Kick a family when they are down why dontcha! Lets see them try to ring my bell or climb my fence…they might encounter a huge pair of enormous 4 legged puppies for trespassing!

Finding Gold in Them Thar Foreclosures

With eye for bargains and stomach for risk, investors sift through wreckage of housing bust

By ADAM GELLER AP National Writer

July 3, 2010 (AP)

GILBERT, Ariz. — If we’re going to search for gold in the wreckage of the mortgage crisis, then 6:57 a.m. in front of 1009 W. Juanita Ave. is as good a time and place as any to start.

The Cooper Ranch subdivision, tucked behind an industrial park 25 minutes from downtown Phoenix, is just beginning to stir. But when Casey Doran pulls his pickup to the curb, the tan stucco house has already seen a steady trickle of visitors. From under the visor of his ball cap, Doran sizes up the first foreclosure of the day.

“Still occupied,” he says, nodding to a green plastic tag hanging from the meter by the garage, proof that someone’s paying the electric bill. He leans on the bell; when no one answers, he tries the door. The house resists his advances, leaving Doran squinting into the darkness behind the blinds. He tugs on the back gate, peering over the wall into a yard corralling chest-high tumbleweeds.

“He isn’t much of a grass person,” Doran says, snapping pictures with his iPhone.

In a little more than three hours, the intelligence Doran gathers in these 10 minutes of reconnaissance will be put to the test. That’s when 1009 W. Juanita and nearly 600 homes like it are scheduled for auction to the highest bidder.

Maybe, with bidding set to open at $105,000, the house is a bargain.

Or maybe it’s a mistake, waiting to drag an investor under.

Either way, there’s little time to ponder this 1,631-square-foot gamble. But there will certainly be other chances.

After all, 50,000 homes clog the county’s foreclosure pipeline and more are added every day. But before you jump to buy, know that you’ll have plenty of company.

At the top of the housing boom, certain cities drew investors like magnets. In Phoenix, speculators bought up houses, largely with borrowed cash, trying to take advantage of fast-rising prices. Those who didn’t sell in time were stung when the market collapsed.

But early last year, a new crop of investors — many buying with their own cash — ventured in, sensing opportunity. In the months since, the share of homes bought by investors at daily auctions has multiplied more than fivefold.

“These are unique times. Very, very unique times,” says Tom Ruff of The Information Market, which analyzes Valley real estate data. “I think the best way to describe it is the Wild West.”

The scene unsettles some, wary that investors could dump homes if the market weakens or take advantage of individual buyers or renters. Others are troubled at banks’ willingness to settle for less at auction rather than give more substantial concessions to homeowners locked into crushing loans. But something’s got to be done with all these overmortgaged, underappreciated houses.

“The investors are a tool to help get those properties moved into new hands,” says Diane Drain, a Phoenix bankruptcy attorney and real estate trustee. “At this point, the dam is so broken. How do you stop the flow? I don’t know how you do it other than one little stick at a time.”

___

During the boom, Steve Vadas sold title insurance on thousands of homes. Now, with business dried up, he’s landed back at the job that gave him his start — in the shadow of the Maricopa County Courthouse, auctioning foreclosures.

It’s hard to recognize the place.

In the old days, Vadas stood on the courthouse steps reading lists of foreclosed homes aloud and almost always only to himself, eyed like a crazy man by the occasional passer-by.

“Nobody would bid on them,” he says. “I literally was reading them to the air.”

No more. On a May afternoon nine years later, a crowd of 60 churns the plaza outside the courthouse doors in downtown Phoenix. Dressed in board shorts and wraparound shades, they scan pages-long printouts of houses and talk furtively into headsets to unseen investors. Five auctioneers compete simultaneously for their attention.

Once Vadas, who conducts sales for Trustee’s Assistance Corp., handled 60 to 70 foreclosures a month. Some days now, he and fellow auctioneers run through that many in an hour or two.

Even in good times, some homeowners failed to pay their mortgages, requiring a process for lenders to recoup losses. In Arizona, they’re called trustee’s sales, and in a steady economy most were little more than formalities. Foreclosed homes were usually offered for the amount owed and, with few bidders, nearly always claimed by the bank holding the loan.

But that was before home prices here plunged by half. Before debt-saddled homeowners started abandoning houses in the dark. Before lenders who never intended to get into the real estate business ended up holding the keys.

In the last year, they’ve done what any merchant with few customers and shelves full of stuff of sometimes dubious quality would do to avoid taking delivery of even more: Slash prices. Cash only. No guarantees. No refunds.

“It’s capitalism at its finest — or at its worst,” Vadas says.

This is not a game for the faint of heart or wallet. Stories circulate of buyers who thought they were getting a deal only to realize they’d bought a second loan, when the first loan holder gets the house. Or of investors who bought a house with a tenant who wouldn’t leave — or had already left, taking cabinets, toilets, even the pipes.

“You can tell all the newbies,” says Randy Lewis, who runs bidding service 3rd Party Buyer LLC, scanning the crowd clumped around the auctioneers. “They’re all up at the front, but not bidding.”

But plenty of others have jumped in, posting the required $10,000 cashier’s check and trying to leverage bits of insider knowledge, marketplace dynamics and a tolerance for risk. The result is a furious chase repeated daily — Lewis calls it “chaos by statute” — that begins as soon as the opening bids are posted for the following morning’s sales.

“You’ve heard of storm chasers?” he says. “We’re deal chasers.”

___

On to the third house of Doran’s morning: 1508 E. Weathervane Lane. Opening bid: $130,100.

A competitor exits the gate of the white stucco house just as Doran, who scouts homes for bidding service Posted Properties.com, pulls up. “It’s vacant,” he says. “You can go inside.”

Just past the pool — veined with cracks that formed as it stood empty under the desert sun (note to investor: could cost $5,000 to repair) — the sliding door yields easily. The place is empty of life except for a moldy loaf of raisin bread in the refrigerator.

On the back door, someone has left a memento of affection painted on the glass: “You rock. I love you.”

Doran takes a few notes about this house, bought in December 2006 for $300,000. On the way out, he runs into a woman from next door. She tells him the former residents have been “stealing” fixtures out of the house for the past month.

“Hopefully soon we’ll have a new neighbor,” she says.

___

By the summer of 2008, Trish Don Francesco was ready to try the Phoenix housing market again.

Her company, Metropolitan Marketing & Management, had spent the boom assembling portfolios of houses for wealthy investors. In 2004, she urged her clients to sell, believing the market had peaked. Instead, most held tight as prices continued to crest, then plunged.

Now, though, seeing houses listed for less than $100,000, she was intrigued. On a Saturday morning that August, Don Francesco and a few of her employees drove to the Camelback Inn to check out an auction of houses.

“It was like being in a candy store,” says daughter Makayla Don Francesco, also a broker. Houses were going for as little as $55,000. In a few hours, Metropolitan snapped up 17.

“I said to myself either the world is coming to an end or we’re going to be really, really rich. I don’t know which,” Trish Don Francesco recalls.

The company found even more enticing deals buying homes directly out of foreclosure. In the months since, Don Francesco has bought nearly 350 homes, spending a few thousand dollars to fix each one and then rent them, often to families who surrendered a previous home to foreclosure. Over the next year, it plans to increase its stake to 1,500 houses, buying at trustee’s sales on behalf of investors looking for a steady income stream from rents.

But investors are far from the only players in this game, which trades in the currency of information as much as cash.

It begins each weekday afternoon, when trustees post the opening bids for as many as 1,000 houses. By the next morning, bidders have whittled down their list of targets. Around dawn, Doran and other property runners zigzag across the Valley to check out houses, starting with those slated for 10 a.m sale. They report back to companies like Posted Properties, which charges investors a fee to bid and buy at auction.

Other drivers work for wholesalers, who buy up armfuls of homes and flip them to investors, often within hours, for a quick profit. Still other homes are bought by fix-and-flippers, who renovate and resell for a short-term gain, or investors who buy to rent and hold for a few years.

When a family buys a house, it’s all about emotion. But foreclosure investing requires setting feelings aside, players say, and making a cold calculation on square footage, location and fixup costs. On the courthouse steps, bidders trade bets with seeming disinterest. When the price goes too high, they walk away.

But to say that all emotion is shelved overlooks the X factor drawing bidders. It’s the edginess of the gamble and the pursuit of a deal.

Doug Hopkins, Posted Properties’ CEO, recalls the morning he tagged along with a friend for his first trustee’s sale 11 years ago.

“I went down there and saw what houses were selling for and I had never known that that existed,” Hopkins said. “I remember coming out of there and calling my dad and I said, ‘My life just changed.'”

___

At first, Doran isn’t sure what to make of today’s fifth house: 6233 S. Parkside Drive. Opening bid: $67,000.

Fresh oil stains the floor of the carport. A package from Amazon.com sits unclaimed on the step. No one answers.

It’s an open secret in Phoenix foreclosure investing that, facing a door that won’t budge, some runners simply drill the lock.

“Applicant will be required to do what it takes to get the maximum amount of information for our investors,” one bidding service stipulated in a recent ad for drivers on Craigslist. “This is not for a meek person. Must be an outgoing, forward and fearless individual.”

To Doran, whose real estate license lets him key in to some houses, the tactics of a few tar his trade unfairly. But at Parkside, the back door slides open without resistance. Whoever lived here is gone, leaving only a copy of “Dear Tooth Fairy” on a windowsill. Doran scans the kitchen.

“I’m always afraid I’m going to find a dead body in one of these,” he says, chuckling as he reaches for the refrigerator handle.

Not yet. But he has found cats and lizards floating in abandoned pools, and once, a dead puppy. A few weeks ago, at an empty house in Chandler, he found an Alaskan husky, very much alive, left behind with a bag of dog food.

At this stop, though, the biggest complications are a roof that needs replacing and the house’s size — it has just two bedrooms and a single bath, limiting its appeal.

“Somebody will buy it … for a rental,” he says.

___

During the boom, borrowing was relatively quick and easy. But buying at a trustee’s sale demands payment in full by 5 p.m. the next day, without an appraisal. Forget about asking a bank for a loan.

That’s where Scott Gould comes in.

At 8:40 a.m. on a Wednesday, Gould tilts back in a black office chair, waiting for two phones and a Blackberry to ring so he can put his money to work. Dressed in shorts, sneakers and white golf shirt, he looks more like the gymnast he once was than a banker. On the wall hangs a gift from his wife — a “loan shark” assembled from Monopoly money.

Gould is a “hard money” lender, by some account’s the valley’s busiest. Last year he loaned investors the cash to buy 1,300 homes at trustee’s sales, at an annualized interest rate of 18 percent, although most repay within a few months. Call Gould for a loan and the answer comes back in 20 minutes, once his staff reviews sales of comparable homes.

“The most important thing at the end is, do we think the guy can make money,” he says.

Gould started managing money at 11, already earning the equivalent of a teacher’s paycheck mowing yards and house sitting. He jumped into lending after the Black Friday stock collapse in 1987, when the Phoenix real estate market was tanking. Today, at 52, he and his partners have $85 million in loans out and a goal of $700,000 in new deals each day.

The phone rings. A fix-and-flip investor asks Gould for his opinion about a house in Mesa.

“The inside, from what we could see, looked good. It smelled good,” the man says.

Gould is skeptical, noting the investor is relying on just one other recent sale to gauge value. He counsels bidding $1 over the asking price and no more.

The phone rings again.

“Good morning, Brad. I got a check sitting here hot for you,” Gould says.

This morning, though, is slow, with just three new loans for homes auctioned the previous day. But at the office of Metropolitan Marketing and Management, a few miles away, a new round of sales keeps Makayla Don Francesco’s ear to the phone.

In pursuit of homes that will rent easily with minimal maintenance, she bids only on those built in 1995 or later, between 1500 and 3300 square feet. A few other criteria narrow the day’s list of 618 scheduled sales to just 17 targets. Don Francesco pares the list to 9, eliminating any backing up to major roads or high-tension lines.

When the auctions begin, Metropolitan staffers on site are outbid on two houses and in the chaos, miss two more. But at the 10 a.m. sale, a house in Phoenix opens at $70,000 and Don Francesco grabs it for $72,300, before discovering it has two bedrooms and a den, limiting its appeal to family renters. Then, at the 11 a.m. sale, a house in Buckeye opens at $63,218 and she snags it for $66,000, despite uncertainty about whether it has three or four bedrooms.

“There’s a lot of risk and you are playing with somebody else’s money,” Don Francesco says. “Some days it is terrifying.”

But then she reminds herself that, at these prices, the deals may last for only so long.

___

It’s almost noon and this will be the 10th and final house of Doran’s morning: 2701 Val Vista Drive. Opening bid: $387,600.

“Holy moly,” he says, pulling in. The house is very big. So are the mounds of discarded mattresses and other garbage piled in the overgrown yard. Two cars sit in the driveway.

“It looks like they started on it and quit,” he says, pointing to a recently replastered wall painted in three different shades. He knocks on the back door, then the front. Not a sound. But the place is unlocked. Doran rolls his eyes and walks in.

“Somebody’s still living here,” he says, walking past dishes in the sink and rooms almost devoid of furniture. “This is odd as hell.”

At the living room, he stops and tilts his head. Music floats up from downstairs — and a pair of men’s voices. Doran takes one last picture, then moves quickly and quietly toward the door.

“Not worth getting shot over, I can tell you that,” he says.

___

By Thursday, workmen have ripped out and replaced the ceiling in the house on Weathervane that Doran checked out two mornings ago. And in a kitchen in Scottsdale, Neil Lende, a real estate agent who invests in houses given up for lost, is trying to decide where to begin.

The house, bought at a trustee’s sale Tuesday and paid for Wednesday with a hard money loan, has gold-tone ceiling fans and a “popcorn” ceiling that will have to go. The pool is so green with algae it might as well be bottomless.

It’s hardly a wreck. But in a valley full of empty houses, what makes this one — or any of the hundreds of others for sale on the courthouse steps — a singular opportunity?

It’s clear only when Lende opens the door to another investment in a subdivision called Paradise Manor, 10 minutes away

“When we first came to this one, this stuff was growing all the way out to here,” says Charlie Sugarman, project manager for Lende’s fix and flip business, pointing to shrubs that blocked the path to the door. Neighbors reported that the previous owner, a chiropractor, moved out in the middle of the night. Inside, Lende found the kitchen plastered with coffee grounds.

Now, the interior is repainted in silver sage, fitted with brushed metal door knobs. The kitchen cabinets, refinished in cream and mocha, snuggle against stainless steel appliances. A sign over the counter welcomes the next chef. “Live. Laugh. Love,” it says.

Lende paid $194,651 for the house in early March, then spent $35,000 to renovate. “We knew we could make it really cute,” he says.

The first weekend on the market, he had two offers. Tomorrow it goes to closing, sold to a retiree couple from New Jersey. For two months work — and risk — he’ll pocket a $40,000 profit.

But while the new owners know they’re buying a foreclosure, they almost certainly don’t realize the pipeline it has traveled.

“I don’t think they can envision it how it used to be, which is good,” Lende says. “Because this is the reality now.”

Adam Geller is a national writer for The Associated Press based in New York. He can be reached at features(at)ap.org.

Copyright © 2010 The Associated Press. All rights reserved.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

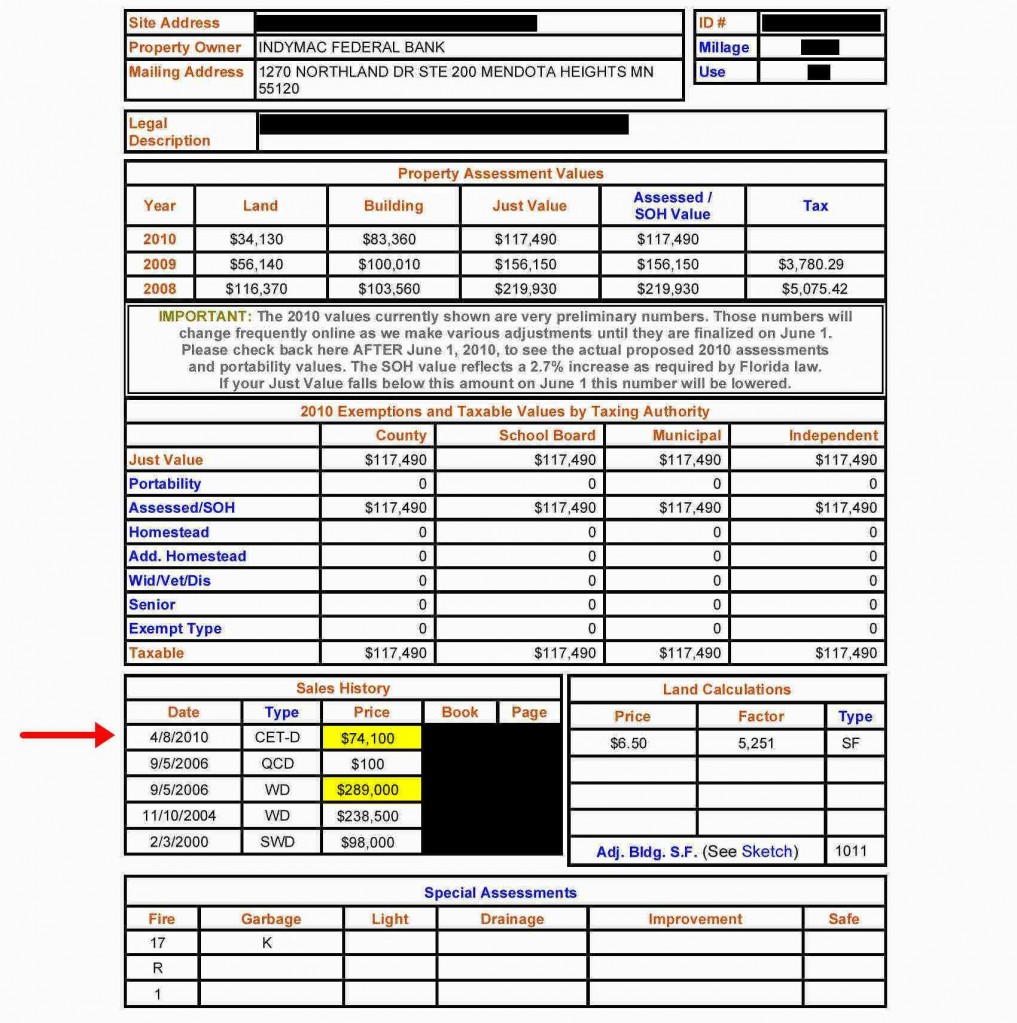

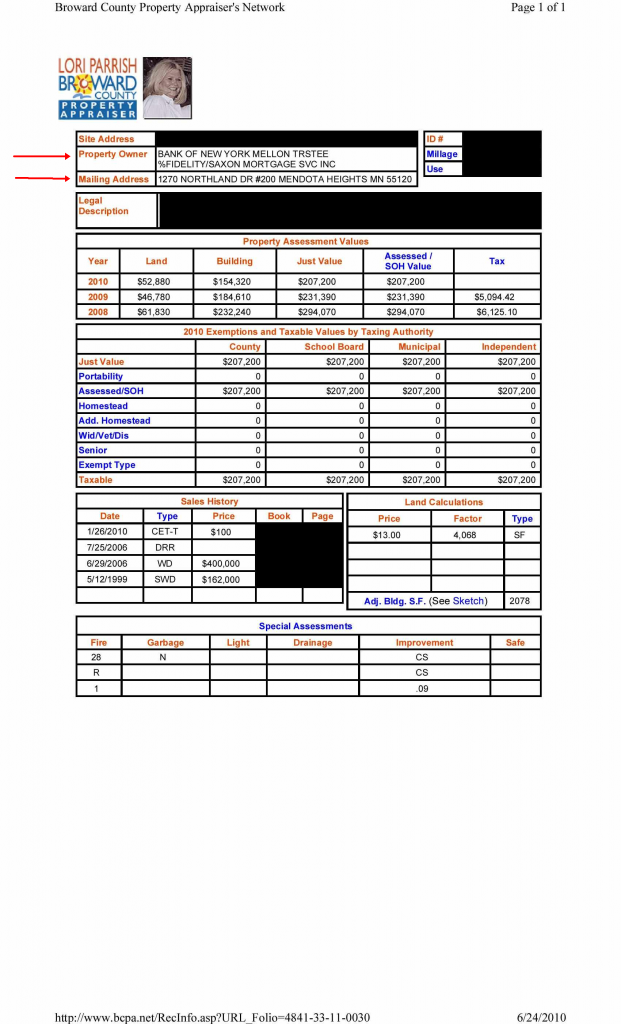

This is what this site is about…”ClOUDED TITLES”! This quote below should have added that it was in 65 Million mortgages not in some. I hope you all read my NO. THERE’S NO LIFE AT MERS…I highly recommend it because it came the heart.

Continue reading…BLOOMBERG

Continue reading…BLOOMBERG

Recent Comments