Remarks by FDIC Chairman Sheila C. Bair to the Urban Land Institute, Washington, DC

October 13, 2010 Opener

Good afternoon. Thank you for inviting me to speak. The real estate sector has played a leading role in the recession and financial turmoil we have experienced in the past few years. The downturn in residential real estate markets and the ensuing financial crisis plunged the country into deep recession.

The economy is now recovering, but progress is slow, and the effects of the recession — including high unemployment — are likely to persist for some time. Once again, the health of the real estate sector will be crucial in determining the path of the entire economy. Restoring stability and normalcy to residential and commercial real estate markets will be essential to establishing a more robust economic recovery. But we still have a lot of work to do to repair our system of mortgage finance.

What I would like to discuss with you today is the work that needs to be done — in the short term and over the long term — to restore the vitality of real estate finance and the stability of our financial system.

Outlook for Housing and the Mortgage Market

After three long and difficult years for the housing sector, we’ve begun to see positive signs — but also continue to see hurdles to overcome. Home prices have largely stabilized in most markets. The Case-Shiller 10-city home price index, which declined by some 33 percent from the height of the crisis, has risen by just over 4 percent in the past year.

Federal policy initiatives — including tax credits for new buyers, the Treasury’s Home Affordable Modification Program, and the Federal Reserve purchases of mortgage-backed bonds — have played an important role in helping to restore stability to U.S. housing markets. But these initiatives come at the price of unprecedented government intervention. Through the FHA and the GSEs, nearly 60 percent of all mortgages outstanding today have government backing. Of the nearly $2.5 trillion in loan originations since 2009, about 94 percent were guaranteed by the GSEs, the FHA or the VA. In addition, the Federal Reserve has purchased more than $1 trillion of mortgage-backed securities.

And despite this unprecedented intervention, many challenges exist. Expiration of the homebuyer tax credit in April led to a second-quarter slump in new home sales and building-related retail sales that helped to slow the pace of economic growth over the summer.

Mortgage Foreclosures Trends

Meanwhile, a sustained high volume of mortgage foreclosures has been adding to the number of vacant homes and distressed sales. Some 2.4 million mortgages remained in the foreclosure process at the end of June, while another 2.7 million mortgages were at least 60 days past due. As of June, an estimated 11 million homeowners, or nearly 1 in 4 of those with mortgages, were underwater, owing more than their homes are worth. Not only are these borrowers generally unable to take advantage of today’s record low mortgage rates to refinance, but they become more likely to walk-away from their mortgages.

We also need to move away from incentives that encourage the lax underwriting that we saw prior to the crisis.

Sometimes I wonder: Have lenders really learned their lessons?

Just a few days ago, I received a flier from a mortgage lender offering 3.75% fixed rates programs up to 125% of value, and 24-hour underwriting.

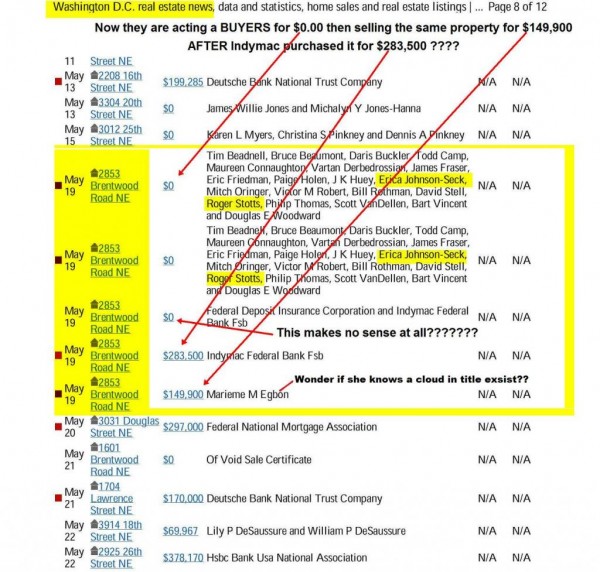

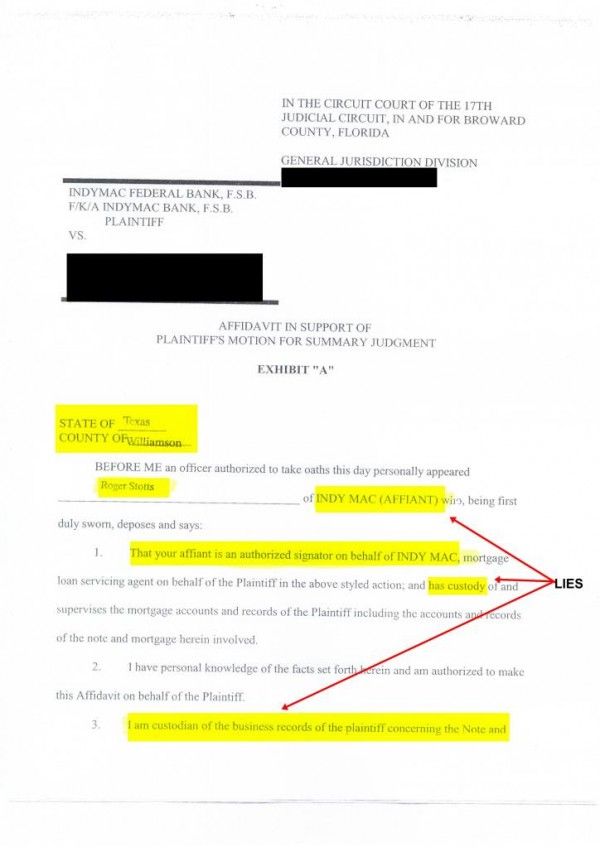

And now we have the added concern that lenders may have been foreclosing on homes without proper documentation. The “robo-signing” of foreclosure documents is a serious matter for loan servicers, homeowners, and the entire industry. Upon initial review, it appears that FDIC supervised non-member state banks did not engage in this behavior and have limited exposure to loans signed by “robo-signers.”

We continue to closely monitor the situation, including working with other regulators through our backup examination capacity where the FDIC is not the primary federal regulator. We are also requesting certifications from loss share participants in our failed bank transactions that their foreclosure activity complies with all legal requirements.

The robo-signer situation underscores how wrong things went in the financial crisis and that there is still a lot of work to do. Foreclosure is a costly, unpleasant, and emotional process. It hurts communities and families alike. It should be a last resort. Loan modifications should be considered whenever possible. Foreclosure should only come after careful thought, thorough analysis, and good documentation.

Properly Aligning Incentives and the “Safe Harbor” Rule

The robo-signing issue also points to the poorly aligned incentives that have existed in the mortgage servicing business. Because the pricing of mortgage securitization deals did not adequately provide for special servicing, servicers were not funded or adequately staffed to address problems.

Not only that, servicers are often required to advance principal and interest on nonperforming loans to securitization trusts — but are quickly reimbursed for foreclosure costs. These incentives can have the effect of encouraging foreclosures, while discouraging modifications.

To address these and other problems, the FDIC recently adopted a new rule on securitizations. The new rule requires that the issue of servicer incentives be addressed in order to obtain safe-harbor status. Servicing agreements must provide servicers with the authority to act to mitigate losses in a timely manner and modify loans in order to address reasonably foreseeable defaults. The agreements must require the servicer to act for the benefit of all investors, not for any particular class of investors.

The rule also addresses a recurring problem in servicing: the obligation for servicers to continue funding payments missed by borrowers. Under most current servicing agreements, this obligation has the effect of accelerating foreclosures as servicers seek to recover these payments by selling the home. Our new rule strictly limits advances to just three payments unless there is a way to repay the servicer that does not rely on foreclosure.

While the FDIC’s new rule will help create positive incentives for servicing, it is, by the nature of our authority, limited to banks. The Dodd-Frank financial reform law now provides a chance to improve incentives across the market, whether the securitization is issued by a bank or not. Dodd-Frank requires regulations governing the risk retained by a securitizer. Those regulations may reduce the standard 5 percent risk-retention where the loan poses a reduced risk of default.

Given the important role that quality servicing plays in mitigating the incidence of default, I believe that the new regulations should address the need for reform of the servicing process. We want the securitization market to come back, but in a sustainable manner.

Its return should be characterized by strong disclosure requirements, high-quality loans, accurate documentation, better oversight of servicers, and incentives to assure that servicers act to maximize value for all investors.

The Government’s Footprint in the Mortgage Market

Looking down the road, the big question on everyone’s mind is what to do about federal government involvement in mortgage lending. For now, federal involvement is needed to keep credit flowing on reasonable terms to the housing market as the economy and the financial system recover. But going forward, there needs to be a broader debate about the future role of government in mortgage finance and the housing sector.

In hindsight, the implicit government backing enjoyed by the mortgage GSEs, where profits were privatized and the risks were socialized, was an accident waiting to happen. The time has come to take a hard look at the full range of housing policies and programs, including the size and nature of tax breaks and other subsidies to owner-occupied and rental real estate. As a nation, we must shift our focus away from narrow, short-term political interests and toward policies that create long-term sustainable improvement in the living standards of all Americans.

Commercial Real Estate Lending

We also face significant challenges in commercial real estate. Average CRE prices are down by 30 to 40 percent or more from their peak levels of 2007, and rents continue to drop for most property types and in most geographic markets.

Credit availability has also been limited as lenders have tightened standards, issuers have virtually stopped offering commercial mortgage-backed securities, and the credit standing of many borrowers has declined. FDIC-insured institutions hold about half of the $3.5 trillion in CRE loans outstanding, which means we’ve been focused on commercial real estate for a very long time. Lenders will continue to face some tough choices when loans come up for renewal with collateral values that have declined significantly from peak levels.

The federal regulatory agencies issued guidance last Fall designed to provide more clarity to banks on how to report those cases where they had restructured problem loans. This was an important step to reduce uncertainty as to how restructuring efforts would be viewed and reported for regulatory purposes.

Some have criticized these loan workouts as a policy of “extend and pretend.” But, as on the residential side, the restructuring of commercial real estate loans around today’s cash flows and today’s low interest rates may be preferable to the alternative of foreclosure and the forced sale of a distressed property. And going forward, as is the case with residential mortgage lending, we need better risk management and stronger lending standards for bank and nonbank originators to help prevent a recurrence of problems in commercial real estate finance.

Conclusion

Obviously, these remain very challenging times for the real estate industry, and for our economy at large. Recovery of the U.S. real estate sector will take time. Problem loans will need to be worked out or written off, and credit channels will have to be re-established around a sounder set of market practices.

As this is taking place, the FDIC and other regulators will be doing our part to promptly and carefully implement the various elements of Dodd-Frank. We are committed to transparency and openness in this process, and have established an open-door policy to make it easier for the public to give input and track the rulemaking process.

I know there is a lot of concern out there right now that Washington and the business community are at cross purposes, and that financial regulatory reform could become an impediment to the economic recovery. I understand these concerns.

But I want to emphasize to you, as I said at the outset of my remarks, that I firmly believe that we share the same basic goals: to restore the vitality of real estate finance and the stability of our financial system. The American people have paid a high price for the mistakes, excesses and abuses of the past. And there is plenty of blame to go around.

I think they are looking for us, as leaders in government and business, to work together and come up with common sense approaches that will put our financial system on a sounder and steadier path for the future. I have outlined some of my thoughts on what needs to be done, and I am looking forward to hearing your thoughts as well in the Q&A session.

We have many challenges before us. But we are Americans. And that means that when the challenges are the greatest, we work together to resolve differences, find solutions and fix the problem. That knowledge, of who we are and what we’re capable of, should give all of us confidence that the future remains bright despite the challenges of the present. Thank you.

Last Updated 10/13/2010 communications@fdic.gov

Recent Comments