C. § 2605(e)(1)(b). The RESPA statute provides that a response is required when the letter requests information relating to the servicing of the loan. 12 U.S.C. § 2605(e) (1) (a). Servicing is defined as: “receiving any scheduled periodic payments from a borrower pursuant to the terms of any loan, . . . and making the payments of principal and interest and such other payments with respect to the amounts received from the borrower as may be required pursuant to the terms of the loan.” 12 U.S.C. § 2605(i).

While the First Motion to Dismiss asserts that Plaintiffs must allege that the letters stated that the account was in error, the statute defining what constitutes a Qualified Written Response is written in the disjunctive, and Plaintiffs have asserted that the letters contained requests for other information. This Court agrees with United States District Judge Fogel’s reading of 12 U.S.C. § 2605(e)(1)(b) found in Luciw v. Bank of America, N.A., 2010 WL 3958715, *3 (N.D. Cal. Oct. 7, 2010), which holds that a letter can be a Qualified Written Request even if the letter does not state that the account is in error. The Court notes that the statute does not clearly state that a letter is not a Qualified Written Response if the letter requests information both about the servicing of the loan and information not related to the servicing of the loan. Luciw, 2010 WL 3958715 at *3.

However, the First Amended Complaint fails to allege sufficient facts about the contents of the letters to show that Plaintiffs’ letters were related to the servicing of the loan such as to give rise to a statutory obligation by AHMSI to respond. The First Amended Complaint alleges that the letters request the identity of the holder of the note or such holder’s agent, which does not appear to relate to the receipt or application by AHMSI of periodic payments received from Plaintiffs. While Plaintiffs’ December 6, 2010 opposition to a motion for relief from stay provides a copy of the letter sent by Plaintiffs to Defendants, the Court is not considering that letter at this time because the letter was not incorporated into the First Amended Complaint.

The Court dismisses the second cause of action with leave to amend.

(3) Third Cause of Action

The third cause of action is against Fidelity National Title Company and AHMSI for violation of the automatic stay pursuant to Bankruptcy Code section 362(k). While the Second Motion to Dismiss asserts that this cause of action should be dismissed for failure to allege conduct rising to a requisite level of outrageousness, the determination of outrageousness is a factual issue, and the case relied upon in the Second Motion to Dismiss is a California state law case not involving Bankruptcy Code section 362(k).

However, both motions to dismiss assert that the First Amended Complaint fails to allege that the two defendants willfully violated the automatic stay. Bankruptcy Code section 362(k) clearly requires a willful violation. In re Bloom, 875 F.2d 224, 227 (9th Cir. 1989). The First Amended Complaint contains no allegations of willfulness and/or knowledge of the bankruptcy case on the part of Fidelity National Title Company and/or AHMSI, and Plaintiffs have indicated that Plaintiffs plan to amend the First Amended Complaint to so allege. The Court dismisses the third cause of action with leave to amend.

(4) Fourth Cause of Action

The fourth cause of action is against all Defendants for declaratory relief. The First Amended Complaint requests the following declaratory relief: (1) a finding that the deed of trust is unenforceable because the deed of trust was severed from the note, rendering the note unsecured; (2) a finding that the notice of default is void because the deed of trust was unenforceable; (3) a finding that assignment of the deed of trust to Deutsche Bank as Trustee is of no effect because the assignment was (a) made while American Brokers Conduit was in bankruptcy and (b) made after the securitized trust had closed; and (4) a finding that the notice of trustee’s sale is void for being in violation of the automatic stay. This cause of action does not request that the note and deed of trust be rescinded or otherwise set aside.

Both motions to dismiss assert that the fourth cause of action must be dismissed because the First Amended Complaint fails to allege that Plaintiffs either have tendered, or can tender, the amount of the outstanding loan balance. All but one of the cases cited by Defendants are cases in which a party requested quiet title or declaratory relief rescinding a loan contract, and those cases are not applicable.

The reasoning of Chavez v. Recontrust Co., 2008 WL 5210893 (E.D. Cal. Dec. 11, 2008), is not disposative here and this Court does not agree with it in any event. In Chavez, a plaintiff requested — among other things — an injunction against a foreclosure sale without either alleging that the plaintiff had tendered, or was able to tender, the amount outstanding on the loan. The Chavez court held: “[t]he law is long-established that a trustor or his successor must tender the obligation in full as a prerequisite to challenge of the foreclosure sale.” Chavez, 2008 WL 5210893 at *6 (quoting U.S. Cold Storage v. Great Western Savings & Loan Assn., 165 Cal. App. 3d 1214, 1222, (1985)). The quoted language is inapposite because the language of U.S. Cold Storage refers to an attempt to undo a foreclosure sale after the fact, rather than a request for declaratory relief based on a finding that a foreclosure sale cannot proceed because the wrong party is seeking to foreclose.

In the context of Truth in Lending Act (“TILA”) violations, Judge Ware has held that the Ninth Circuit “gives a trial court discretion to condition rescission on a tender by the borrower of the property, or the property’s reasonable value, to the lender. Yamamoto v. Bank of New York, 329 F.3d 1167, 1171 (9th Cir. 2003). Mangindin, 637 F. Supp. 2d at 705-06. Judge Ware stated:

Notably absent from Plaintiffs’ Complaint is any allegation that they attempted to tender, or are capable of tendering, the value of the property pursuant to the rescission framework established by TILA. Nor do Plaintiffs allege that such equitable circumstances exist that conditioning rescission on any tender would be inappropriate. Thus, the Court finds that Plaintiffs have failed to adequately allege that they are entitled to rescission under TILA.

Mangindin, 637 F. Supp. 2d at 706. Thus, Plaintiffs are only required to allege that Plaintiffs attempted to tender — or were capable of tendering — the value of the property, or that such equitable circumstances existed that conditioning rescission on any tender would be inappropriate.

The First Motion to Dismiss also asserts that the California nonjudicial foreclosure statutes do not require a foreclosing lender to produce the original copy of the note in order to foreclose. However, the First Amended Complaint does not request declaratory relief based on a finding that a foreclosure cannot take place because no party holds an original copy of the note. The First Amended Complaint seeks declaratory relief regarding whether the note is secured; whether the assignment of the note is of any legal effect; and whether the notice of trustee’s sale is void.

The First Motion to Dismiss next asserts that the First Amended Complaint fails to allege with sufficient specificity that the purported transfer of the note from American Brokers Conduit took place while American Brokers Conduit was a debtor in a bankruptcy proceeding. The First Amended Complaint clearly alleges that: “at the time of the assignment, American Broker’s Conduit was in a bankruptcy proceeding under chapter 11 of the U.S. Bankruptcy Code. Plaintiffs are informed and believe that the bankruptcy court did not authorize or approve the assignment of the deed of trust. . . .” First Amended Complaint at page 6, ¶ 20. This allegation is more than a mere threadbare recital and is sufficient to withstand this motion to dismiss. Therefore, the cause of action is not dismissed on this basis.

The First Motion to Dismiss asserts that American Brokers Conduit transferred the note and deed of trust on June 5, 2006 and provides a copy of a loan history for the property. This Court will not take judicial notice of the copy at this time because Plaintiffs have objected to the admissibility of this document and the copy was not part of an official record or court decision.

The First Motion to Dismiss also argues that — even if the deed of trust was transferred out of the bankruptcy estate of American Brokers Conduit without bankruptcy court approval — Plaintiffs have no standing to challenge the transfer. Plaintiffs assert that Plaintiffs have standing because the legal effect of the transfer directly affects Defendants’ ability to foreclose on Plaintiffs’ home. American Brokers Conduit filed for relief under chapter 11 as case number 07-11047 in the Bankruptcy Court for the District of Delaware. Bankruptcy Code section 1109(b) provides: “a party in interest . . . may raise and may appear and be heard on any issue in a case under this chapter.” 11 U.S.C. § 1109(b). The term party in interest is meant to be elastic, and whether a party is a party in interest is determined by the facts of the case. In re Amatex Corp., 755 F.2d 1034, 1042 (3d Cir. 1985). The First Amended Complaint clearly alleges that Plaintiffs have a very practical stake in the legal effectiveness of the transfer of the deed of trust. At least insofar as Plaintiffs seek to challenge that transfer, Plaintiffs’ interest in the American Brokers Conduit bankruptcy proceeding is sufficient to make Plaintiffs a party in interest.

The First Motion to Dismiss further asserts that, even if the assignment took place after American Brokers Conduit filed for bankruptcy, the assignment was in the ordinary course of business and did not require bankruptcy court approval. Under these circumstances, any assignment would be valid. 11 U.S.C. § 363(c)(1). The First Amended Complaint only alleges that the assignment was made when American Broker’s Conduit was in bankruptcy and that there was no authorization from the bankruptcy court, which is only required if the assignment was made outside of the ordinary course of business. Because the First Amended Complaint fails to allege that the assignment was not in the ordinary course of business, this Court dismisses the fourth cause of action with leave to amend with respect to the fact that the assignment from American Brokers Conduit was invalid as an unauthorized post-petition transfer from a bankruptcy debtor.

Finally, the First Motion to Dismiss asserts that the First Amended Complaint must be dismissed because Plaintiffs’ bad faith — as evidenced by Plaintiffs’ failure to tender or to make post-petition payments on the note — estops Plaintiffs from seeking equitable relief. However, the issue of Plaintiffs’ bad faith is a factual issue which this Court will not decide at the motion to dismiss stage. Also, as previously mentioned, this Court does not hold — and leaves for trial, a possible summary judgment motion or other context — Defendants’ contention that alleging tender in the particular manner that Defendants say is mandatory is a requirement to obtaining the declaratory relief sought in Plaintiffs’ First Amended Complaint. Mangindin, 637 F. Supp. 2d at 706.

For the above reasons, this Court dismisses the fourth cause of action with leave to amend only insofar as the fourth cause of action requests a finding that the assignment from American Brokers Conduit was without legal effect for being an unauthorized post-petition transfer from a bankruptcy debtor.

(5) Fifth Cause of Action

The fifth cause of action is against all Defendants for injunctive relief. Plaintiffs request an injunction against a foreclosure sale of the property. Both motions to dismiss assert that this cause of action should be dismissed because injunctive relief cannot be granted without the existence of a substantive cause of action. Shell Oil Co. v. Richter, 52 Cal. App. 2d 164, 168 (Cal. App. 1942). The First Amended Complaint has adequately pled a substantive cause of action for declaratory relief, so the motions to dismiss are denied as to the fifth cause of action.

(6) Sixth Cause of Action

The sixth cause of action is against all Defendants for cancellation of the deed of trust and other instruments and records. In Plaintiffs’ responses to both motions to dismiss, Plaintiffs have agreed to delete the sixth cause of action from future amended complaints based on Defendants’ arguments. Because, as noted earlier, Plaintiffs could allege that Plaintiffs attempted to tender — or were capable of tendering — the value of the property, or that such equitable circumstances exist that conditioning rescission on any tender would be inappropriate, this Court dismisses the sixth cause of action with leave to amend.

E. CONCLUSION

For the forgoing reasons, Defendants’ motions are granted in part with leave to amend and denied in part. Counsel for each set of moving parties shall prepare a form of order consistent with this ruling and submit the proposed order to the Court after service on counsel for Plaintiffs. The Court prefers for all counsel to sign off on the form of order.

[1] Defendants oppose Plaintiffs’ filing of the Second Amended Complaint. Plaintiffs filed the Second Amended Complaint without leave from the Court or consent from Defendants as required by Federal Rule of Civil Procedure Rule 15(a)(2), incorporated by Federal Rule of Bankruptcy Procedure Rule 7015. The Court is deciding these motions to dismiss as to the First Amended Compliant only, and not as to the Second Amended Complaint.

Various Signatures of Korell Harp

[ipaper docId=68626783 access_key=key-1axgr4k8ofuv0gvoqkf9 height=600 width=600 /]

Recent Comments