False Statements

R.K. Arnold

Mortgage Electronic Registration Systems

Action Date: November 18, 2010

Location: WASHINGTON, DC

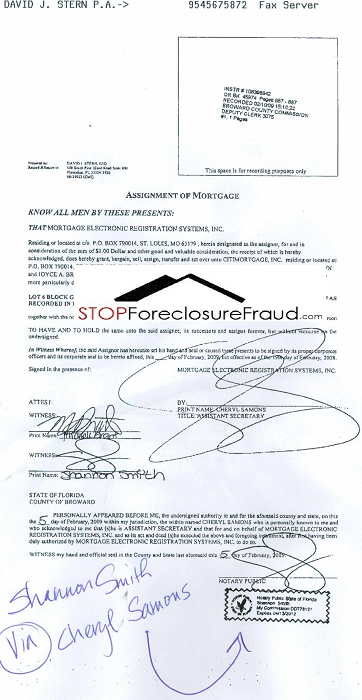

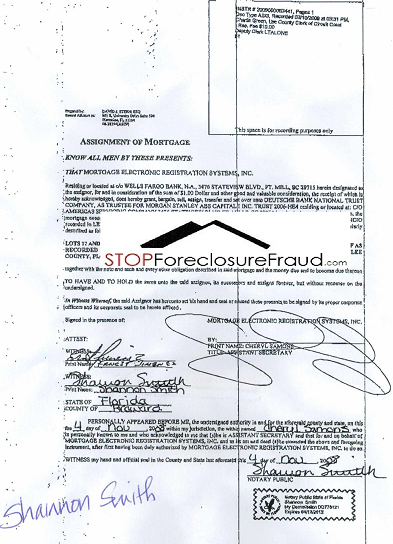

As the many problems (frauds) are exposed regarding documents used by mortgage-backed trusts in foreclosures, some revelations stand out. Literally millions of foreclosures by mortgage-backed trusts hinge on a Mortgage Assignment signed by an officer of Mortgage Electronic Registration Systems (“MERS”) showing that the mortgage in question was transferred to the trust by MERS. The “MERS officer” who signs the Mortgage Assignment is actually most often an employee of a mortgage servicing company that is paid by the trust.

MERS itself has only 50 employees and they are not involved in signing mortgage assignments to trusts. These servicing company employees sign as officers of MERS “as nominee for” a particular mortgage company or bank. They are not employees of the mortgage companies or employees of the original named lender, but their titles on the Mortgage Assignment belie this and typically read: “Linda Green, Vice President, Mortgage Electronic Registration Systems, Inc., as nominee for American Brokers Conduit.”

MERS president R.K. Arnold testified in Senate testimony earlier this week that there are over 20,000 MERS “certifying officers.” To become a MERS certifying officer, a mortgage servicing company employee need only complete an online form and pay $25.00. Because of the concealment of the actual employer on the Mortgage Assignments, it is easy enough for Courts, and homeowners, to believe that they are examining a document prepared by the lender that sold the mortgage to the trust, when, in fact, the signer was a servicing company clerk paid by the trust itself.

The representative of the GRANTOR is, in truth, a paid employee of the GRANTEE. In hundreds of thousands of cases, the authority is, therefore, misrepresented. It is now also coming to light that in tens of thousands of cases, the individuals signing these forms did not even sign their own names. The documents were made to look official because other mortgage servicing company employees signed as witnesses and then all four “signatures” were notarized by yet another mortgage servicing company employee. The titles were false, the signatures were forged, the “witnessing” was a lie, as was the notarization. Despite all of these false statements, the BIGGEST LIE on these documents is that the trust acquired the mortgage on the date stated plainly on the Mortgage Assignment. In truth, no such transfers ever took place as represented by these MERS certifying officers (or their stand-in forgers). The date chosen almost always corresponds not to an actual transfer, but to the date roughly corresponding to the time the loan went into default. The Mortgage Assignment was prepared only to provide “proof” that the trust owned the mortgage. Until courts require Trusts to come forward with actual proof that they acquired the mortgages in question, specifying whom they paid and how much they paid for each such trust-owned mortgage, the actual owner of these mortgages will never be known.

In response to the exposure of the widespread fraud in the securitization process, the American Bankers Association issued a statement essentially saying that Mortgage Assignments were unnecessary. Investors and regulators were told, however, that the trusts owned the mortgages and notes in each pool of mortgages and that valid Assignments of Mortgages had been obtained. Where the proof of ownership put forth by the trusts is a sworn statement by a MERS “certifying officer” who had no knowledge whatsoever of the transactions involved and did not even review documents related to the transactions, such proof of ownership should be deemed worthless by the Courts. Other litigants are not allowed to manufacture their own evidence and offer it as proof at trial – there should be no exception for mortgage-backed trusts.

In particular, where the “MERS Certifying Officer” is actually an employee of the law firm hired to handle the foreclosure, such documents should be stricken and sanctioned. “MERS Certifying Officers” should be the next group required to testify before Congress. Here are the statistics for one Florida county, Palm Beach County, regarding the number of Mortgage Assignments filed by Mortgage Electronic Registration Systems: January, 2009: 1,164; February, 2009: February, 2009: 1,230; March, 2009: March, 2009: 1,113. An examination of just one day’s (March 31, 2009) filed Mortgage Assignments reveals that the signers of these Assignments are the very same mortgage servicing company employees who signed the “no-actual knowledge” Affidavits that triggered the national scrutiny: Jeffrey Stephan from Ally, Erica Johnson-Seck from IndyMac, Crystal Moore from Nationwide Title Clearing, Liquenda Allotey from Lender Processing Services, Denise Bailey from Litton Loan Services, Noriko Colston, Krystal Hall, and other well-known professional signers from the mortgage servicing industry. The most frequent signers from that particular day were two lawyers, associates in the law firm representing the trusts, who signed as Assistant Secretary for Mortgage Electronic Registration Systems.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Recent Comments