In re: WALTER RALPH PINEDA, Debtor(s).

WALTER RALPH PINEDA, Plaintiff(s),

v.

BANK OF AMERICA, N.A., et al, Defendant(s).

Case No. 10-91936-E-7, Adv. Pro. No. 10-9060, Docket Control No. WRP-5.

United States Bankruptcy Court, E.D. California, Modesto Division.

March 15, 2011.

NOT FOR PUBLICATION

MEMORANDUM FOR ISSUANCE OF TEMPORARY RESTRAINING ORDER

RONALD H. SARGIS, Bankruptcy Judge

The court has been presented with a Motion for Injunctive Relief and Ex Parte Application for a Temporary Restraining Order filed by Walter R. Pineda, a pro se plaintiff in this adversary proceeding. The Motion was presented the court at 4:00 p.m. on March 14, 2011. In the Motion Mr. Pineda asserts that Bank of America Corp, LP, a defendant, intends to conduct a non-judicial foreclosure sale at 3:00 p.m. on March 15, 2011, for real property commonly known as 22550 Bennett Road, Sonora, California (“Bennett Road Property”). The Bennet Road Property is listed on Schedule A as real property owned by the Debtor and his unnamed spouse, with a value of $210,000.00 Schedule A, Docket Entry No. 16, Case No. 10-91936.

The Debtor commenced a voluntary Chapter 7 case on May 20, 2010. The petition lists the Bennett Road Property as his street address. The nature of the Debtor’s business is listed as “Law.” The petition further states that the Debtor has not filed any prior bankruptcy cases within the last 8 years. Petition, Docket Entry No. 1, Case No. 10-91936.

On Schedule D filed by the Debtor on June 14, 2010, the Debtor lists the Bank of New York Mellon as his only creditor having a secured claim. He states under penalty of perjury that there is a codebtor, that the date the claim was incurred, nature of the lien, and description of collateral is “Unknown,” the value of the unknown collateral is $10.00, and the amount of the claim is $10.00. Docket Entry No. 18. In the original Schedule D filed on June 3, 2010, the Debtor stated under penalty of perjury that Bank of America had a claim for a debt incurred on August 13, 2002, secured by a deed of trust against the Bennett Road Property, that the Bennett Road Property had a value of $300,000.00, and that the Bank’s disputed claim was for $477,894.27. Nothing in the court’s file indicates which statement under penalty of perjury is true and correct.

The Motion asserts that by proceeding with a trustee’s sale under the deed of trust, Bank of America Corp., LP is attempting to usurp the court’s authority with respect to this adversary proceeding, and is in violation of Rule 7001, Federal Rules of Civil Procedure (which states the matters for which an adversary proceeding is required), and Rule 65, Federal Rules of Civil Procedure, and Rule 7065, Federal Rules of Bankruptcy Procedure, (injunctive relief). The Motion does not assert how a non-judicial foreclosure sale usurps the court’s power relating to adversary proceedings and injunctive relief. The court construes this contention to be that if the foreclosure sale is allowed to proceed, the court will be unable to grant the relief requested by the Debtor in the Complaint.

The Debtor next contends that he will suffer immediate, irreparable injury, loss or damage in that Plaintiff/Debtor’s “current poor, physical condition will worsen and Plaintiff will become homeless balanced against adding another vacant home to Defendant’s hundreds of thousands of vacant homes inventory.” Motion, pg. 2:17-20. The Debtor/Plaintiff further alleges that a non-judicial foreclosure will impair the administration of the Chapter 7 case, but does not identify the potential impairment.

The Debtor has filed a document titled affidavit in support of the Motion in which he states that he is currently under treatment for a deteriorating transplanted liver and will become homeless in the event of a sale. Further, that failure to grant the restraining order will result in the Debtor/Plaintiff being denied the protection of the injunctive relief rules, as well as frustrating (in an unstated way) the administration of the Chapter 7 case. The “Affidavit” further states that he called the law office for Bank of America’s attorneys and advised them that he was seeking a temporary restraining order. Though this document is not in the proper form or notarized as an affidavit and does not state that it is under penalty of perjury so as to be a declaration, the court takes into account that the Debtor is representing himself in pro se, and for purposes of this ex parte Motion will consider the statements as being made under penalty of perjury.

On January 25, 2010, Bank of America, N.A., as the alleged beneficiary under the deed of trust, instructed ReconTrust Company, N.A. to file a notice of default. The deed of trust, Exhibit 4, names PRLAP, Inc. as the trustee and not ReconTrust Company, N.A. On February 9, 2010, Bank of America an assignment of trust deed and a substitution of trustee, naming ReconTrust Company as the trustee. It is alleged that this assignment was for the purpose of misrepresenting who is the owner of the note and deed of trust. Debtor/Plaintiff further contends that Bank of America, N.A. and ReconTrust Company improperly commenced the nonjudicial foreclosure in violation of California Civil Code Sections 2924a et. seq.

Debtor/Plaintiff further alleges that on May 2, 2010, he was notified that a nonjudcial foreclosure sale would be conducted at 3:30 p.m. pursuant to the deed of trust. It is contended that such sale was improper because Bank of America and ReconTrust Company did not have the authority to conduct a nonjudical foreclosure sale.

Summary of Complaint

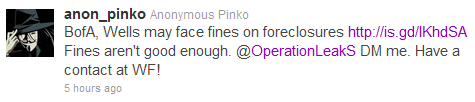

The court has reviewed the First Amended Complaint filed in this Adversary Proceeding, Docket Entry No. 57. The Debtor/Plaintiff first asserts a series of claims against Bank of America, N.A. and other Defendants arising under the Real Estate Settlement Procedures Act (RESPA, 12 U.S.C. 2601 et seq.), Truth in Lending Act (15 U.S.C. § 1600 et. seq.), Fraud (California Civil Code § 1709), California Unfair Business Practices Act (California Civil Code § 17200 et seq.), and breach of contract. The gist of the complaint is that various improper conduct has existed with respect to loan foreclosures throughout the country. This is commonly referred to as the Robo-Signing investigations. It is alleged that the Defendants have refused to provide the Debtor/Plaintiff with an accounting as required under 12 U.S.C. § 2605(a)(1)(A), (f), which has caused Debtor/Plaintiff unstated pecuniary damages. Much of this part of the complaint appears to focus on default swaps, obtaining funds from investors, credit obtained by Defendants, securitized loan pools into which the note was transferred. These allegations do not go to the question of whether the Debtor/Plaintiff has defaulted on his particular loan. At no point in the Complaint or present motion does the Debtor/Plaintiff assert that he is current on the obligations secured by the Deed of Trust. Rather, the contention appears to be that based upon the post-loan financial transactions of the Defendants, monies they received from third-parties from the sale and brokering of the note should be treated as payments on the Note.

It is also asserted that neither Bank of America, N.A. or ReconTrust Company are authorized as agents of the Bank of New York Mellon, the alleged trustee of the trust in which the Debtor/Plaintiff’s note has been transferred to initiate the nonjudical foreclosure process. It is further contended that the nonjudical foreclosure process is an attempt to swindle the property from the Debtor/Plaintiff. Through this second cause of action the Debtor/Plaintiff seeks a determination of the rights of the respective parties.

In reviewing the exhibits filed with the original complaint, there is a May 7, 2010 letter from Bank of America, to the Debtor/Plaintiff stating that it was servicing the loan for the Bank of New York, the investor. The letter does not explain what is meant by referencing the Bank of New York as an investor. However, the letter does clearly state that Bank of America is the entity servicing the loan, though that position is not explained in the letter. Finally, this letter unequivocally states that “Bank of America did not sell your loan at anytime.”

The Debtor/Plaintiff has attached as Exhibit 2 an April 6, 2010 letter from Bank of America to the Debtor/Plaintiff which states that a copy of the complete loan history is attached. (The Debtor/Plaintiff did not include the loan history as part of the exhibit.) This letter states that “The Bank of New York Mellon, fka The Bank of New York, as trustee for the certificate holders of GSR 2003-9…” is the owner of the Note. This appears to conflict with the May 7, 2010 letter stating to the Debtor/Plaintiff that the note has never been sold. Additionally, the letter identifies the Bank of New York Mellon as the trustee for the “certificate holders” of the trust, and not as a trustee of the trust itself.

The Debtor/Plaintiff also contends that the Substitution of Trustee and Assignment of Deed of Trust recorded by Bank of America on February 9, 2010, Exhibit 8 is false as there is no basis for showing that it had the authority to do so at that time. The document purports to assign all beneficial interest in the deed of trust from Bank of America, N.A. to Bank of America, N.A., as servicer for GSR Mortgage Loan Trust 2003-9. This purported assignment was made three months prior to the May 7, 2010 letter in which Bank of America advised the Debtor/Plaintiff that Bank of America never sold the loan at any time.

The Debtor/Plaintiff has attached as Exhibit 10 the notice of default issued with respect to the Note and Deed of Trust. This notice was recorded on January 25, 2010 and states that ReconTrust Company is acting as the agent for the beneficiary under the Deed of Trust. At this juncture, based upon the allegations in the complaint, Bank of New York Mellon was the owner of the Note, as the trustee of the GSR Mortgage Loan Trust 2003-9 (the court is presuming that the reference by Bank of America to Bank of New York Mellon being the trustee for the certificate holders actually means the trustee of the trust for which the beneficiaries are certificate holders). The purported assignment of the Deed of Trust to Bank of America, as servicer did not occur until February 2010, after the notice of default was issued and recorded.

From the court’s survey of California law, an assignment of the note carries the mortgage with it, while an assignment of the mortgage alone is a nullity. Carpenter v. Longan, 83 U.S. 271, 274 (1872); accord Henley v. Hotaling, 41 Cal. 22, 28 (1871); Seidell v. Tuxedo Land Co., 216 Cal. 165, 170 (1932). If one party receives the note and another receives the deed of trust, the holder of the note prevails regardless of the order in which the interests were transferred. Adler v. Sargent, 109 Cal. 42, 49-50 (1895). “Where a power to sell real property is given to a mortgagee, or other encumbrancer, in an instrument intended to secure the payment of money, the power is part of the security and vests in any person by assignment becomes entitled to payment of the money secured by the instrument. The power of sale may be exercised by the assignee if the assignment is duly acknowledged and recorded.” California Civil Code § 2932.5.

The Debtor/Plaintiff also alleges that the Defendants have breach their contractual obligations arising under the Note and Deed of Trust. The alleged breaches include instructing ReconTrust to file the notice of default; failure to advise the Debtor/Plaintiff of the transfer of the Note; failing to account for the monies received in the transfers, securitization, and credit default swaps; and using the note in the GSR Trust. Debtor/Plaintiff asserts that his damages include the drop in real estate values due to the Defendants “reckless, irresponsible, and greedy conduct” in the home mortgage market in the 2000’s.

In light of the Debtor/Plaintiff’s pro se status, it also appears that the Complaint seeks to enjoin the Defendants from proceeding with a non-judicial foreclosure sale peding a determination of who owns the note and who is the beneficiary of under the Deed of Trust.

STATUS OF ADVERSARY PROCEEDING

The Adversary Proceeding was filed August 20, 2010. No answer has been filed, with the Defendants having filed several motions attacking the complaint. These have been denied without prejudice. On January 28, 2011 the Debtor/Plaintiff, Bank of America, N.A., ReconTrust Company, N.A., Bank of New York Mellon, N.A., Inc., and Goldman Sachs, Inc. (GSR Mortgage Loan Trust 2003-9) filed a stipulation extending the deadline for Debtor/Plaintiff to file a first amended complaint. The First Amended Complaint was filed on February 4, 2011, and the Defendants have filed a Motion to Dismiss which is set for hearing on April 6, 2011. It appears that the Motion to Dismiss directly attacks the issues raised in the Complaint and are inexorably tied to the issuance of injunctive relief in this case.

RULING

Though the Debtor/Plaintiff appears to have staked his case on contentions and allegations which have nothing to do with his performance on the Note — making the payments promised for the monies borrowed, he does raise a credible issue as to who owns the note, and under California law, who is the beneficiary entitled to enforce the Note. At this early juncture, it appears that by the time Bank of America sought to “assign” the beneficial interest to itself as servicer, the Note had been transferred to The Bank of New York Mellon, as Trustee. Since the obligation was owed to the Bank of New York Mellon, as Trustee, it appears that it is this bank that holds the beneficial interest.

The parties must properly address who holds the note and has the right to enforce the beneficial interest. The court issues the Temporary Restraining Order to maintain the status quo pending the hearing on the motion to dismiss. If the parties elect to extend the term of the Temporary Restraining Order so as to allow the hearing on the preliminary injunction to April 6, 2011, the court will do so for the convenience of the parties.

Pursuant to Rule 65, Federal Rules of Civil Procedure, and Rule 7065, Federal Rules of Bankruptcy Procedure, the court may issue a temporary restraining order without notice if there is a clear showing of immediate and irreparable harm. As stated above, the court accepts the pro se Debtor/Plaintiff’s statements in the Motion for Temporary Restraining Order as being stated under penalty of perjury. The court shall not grant the Debtor/Plaintiff shall liberties in the future, and even the pro se plaintiff must comply with basic requirements for pleadings and evidence.

In balancing the hardships, there appears to be little hardship for the Defendants as they have been litigating this case since August 2010, and are operating under a stipulated time line. Further, it appears that the automatic stay continues in full force and effect in this case as to property of the estate, even though the Debtor/Plaintiff has been discharged. The bankruptcy case has not been closed and the property has not been abandoned by the Chapter 7 Trustee. 11 U.S.C. § 362(c)(2). If the automatic stay does not apply, then there is potential significant harm to the Debtor/Plaintiff by clouding title to the property through a purported valid non-judicial foreclosure sale or a potential third-party purchasing the property at the sale. The potential loss of his interest in the real property is potential irreparable harm sufficient for the issuance of this preliminary injunction.

At this juncture and given that the parties are already in the process of addressing the issues in the Motion to Dismiss of whether there are even valid claims pled, the court finds that no bond is required pending the hearing on the preliminary injunction. In granting this Temporary Restraining Order, the Debtor/Plaintiff should not be misled into thinking that the court has determined that the various claims and assertions attacking the home mortgage market in the 2000’s, Robo-Signing, and post-Pineda loan transactions by financial institutions are meritorious with respect to the obligations owed by the Debtor/Plaintiff on the Note that is secured by the Deed of Trust. Debtor/Plaintiff shall have to carry his burden for any such claims at the hearing on the motion for preliminary injunction, as well as the facts at his for his specific loan, payments made by him on his specific loan, the balance due on his loan, and why the holder of the note, whomever it is, should not be allowed to foreclose based on the borrower’s (Pineda’s) failure to make payments for the monies borrowed.

The court shall issue a Temporary Restraining Order and set the hearing on the Preliminary Injunction for 10:30 a.m. on March 23, 2011, at the United States Bankruptcy Court, 1200 I Street, Modesto, California.

[ipaper docId=51089394 access_key=key-2i7363f423r2g8akxgmn height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

-0.31 (-2.36%)

-0.31 (-2.36%)

![[NYSC] MODIFICATION GONE WILD! BAC Home Loans Servicing v Westervelt](https://stopforeclosurefraud.com/wp-content/themes/gazette/thumb.php?src=wp-content/uploads/2010/11/signs.jpg&w=100&h=57&zc=1&q=90)

Recent Comments