This man is fighting to keep his home in Placerville, California. He feels the local Distract Attorney is doing nothing even when Fraud is uncovered.

[youtube=http://www.youtube.com/watch?v=8alNN63OWQY]

Posted on 16 April 2010.

This man is fighting to keep his home in Placerville, California. He feels the local Distract Attorney is doing nothing even when Fraud is uncovered.

[youtube=http://www.youtube.com/watch?v=8alNN63OWQY]

Posted in concealment, conspiracy, corruption, foreclosure fraud, forensic mortgage investigation auditComments (0)

Posted on 21 March 2010.

William Black, author of “Best way to rob a bank is to own one” talks about deliberate fraud on Wall St. courtesy of TheRealNews

[youtube=http://www.youtube.com/watch?v=sA_MkJB84VA]

[youtube=http://www.youtube.com/watch?v=ISsR7ZiWlsk]

Not all Forensic Auditors are alike! FMI may locate exactly where the loan sits today.

This will make your lender WANT to communicate with you. Discover what they don’t want you to know. Go back in time and start from the minute you might have seen advertisements that got you hooked ” No Money Down” “100% Financing” “1% interest” “No income, No assetts” NO PROBLEM! Were you given proper disclosures on time, proper documents, was your loan broker providing you fiduciary guidance or did they hide undisclosed fees from you? Did they conceal illegal kickbacks? Did your broker tell you “Don’t worry before your new terms come due we will refinance you”? Did they inflate your appraisal? Did the developer coerce you to *USE* a certain “lender” and *USE* a certain title company?

If so you need a forensic audit. But keep in mind FMI:

DO NOT STOP FORECLOSURE

DO NOT NEGOTIATE ON YOUR BEHALF WITH YOUR BANK OR LENDER

DO NOT MODIFY YOUR LOAN

DO NOT TAKE CASES that is upto your attorney!

FMI does however, provide your Attorney with AMMO to bring your Lender into the negotiation table.

Posted in bank of america, bernanke, chase, citi, concealment, conspiracy, corruption, fdic, FED FRAUD, federal reserve board, FOIA, foreclosure mills, forensic mortgage investigation audit, fraud digest, freedom of information act, G. Edward Griffin, geithner, indymac, jpmorgan chase, lehman brothers, Lynn Szymoniak ESQ, MERS, Mortgage Foreclosure Fraud, nina, note, onewest, scam, siva, tila, title company, wachovia, washington mutual, wells fargoComments (0)

Posted on 19 March 2010.

Yup! You heard it right X’s 2…I feel it’s going to be one of the great defense attorney’s in Florida that will bring down the MILL’s who are destroying families. Mark my words watch for Jeff Barnes, Matt Weidner, Greg Clark, George Gingo and Ice Legal… Baby! Many other…Lets not forget the attorney who is diligently uncovering assignment fraud time after time Lynn Szymoniak ESQ.

March 17, 2010

FDN has obtained another borrower victory in Florida by having a summary judgment of foreclosure vacated. The Judge in the Brevard County Circuit Court has entered an Order, on motion of the borrower which was prepared, filed, and argued in person by Jeff Barnes, Esq., vacating and setting aside a Final Summary Judgment of Foreclosure and enjoining any foreclosure sale. The Motion set forth that the Judgment was void as there was no proof of legal standing.

The Complaint, filed by the Law Offices of David J. Stern, P.A., alleged that the Plaintiff was the holder and owner of the note and mortgage by an assignment “to be filed”. No such assignment was ever filed, and thus Plaintiff Deutsche Bank fraudulently represented to the Court that it had proper legal standing to foreclose when in reality it did not. The threshold hurdle of proof of legal standing to foreclose under Florida law was recently highlighted by the Florida Second District Court of Appeal in the BAC Funding decision which was recently discussed on this website.

The same day that the hearing took place on the Brevard County Motion, FDN attorney Jeff Barnes, Esq. was presented with yet another case filed by the same attorney from the Stern law office for the same client (Deutsche Bank as “Trustee” of a securitized mortgage loan trust) with the same problem (no assignment or proof of VALID ownership of the Note and Mortgage) but filed in Manatee County, Florida with a summary judgment having been entered in favor of Deutsche Bank despite no assignment ever having been filed. A Motion has thus been filed to seek vacatur of the Stern Summary Judgment entered in this separate proceeding.

FDN litigates foreclosure cases throughout the State of Florida as well as in 27 other states, assisted by local counsel. The consistent pattern which is emerging, as to Deutsche Bank, is a misrepresentation of ownership of the Note and Mortgage (or “Deed of Trust” as it is called in non-judicial states other than Georgia, which terms the instrument a “Security Deed”); lack of valid ownership interest in these instruments and the rights attendant thereto; and a failure to produce competent evidence of any ownership (meaning that meritless MERS assignments are not “competent”). This pattern is present in numerous states with different law Firms. Deutsche Bank thus continues to be an entity whose representations must be carefully examined in any foreclosure attempt, because there is a high probability that one or more of its representations are false.

Jeff Barnes, Esq., www.ForeclosureDefenseNationwide.com

Posted in concealment, conspiracy, corruption, foreclosure fraud, foreclosure mills, forensic mortgage investigation audit, Former Fidelity National Information Services, Law Offices Of David J. Stern P.A., MERS, Mortgage Foreclosure FraudComments (3)

Posted on 19 March 2010.

Jacksonville Business Journal – by Rachel Witkowski Staff reporter-

Lender Processing Services Inc. recently opened an office in Washington, D.C. in order to attract more government work, the company announced Thursday.

The Jacksonville-based technology and services provider (NYSE: LPS) to the mortgage and real estate industries said having an office in the nation’s capital “gives LPS the ability to quickly respond to the needs of its government clients and to increase its presence by pursuing opportunities with new government partners.”

The company said it is currently has contractual relationships with a number of federal agencies. The D.C. office will provide services including mortgage consulting, technology, portfolio data analytics and risk management as well as due diligence and valuation.

“In today’s challenging economic environment, government agencies need expert support and data to make the most informed decisions, mitigate risks and operate at peak efficiency,” said LPS’ co-chief operating officer, Eric Swenson in the announcement. “LPS’ proven, robust technology solutions and extensive governmental expertise can help agencies quickly adapt to changing market conditions and regulatory requirements for optimal performance.”

Continue reading….http://jacksonville.bizjournals.com/jacksonville/stories/2010/03/01/daily34.html

Posted in concealment, conspiracy, DOCX, FIS, foreclosure fraud, foreclosure mills, forensic mortgage investigation audit, Former Fidelity National Information Services, Lender Processing Services Inc., LPS, MERS, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC.Comments (1)

Posted on 13 March 2010.

WHOA! …before any of this BS happens. Who is going to address the Perpetual Fraud that exist? Is anyone from the government even doing any due diligence on any of the TOP FORECLOSURE HELP sites? WE HAVE DONE MOST OF YOUR WORK FOR YOU. Who is going to rescue the homeowners buying these fraudulent issues encumbered in these homes? In our illegal foreclosures today and yesterday? May I please have 1 day in the White House to fix all this because apparently they are digging all this up, even further. In order to fix this crap this needs to be fixed first. I think the government has learned a thing or 2 from these bankers (a bird in a hand is worth two in a bush). They are running with their heads in the dark! Go HERE, HERE, HERE, HERE, HERE, HERE, HERE, HERE, HERE, HERE and HERE…you see I did it for you! For a start…YOU MUST FIX THESE ISSUES BEFORE ANYTHING!

If you feel like this is not enough then go here:

http://www.frauddigest.com

http://www.msfraud.org/

http://www.foreclosurehamle…

http://livinglies.wordpress…

http://4closurefraud.org/

http://stopforeclosurefraud…

In an effort to end the foreclosure crisis, the Obama administration has been trying to keep defaulting owners in their homes. Now it will take a new approach: paying some of them to leave.

This latest program, which will allow owners to sell for less than they owe and will give them a little cash to speed them on their way, is one of the administration’s most aggressive attempts to grapple with a problem that has defied solutions.

More than five million households are behind on their mortgages and risk foreclosure. The government’s $75 billion mortgage modification plan has helped only a small slice of them. Consumer advocates, economists and even some banking industry representatives say much more needs to be done.

For the administration, there is also the concern that millions of foreclosures could delay or even reverse the economy’s tentative recovery — the last thing it wants in an election year.

Taking effect on April 5, the program could encourage hundreds of thousands of delinquent borrowers who have not been rescued by the loan modification program to shed their houses through a process known as a short sale, in which property is sold for less than the balance of the mortgage. Lenders will be compelled to accept that arrangement, forgiving the difference between the market price of the property and what they are owed.

“We want to streamline and standardize the short sale process to make it much easier on the borrower and much easier on the lender,” said Seth Wheeler, a Treasury senior adviser.

The problem is highlighted by a routine case in Phoenix. Chris Paul, a real estate agent, has a house he is trying to sell on behalf of its owner, who owes $150,000. Mr. Paul has an offer for $48,000, but the bank holding the mortgage says it wants at least $90,000. The frustrated owner is now contemplating foreclosure.

To bring the various parties to the table — the homeowner, the lender that services the loan, the investor that owns the loan, the bank that owns the second mortgage on the property — the government intends to spread its cash around.

Under the new program, the servicing bank, as with all modifications, will get $1,000. Another $1,000 can go toward a second loan, if there is one. And for the first time the government would give money to the distressed homeowners themselves. They will get $1,500 in “relocation assistance.”

Should the incentives prove successful, the short sales program could have multiple benefits. For the investment pools that own many home loans, there is the prospect of getting more money with a sale than with a foreclosure.

For the borrowers, there is the likelihood of suffering less damage to credit ratings. And as part of the transaction, they will get the lender’s assurance that they will not later be sued for an unpaid mortgage balance.

For communities, the plan will mean fewer empty foreclosed houses waiting to be sold by banks. By some estimates, as many as half of all foreclosed properties are ransacked by either the former owners or vandals, which depresses the value of the property further and pulls down the value of neighboring homes.

If short sales are about to have their moment, it has been a long time coming. At the beginning of the foreclosure crisis, lenders shunned short sales. They were not equipped to deal with the labor-intensive process and were suspicious of it.

The lenders’ thinking, said the economist Thomas Lawler, went like this: “I lend someone $200,000 to buy a house. Then he says, ‘Look, I have someone willing to pay $150,000 for it; otherwise I think I’m going to default.’ Do I really believe the borrower can’t pay it back? And is $150,000 a reasonable offer for the property?”

Short sales are “tailor-made for fraud,” said Mr. Lawler, a former executive at the mortgage finance company Fannie Mae.

Last year, short sales started to increase, although they remain relatively uncommon. Fannie Mae said preforeclosure deals on loans in its portfolio more than tripled in 2009, to 36,968. But real estate agents say many lenders still seem to disapprove of short sales.

Under the new federal program, a lender will use real estate agents to determine the value of a home and thus the minimum to accept. This figure will not be shared with the owner, but if an offer comes in that is equal to or higher than this amount, the lender must take it.

Mr. Paul, the Phoenix agent, was skeptical. “In a perfect world, this would work,” he said. “But because estimates of value are inherently subjective, it won’t. The banks don’t want to sell at a discount.”

There are myriad other potential conflicts over short sales that may not be solved by the program, which was announced on Nov. 30 but whose details are still being fine-tuned. Many would-be short sellers have second and even third mortgages on their houses. Banks that own these loans are in a position to block any sale unless they get a piece of the deal.

“You have one loan, it’s no sweat to get a short sale,” said Howard Chase, a Miami Beach agent who says he does around 20 short sales a month. “But the second mortgage often is the obstacle.”

Major lenders seem to be taking a cautious approach to the new initiative. In many cases, big banks do not actually own the mortgages; they simply administer them and collect payments. J. K. Huey, a Wells Fargo vice president, said a short sale, like a loan modification, would have to meet the requirements of the investor who owns the loan.

“This is not an opportunity for the customer to just walk away,” Ms. Huey said. “If someone doesn’t come to us saying, ‘I’ve done everything I can, I used all my savings, I borrowed money and, by the way, I’m losing my job and moving to another city, and have all the documentation,’ we’re not going to do a short sale.”

But even if lenders want to treat short sales as a last resort for desperate borrowers, in reality the standards seem to be looser.

Sree Reddy, a lawyer and commercial real estate investor who lives in Miami Beach, bought a one-bedroom condominium in 2005, spent about $30,000 on improvements and ended up owing $540,000. Three years later, the value had fallen by 40 percent.

Mr. Reddy wanted to get out from under his crushing monthly payments. He lost a lot of money in the crash but was not in default. Nevertheless, his bank let him sell the place for $360,000 last summer.

“A short sale provides peace of mind,” said Mr. Reddy, 32. “If you’re in foreclosure, you don’t know when they’re ultimately going to take the place away from you.”

Mr. Reddy still lives in the apartment complex where he bought that condo, but is now a renter paying about half of his old mortgage payment. Another benefit, he said: “The place I’m in now is nicer and a little bigger.”

Posted in Mortgage Foreclosure FraudComments (0)

Posted on 12 March 2010.

Listen carefully it’s not only the sub-prime …it’s now those who called everyone in foreclosure a dead beat. Those “who” were living in glass houses shouldn’t throw stones because one might come bouncing back to shatter. We are now in this together so I welcome you with open arms and into a hug because I know you will need one.

[youtube=http://www.youtube.com/watch?v=shYJ_KkbzWg]

[youtube=http://www.youtube.com/watch?v=GZWC0fBqlYE]

Posted in concealment, conspiracy, corruption, FED FRAUD, foreclosure fraud, forensic mortgage investigation audit, MERS, naked short selling, nina, note, scam, siva, tilaComments (0)

Posted on 12 March 2010.

First, Lynn Szymoniak ESQ. presented “Compare these Titles & Signatures” & “Too Many Jobs”…Now the next of many of compare these signatures & titles series. “Officers of Way, Way too many banks”…Part Deux “The Twilight Zone”.

How can you be an OFFICER of all these banks and Why is your signature never signed the same??? Minnesota? LPS? Bueller? …anyone?…Bueller?

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in dennis kirkpatrick, DOCX, erica johnson seck, FIS, foreclosure fraud, Former Fidelity National Information Services, fraud digest, indymac, Law Offices Of David J. Stern P.A., Lender Processing Services Inc., LPS, Lynn Szymoniak ESQ, marshall watson, MERS, Mortgage Foreclosure Fraud, roger stotts, washington mutualComments (12)

Posted on 11 March 2010.

One may have seen this coming, so what do they do…

Go NASDAQ BABY!

By: Matthew Weidner P.A.

For a brief period of time in the history of courts in Florida, lawyers engaged in a widespread and pervasive practice of submitting blatantly false evidence in courts. This period of time began roughly when the foreclosure crisis moved from the mortgage and lending industries and into Florida courts.

Now that judges and courts have become aware of just how pervasive this practice was, individual efforts on the part of judges and systemic rule changes implemented by the Florida Supreme Court should signal the end of this era. An article that appeared in the Sarasota Tribune and can be viewed here quotes a local judge, Robert Bennett from Sarasota who recently had one of his opinions reversed by the Second District Court of Appeals. (Verizzo v. Bank of New York) Found here

In the article, the good judge admits that his initial ruling…in favor of the bank was incorrect. The decision was a reflection of a judicial system that was totally overwhelmed by problems caused by the mortgage and lending institutions….they caused the problems then dumped their problems in the laps of absurdly understaffed courts and judges then said, “Here, you fix the mess we’ve created!”

It’s taken a while to identify the issues and to grasp the scope of the problem, but now that judges and court systems are aware that they were taken advantage of, the tide has shifted. New rules and new cases, both from appellate courts and from sister courts, have made judges all over aware of the issues such that they are no longer willing to look the other way and sign off granting sale….when asked how he thinks Plaintiff’s attorneys will comply, Chief Judge Lee Hayworth (long a critic of sloppy Plaintiff practice) had this to say:

“I’m looking forward to see how they do comply,” Haworth said. “Their license could be on the line.”

Liberty and Justice Prevail When Good Judges Sit Firmly on The Bench!

Source: Matthew Weidner Blog

Posted in ben-ezra, concealment, conspiracy, corruption, foreclosure fraud, Law Offices Of David J. Stern P.A., marshall watson, shapiroComments (0)

Posted on 04 March 2010.

I warned these banks in 2007, “give the People a loan modification before they discover that you defrauded them, because woe be onto you when they find out”. Anyway, I figured out that was on to something so to buy time to think strategy, I demanded that my mortgage go from the $3,833.54 to $1,200 per month. The judge agreed and ordered that the mortgage payments was going to be $1,200 a month, and he also wiped out the $20,000 plus mortgage in arrears. This was too easy, they were willing to cater to me just to keep my brethren from feasting. The judge then ordered that I was to begin mortgage payments of $1,200 a month, but not to pay it to the lender, but to the court’s registry. My claims were still pending, even though I was paying the mortgage, I could still pursue my claims of mortgage fraud against the banks. But I saw the trap! The day I sign any papers accepting this payment modification, I the day that the case is SETTLED, and the banks would get away with robbery. The judge also gave me a stern warning, “Mr. Muckle, I am going to tell you this and please listen to me carefully”.. then he looked me into my dark brown cold eyes with is tender and sincere big blue ones, and said, ever so sincerely and meaningfully, “Mr. Muckle, do not win the battle and lose the war”. He really was looking out for mines and my children’s best interest. But as his mouth opened up and uttered those words, all I could really hear him saying to me was, “ Mr. Muckle, why settle for a battle when you can win the war?” Fight them my brother, I have your back!”.( Lol, I swear, that’s what heard). But to secure the order and bind me, the judge ordered in writing, “If the plaintiff do not begin to pay the money into the court’s registry as ordered, the defendant SHALL foreclose on the Plaintiff’s property and sell it” Huh! …continue HERE

Posted in concealment, conspiracy, corruption, fraud digest, indymac, Law Offices Of David J. Stern P.A., Lender Processing Services Inc., LPS, MERS, onewest, paul muckleComments (0)

Posted on 03 March 2010.

Whenever I get any mail from anyone I make it a point to save the envelope! Since all outgoing mail postage stamps are “created” by Pitney Bowes machines in-house (foreclosing law firms)…dates can simply be omitted, NO DATE and might have gone “Lost in the Mail” or take a long…long…long…long…time to arrive to you. Oh NO! WE JUST GOT FORECLOSED without any warning!

I know when this is coming because I check my file but those of you who don’t …Take a look at what I mean before you end up in the streets. I am not certain what Pitney Bowes guidelines are but this might be wrong for anyone to do.CHECK THE DATES

Check out this story on “sewer service”

Not only are they post dating the assignments but the material inside the envelopes might be dated months before you get it …thanks to this new tactic!

Posted in erica johnson seck, fraud digest, Law Offices Of David J. Stern P.A., Lender Processing Services Inc., LPS, MERS, Mortgage Foreclosure Fraud, roger stotts, scam, sewer serviceComments (0)

Posted on 02 March 2010.

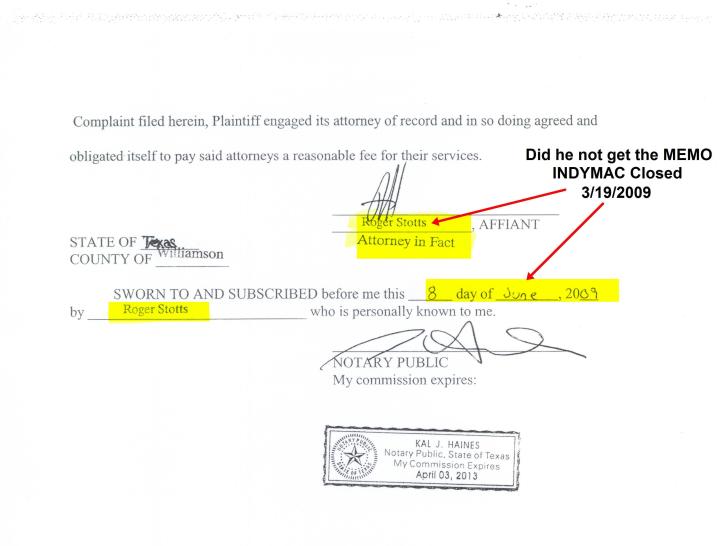

Lets connect this Pyramid: Erica Johnson-Seck, Roger Stotts, Dennis Kirkpatrick. The Law Offices Of David J. Stern P.A. seem to have the same players by “virtue” hereof?

“WALLSTREET is our AMERICAN TERRORTIST”

What these people have done is no different than the 9/11 acts, they did not use planes

they used our homes to destroy us financially! They are killing us s..l..o…w..l..y!

This time the government is rewarding their behavior!

WE WILL NEVER FORGET 9/11

But…I thought he is an Attorney in Fact for IndyMac above? But Now VP for MERS?

COMPARE HIS SIGNATURES

They are in my stash will post when I find em’.

All three together as Attorney In Fact for OnesWest

Below is a sale that happened in DC all in 1 single day! I am still trying to understand it all.

HHHmmm more investigating….

So there you have it..I can show plenty more but it will take many years truthfully to put all the documents they signed all in one room!

See Erica’s Master Pieces here…

Posted in concealment, conspiracy, corruption, dennis kirkpatrick, erica johnson seck, fraud digest, indymac, Law Offices Of David J. Stern P.A., Lender Processing Services Inc., LPS, MERS, michael dell, Mortgage Foreclosure Fraud, onewest, roger stotts, scamComments (6)

Posted on 02 March 2010.

This is a Must Read where ICE Legal from Palm Beach rips into Ms. Seck…

Picture says it all!

Here, Plaintiff and Plaintiff’s counsel misled the Court about the real party in interest in the case; and 2) engaged in extensive discovery abuse to obstruct revelation of the

known falsities in the complaint – a “flagrant abuse of the judicial process” worthy of severe sanctions. See Martin v. Automobili Lamborghini Exclusive, Inc., 307 F.3d 1332 (11th Cir. 2002). Dismissal for fraud is appropriate where “a party has sentiently set in motion some unconscionable scheme calculated to interfere with the judicial system’s ability impartially to adjudicate a matter by improperly influencing the trier of fact or unfairly hampering the presentation of the opposing party’s claim or defense.” Cox v. Burke, 706 So.2d 43, 46 (Fla. 5th DCA 1998).

Yep you gone done it again…This time you messed with the WRONG assignments…MINE!!!

[youtube=http://www.youtube.com/watch?v=LoSPTjd_PXM]

[youtube=http://www.youtube.com/watch?v=SD6XUboT1JM]

DEPOSITION OF ERICA JOHNSON-SECK by DinSFLA on Scribd

Here is her peers doing the same…

Posted in concealment, conspiracy, corruption, fraud digest, Law Offices Of David J. Stern P.A., Lender Processing Services Inc., LPS, MERS, Mortgage Foreclosure Fraud, scamComments (3)

Posted on 01 March 2010.

“A ex-employee of the Law Offices of David J. Stern of Plantation has contacted me, Bill Warner, in response to the article I posted on Monday, May 18, 2009, that followed up on the Tampa Tribune article of April 2008, (see above), it appears that what I had claimed about “sewer service” by ProVest LLC in Tampa Fl (working for the Stern law office) is just the tip of the iceberg.

It appears from this ex-employee of the Law Offices of David J. Stern of Plantation that ProVest, the process service company in Tampa, also had an office in the same building as the Law Offices of David J. Stern in Plantation and that “sewer service’ was done all the time and if needed Provest would pre-date the service of summons to make it appear that you had already been served and allow Stern to put your foreclosure case on a “rocket docket’ to get the house up for sale on the Court House steps (David J. Stern Law Office appears to have severed ties to Pro Vest).

Then the sales girls in the Stern office (a lot of the associate attorneys at the Stern Law firm have real estate licenses) would contact outside buyers and inform them of the exact time and date of the “court house steps sale” and tell the outside buyers what the correct amount to bid that would be approved by the bank and the court,(this is ”bid rigging”).

A recent hire by the Law office of David J. Stern is Attorney Vivien Leora Lurlene who also has a Real Estate Sales License in the State of Florida, I have no knowledge of her involvement in the ”bid rigging”or any other illegal activity at the Law Office of David J. Stern. These outside buyers contacted by the sales girls at the Stern Law office would resell these super low bargain houses purchaed on the Court House Steps for a profit and pay off the sales girls in the Stern Law office for the tip. “

It appears from this ex-employee of the Law Offices of David J. Stern of Plantation that she was told to make up false documents for Freddie Mac and Fannie Mae when they came around to check their Foreclosure files, she was also instructed to lie to the banks when they requested a chronology report which is the foreclosure time-line on a file, there appears to be Federal violations that would necessitate an FBI investigation, the ex-employee is afraid to talk.

Continue HERE

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in chase, concealment, conspiracy, corruption, fraud digest, geithner, george soros, Law Offices Of David J. Stern P.A., Lender Processing Services Inc., LPS, MERS, Mortgage Foreclosure Fraud, mozillo, scamComments (1)

Posted on 28 February 2010.

Citi recently agreed to give qualified borrowers six months in their homes before it takes them over. It will offer these homeowners $1,000 or more in relocation assistance, provided the property is in good condition. Previously, the bank had no formal process for serving borrowers who failed to qualify for Citi’s other foreclosure-avoidance programs like loan modification.

continue reading here

Posted in chase, concealment, conspiracy, corruption, fraud digest, geithner, george soros, lehman brothers, Lender Processing Services Inc., LPS, Lynn Szymoniak ESQ, MERS, michael dell, Mortgage Foreclosure Fraud, mozillo, scam, steven mnuchin, Uncategorized, wells fargoComments (0)

Posted on 27 February 2010.

Lynn I am working on your YELLOW LAMBORGHINI… Question: What entity should I assign title to? If it is “TOTALLED” who should I vest title to after I SWAP out the VIN # onto another Car to? We can do this as many times as you like for a fee.

“This is no different to what these Banks are doing with the help of the MILLS.”

[youtube=http://www.youtube.com/watch?v=kkMeuSB68E4&hl=en_US&fs=1&]

CHERYL SAMONS states in her DEPOSITION:

She is not a Paid Employee for MERS, Does not answer to ANY President, Any Supervisors…Heck she doesn’t even know where any offices are for MERS!!! BUT SHE DOES KNOW SHE IS AN ASSISTANT SECRETARY FOR MERS.

Posted on 27 February 2010.

For $29.95 YOU TOO CAN STEAL…OOOPS I MEAN BUY ANY HOME or ASSIGN ANY MORTGAGE!!

Now we have Topako Love, Christina Allen & Laura Hescott MASTER PIECES!!! These belong up there with the works of Salvador Dali, Pablo Picasso, Vincent Van Gogh, Claude Monet, Erica Johnson-Seck, Roger Stotts & Dennis Kirkpatrick!

I can’t wait for DMV to allow anyone FOR A FEE to assign auto Titles too!! Or has this occurred all ready…I am too tired to check!

Bank Mortgage Foreclosure FRAUD….BOGUS ASSIGNMENTS 3…Forgery, Counterfeit, Fraud …Oh MY!

Posted in Lender Processing Services Inc., LPS, MERS, MERSCORP, mortgage bankers association, mortgage electronic registration system, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC., Mortgage Foreclosure Fraud, UncategorizedComments (0)

Posted on 10 February 2010.

These are bogus assignments used to foreclose on your home. Imagine a judge accepting this to let them take the roof off of you.

There was many of these and they are all over the US.

.

Posted in assignment of mortgage, bogus, DOCX, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, Lender Processing Services Inc., linda green, LPS, MERS, MERSCORP, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC.Comments (1)

Recent Comments