.

ONEWEST BANK, F.S.B., Plaintiff,

v.

COVAN DRAYTON, ET AL., Defendants.

15183/09.Supreme Court, Kings County.

Decided October 21, 2010.Gerald Roth, Esq., Stein Wiener and Roth, LLP, Carle Place NY, Defendant did not answer Plaintiff.

ARTHUR M. SCHACK, J.

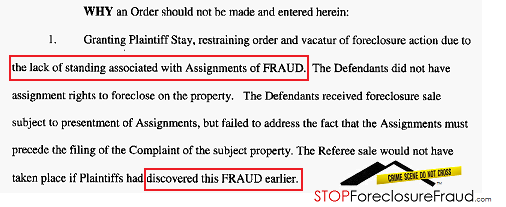

In this foreclosure action, plaintiff ONEWEST BANK, F.S.B. (ONEWEST), moved for an order of reference and related relief for the premises located at 962 Hemlock Street, Brooklyn, New York (Block 4529, Lot 116, County of Kings), upon the default of all defendants. The Kings County Supreme Court Foreclosure Department forwarded the motion papers to me on August 30, 2010. While drafting this decision and order, I received on October 14, 2010, in the midst of the present national media attention about “robo-signers,” an October 13, 2010-letter from plaintiff’s counsel, by which “[i]t is respectfully requested that plaintiff’s application be withdrawn at this time.” There was no explanation or reason given by plaintiff’s counsel for his request to withdraw the motion for an order of reference other than “[i]t is our intention that a new application containing updated information will be re-submitted shortly.”

The Court grants the request of plaintiff’s counsel to withdraw the instant motion for an order of reference. However, to prevent the waste of judicial resources, the instant foreclosure action is dismissed without prejudice, with leave to renew the instant motion for an order of reference within sixty (60) days of this decision and order, by providing the Court with necessary and additional documentation.

First, the Court requires proof of the grant of authority from the original mortgagee, CAMBRIDGE HOME CAPITAL, LLC (CAMBRIDGE), to its nominee, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. (MERS), to assign the subject mortgage and note on March 16, 2009 to INDYMAC FEDERAL BANK, FSB (INDYMAC). INDYMAC subsequently assigned the subject mortgage and note to its successor, ONEWEST, on May 14, 2009.

Second, the Court requires an affidavit from Erica A. Johnson-Seck, a conflicted “robo-signer,” explaining her employment status. A “robo-signer” is a person who quickly signs hundreds or thousands of foreclosure documents in a month, despite swearing that he or she has personally reviewed the mortgage documents and has not done so. Ms. Johnson-Seck, in a July 9, 2010 deposition taken in a Palm Beach County, Florida foreclosure case, admitted that she: is a “robo-signer” who executes about 750 mortgage documents a week, without a notary public present; does not spend more than 30 seconds signing each document; does not read the documents before signing them; and, did not provide me with affidavits about her employment in two prior cases. (See Stephanie Armour, “Mistakes Widespread on Foreclosures, Lawyers Say,” USA Today, Sept. 27, 2010; Ariana Eunjung Cha, “OneWest Bank Employee: Not More Than 30 Seconds’ to Sign Each Foreclosure Document,” Washington Post, Sept. 30, 2010).

In the instant action, Ms. Johnson-Seck claims to be: a Vice President of MERS in the March 16, 2009 MERS to INDYMAC assignment; a Vice President of INDYMAC in the May 14, 2009 INDYMAC to ONEWEST assignment; and, a Vice President of ONEWEST in her June 30, 2009-affidavit of merit. Ms. Johnson-Seck must explain to the Court, in her affidavit: her employment history for the past three years; and, why a conflict of interest does not exist in the instant action with her acting as a Vice President of assignor MERS, a Vice President of assignee/assignor INDYMAC, and a Vice President of assignee/plaintiff ONEWEST. Further, Ms. Johnson-Seck must explain: why she was a Vice President of both assignor MERS and assignee DEUTSCHE BANK in a second case before me, Deutsche Bank v Maraj, 18 Misc 3d 1123 (A) (Sup Ct, Kings County 2008); why she was a Vice President of both assignor MERS and assignee INDYMAC in a third case before me, Indymac Bank, FSB, v Bethley, 22 Misc 3d 1119 (A) (Sup Ct, Kings County 2009); and, why she executed an affidavit of merit as a Vice President of DEUTSCHE BANK in a fourth case before me, Deutsche Bank v Harris (Sup Ct, Kings County, Feb. 5, 2008, Index No. 35549/07).

Third, plaintiff’s counsel must comply with the new Court filing requirement, announced yesterday by Chief Judge Jonathan Lippman, which was promulgated to preserve the integrity of the foreclosure process. Plaintiff’s counsel must submit an affirmation, using the new standard Court form, that he has personally reviewed plaintiff’s documents and records in the instant action and has confirmed the factual accuracy of the court filings and the notarizations in these documents. Counsel is reminded that the new standard Court affirmation form states that “[t]he wrongful filing and prosecution of foreclosure proceedings which are discovered to suffer from these defects may be cause for disciplinary and other sanctions upon participating counsel.”

Background

Defendant COVAN DRAYTON (DRAYTON) executed the subject

mortgage and note on January 12, 2007, borrowing $492,000.00 from CAMBRIDGE. MERS “acting solely as a nominee for Lender [CAMBRIDGE]” and “FOR PURPOSES OF RECORDING THIS MORTGAGE, MERS IS THE MORTGAGEE OF RECORD,” recorded the instant mortgage and note on March 19, 2007, in the Office of the City Register of the City of New York, at City Register File Number (CRFN) XXXXXXXXXXXXX. Plaintiff DRAYTON allegedly defaulted in his mortgage loan payment on September 1, 2008. Then, MERS, as nominee for CAMBRIDGE, assigned the instant nonperforming mortgage and note to INDYMAC, on March 16, 2009. Erica A. Johnson-Seck executed the assignment as a Vice President of MERS, as nominee for CAMBRIDGE. This assignment was recorded in the Office of the City Register of the City of New York, on March 24, 2009, at CRFN XXXXXXXXXXXX. However, as will be discussed below, there is an issue whether MERS, as CAMBRIDGE’s nominee, was authorized by CAMBRIDGE, its principal, to assign the subject DRAYTON mortgage and note to plaintiff INDYMAC. Subsequently, almost two months later, Ms. Johnson-Seck, now as a Vice President of INDYMAC, on May 14, 2009, assigned the subject mortgage and note to ONEWEST. This assignment was recorded in the Office of the City Register of the City of New York, on May 22, 2009, at CRFN XXXXXXXXXXXXX. Plaintiff ONEWEST commenced the instant foreclosure action on June 18, 2009 with the filing of the summons, complaint and notice of pendency. On August 6, 2009, plaintiff ONEWEST filed the instant motion for an order of reference. Attached to plaintiff ONEWEST’s moving papers is an affidavit of merit by Erica A. Johnson-Seck, dated June 30, 2009, in which she claims to be a Vice President of plaintiff ONEWEST. She states, in ¶ 1, that “[t]he facts recited herein are from my own knowledge and from review of the documents and records kept in the ordinary course of business with respect to the servicing of this mortgage.” There are outstanding questions about Ms. Johnson-Seck’s employment, whether she executed sworn documents without a notary public present and whether she actually read and personally reviewed the information in the documents that she executed.

July 9, 2010 deposition of Erica A. Johnson-Seck in the Machado case

On July 9, 2010, nine days after executing the affidavit of merit in the instant action, Ms. Johnson-Seck was deposed in a Florida foreclosure action, Indymac Federal Bank, FSB, v Machado (Fifteenth Circuit Court in and for Palm Beach County, Florida, Case No. 50 2008 CA 037322XXXX MB AW), by defendant Machado’s counsel, Thomas E. Ice, Esq. Ms. Johnson-Seck admitted to being a “robo-signer,” executing sworn documents outside the presence of a notary public, not reading the documents before signing them and not complying with my prior orders in the Maraj and Bethley decisions. Ms. Johnson-Seck admitted in her Machado deposition testimony that she was not employed by INDYMAC on May 14, 2009, the day she assigned the subject mortgage and note to ONEWEST, even though she stated in the May 14, 2009 assignment that she was a Vice President of INDYMAC. According to her testimony she was employed on May 14, 2010 by assignee ONEWEST. The following questions were asked and then answered by Ms. Johnson Seck, at p. 4, line 11-p. 5, line 4:

Q. Could you state your full name for the record, please.

A. Erica Antoinette Johnson-Seck.

Q. And what is your business address?

A. 7700 West Parmer Lane, P-A-R-M-E-R, Building D, Austin, Texas 78729.

Q. And who is your employer?

A. OneWest Bank.

Q. How long have you been employed by OneWest Bank?

A. Since March 19th, 2009.

Q. Prior to that you were employed by IndyMac Federal Bank, FSB?

A. Yes.

Q. And prior to that you were employed by IndyMac Bank, FSB?

A. Yes.

Q. Your title with OneWest Bank is what?

A. Vice president, bankruptcy and foreclosure.

Despite executing, on March 16, 2009, the MERS, as nominee for CAMBRIDGE, assignment to INDYMAC, as Vice President of MERS, she admitted that she is not an officer of MERS. Further, she claimed to have “signing authority” from several major banking institutions and the Federal Deposit Insurance Corporation (FDIC). The following questions were asked and then answered by Ms. Johnson-Seck, at p. 6, lines 5-21:

Q. Are you also an officer of Mortgage Electronic Registration Systems?

A. No.

Q. You have signing authority to sign on behalf of Mortgage Electronic Registration Systems as a vice president, correct?

A. Yes.

Q. Are you an officer of any other corporation?

A. No.

Q. Do you have signing authority for any other corporation?

A. Yes.

Q. What corporations are those?

A. IndyMac Federal Bank, Indymac Bank, FSB, FDIC as receiver for Indymac Bank, FDIC as conservator for Indymac, Deutsche Bank, Bank of New York, U.S. Bank. And that’s all I can think of off the top of my head.

Then, she answered the following question about her “signing authority,” at page 7, lines 3-10:

Q. When you say you have signing authority, is your authority to sign as an officer of those corporations?

A. Some.

Deutsche Bank I have a POA [power of attorney] to sign as attorney-in-fact. Others I sign as an officer. The FDIC I sign as attorney-in-fact. IndyMac Bank and IndyMac Federal Bank I now sign as attorney-in-fact. I only sign as a vice president for OneWest. Ms. Johnson-Seck admitted that she is not an officer of MERS, has no idea how MERS is organized and does not know why she signs assignments as a MERS officer. Further, she admitted that the MERS assignments she executes are prepared by an outside vendor, Lender Processing Services, Inc. (LPS), which ships the documents to her Austin, Texas office from Minnesota. Moreover, she admitted executing MERS assignments without a notary public present. She also testified that after the MERS assignments are notarized they are shipped back to LPS in Minnesota. LPS, in its 2009 Form 10-K, filed with the U.S. Securities and Exchange Commission, states that it is “a provider of integrated technology and services to the mortgage lending industry, with market leading positions in mortgage processing and default management services in the U.S. [p. 1]”; “we offer lenders, servicers and attorneys certain administrative and support services in connection with managing foreclosures [p. 4]”; “[a] significant focus of our marketing efforts is on the top 50 U.S. banks [p. 5]”; and, “our two largest customers, Wells Fargo Bank, N.A. and JP Morgan Chase Bank, N.A., each accounted for more than 10% of our aggregate revenue [p. 5].”LPS is now the subject of a federal criminal investigation related to its foreclosure document preparation. (See Ariana Eunjung Cha. “Lender Processing Services Acknowledges Employees Allowed to Sign for Managers on Foreclosure Paperwork,” Washington Post, Oct. 5, 2010). Last week, on October 13, 2010, the Florida Attorney-General issued to LPS an “Economic Crimes Investigative Subpoena Duces Tecum,” seeking various foreclosure documents prepared by LPS and employment records for various “robo-signers.” The following answers to questions were given by Ms. Johnson-Seck in the Machado deposition, at p. 116, line 4-p. 119, line 16:

Q. Now, given our last exchange, I’m sure you will agree that you are not a vice president of MERS in any sense of the word other than being authorized to sign as one?

A. Yes.

Q. You are not —

A. Sorry.

Q. That’s all right. You are not paid by MERS?

A. No.

Q. You have no job duties as vice president of MERS?

A. No.

Q. You don’t attend any board meetings of MERS?

A. No.

Q. You don’t attend any meetings at all of MERS?

A. No.

Q. You don’t report to the president of MERS?

A. No.

Q. Who is the president of MERS?

A. I have no idea.

Q. You’re not involved in any governance of MERS?

A. No.

Q. The authority you have says that you can be an assistant secretary, right?

A. Yes.

Q. And yet you don’t report to the secretary —

A. No.

Q. — of MERS. You don’t have any MERS’ employees who report to you?

A. No.

Q. You don’t have any vote or say in any corporate decisions of MERS?

A. No.

Q. Do you know where the MERS’ offices are located?

A. No.

Q. Do you know how many offices they have?

A. No.

Q. Do you know where they are headquartered?

A. No.

Q. I take it then you’re never been to their headquarters?

A. No.

Q. Do you know how many employees they have?

A. No.

Q. But you know that you have counterparts all over the country signing as MERS’s vice-presidents and assistant secretaries?

A. Yes.

Q. Some of them are employees of third-party foreclosure service companies, like LPS?

A. Yes.

Q. Why does MERS appoint you as a vice president or assistant secretary as opposed to a manager or an authorized agent to sign in that capacity?

A. I don’t know.

Q. Why does MERS give you any kind of a title?

A. I don’t know.

Q. Take me through the procedure for drafting and — the drafting and execution of this Assignment of Mortgage which is Exhibit E.

A. It is drafted by our forms, uploaded into process management, downloaded by LPS staff in Minnesota, shipped to Austin where we sign and notarize it, and hand it back to an LPS employee, who then ships it back to Minnesota, up uploads a copy and mails the original to the firm.

Q. Very similar to all the other document, preparation of all the other documents.

A. (Nods head.)

Q. Was that a yes? You were shaking your head.

A. Yes.

Q. As with the other documents, you personally don’t review any of the information that’s on here —

A. No.

Q. — other than to make sure that you are authorized to sign as the person you’re signing for?

A. Yes.

Q. Okay. As with the other documents, you signed these and took them to be notarized just to a Notary that’s outside your office?

A. Yes.

Q. And they will get notarized as soon as they can. It may or may not be the same day that you executed it?

A. That’s true. Further, with respect to MERS, Ms. Johnson-Seck testified in answering questions, at p. 138, line 2-p. 139, line 17:

Q. Do you have an understanding that MERS is a membership organization?

A. Yes, yes.

Q. And the members are —

A. Yes.

Q. — banking entities such as OneWest?

A. Yes.

Q. In fact, OneWest is a member of MERS?

A. Yes.

Q. Is Deutsche Bank National Trust Company a member of MERS?

A. I don’t know.

Q. Most of the major banking institutions in the Untied States, at least, are members of MERS, correct?

A. That sounds right.

Q. It’s owned and operated by banking institutions?

A. I’m not a big — I don’t, I don’t know that much about the ins and outs of MERS. I’m sorry. I understand what it’s for, but I don’t understand the nitty-gritty.

Q. What is it for?

A. To track the transfer of doc — of interest from one entity to another. I know that it was initially created so that a servicer did not have to record the assignments, or if they didn’t, there was still a system to keep track of the transfer of property.

Q. Does it also have a function to hold the mortgage separate and apart from the note so that note can be transferred from entity to entity to entity, bank to bank to bank —

A. That sounds right.

Q. — without ever having to rerecord the mortgage?

A. That sounds right.

Q. So it’s a savings device. It makes it more efficient to transfer notes?

A. Yes.

Q. And cheaper?

A. Yes. Moreover,

Ms. Johnson-Seck testified that one of her job duties was to sign documents, which at that time took her about ten minutes per day [p. 11]. Further, she admitted, at p. 13, line 11-p. 14, line 15, that she signs about 750 documents per week and doesn’t read each document.

Q. Okay. How many documents would you say that you sign on a week on average, in a week on average?

A. I could have given you that number if you had that question in there because I would brought the report. However, I’m going to guess, today I saw an e-mail that 1,073 docs are in the office for signing. So if we just — and there’s about that a day. So let’s say 6,000 a week and I do probably — let’s see. There’s eight of us signing documents, so what’s the math?

Q. Six thousand divided by eight, that gives me 750..

A. That sounds, that sounds about right.

Q. Okay. That would be a reasonable estimate of how many you sign, you personally sign per week?

A. Yes.

Q. And that would include Lost Note Affidavits, Affidavits of Debt?

A. Yes.

Q. What other kinds of documents would be included in that?

A. Assignments, declarations. I can sign anything related to a bankruptcy or a foreclosure.

Q. How long do you spend executing each document?

A. I have changed my signature considerably. It’s just an E now.

So not more than 30 seconds.

Q. Is it true that you don’t read each document before you sign it?

A. That’s true. [Emphasis added]

Ms. Johnson-Seck, in the instant action, signed her full name on the March 16, 2009 MERS, as nominee for CAMBRIDGE, assignment to INDYMAC. She switched to the letter E in signing the May 14, 2009 INDYMAC to ONEWEST assignment and the June 30, 2009 affidavit of merit on behalf of ONEWEST. Additionally. she testified about how LPS prepares the documents in Minnesota and ships them to her Austin office, with LPS personnel present in her Austin office [pp. 16-17]. Ms. Johnson-Seck described the document signing process, at p. 17, line 6-p. 18, line 18:

Q. Take me through the procedure for getting your actual signature on the documents once they’ve gone through this quality control process?

A. The documents are delivered to me for signature and I do a quick purview to make sure that I’m not signing for an entity that I cannot sign for. And I sign the document and I hand it to the Notary, who notarizes it, who then hands it back to LPS who uploads the document so that the firms know it’s available and they send an original.

Q. “They” being LPS?

A. Yes.

Q. Are all the documents physically, that you were supposed to sign, are they physically on your desk?

A. Yes.

Q. You don’t go somewhere else to sign documents?

A. No.

Q. When you sign them, there’s no one else in your office?

A. Sometimes.

Q. Well, the Notaries are not in your office, correct?

A. They don’t sit in my office, no.

Q. And the witnesses who, if you need witnesses on the document, are not sitting in your office?

A. That’s right.

Q. So you take your ten minutes and you sign them and then you give them to the supervisor of the Notaries, correct?

A. I supervise the Notaries, so I just give them to a Notary.

Q. You give all, you give the whole group that you just signed to one Notary?

A. Yes. [Emphasis added]

Ms. Johnson-Seck testified, at p. 20, line 1-p. 21, line 4 about notaries not witnessing her signature:

Q. I’m mostly interested in how long it takes for the Notary to notarize your signature.

A. I can’t say categorically because the Notary, that’s not the only job they do, so.

Q. In any event, it doesn’t have to be the same day?

A. No.

Q. When they notarize it and they put a date that they’re notarizing it, is it the date that you signed it or is it the date that they’re notarizing it?

A. I don’t know.

Q. When you execute a sworn document, do you make any kind of a verbal acknowledgment or oath to anyone?

A. I don’t know if I know what you’re talking about. What’s a sworn document?

Q. Well, an affidavit.

A. Oh. No.

Q. In any event, there’s no Notary in the room for you to —

A. Right.

Q. — take an oath with you, correct?

A. No there is not.

Q. In fact, the Notaries can’t see you sign the documents; is that correct?

A. Not unless that made it their business to do so?

Q. To peek into your office?

A. Yes. [Emphasis added]

As noted above, I found Ms. Johnson-Seck engaged in “robo-signing” in Deutsche Bank v Maraj and Indymac Bank, FSB, v Bethley. In both foreclosure cases I denied plaintiffs’ motions for orders of reference without prejudice with leave to renew if, among other things, Ms. Johnson-Seck could explain in affidavits: her employment history for the past three years; why she was a Vice President of both assignor MERS and assignee Deutsche Bank National Trust Company in Maraj; and, Vice President of INDYMAC in Bethley. Mr. Ice questioned Ms. Johnson-Seck about my MarajMaraj decision as exhibit M in the Machado deposition. The following colloquy at the Maraj deposition took place at p. 153, line 15-p. 156, line 9. decision and showed her the

Q. Exhibit M is a document that you saw before in your last deposition, correct?

A. Yes.

Q. It’s an opinion from Judge Schack up in New York —

A. Yes.

Q. — correct? You’re familiar with that?

A. Yes.

Q. In it, he says that you signed an Assignment of Mortgage as the vice president of MERS, correct —

A. Yes.

Q. — just as you did in this case? Judge Schack also says that you executed an affidavit as an officer of Deutsche Bank National Trust Company, correct?

A. Yes.

Q. And is that true, you executed an affidavit for Deutsche Bank in that case?

A. That is not true.

Q. You never executed a document as an officer of Deutsche Bank National Trust Company in that case, Judge Schack’s case?

A. Let me just read it so I can — I have to refresh my memory completely.

Q. Okay.

A. I don’t remember. Most likely.

Q. That you did?

A. It sounds reasonable that I may have. I don’t remember, and since it’s not attached, I can’t say.

Q. And as a result, Judge Schack wanted to know if you were engaged in self-dealing by wearing two corporate hats?

A. Yes.

Q. And the court was concerned that there may be fraud on the part of the bank?

A. I guess.

Q. I mean he said that, right?

A. Oh, okay. I didn’t read the whole thing. Okay.

Q. Okay. The court ordered Deutsche Bank to produce an affidavit from you describing your employment history for the past three years, correct?

A. That’s what this says.

Q. Did you do that?

A. No, because we were never — no affidavit ever existed and no request ever came to produce such a document. The last time we spoke, I told you that in-house counsel was reviewing the whole issue and that’s kind of where — and we still haven’t received any communication to produce an affidavit.

Q. From your counsel?

A. From anywhere.

Q. Well, you’re reading Judge Schack’s opinion. He seems to want one. Isn’t that pretty clear on its face.

A. We didn’t get — we never even got a copy of this.

Q. Okay. But now you have it —

A. And —

Q. And you had it when we met at our deposition back in February 5th.

A. And our in-house counsel’s response to this is we were never — this was never requested of me and it was his recommendation not to comply.

Q. What has become of that case?

A. I don’t know.

Q. Was it settled?

A. I don’t know. After a break in the Machado deposition proceedings, Mr. Ice questioned Ms. Johnson-Seck about various documents that were subpoenaed for the July 9, 2010 deposition, including her employment affidavits that I required in both Maraj and Bethley. Ms. Johnson-Seck answered the following questions at p. 159, line 19-p. 161, line 9:

Q. So let’s start with the duces tecum part of you notice, which is the list of documents. No. 1 was: The affidavit of the last three years of deponent’s employment provided to Judge Schack in response to the order dated January 31st, 2008 in the case of Deutsche Bank National Trust Company vs. Maraj, Case No. 25981-07, Supreme Court of New York. We talked about that earlier. There is no such affidavit, correct?

A. Correct.

Q. By the way, why was IndyMac permitted to bring the case in Deutsche Bank’s name in that case?

A. I don’t — I don’t know. Now, errors have been made.

Q. No. 2: The affidavit of the deponent provided to Judge Schack in response to the order dated February 6th, 2009 in the case of IndyMac Bank, FSB vs, Bethley, New York Slip Opinion 50186, New York Supreme Court 2/5/09, “explaining,” and this is in quotes, “her employment history for the past three years; and, why a conflict of interest does not exist in how she acted as vice president of assignee IndyMac Bank, FSB in the instant action, and vice president of both Mortgage Electronic Registrations Systems, Inc. and Deutsche Bank in Deutsche Bank vs. Maraj,” and it gives the citation and that’s the case referred to in item 1 of our request. Do you have that affidavit with you here today?

A. No.

Q. Were you aware of that second opinion where Judge Schack asks for a second affidavit?

A. Nope. Where is Judge Schack sending these?

Q. Presumably to your counsel.

A. I wonder if he has the right address. Maybe that’s what we should do, send Judge Schack the most recent, and I will gladly show up in his court and provide him everything he wants.

Q. Okay. Well, I sent you this back in March. Have your or your counsel or in-house counsel at IndyMac pursued that?

A. No. [Emphasis added] Counsel for plaintiff ONEWEST has leave to produce Ms. Johnson-Seck in my courtroom to “gladly show up . . . and provide [me] . . . everything he wants.”

Discussion

Real Property Actions and Proceedings Law (RPAPL) § 1321 allows the Court in a foreclosure action, upon the default of the defendant or defendant’s admission of mortgage payment arrears, to appoint a referee “to compute the amount due to the plaintiff.” In the instant action, plaintiff ONEWEST’s application for an order of reference is a preliminary step to obtaining a default judgment of foreclosure and sale against defendant DRAYTON. (Home Sav. of Am., F.A. v Gkanios, 230 AD2d 770 [2d Dept 1996]). Plaintiff’s request to withdraw its application for an order of reference is granted. However, to allow this action to continue without seeking the ultimate purpose of a foreclosure action, to obtain a judgment of foreclosure and sale, makes a mockery of and wastes the resources of the judicial system. Continuing the instant action without moving for an order of reference is the judicial equivalent of a “timeout.” Granting a “timeout” to plaintiff ONEWEST to allow it to re-submit “a new application containing new information . . . shortly” is a waste of judicial resources. Therefore, the instant action is dismissed without prejudice, with leave granted to plaintiff ONEWEST to renew its motion for an order of reference within sixty (60) days of this decision and order, if plaintiff ONEWEST and plaintiff ONEWEST’s counsel can satisfactorily address the various issues previously enumerated. Further, the dismissal of the instant foreclosure action requires the cancellation of the notice of pendency. CPLR § 6501 provides that the filing of a notice of pendency against a property is to give constructive notice to any purchaser of real property or encumbrancer against real property of an action that “would affect the title to, or the possession, use or enjoyment of real property, except in a summary proceeding brought to recover the possession of real property.” The Court of Appeals, in 5308 Realty Corp. v O & Y Equity Corp. (64 NY2d 313, 319 [1984]), commented that “[t]he purpose of the doctrine was to assure that a court retained its ability to effect justice by preserving its power over the property, regardless of whether a purchaser had any notice of the pending suit,” and, at 320, that “the statutory scheme permits a party to effectively retard the alienability of real property without any prior judicial review.” CPLR § 6514 (a) provides for the mandatory cancellation of a notice of pendency by:

The Court, upon motion of any person aggrieved and upon such notice as it may require, shall direct any county clerk to cancel a notice of pendency, if service of a summons has not been completed within the time limited by section 6512; or if the action has been settled, discontinued or abated; or if the time to appeal from a final judgment against the plaintiff has expired; or if enforcement of a final judgment against the plaintiff has not been stayed pursuant to section 551. [emphasis added] The plain meaning of the word “abated,” as used in CPLR § 6514 (a) is the ending of an action. “Abatement” is defined as “the act of eliminating or nullifying.” (Black’s Law Dictionary 3 [7th ed 1999]). “An action which has been abated is dead, and any further enforcement of the cause of action requires the bringing of a new action, provided that a cause of action remains (2A Carmody-Wait 2d § 11.1).” (Nastasi v Nastasi, 26 AD3d 32, 40 [2d Dept 2005]). Further, Nastasi at 36, held that the “[c]ancellation of a notice of pendency can be granted in the exercise of the inherent power of the court where its filing fails to comply with CPLR § 6501 (see 5303 Realty Corp. v O & Y Equity Corp., supra at 320-321; Rose v Montt Assets, 250 AD2d 451, 451-452 [1d Dept 1998]; Siegel, NY Prac § 336 [4th ed]).” Thus, the dismissal of the instant complaint must result in the mandatory cancellation of plaintiff ONEWEST’s notice of pendency against the subject property “in the exercise of the inherent power of the court.”

Moreover, “[t]o have a proper assignment of a mortgage by an authorized agent, a power of attorney is necessary to demonstrate how the agent is vested with the authority to assign the mortgage.” (HSBC Bank, USA v Yeasmin, 27 Misc 3d 1227 [A], *3 [Sup Ct, Kings County 2010]). “No special form or language is necessary to effect an assignment as long as the language shows the intention of the owner of a right to transfer it [Emphasis added].” (Tawil v Finkelstein Bruckman Wohl Most & Rothman, 223 AD2d 52, 55 [1d Dept 1996]). (See Suraleb, Inc. v International Trade Club, Inc., 13 AD3d 612 [2d Dept 2004]). MERS, as described above, recorded the subject mortgage as “nominee” for CAMBRIDGE. The word “nominee” is defined as “[a] person designated to act in place of another, usu. in a very limited way” or “[a] party who holds bare legal title for the benefit of others.” (Black’s Law Dictionary 1076 [8th ed 2004]). “This definition suggests that a nominee possesses few or no legally enforceable rights beyond those of a principal whom the nominee serves.” (Landmark National Bank v Kesler, 289 Kan 528, 538 [2009]). The Supreme Court of Kansas, in Landmark National Bank, 289 Kan at 539, observed that: The legal status of a nominee, then, depends on the context of the relationship of the nominee to its principal. Various courts have interpreted the relationship of MERS and the lender as an agency relationship. See In re Sheridan, 2009 WL631355, at *4 (Bankr. D. Idaho, March 12, 2009) (MERS “acts not on its own account. Its capacity is representative.”); Mortgage Elec. Registrations Systems, Inc. v Southwest,La Salle Nat. Bank v Lamy, 12 Misc 3d 1191 [A], at *2 [Sup Ct, Suffolk County 2006]) . . . (“A nominee of the owner of a note and mortgage may not effectively assign the note and mortgage to another for want of an ownership interest in said note and mortgage by the nominee.”) The New York Court of Appeals in MERSCORP, Inc. v Romaine (8 NY3d 90 [2006]), explained how MERS acts as the agent of mortgagees, holding at 96: In 1993, the MERS system was created by several large participants in the real estate mortgage industry to track ownership interests in residential mortgages. Mortgage lenders and other entities, known as MERS members, subscribe to the MERS system and pay annual fees for the electronic processing and tracking of ownership and transfers of mortgages. Members contractually agree to appoint MERS to act as their common agent on all mortgages they register in the MERS system. [Emphasis added] 2009 Ark. 152 ___, ___SW3d___, 2009 WL 723182 (March 19, 2009) (“MERS, by the terms of the deed of trust, and its own stated purposes, was the lender’s agent”);

Thus, it is clear that MERS’s relationship with its member lenders is that of agent with principal. This is a fiduciary relationship, resulting from the manifestation of consent by one person to another, allowing the other to act on his behalf, subject to his control and consent. The principal is the one for whom action is to be taken, and the agent is the one who acts.It has been held that the agent, who has a fiduciary relationship with the principal, “is a party who acts on behalf of the principal with the latter’s express, implied, or apparent authority.” (Maurillo v Park Slope U-Haul, 194 AD2d 142, 146 [2d Dept 1992]). “Agents are bound at all times to exercise the utmost good faith toward their principals. They must act in accordance with the highest and truest principles of morality.” (Elco Shoe Mfrs. v Sisk, 260 NY 100, 103 [1932]). (See Sokoloff v Harriman Estates Development Corp., 96 NY 409 [2001]); Wechsler v Bowman, 285 NY 284 [1941]; Lamdin v Broadway Surface Advertising Corp., 272 NY 133 [1936]). An agent “is prohibited from acting in any manner inconsistent with his agency or trust and is at all times bound to exercise the utmost good faith and loyalty in the performance of his duties.” (Lamdin, at 136). Therefore, in the instant action, MERS, as nominee for CAMBRIDGE, is an agent of CAMBRIDGE for limited purposes. It can only have those powers given to it and authorized by its principal, CAMBRIDGE. Plaintiff ONEWEST has not submitted any documents demonstrating how CAMBRIDGE authorized MERS, as nominee for CAMBRIDGE, to assign the subject DRAYTON mortgage and note to INDYMAC, which subsequently assigned the subject mortgage and note to plaintiff ONEWEST. Recently, in Bank of New York v Alderazi,Lippincott v East River Mill & Lumber Co., 79 Misc 559 [1913]) and “[t]he declarations of an alleged agent may not be shown for the purpose of proving the fact of agency.” (Lexow & Jenkins, P.C. v Hertz Commercial Leasing Corp., 122 AD2d 25 [2d Dept 1986]; see also Siegel v Kentucky Fried Chicken of Long Is. 108 AD2d 218 [2d Dept 1985]; Moore v Leaseway Transp/ Corp., 65 AD2d 697 [1st Dept 1978].) “[T]he acts of a person assuming to be the representative of another are not competent to prove the agency in the absence of evidence tending to show the principal’s knowledge of such acts or assent to them.” (Lexow & Jenkins, P.C. v Hertz Commercial Leasing Corp., 122 AD2d at 26, quoting 2 NY Jur 2d, Agency and Independent Contractors § 26). Plaintiff has submitted no evidence to demonstrate that the original lender, the mortgagee America’s Wholesale Lender, authorized MERS to assign the secured debt to plaintiff. Therefore, in the instant action, plaintiff ONEWEST failed to demonstrate how MERS, as nominee for CAMBRIDGE, had authority from CAMBRIDGE to assign the DRAYTON mortgage to INDYMAC. The Court grants plaintiff ONEWEST leave to renew its motion for an order of reference, if plaintiff ONEWEST can demonstrate how MERS had authority from CAMBRIDGE to assign the DRAYTON mortgage and note to INDYMAC. Then, plaintiff ONEWEST must address the tangled employment situation of “robo-signer” Erica A. Johnson-Seck. She admitted in her July 9, 2010 deposition in the Machado case that she never provided me with affidavits of her employment for the prior three years and an explanation of why she wore so-many corporate hats in Maraj and Bethley. Further, in Deutsche Bank v Harris, Ms. Johnson-Seck executed an affidavit of merit as Vice President of Deutsche Bank. If plaintiff renews its motion for an order of reference, the Court must get to the bottom of Ms. Johnson-Seck’s employment status and her “robo-signing.” The Court reminds plaintiff ONEWEST’s counsel that Ms. Johnson-Seck, at p. 161 of the Machado deposition, volunteered, at lines 4-5 to “gladly show up in his court and provide him everything he wants.” Lastly, if plaintiff ONEWEST’S counsel moves to renew its application for an order of reference, plaintiff’s counsel must comply with the new filing requirement to submit, under penalties of perjury, an affirmation that he has taken reasonable steps, including inquiring of plaintiff ONEWEST, the lender, and reviewing all papers, to verify the accuracy of the submitted documents in support of the instant foreclosure action. According to yesterday’s Office of Court Administration press release, Chief Judge Lippman said: We cannot allow the courts in New York State to stand by idly and be party to what we now know is a deeply flawed process, especially when that process involves basic human needs — such as a family home — during this period of economic crisis. This new filing requirement will play a vital role in ensuring that the documents judges rely on will be thoroughly examined, accurate, and error-free before any judge is asked to take the drastic step of foreclosure. 28 Misc 3d at 379-380, my learned colleague, Kings County Supreme Court Justice Wayne Saitta explained that: A party who claims to be the agent of another bears the burden of proving the agency relationship by a preponderance of the evidence (

(See Gretchen Morgenson and Andrew Martin, Big Legal Clash on Foreclosure is Taking Shape, New York Times, Oct. 21, 2010; Andrew Keshner, New Court Rules Says Attorneys Must Verify Foreclosure Papers, NYLJ, Oct. 21, 2010).

Conclusion

Accordingly, it is

ORDERED, that the request of plaintiff ONEWEST BANK, F.S.B., to withdraw its motion for an order of reference, for the premises located at 962 Hemlock Street, Brooklyn, New York (Block 4529, Lot 116, County of Kings), is granted; and it is further

ORDERED, that the instant action, Index Number 15183/09, is dismissed without prejudice; and it is further

ORDERED, that the notice of pendency in the instant action, filed with the Kings County Clerk on June 18, 2009, by plaintiff ONEWEST BANK, F.S.B., to foreclose a mortgage for real property located at 962 Hemlock Street, Brooklyn, New York (Block 4529, Lot 116, County of Kings), is cancelled; and it is further

ORDERED, that leave is granted to plaintiff, ONEWEST BANK, F.S.B., to renew, within sixty (60) days of this decision and order, its motion for an order of reference for the premises located at 962 Hemlock Street, Brooklyn, New York (Block 4529, Lot 116, County of Kings), provided that plaintiff, ONEWEST BANK, F.S.B., submits to the Court: (1) proof of the grant of authority from the original mortgagee, CAMBRIDGE CAPITAL, LLC, to its nominee, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC., to assign the subject mortgage and note to INDYMAC FEDERAL BANK, FSB; and (2) an affidavit by Erica A. Johnson-Seck, Vice President of plaintiff ONEWEST BANK, F.S.B., explaining: her employment history for the past three years; why a conflict of interest does not exist in how she acted as a Vice President of assignor MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC., a Vice President of assignee/assignor INDYMAC FEDERAL BANK, FSB, and a Vice President of assignee/plaintiff ONEWEST BANK, F.S.B. in this action; why she was a Vice President of both assignor MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. and assignee DEUTSCHE BANK in Deutsche Bank v Maraj, 18 Misc 3d 1123 (A) (Sup Ct, Kings County 2008); why she was a Vice President of both assignor MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. and assignee INDYMAC BANK, FSB in Indymac Bank, FSB, v Bethley, 22 Misc 3d 1119 (A) (Sup Ct, Kings County 2009); and, why she executed an affidavit of merit as a Vice President of DEUTSCHE BANK in Deutsche Bank v Harris (Sup Ct, Kings County, Feb. 5, 2008, Index No. 35549/07); and (3) counsel for plaintiff ONEWEST BANK, F.S.B. must comply with the new Court filing requirement, announced by Chief Judge Jonathan Lippman on October 20, 2010, by submitting an affirmation, using the new standard Court form, pursuant to CPLR Rule 2106 and under the penalties of perjury, that counsel for plaintiff ONEWEST BANK, F.S.B. has personally reviewed plaintiff ONEWEST BANK, F.S.B.’s documents and records in the instant action and counsel for plaintiff ONEWEST BANK, F.S.B. confirms the factual accuracy of plaintiff ONEWEST BANK, F.S.B.’s court filings and the accuracy of the notarizations in plaintiff ONEWEST BANK, F.S.B.’s documents.

This constitutes the Decision and Order of the Court.

[ipaper docId=40499638 access_key=key-1n9ja8i2jfczxnt1epea height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

![[NYSC] Judge Restrains EMC MTG, MERS From Foreclosing For FRAUDULENT ASSIGNMENTS](https://stopforeclosurefraud.com/wp-content/themes/gazette/thumb.php?src=wp-content/uploads/2011/01/fraud24.jpg&w=100&h=57&zc=1&q=90)

![[NYSC] Judge Orders JPMorgan Chase “TO SHOW CAUSE”: JPMORGAN CHASE v. SCISSURA](https://stopforeclosurefraud.com/wp-content/themes/gazette/thumb.php?src=wp-content/uploads/2010/12/showcause.jpg&w=100&h=57&zc=1&q=90)

![[NYSC] JUDGE SCHACK Tears up WaMU’s Counsel For “Defective Verification, Phony NY House Counsel” WAMU v. PHILLIP](https://stopforeclosurefraud.com/wp-content/themes/gazette/thumb.php?src=wp-content/uploads/2010/12/LawyerForHire.jpg&w=100&h=57&zc=1&q=90)

![[NYSC] JUDGE SCHACK TAKES ON ROBO-SIGNER ERICA JOHNSON SECK: ONEWEST BANK v. DRAYTON (3)](https://stopforeclosurefraud.com/wp-content/themes/gazette/thumb.php?src=wp-content/uploads/2010/10/2strikes.jpg&w=100&h=57&zc=1&q=90)

![[NYSC] JUDGE SCHACK TAKES ON ROBO-SIGNER ERICA JOHNSON SECK: DEUTSCHE BANK v. HARRIS (2)](https://stopforeclosurefraud.com/wp-content/themes/gazette/thumb.php?src=wp-content/uploads/2010/10/Fraud_11.jpg&w=100&h=57&zc=1&q=90)

![[NYSC] JUDGE SCHACK TAKES ON ROBO-SIGNER ERICA JOHNSON SECK: DEUTSCHE BANK v. MARAJ (1)](https://stopforeclosurefraud.com/wp-content/themes/gazette/thumb.php?src=wp-content/uploads/2010/10/002_arthur_schack-300x300.jpg&w=100&h=57&zc=1&q=90)

Recent Comments