Oct. 12 (Bloomberg) — Elizabeth Warren, the White House adviser in charge of forming the Consumer Financial Protection Bureau, discusses her first month on the job, the need for U.S. lenders to simplify home mortgage paperwork and the outlook for financial industry regulation. Warren, speaking with Margaret Brennan on Bloomberg Television’s “InBusiness.” (Source: Bloomberg)

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Archive | foreclosures

VIDEO: ELIZABETH WARREN “THIS IS A VERY BIG PROBLEM” On FORECLOSURE FRAUD

Posted on 12 October 2010.

Posted in elizabeth warren, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, Moratorium, mortgage, servicers4 Comments

WELLS FARGO Screws Mother with Two Autistic Children!

Posted on 12 October 2010.

Wells Fargo asked this mother raising autistic twins to send in $2,300 dollars in return to freeze the foreclosure and reach a settlement…they never did. But took her money anyway.

“I’m going to lose everything,” she said, sitting on the front porch of the two story home. Wells Fargo Bank plans to foreclose on the house Thursday. “The American Dream to me is just a lie. I did what I was supposed to do. And they don’t want to help me.”

In Missouri all a lender needs to do is send a letter to foreclose on your house.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in foreclosure, foreclosure fraud, foreclosure mills, foreclosures, settlement, wells fargo2 Comments

Law Office Of David J. Stern Confirms Layoffs

Posted on 12 October 2010.

In all seriousness this is never good news for anyone. These are workers who may have families to feed and may not be able to find jobs easily like Tammie Lou Kapusta said in her deposition, “I’ve actually had such a difficult time getting a job because I worked at David Stern’s office“.

Mr. Stern once told investors, “We take it from Cradle to Grave“.

According to South Florida Business Journal:

Jeffrey Tew, Stern’s attorney, confirmed that there were layoffs, and that it was because several key lenders had frozen prosecution of foreclosure cases. Tew, a partner at Tew Cardenas LLP in Miami, said it was only normal that some cutbacks had to occur as work slowed. He said most of the layoffs were temporary positions.

Related:

Mind-blowing Highlights from David J. Stern “DJSP Enterprise” Conference With Audio

.

EXPLOSIVE DEPOSTION!!!! BUSTED!! DAVID J. STERN “MILL” KNEW THIS ALL ALONG…THIS FORECLOSURE FRAUD!!!

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in djsp enterprises, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, investigation, Law Offices Of David J. Stern P.A., STOP FORECLOSURE FRAUD2 Comments

Full Deposition of Residential Funding/GMAC JUDY FABER: US BANK v. Cook

Posted on 12 October 2010.

Make sure you read this carefully…This is a transcript of an employee of Residential Funding Company who is in charge of record keeping of original documents. Don’t miss the full deposition down below.

Follow the assets, don’t get lost in the trail…

17 Q. Now, when you said you’re the Director of

18 Records Management for the Minnesota office?

19 A. Uh-huh.

20 Q. Are there other offices of Residential

21 Funding that maintain records that you are

22 not responsible for?

23 A. There are records services sites in Iowa and

24 in Pennsylvania. Those deal mostly with the

25 GMAC mortgage assets.

<snip>

11 Q. And what, if anything, is your responsibility

12 with regard to those records?

13 A. To track the physical paper for those

14 assets — or that asset.

15 Q. Are you what you consider to be the keeper of

16 the records for those documents?

17 A. Sure, yep.

5 Q. Okay. And then when somebody wants to view

6 specific records from your system, is that

7 something that you’re responsible for

8 obtaining as part of your day-to-day

9 responsibilities?

10 A. The people that report to me, yes, or the

11 vendor that — that we have retained to do

12 those functions, yes. I don’t do that

13 myself.

14 Q. Who’s the vendor that you retain to do that?

15 A. A company called ACS.

16 Q. ACS?

17 A. Yep.

18 Q. And what does ACS do with regard to the

19 records?

20 A. They fulfill the request. So if somebody

21 needs a credit folder or a legal folder, they

22 research where those documents are, obtain

23 the documents and then provide that requestor

24 with either the paper documents or images.

<snip>

21 Q. There’s a file folder that shows it came from

22 the outside vendor?

23 A. Yes. Their sticker is affixed to the front

24 of the folder, so I know it came from them.

25 Q. Okay. And then is there anything on the

1 documents themselves that show where they

2 came from?

3 A. No.

4 Q. And by the outside vendor, do you mean ACS?

5 A. No. Actually, the vendor that stores the

6 actual folder is Iron Mountain.

7 Q. So there’s a sticker on that file that shows

8 it came from Iron Mountain?

9 A. Correct, yes.

10 Q. Does Iron Mountain maintain your system or do

11 they just maintain hard copies of documents?

12 A. They maintain the hard copies of the

13 documents.

14 Q. Not any records on your computer system,

15 correct?

16 A. No.

17 Q. Is that correct?

18 A. Correct.

<snip>

18 Q. What’s the relationship between Residential

19 Funding Company, LLC and U.S. Bank National

20 Association?

21 A. In — in this instance, U.S. Bank is the

22 trustee on the security that this loan is in.

23 And RFC was the issuer of the security that

24 was created.

25 Q. Who was the issuer of the security?

1 A. RFC was the issuer of the security.

2 Q. Oh, RFC is what you call Residential Funding

3 Company?

4 A. Yes.

5 Q. So RFC issued the security?

6 A. Right.

7 Q. Can you explain to me what that means?

8 A. No, I can’t.

9 Q. Okay. How do you know RFC issued the

10 security?

11 A. It’s the normal course of business as to how

12 our — our business works. RFC is in the

13 business of acquiring assets and putting them

14 together into securities to sell in the — in

15 the market.

16 MR. SHAW: I would like to

17 register a general objection to this line of

18 questioning. There’s not been a foundation

19 laid for Judy Faber being competent to reach

20 some of these conclusions that are being

21 stated on the record.

22 BY MR. HOLLANDER:

23 Q. So in this particular instance, do you have

24 any personal knowledge of the relationship

25 between RFC and U.S. Bank National

1 Association as trustee?

2 A. No.

3 Q. For whom is U.S. Bank National Association

4 acting as the trustee?

5 A. I believe it would be for the investors of

6 the — that have bought the securities.

7 Q. I’m sorry. Something happened with the phone

8 and I didn’t hear your answer. I’m sorry.

9 A. I believe it would be for the different

10 investors who have bought pieces of that

11 security that was issued.

12 Q. Are there different investors that have

13 purchased the Peter Cook note?

14 A. I don’t think I’m qualified to answer that.

15 You know, I can tell you from what my basic

16 understanding is from the process, but I’m

17 not an expert.

18 MR. SHAW: Once again, I’d like to

19 raise a continuing general objection that she

20 being — testifying with respect to what her

21 job is, and I believe you’re getting into

22 areas that is other than what her job is and

23 you’re asking for possibly even legal

24 conclusions here. So I would like to raise

25 that objection again.

[…]

[ipaper docId=39156662 access_key=key-hxfsobk1503f3iza8sn height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in assignment of mortgage, bifurcate, conspiracy, deposition, foreclosure, foreclosure fraud, foreclosures, GMAC, mbs, securitization, STOP FORECLOSURE FRAUD, trade secrets, trustee, Trusts, us bank2 Comments

BLOOMBERG: Citigroup Stops Using Foreclosure Law Firm Under Investigation in Florida

Posted on 12 October 2010.

By Dakin Campbell and Donal Griffin – Oct 12, 2010 12:00 AM ET

Citigroup Inc. said it stopped steering foreclosure work to a Florida law firm whose court filings to support home seizures are under investigation by the state’s attorney general.

The bank, which is proceeding with seizures as some rivals stop to recheck documents, had used the Law Offices of David J. Stern PA. Florida Attorney General Bill McCollum said Aug. 10 it is examining whether Stern and two other firms filed “improper documentation” with the state’s courts to speed proceedings.

“Pending the outcome of the AG’s investigation, Citi is not referring new matters to this firm,” the New York-based bank said in an e-mailed statement. Citigroup services loans for government-sponsored entities, such as Fannie Mae and Freddie Mac. Stern “was approved by the GSEs during the time in which it was retained by Citi,” the bank said.

Lawmakers, attorneys general and consumer groups have pressed mortgage firms to follow Bank of America Corp., the biggest U.S. lender, which last week suspended all foreclosures to check whether faulty documents were used to confiscate homes. JPMorgan Chase & Co. and Ally Financial Inc.’s GMAC Mortgage unit froze seizures or evictions in Florida and 22 other states. Citigroup said last week it doesn’t plan to join them.

McCollum’s office “hasn’t made any charges or allegations of fault,” said Jeffrey Tew, an outside attorney for Plantation, Florida-based Stern, who declined to discuss its work for Citigroup. “I believe they’re a client. I can’t go into any details.”

Continue reading…BLOOMBERG

Continue reading…BLOOMBERG

.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in assignment of mortgage, CitiGroup, djsp enterprises, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, forgery, investigation, Law Offices Of David J. Stern P.A., notary fraud0 Comments

YOU MUST READ! Federal Bankruptcy Trustee Joins Litigation Against Lender Processing Services (LPS)

Posted on 12 October 2010.

WOW! Lender Processing Services is up against some BIG TIME players!

According to Naked Capitalism:

The standing Chapter 13 Trustee for the Northern District of Mississippi, Locke Barkley, has joined the case on behalf of herself and of all Chapter 13 Trustees in the US.

and also

The filings were amended to add counsel with class action expertise. On the Federal case, in Mississippi, CaseyGerry has joined the case. The head of the firm, David Casey, is a former president of the Association of Trial Lawyers of America. Cases his firm has handled include Exxon Valdez and the California tobacco case. In other words, this is a heavyweight player. On the Kentucky case, McGowan & Hood, a firm which has won major class actions lawsuits, including medical device cases, has signed up.

Lender-Processing-Services-Federal-Bankruptcy-Suit-Second-Amended-Complaint

[ipaper docId=39154884 access_key=key-111rl37zha9oh040eqcs height=600 width=600 /]

Posted in bankruptcy, CONTROL FRAUD, corruption, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, Lender Processing Services Inc., LPS, lps default solutions Inc., trade secrets0 Comments

After Foreclosure, a Focus on Title Insurance

Posted on 11 October 2010.

By RON LIEBER

Published: October 8, 2010

When home buyers and people refinancing their mortgages first see the itemized estimate for all the closing costs and fees, the largest number is often for title insurance.

This moment is often profoundly irritating, mysterious and rushed — just like so much of the home-buying process. Lenders require buyers to have title insurance, but buyers are often not sure who picked the insurance company. And the buyers are so exhausted by the gauntlet they’ve already run that they’re not interested in spending any time learning more about the policies and shopping around for a better one.

Besides, does anyone actually know people who have had to collect on title insurance? It ultimately feels like a tax — an extortionate one at that — and not a protective measure.

But all of the sudden, the importance of title insurance is becoming crystal-clear. In recent weeks, big lenders like GMAC Mortgage, JPMorgan Chase and Bank of America have halted many or all of their foreclosure proceedings in the wake of allegations of sloppiness, shortcuts or worse. And a potential nightmare situation has emerged that has spooked not only homeowners but lawyers, title insurance companies and their investors.

What would happen if scores of people who had lost their homes to foreclosure somehow persuaded a judge to overturn the proceedings? Could they somehow win back the rights to their homes, free and clear of any mortgage? But they may not be able to simply move back into their home at that point. Banks, after all, have turned around and sold some of those foreclosed homes to nice young families reaching out for a bit of the American dream. Would they simply be put out on the street? And then what?

The answer to that last question may depend on whether those new homeowners have title insurance, because people who buy a home without a mortgage can choose to go without a policy.

Title insurance covers you in case people turn up months or years after you buy your home saying that they, in fact, are the rightful owners of the house or the land, or at least had a stake in the transaction. (The insurance may cover you in other instances as well, relating to easements and other matters, but we’ll leave those aside for now.)

Continue reading…NEW YORK TIMES

Continue reading…NEW YORK TIMES

.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in assignment of mortgage, foreclosure, foreclosure fraud, foreclosures, Old Republic Title, STOP FORECLOSURE FRAUD, title company, Title insurance2 Comments

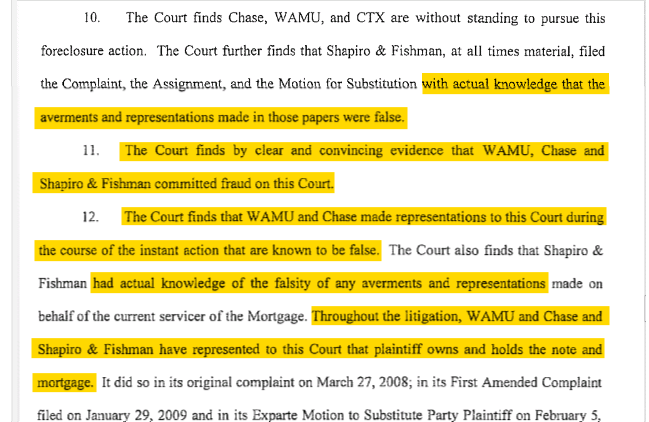

FL Attorney General Files A Motion for Rehearing to Judge’s Ruling in Shapiro & Fishman Investigation

Posted on 11 October 2010.

Attorney General McCollum I applaud you for STANDING UP for Florida!

Assistant AG’s June M. Clarkson and Theresa B. Edwards what an amazing job! Thank you.

Investigate the law suit Shapiro and Stern had against each other…You might just find missing pieces there.

The facts are the facts…crystal clear. This glass is not half full but spilling out the rim of the glass!

Attorney General Bill McCollum today filed a Motion for Rehearing on last week’s ruling by Circuit Judge Jack Cox that the Attorney General could not investigate the Shapiro & Fishman law firm for the firm’s alleged involvement in presenting fabricated documents to the courts in foreclosure actions to obtain final judgments against homeowners. The Attorney General is currently investigating four law firms, The Law Offices of Marshall C. Watson, P.A.; Shapiro & Fishman, LLP, the Law Offices of David J. Stern, P.A., and Florida Default Law Group, PL for allegedly engaging in these practices.

[ipaper docId=39125376 access_key=key-9hpgp1r3itfgcl5uvog height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Posted in CONTROL FRAUD, corruption, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, forgery, investigation, Law Offices Of David J. Stern P.A., law offices of Marshall C. Watson pa, shapiro & fishman pa, STOP FORECLOSURE FRAUD, trade secrets1 Comment

What is Alter Ego Liability?

Posted on 11 October 2010.

THIS IS NOT Intended to Be Construed or Relied upon as COMPETENT LEGAL ADVICE—Readers are urged to obtain competent legal representation to review their facts. I am not an attorney and this is not legal advice. I’m trying to gather a few things in order for research…that’s all.

This is very similar to the notion of piercing the corporate veil (aside from certain technical distinctions that are being ignored for the purpose of this discussion). Owners of corporations (i.e., its shareholders) are generally not personally liable for debts, losses and liabilities of the business itself, because of limited liability. However, if those owners have acted in a way where their business is really just a shell, and not an entirely separate legal entity, a court may decide that the business is simply an alter ego, meaning the owners should be held personally liable because of their wrongful acts.

There are many things that a court will look at in determining whether alter ego liability should be applied. Typical factors include (but are not limited to) whether the company kept its own records, whether there were shares (for a corporation) or units (for an LLC) that were actually issued, whether the owners co-mingled their finances with the business entity, whether there were actually corporate directors or LLC managers running the business, how legal formalities were followed and whether the owners used the business for personal purposes. It is often a case-by-case situation, and the key here is that you should take every precaution to run your business in full compliance with the legally required formalities and use the business in a proper way in order to avoid such alter ego liability.

Uniform Fraudulent Transfer Act

Successor liability claims are often paired with alleged violations under a state law adaptation or adoption of the Uniform Fraudulent Transfer Act (“UFTA”),5such as the Delaware Uniform Fraudulent Transfer Act (“DUFTA”). Some typical factual scenarios that give rise to a successor liability claim mirror those for a claim under UFTA. For instance, a violation of DUFTA by transferring the assets of company A into company B to avoid liability, while the successor company B is a mere continuation of company A, as all of the assets were transferred, and company B retained the same management as company A, could trigger both exceptions three and four noted above as well as a fraudulent conveyance claim. See DEL. CODE ANN. tit. 6, § 1305.

DUFTA finds a fraudulent conveyance if the debtor made the transfer or incurred the obligation with “intent to hinder, delay or defraud any creditor of the debtor;” or “[w]ithout receiving a reasonably equivalent value in exchange for the transfer or obligation.” DEL. CODE ANN. tit. 6 §§ 1304(a)(2) and 1305(a); see also In re Hechinger Inc. Co. of Del., 327 B.R. 537, 551 (D. Del. 2005); China Res. Prods. (U.S.A.) v. Fayda Int’l, Inc., 856 F. Supp. 856, 863 (D. Del. 1994); In re MDIP, Inc., 332 B.R. 129, 132 (Bankr. D. Del. 2005). The debtor must also be engaged or about to engage in a business or a transaction for which the remaining assets of the debtor were “unreasonably small in relation to the business or transaction,” or intended, had a belief, or should have believed, that the debtor would “incur, debts beyond the debtor’s ability to pay as they became due.” In re MDIP, Inc., 332 B.R. at 132. If a creditor prevails on a claim under the DUFTA, the statute empowers the Court to appoint a receiver to take charge of the transferred asset or other property of the transferee. DEL. CODE ANN. tit. 6 § 1307(a).

Sources:

http://www.quizlaw.com/business_law/what_is_alter_ego_liability.php

———————————

LIMITATIONS TO BANKRUPTCY ALTERNATIVES: SUCCESSOR LIABILITY, THE UNIFORM FRAUDULENT TRANSFER ACT, PIERCING THE CORPORATE VEIL, AND PERSISTENT LIABILITIES.1

Rafael X. Zahralddin-Aravena2

Elliott Greenleaf, Wilmington, Delaware

.

Related:

ALTER EGO DOCTRINE: ‘Pierce the Corporate Veil’

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in foreclosure, foreclosure fraud, foreclosures, forgery2 Comments

Florida Foreclosure Firm Fudged Forms, Ex-Paralegal Claims

Posted on 11 October 2010.

By Phil Milford and Denise Pellegrini – Oct 9, 2010 12:01 AM ET

A former paralegal told Florida investigators that workers at a law firm that processed foreclosures signed paperwork without reading it, misdated records and skirted rules protecting homeowners in the military.

Tammie Lou Kapusta, who said she spent more than a year at the Law Offices of David J. Stern PA, made the accusations in a Sept. 22 interview with lawyers for Florida Attorney General Bill McCollum. In August, McCollum announced a probe of three law firms to see whether improper documents were created and filed with state courts to hasten the foreclosure process.

Jeffery Tew, a lawyer for the Stern firm, denied Kapusta’s claims.

Kapusta, who spoke under oath, said the Stern firm ballooned from 225 employees when she started in March 2008, to more than 1,100 when she was fired in July 2009. She described a disorganized workplace where documents got lost and mortgages were misfiled. The training process was “stupid and ridiculous,” she said.

“There were a lot of young kids working up there who really didn’t pay attention to what they were doing,” she said, according to a transcript. “We had a lot of people that were hired in the firm that were just hired as warm bodies.”

Kapusta’s statements were reported Oct. 7 in the Tampa Tribune. Tew, of Tew Cardenas LLP in Miami, said he wasn’t aware of the interview until it was released to the public.

“We didn’t get a chance to cross-examine her,” he said. “It was a one-sided statement by a disgruntled employee. There was a lot of animus and personal references, and she seeks to besmirch people’s reputation. The law firm denies there’s any accuracy in the charges.”

Jurisdiction Challenged

There’s a court hearing set for Oct. 12 to determine whether McCollum’s office has jurisdiction over the firm’s conduct, Tew said.

“This is a civil investigation, and the attorney general hasn’t made any conclusions,” Tew said.

Continue reading…BLOOMBERG

Continue reading…BLOOMBERG

.

Related:

EXPLOSIVE DEPOSTION!!!! BUSTED!! DAVID J. STERN “MILL” KNEW THIS ALL ALONG…THIS FORECLOSURE FRAUD!!!

.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in assignment of mortgage, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, Law Offices Of David J. Stern P.A., ProVest, robo signers, sewer service1 Comment

Government had been warned for months about troubles in mortgage servicer industry

Posted on 10 October 2010.

Washington Post Staff Writer

Saturday, October 9, 2010; 10:11 PM

Consumer advocates and lawyers warned federal officials in recent years that the U.S. foreclosure system was designed to seize people’s homes as fast as possible, often without regard to the rights of homeowners.

In recent days, amid reports that major lenders have used improper procedures and fraudulent paperwork to seize properties, some Obama administration officials have acknowledged they had been aware of flaws in how the mortgage industry pursues foreclosures.

But the officials said they could take only limited action to address the danger. In part, this was because they wanted lenders’ help carrying out federal programs to modify mortgages that had fallen into default or were poised to do so.

New concerns about improper practices – such as those involving faked documents or “robo-signers” who signed tens of thousands of documents without reviewing them – have prompted the mortgage servicing arms of the country’s largest banks to freeze millions of foreclosures. As momentum builds for a national moratorium, the administration has begun assessing the potential impact, examining the threat it could pose for the ailing housing market and the wider financial system.

There is no evidence so far that the specific abuses made public in the past few weeks were known to government officials. Nor is it clear whether they were aware that the process of the selling and reselling of mortgages among financial firms – which became extremely common and highly profitable during the housing boom – was raising legal questions about who actually owned the loans and had the right to foreclose if they want bad.

But government officials were told repeatedly that the mortgage servicing industry was deeply troubled, according to administration officials, consumer advocates, housing lawyers and congressional aides.

Continue reading…WASHINGTON POST

Continue reading…WASHINGTON POST

.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in assignment of mortgage, concealment, conspiracy, corruption, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, MERS, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC.3 Comments

False Statements| Bank of America, Florida Default Law Group, Law Offices of David Stern, Lender Processing Services, Litton Loan Servicing, Cheryl Samons, Security Connections, Inc.

Posted on 10 October 2010.

False Statements

Bank of America

Florida Default Law Group

Law Offices of David Stern

Lender Processing Services

Litton Loan Servicing, LP

Cheryl Samons

Security Connections, Inc.

Action Date: October 10, 2010

Location: Charlotte, NC

On October 8, 2010, Bank of America announced it was extending its suspension of foreclosures to all 50 states. A review of the documents used by Bank of America to foreclose readily shows why this was the only appropriate action for Bank of America. In thousands of cases, Bank of America has used Mortgage Assignments specially prepared just for foreclosure litigation. On these assignments, the identity of the mortgage company officer assigning the mortgage to BOA is wrongly stated. Who has signed most frequently as mortgage officers on mortgage assignments used by BOA to foreclose? Regular signers include the “robo-signers” from Lender Processing Services in both Alpharetta, Georgia and Mendota Heights, Minnesota. LPS employees Liquenda Allotey, Greg Allen, John Cody and others, using dozens of different corporate titles, sign mortgage assignments stating BOA has acquired certain mortgages. When the mortgages involved originated from First Franklin Bank, BOA used Security Connections, Inc. in Idaho Falls, Idaho. Employees Melissa Hively, Vicki Sorg and Krystal Hall also signed for many different corporations for BOA. Litton Loan Servicing in Houston, Texas, a company owned by Goldman Sachs, also produced documents as needed by BOA, usually signed by Denise Bailey, Diane Dixon or Marti Noriega signing as officers of at least a dozen different mortgage companies and banks. BOA also has used mortgage assignments signed by Cheryl Samons, the office administrator for the Law Offices of David Stern, who has admitted to signing thousands of mortgage documents each month with no actual knowledge of the contents. On other cases, employees of the law firm Florida Default Law Group have signed for BOA, using various titles, including claiming to be Vice Presidents of Wells Fargo Bank, all while failing to disclose they actually worked for Florida Default. in most of these cases, BOA is acting as Trustee for residential mortgage-backed securitized trusts. These trusts are claiming to have acquired the mortgages in 2009 and 2010, even though the trusts deadline for acquiring mortgages was often in 2006 and 2007. In hundreds of cases, the mortgage assignments presented by BOA are actually signed months AFTER the foreclosure actions were commenced. At least 50 trusts using BOA as Trustee are involved in using these fraudulent documents. Each trust has between $1.5 billion and $2 billion of mortgages. The BOA documents have been used in thousands of cases, pending and completed, for at least three years. This massive problem cannot be “fixed” in 90 days, but a nationwide suspension of foreclosures is a good, responsible beginning.

Posted in assignment of mortgage, florida default law group, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, fraud digest, Law Offices Of David J. Stern P.A., Lender Processing Services Inc., Litton, LPS, Lynn Szymoniak ESQ2 Comments

VIDEO: OHIO SOS JENNIFER BRUNNER on Foreclosure Fraud, Kaptur, MERS, H.R. 3808, Notaries, Moratorium

Posted on 09 October 2010.

Democracy NOW! News – Calls are growing for a nationwide moratorium on home foreclosures following the recent revelations that major lenders may have committed fraud while forcing thousands of people out of their homes. On Thursday the White House announced President Obama will not sign a bill approved by Congress that could have made it easier for banks to foreclose. We discuss the latest in the foreclosure crisis with Ohio Secretary of State Jennifer Brunner. This week Ohio filed a lawsuit accusing the lender Ally Financial and its GMAC Mortgage division of fraud in approving scores of foreclosures. Published with written permission from democracynow.org.

http://www.democracynow.org Provided to you under Democracy NOW! creative commons license. Copyright democracynow.org, an independent non-profit user funded news media, recognized and broadcast world wide.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in assignment of mortgage, chain in title, CONTROL FRAUD, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, MERS, MERSCORP, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC., notary fraud1 Comment

“DON’T QUIT”

Posted on 09 October 2010.

Anonymous

When things go wrong, as they sometimes will,

When the road you’re trudging seems all uphill,

When the funds are low and the debts are high,

And you want to smile, but you have to sigh,

When care is pressing you down a bit Rest if you

must, but don’t you quit.

Life is queer with its twists and its turns, As

everyone of us sometimes learns, And many a

failure turns about When they might have won,

had they stuck it out. Don’t give up though the

pace seems slow, You may succeed with

another blow.

Often the goal is nearer than,

It seems to a faint and faltering man,

Often the struggler has given up

When he might have captured the victor’s cup;

And he learned too late when the night came down,

How close he was to the golden crown.

Success is failure turned inside out The

silver tint of the clouds of doubt And

you never can tell how close you are,

It may be near when it seems so far;

So stick to the fight when you’re

hardest hit, It’s when things

seem worst that you…

MUST NOT QUIT!

Because I haven’t quit on you!

Posted in foreclosure, foreclosure fraud, foreclosures, STOP FORECLOSURE FRAUD5 Comments

Obama Clarifies Pocket Veto Of Controversial Bill Related To Foreclosures

Posted on 09 October 2010.

The White House issued a statement Friday clarifying President Obama’s “pocket veto” of legislation that consumer advocates worried would have made it more difficult for homeowners to fight fraudulent foreclosures.

Some have been skeptical that a pocket veto, which allows the president to kill legislation simply by not signing it when Congress is not in session, was available because the Senate has, in fact, been holding pro-forma sessions.

So instead of just not signing the bill, Obama is also sending it back to the House, making it a “protective return” veto.

“To leave no doubt that the bill is being vetoed,” said Obama in a statement, “in addition to withholding my signature, I am returning H.R. 3808 to the Clerk of the House of Representatives, along with this Memorandum of Disapproval.”

Continue reading…HUFFINGTON POST

Continue reading…HUFFINGTON POST

.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in assignment of mortgage, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, Notary, notary fraud, STOP FORECLOSURE FRAUD1 Comment

Statement by CEO of Mortgage Electronic Registration Systems (MERS)

Posted on 09 October 2010.

RESTON, Va. – (Business Wire) Mortgage Electronic Registration Systems (MERS) Chief Executive Officer R.K. Arnold today issued the following statement regarding the organization and clarifying certain aspects of its operations:

“MERS is one important component of the complex infrastructure of America’s housing finance system. Billions of dollars of mortgage money flow through the financial system every year. It takes many, often-unseen mechanical processes to properly get those funds into the hands of qualified homebuyers.

Technology designed to reduce paperwork has a very positive effect on families and communities. They may not see it, but these things save money and time, creating reliability and stability in the system. That’s important to keep the mortgage funds flowing to the consumers who need it.

With millions of Americans facing foreclosure, every element of the housing finance system is under tremendous strain. What we’re seeing now is that the foreclosure process itself was not designed to withstand the extraordinary volume of foreclosures that the mortgage industry and local governments must now handle.

MERS helps the mortgage finance process work better. The MERS process of tracking mortgages and holding title provides clarity, transparency and efficiency to the housing finance system. We are committed to continually ensuring that everyone who has responsibilities in the mortgage and foreclosure process follows local and state laws, as well as our own training and rules.”

Facts about MERS

(NOTE TO EDITORS: The following is attributed to MERS Communications Manager Karmela Lejarde)

FACT: Courts have ruled in favor of MERS in many lawsuits, upholding MERS legal interest as the mortgagee and the right to foreclose.

This legal right springs from two important facts:

1) MERS holds legal title to a mortgage as an agent for the owner of the loan

2) MERS can become the holder of the promissory note when the owner of the loan chooses to make MERS the holder of the note with the right to enforce if the mortgage loan goes into default.

MERS does not authorize anyone to represent it in a foreclosure unless both the mortgage and the note are in MERS possession. In some cases where courts have found against MERS, those cases have hinged on other procedural defects or improper presentation of MERS’s legal interests and rights. Citations can be found at the end of this document.*

FACT: MERS does not create a defect in the mortgage or deed of trust

Claims that MERS disrupts or creates a defect in the mortgage or deed of trust are not supported by fact or legal precedents. This is often used as a tactic by lawyers to delay or prevent the foreclosure. The mortgage lien is granted to MERS by the borrower and the seller and that is what makes MERS the mortgagee. The role of mortgagee is legal and binding and confers to MERS certain legal rights and responsibilities.

FACT: The trail of ownership does not change because of MERS

MERS does not remove, omit, or otherwise fail to report land ownership information from public records. Parties are put on notice that MERS is the mortgagee and notifications by third parties can be sent to MERS. Mortgages and deeds of trust still get recorded in the land records.

The MERS System tracks the changes in servicing rights and beneficial ownership. No legal interests are transferred on the MERS System, including servicing and ownership. In fact, MERS is the only publicly available comprehensive source for note ownership.

While this information is tracked through the MERS System, the paperwork still exists to prove actual legal transfers still occurred. No mortgage ownership documents have disappeared because loans were registered on the MERS System. These documents exist now as they have before MERS was created. The only pieces of paper that have been eliminated are assignments between servicing companies because such assignments become unnecessary when MERS holds the mortgage lien for the owner of the note.

FACT: MERS did not cause mortgage securitization

MERS was created as a means to keep better track of the mortgage servicing and beneficial rights as loans were getting bought and sold at a high rate during the late 1990s.

At the height of the housing market, low interest rates prompted some homeowners to refinance once, twice, even three times in the space of months. Banks were originating loans at more than double their usual rate. Assignments – the document that names the holder of the legal title to the lien – primarily between servicing companies, were piling up in county land record offices, awaiting recording. Many times the loans were getting refinanced before the assignments could get recorded on the old loan. The delay prevented lien releases from getting recorded in a timely manner, leaving clouds on title.

MERS was created to provide clarity, transparency and efficiency by tracking the changes in servicing rights and beneficial ownership interests. It was not created to enable faster securitization. MERS is the only publicly available source of comprehensive information for the servicing and ownership of the more than 64 million loans registered on the system. The Mortgage Identification Number (MIN), created by MERS, is similar in function to a motor vehicle VIN, which keeps track of these loans. Without MERS the current mortgage crisis would be even worse.

FACT: Lenders cannot “hide” behind MERS

MERS is the only comprehensive, publicly available source of the servicing and ownership of more than 64 million loans in the United States. If a homeowner needs to identify the servicer or investor of their loan, and it is registered in MERS, they can be helped through the MERS website or via toll-free number at 888-679-6377.

FACT: MERS fully complies with recording statutes

The purpose of recording laws is to show that a lien exists, which protects the mortgagee and any bona fide purchasers. When MERS is the mortgagee, the mortgage or deed of trust is recorded, and all recording fees are paid.

*NOTABLE LEGAL VICTORIES:

a. IN RE Mortgage Electronic Registration Systems (MERS) Litigation, a multi-district litigation case in federal court in Arizona who issued a favorable opinion, stating that “The MERS System is not fraudulent, and MERS has not committed any fraud.”

b. IN RE Tucker (9/20/2010) where a Missouri bankruptcy judge found that the language of the deed of trust clearly authorizes MERS to act on behalf of the lender in serving as the legal title holder.

c. Mortgage Electronic Registration Systems, Inc. v. Bellistri, 2010 WL 2720802 (E.D. Mo. 2010), where the court held that Bellistri’s failure to provide notice to MERS violated MERS’ constitutional due process rights.

Mortgage Electronic Registration Systems

Karmela Lejarde, 703-772-7156

Copyright © 2010 Business Wire. All rights reserved. |

RELATED LINKS:

MERS 101

.

NO. THERE’S NO LIFE AT MERS

.

MUST READ |E-Discovery…Electronic Registration Systems WORST NIGHTMARE!

.

ALTER EGO DOCTRINE: ‘Pierce the Corporate Veil’

R.K. ARNOLD Pres. & CEO Of MERS (Photo Credit) Daniel Rosenbaum for The New York Times

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in assignment of mortgage, foreclosure, foreclosure mills, foreclosures, forgery, MERS, MERSCORP, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC., R.K. Arnold, robo signers, STOP FORECLOSURE FRAUD3 Comments

FORECLOSURE CRISIS by The Daily show with JON STEWART

Posted on 09 October 2010.

Foreclosure Crisis

The banks admit to not reading the fine print on the crappy mortgages the American taxpayers now own.

| The Daily Show With Jon Stewart | Mon – Thurs 11p / 10c | |||

| Foreclosure Crisis | ||||

|

||||

.

.

Posted in assignment of mortgage, foreclosure, foreclosure fraud, foreclosures, forgery, robo signers, STOP FORECLOSURE FRAUD0 Comments

BLOOMBERG: Attorneys General in 40 States Said to Join on Foreclosures

Posted on 08 October 2010.

By Dakin Campbell and Prashant Gopal – Oct 8, 2010 5:43 PM ET

Attorneys general in about 40 states may announce a joint investigation into foreclosures at the largest banks and mortgage firms, according to a person with direct knowledge of the matter.

State attorneys general led by Iowa’s Tom Miller are in talks that may lead to the announcement of a coordinated probe as soon as Oct. 12, said the person, who declined to be identified because a final agreement hasn’t been reached. The number of states may change because several are still deciding whether to join the investigation, the person said. New Mexico Attorney General Gary King said today in a statement that his state will join a multi-state effort.

Lawyers representing the banks are expecting a more widespread investigation, according to Patrick McManemin, a partner at Patton Boggs LLP, a Washington-based law firm that represents banks, loan servicers and financial institutions. Bank of America Corp., the biggest U.S. lender, today extended a freeze on foreclosures to all 50 states.

“We are aware of or involved in a large number of investigations that lead us to believe there are in the neighborhood of 40 state attorneys general who have initiated investigations or expressed an interest,” McManemin said in a telephone interview.

Continue reading …BLOOMBERG

Continue reading …BLOOMBERG

.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in assignment of mortgage, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, Moratorium1 Comment

Reid calls on lenders to halt foreclosures in all states

Posted on 08 October 2010.

Washington Post Staff Writers

Friday, October 8, 2010; 2:16 PM

Senate Majority Leader Harry Reid (D-Nev.) called on major lenders to halt foreclosures across the country Friday following Bank of America‘s announcement that it will suspend all such proceedings until a review of possible paperwork problems is completed.

Reid, who had sent a letter to major banks asking them to suspend foreclosures in Nevada, extended his concern to include all 50 states.

“I thank Bank of America for doing the right thing by suspending actions on foreclosures while this investigation runs its course,” he said. “I urge other major mortgage servicers to consider expanding the area where they have halted foreclosures to all 50 states as well.”

Reid is the latest Democratic leader to join a growing chorus of lawmakers and state attorneys general who have called for greater scrutiny of the foreclosure process and a nationwide moratorium. Homeowner advocates say that lenders have used dubious paperwork to expedite the eviction of homeowners who are behind on their payments.

Pressure on the banks continues to grow on Capitol Hill, where Sen. Christopher J. Dodd (D-Conn.) said Friday that the banking committee he chairs will hold hearings Nov. 16 to investigate the foreclosure paperwork morass.

CONTINUE READING…WASHINGTON POST

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in CONTROL FRAUD, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, Moratorium3 Comments

BofA halts foreclosure sales in 50 states

Posted on 08 October 2010.

Bank of America Corp., the nation’s largest bank, said Friday it would stop sales of foreclosed homes in all 50 states as it reviews potential flaws in foreclosure documents.

A week earlier, the company had said it would only stop such sales in the 23 states where foreclosures must be approved by a judge.

The move comes amid evidence that mortgage company employees or their lawyers signed documents in foreclosure cases without verifying the information in them.

“We will stop foreclosure sales until our assessment has been satisfactorily completed,” company spokesman Dan Frahm said in a statement. “Our ongoing assessment shows the basis for our past foreclosure decisions is accurate.”

Concern is growing that mortgage lenders have been evicting homeowners using flawed court papers. State and federal officials have been ramping up pressure on the mortgage industry over worries about potential legal violations.

On Thursday, Senate Majority Leader Harry Reid, D-Nev., urged five large mortgage lenders to suspend foreclosures in Nevada until they have set up systems to make sure homeowners aren’t “improperly directed into foreclosure proceedings.” Nevada is not among the states where banks had suspended foreclosures.

Also Friday, PNC Financial Services Group Inc. said it is halting most foreclosures and evictions in 23 states for a month so it can review whether documents it submitted to courts complied with state laws. An official at the Pittsburgh-based bank confirmed the decision on Friday, which was reported earlier by the New York Times. The official requested anonymity because the decision hasn’t been publicly announced.

Continue reading…ASSOCIATED PRESS

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in assignment of mortgage, bank of america, CONTROL FRAUD, foreclosure, foreclosure fraud, foreclosure mills, foreclosures1 Comment

AZ Bankruptcy Judge Eileen W. Hollowell Sanctions Tiffany & Bosco, Saxon Mortgage

Posted on 08 October 2010.

Hat Tip to a subscriber on this!

UNITED STATES BANKRUPTCY COURT

Minute Entry

FOR THE DISTRICT OF ARIZONA

Hearing Information:

Date / Time / Room:

Case Number: 4:08-BK-15510-EWH Chapter: 13

Debtor: JULIA V. VASQUEZ

Hearing Information:

THURSDAY, OCTOBER 07, 2010 11:30 AM COURTROOM 430

Bankruptcy Judge: EILEEN W. HOLLOWELL

Reporter / ECR: ALICIA JOHNS

Courtroom Clerk: TERESA MATTINGLY

Matter:

ORDER TO SHOW CAUSE WHY SANCTIONS SHOULD NOT BE IMPOSED PURSUANT TO FED. R. BANKR. P. 9011, 3001, LOCAL BANKRUPTCY RULES 4001 (e) AND 9011-1 AND 11 U.S.C. SEC. 105 FOR CONDUCT RELATED TO A PROOF OF CLAIM FILED 11/28/08 AND MOTION FOR RELIEF FROM STAY FILED ON 1/6/09. (reset from 9/2/10) R / M #: 90 / 0

Appearances:

BEVERLY B. PARKER, ATTORNEY FOR JULIA V. VASQUEZ, Appearing in Phoenix

ERIC J MCNEILUS, ATTORNEY FOR JULIA V. VASQUEZ

LEONARD MCDONALD, ATTORNEY FOR TIFFANY & BOSCO, Appearing in Phoenix

DAVID GOSS FROM SAXON MORTGAGE, ASSISTANT VICE-PRESIDENT OF BANKRUPTCY DEPARTMENT, Present in courtroom in Phoenix

Proceedings:

Mr. McDonald filed a pre-hearing statement yesterday and provides a copy to Ms. Parker.

The court expresses its concerns and explains why the order was issued.

Mr. McDonald walks the court through what he has learned about the matter. Admittedly the proof of claim nor stay relief motion were plead to say that they were done in the name of Saxon Mortgage Servicer as servicer for the beneficial interest of Deutsche.

Court asks Mr. McDonald if his office knew who held the deed of trust.

Mr. McDonald responds that the electronic referral was asked to be done in the name of Saxon. They were not prosecuting a non-judicial trustee sale. They noticed up the trustee sale in the name of Deutsche. If you look at the note and deed of trust they are in the name of Saxon Mortgage.

Court points out that the proof of claim was never withdrawn. No one had the courtesy to inform the debtor that Deutsche Bank should have been served.

Mr. McDonald responds that he did not represent Saxon in the adversary. When they received push back they did not go forward with a trustee sale or prosecute the motion for relief from stay.

Mr. David Goss is sworn and examined by the court. Ms. Parker cross-examines the witness and Mr. McDonald objects.

The witness is excused.

COURT PLACES ITS FINDINGS ON THE RECORD. SAXON TO PAY MS. VASQUEZ’S LAWYERS $5000.00 WITHIN TEN DAYS FROM TODAY OR A NOTICE OF APPEAL IS FILED.

[ipaper docId=38952020 access_key=key-1zk1c61wyp2ygx4m5djd height=600 width=600 /]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.Posted in bankruptcy, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, sanctioned, STOP FORECLOSURE FRAUD2 Comments

FULL DEPOSITION OF BANK OF AMERICA ROBO SIGNER RENEE D. HERTZLER

Posted on 07 October 2010.

Be sure to catch the Full Depo of Renee Hertzler below after AP Alan Zibel’s article

Bank of America delays foreclosures in 23 states

WASHINGTON – Bank of America is delaying foreclosures in 23 states as it examines whether it rushed the foreclosure process for thousands of homeowners without reading the documents.

The move adds the nation’s largest bank to a growing list of mortgage companies whose employees signed documents in foreclosure cases without verifying the information in them.

Bank of America isn’t able to estimate how many homeowners’ cases will be affected, Dan Frahm, a spokesman for the Charlotte, N.C.-based bank, said Friday. He said the bank plans to resubmit corrected documents within several weeks.

Two other companies, Ally Financial Inc.’s GMAC Mortgage unit and JPMorgan Chase, have halted tens of thousands of foreclosure cases after similar problems became public.

The document problems could cause thousands of homeowners to contest foreclosures that are in the works or have been completed. If the problems turn up at other lenders, a foreclosure crisis that’s already likely to drag on for several more years could persist even longer. Analysts caution that most homeowners facing foreclosure are still likely to lose their homes.

State attorneys general, who enforce foreclosure laws, are stepping up pressure on the industry.

On Friday, Connecticut Attorney General Richard Blumenthal asked a state court to freeze all home foreclosures for 60 days. Doing so “should stop a foreclosure steamroller based on defective documents,” he said.

And California Attorney General Jerry Brown called on JPMorgan to suspend foreclosures unless it could show it complied with a state consumer protection law. The law requires lenders to contact borrowers at risk of foreclosure to determine whether they qualify for mortgage assistance.

In Florida, the state attorney general is investigating four law firms, two with ties to GMAC, for allegedly providing fraudulent documents in foreclosure cases .The Ohio attorney general this week asked judges to review GMAC foreclosure cases.

Mark Paustenbach, a Treasury Department spokesman, said the Treasury has asked federal regulators “to look into these troubling developments.”

A document obtained Friday by the Associated Press showed a Bank of America official acknowledging in a legal proceeding that she signed up to 8,000 foreclosure documents a month and typically didn’t read them.

The official, Renee Hertzler, said in a February deposition that she signed 7,000 to 8,000 foreclosure documents a month.

“I typically don’t read them because of the volume that we sign,” Hertzler said.

She also acknowledged identifying herself as a representative of a different bank, Bank of New York Mellon, that she didn’t work for. Bank of New York Mellon served as a trustee for the investors holding the homeowner’s loan.

Hertzler could not be reached for comment.

CONTINUE READING…..YAHOO

CONTINUE READING…..YAHOO

.

FULL DEPOSITION OF RENEE HERTZLER BELOW:

[ipaper docId=38902529 access_key=key-1iju4izmwpbrhvru9u14 height=600 width=600 /]

Posted in assignment of mortgage, bank of america, bank of new york, bogus, chain in title, CONTROL FRAUD, deposition, foreclosure, foreclosure fraud, foreclosure mills, foreclosures, investigation, robo signers, stopforeclosurefraud.com4 Comments

Recent Comments