Posted on 05 October 2012.

Decided on October 4, 2012

Supreme Court, Kings County

IndyMac Federal Bank, FSB, Plaintiff,

against

Mendel Meisels et. al., Defendants.

8752/09

Plaintiff

Fein Such and Crane, LLP

Rochester NY

Defendant:

Hanna & Vlahakis

Brooklyn NY

Arthur M. Schack, J.

In this mortgage foreclosure action, for the premises located at 2062 61st Street, Brooklyn, New York (Block 5528, Lot 33, County of Kings), defendant MENDEL MEISELS (MEISELS) moves, pursuant to CPLR Rule 5015 (a) (4), to vacate the July 27, 2010 order of reference granted upon defendant MEISEL’s default, for “lack of jurisdiction to render the . . . order” to plaintiff INDYMAC FEDERAL BANK, FSB [INDYMAC FED] and then, if vacated, either dismiss the instant action, pursuant to CPLR Rule 3211 (a) (1) and (7), or grant leave to defendant MEISELS to file a late answer, pursuant to the CPLR Rule 2004 and § 3012 (d). [*2]

The Court grants relief to defendant MEISELS. In the instant action, plaintiff INDYMAC FED lacks jurisdiction. It ceased to exist on March 19, 2009, almost three weeks before the instant action commenced on April 9, 2009. If plaintiff INDYMAC FED has jurisdiction and standing it would be the legal equivalent of a vampire – the “living dead.” Further, the Court is concerned that: there are documents in this action in which various individuals claim to be officers of either the “living dead” INDYMAC FED or its deceased predecessor INDYMAC BANK, FSB [INDYMAC]; and, the law firm of Fein, Such & Crane, LLP (FS & C) commenced and prosecuted this meritless action, asserting false material statements, on behalf of a client that ceased to exist 20 days prior to the commencement of the instant action.

If plaintiff INDYMAC FED is a financial “Count Dracula,” then its counsel, FS & C, is its “Renfield.” In the 1931 Bela Lugosi “Dracula” movie, the English solicitor Renfield travels to Transylvania to have Dracula execute documents for the purchase of Carfax Abbey, only to be drugged by Count Dracula and turned into his thrall. Renfield, before his movie death, tells Dracula “I’m loyal to you. Master, I am your slave, I didn’tBetray you! Oh, no, don’t! Don’t kill me! Let me live, please! Punish me, torture me, but let me live! I can’t die with all those lives on my conscience! All that blood on my hands!”(“Memorable quotes for Dracula [1931]” at www.imdb.com/title/tt021814/ quotes). FS & C, similar to Renfield, throughout its papers and at oral argument demonstrated its loyalty by not betraying its client and Master, the “living dead” INDYMAC FED.

Further, the Court finds that it is an extraordinary circumstance for a corporate entity that ceased to exist, plaintiff INDYMAC FED, to retain counsel and proceed to foreclose on a mortgage for real property. This extraordinary circumstance requires the Court to: vacate defendant MEISELS’ default, because it is impossible for the “living dead” plaintiff, INDYMAC FED, to have jurisdiction; dismiss the instant action with prejudice; and, give FS & C an opportunity to be heard as to why the Court should not sanction it for engaging in frivolous conduct, in violation of 22 NYCRR § 130-1.1 (c) (1) and (3), because the instant action is “completely without merit in law” and “asserts material factual representations that are false.”

Background

Defendant MEISELS closed on his $765,000.00 purchase of the subject property, a two-family investment property, on March 7, 2005. The deed was recorded on March 25,

2005, in the Office of the City Register of the City of New York, at City Register File Number (CRFN) 2005000175346. MEISELS, to finance the purchase, borrowed

$460,000.00 from INDYMAC and, at the March 7, 2005 closing, executed a mortgage and note for that amount. In the subject mortgage it states that INDYMAC is the “lender” and Mortgage Electronic Registrations Systems, Inc. [MERS] “is a separate corporation that is acting solely as a nominee for Lender” and “FOR PURPOSES OF RECORDING THIS MORTGAGE, MERS IS THE MORTGAGEE OF RECORD.” The subject note states that INDYMAC is the “lender” and the “Note Holder” is “[t]he Lender or anyone who takes this Note by transfer.” MERS, as nominee for INDYMAC, recorded the subject mortgage and note on March 25, 2005, in the Office of the City Register of the City of New York, at CRFN 2005000175347.

Subsequently, INDYMAC failed in the 2008 financial meltdown. The Federal Deposit [*3]Insurance Corporation [FDIC] stated in its December 15, 2010 “Failed Bank Information” for INDYMAC and INDYMAC FED:

On July 11, 2008, IndyMac Bank, F.S.B., Pasadena, CA was closed

by the Office of Thrift Supervision (OTS) and the FDIC was named

Conservator. All non-brokered insured deposit accounts and substantially

all of the assets of IndyMac Bank, F.S.B. have been transferred to

IndyMac Federal Bank, F.S.B. (IndyMac Federal Bank), Pasadena,

CA (“assuming institution”) a newly chartered full-service FDIC-insured

institution.

Then, the FDIC, approximately eight months later, on March 19, 2009, transferred the assets of INDYMAC FED to a new bank, OneWest Bank, FSB. The FDIC stated in its December 15, 2010 “Failed Bank Information” for INDYMAC and INDYMAC FED:On March 19, 2009, the Federal Deposit Insurance Corporation

(FDIC) completed the sale of IndyMac Federal Bank, FSB, Pasadena,

California, to OneWest Bank, F.S.B., Pasadena, California. OneWest

Bank, FSB is a newly formed federal savings bank organized by IMB

HoldCo LLC. All deposits of IndyMac Federal Bank, FSB have

been transferred to OneWest Bank, FSB.

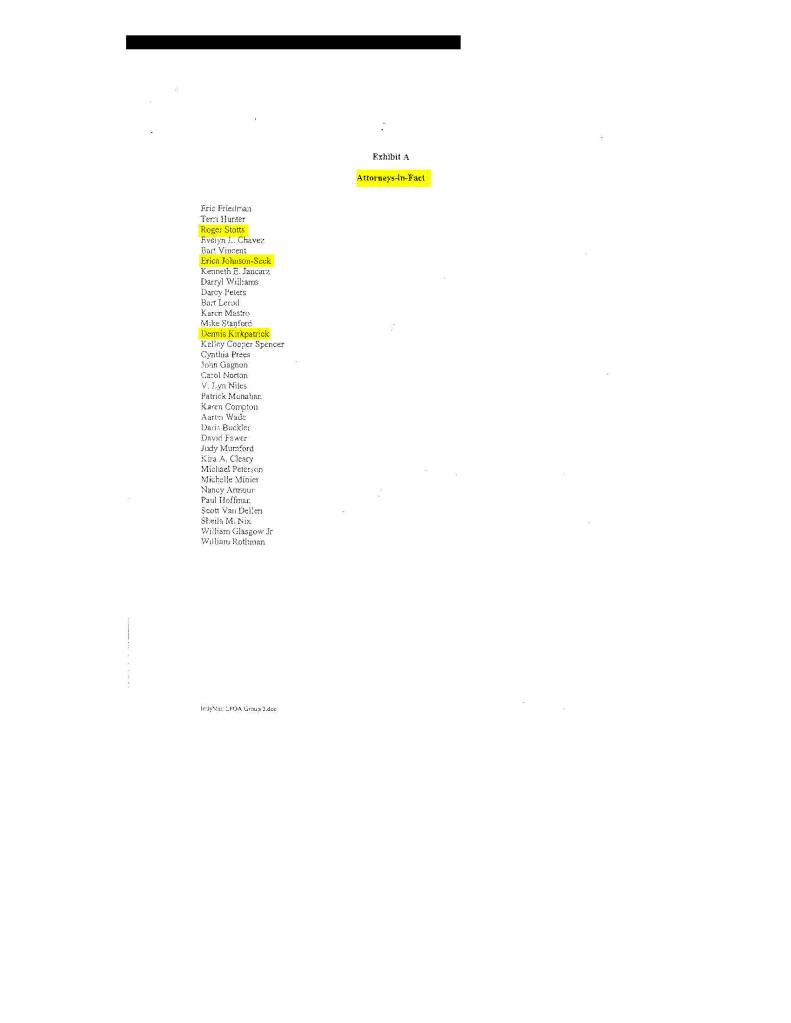

Meanwhile, MERS, as nominee for INDYMAC, on March 10, 2009, despite INDYMAC’s July 11, 2008 corporate demise, assigned the subject mortgage with “all rights accrued under said Mortgage and all indebtedness secured thereby” to INDYMAC FED. This assignment was recorded in the Office of the City Register of the City of New York, at CRFN 2009000085845, on March 25, 2009. No power of attorney authorizing MERS to assign the mortgage was attached or recorded. Further, MERS’ assignor, as Vice President of MERS, for the “living dead” INDYMAC, was the infamous robosigner

Erica Johnson-Seck. This Court, in several previous decisions, most notably in OneWest Bank, F.S.B. v Drayton (29 Misc 3d 1021 [Sup Ct, Kings County 2010]), discussed Ms. Johnson-Seck’s robosigning activities. In Deutsche Bank v Maraj (18 Misc 3d 1123 [A] [Sup Ct, Kings County 2008]), Ms. Johnson-Seck was Vice President of both assignor MERS and assignee Deutsche Bank. In Indymac Bank, FSB v Bethley (22 Misc 3d 1119 [A] [Sup Ct, Kings County 2009]), Ms. Johnson-Seck was Vice President of both assignor MERS and assignee Indymac Bank. In Deutsche Bank v Harris (Sup Ct, Kings County, Feb. 5, 2008, Index No. 35549/07), Ms. Johnson-Seck executed an affidavit of merit as Vice President of Deutsche Bank.

This Court observed in Drayton, at 1022-1023:

Ms. Johnson-Seck, in a July 9, 2010 deposition taken in a Palm Beach

County, Florida foreclosure case, admitted that she: is a “robo-signer”

who executes about 750 mortgage documents a week, without a notary [*4]

public present; does not spend more than 30 seconds signing each

document; does not read the documents before signing them; and,

did not provide me with affidavits about her employment in two

prior cases.

Moreover, in Drayton, at 1026:

Ms. Johnson-Seck admitted that she is not an officer of MERS, has

no idea how MERS is organized and does not know why she signs

assignments as a MERS officer. Further, she admitted that the MERS

assignments she executes are prepared by an outside vendor, Lender

Processing Services, Inc. (LPS), which ships the documents to her

Austin, Texas office from Minnesota. Moreover, she admitted executing

MERS assignments without a notary public present. She also testified

that after the MERS assignments are notarized they are shipped back

to LPS in Minnesota.

FS & C, as counsel for the “living dead” plaintiff, INDYMAC FED, commenced the instant action on April 9, 2009 by filing the summons, verified complaint and notice of pendency with the Kings County Clerk. These documents are all dated April 8, 2009. Plaintiff’s counsel, FS & C, incorrectly states in the April 8, 2009 complaint that: plaintiff INDYMAC FED is “existing” and “doing business in the State of New York” [¶ 1]; and “the plaintiff is now the owner and holder of the said bond(s)/notes(s) and mortgages securing the same” [¶ 11]. Mark K. Broyles, Esq., the “Renfield” for the “living dead” INDYMAC FED, in his verification of the complaint, dated 20 days after plaintiff INDYMAC FED ceased to exist, states “I am the attorney of record, or of counsel with the attorney(s) of record for the plaintiff. I have read the annexed Summons and Complaint and know the contents thereof and the same are true to my knowledge” and “I verify that the foregoing statement are true under the penalties of perjury [emphasis added].”

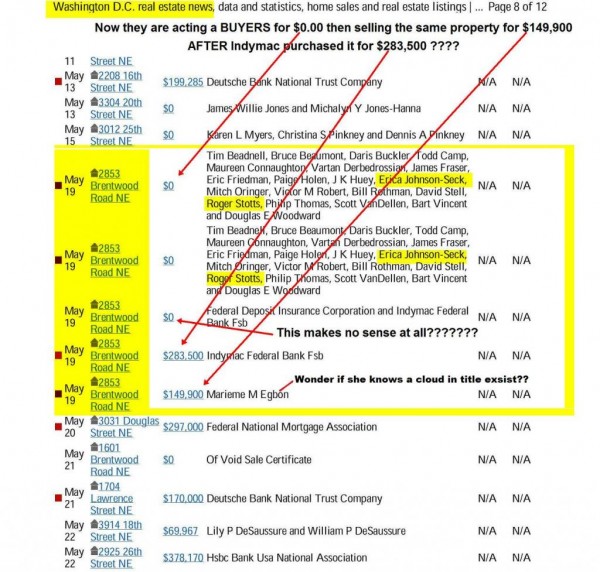

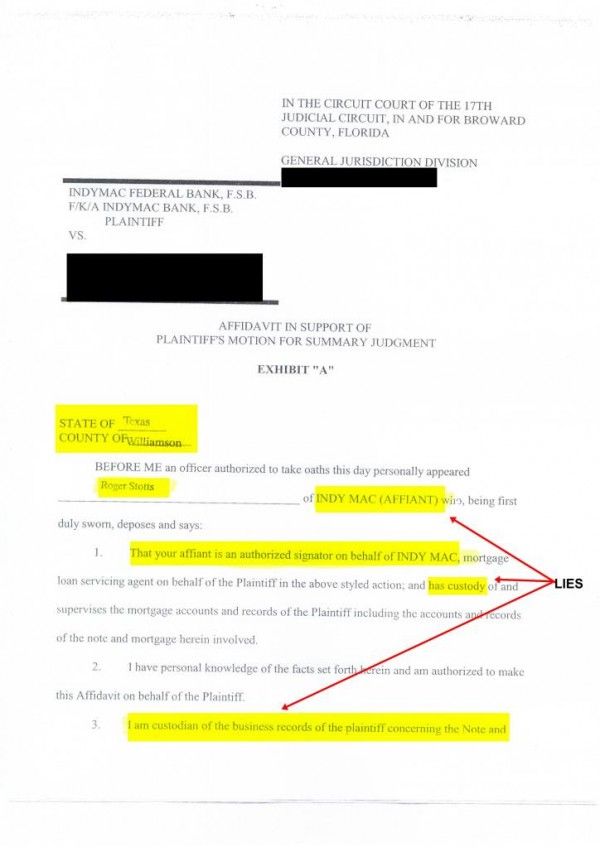

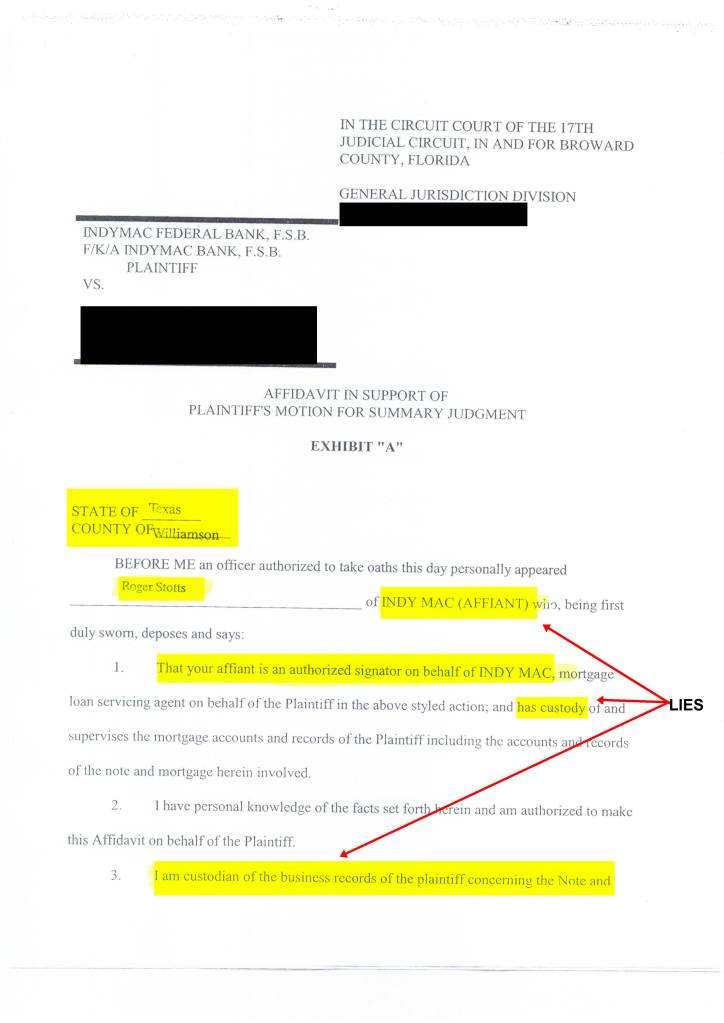

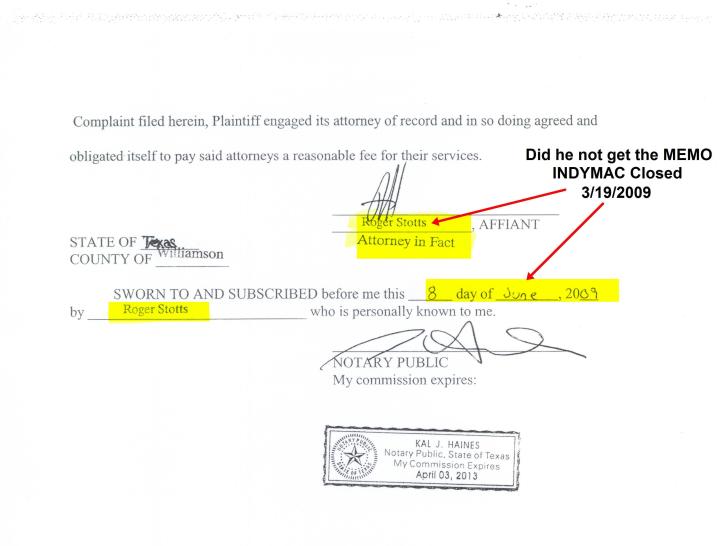

In his April 15, 2009 affidavit of amount due, Roger Stotts claims to be Vice President of plaintiff INDYMAC FED, despite the end of its existence on March 19, 2009, and claims, in ¶ 4, “Plaintiff is still the holder of the aforesaid obligation and mortgage” and, in ¶ 7, “I hereby certify that the foregoing statements made by me are true; I am aware that if any of the foregoing statements made by me are willfully false, I am subject to punishment.” Mr. Stotts alleges that defendant MEISELS

defaulted in his mortgage loan payments on August 1, 2008. Then, in his June 2, 2009 certificate of conformity, Mr. Broyles swears that “the foregoing acknowledgment of Roger Stotts . . . and based upon my review thereof, appears to conform with the laws of the State of New York.” The Court wonders why Mr. Broyles and FS & C continue the charade of representing a deceased corporation and falsely asserting its existence.

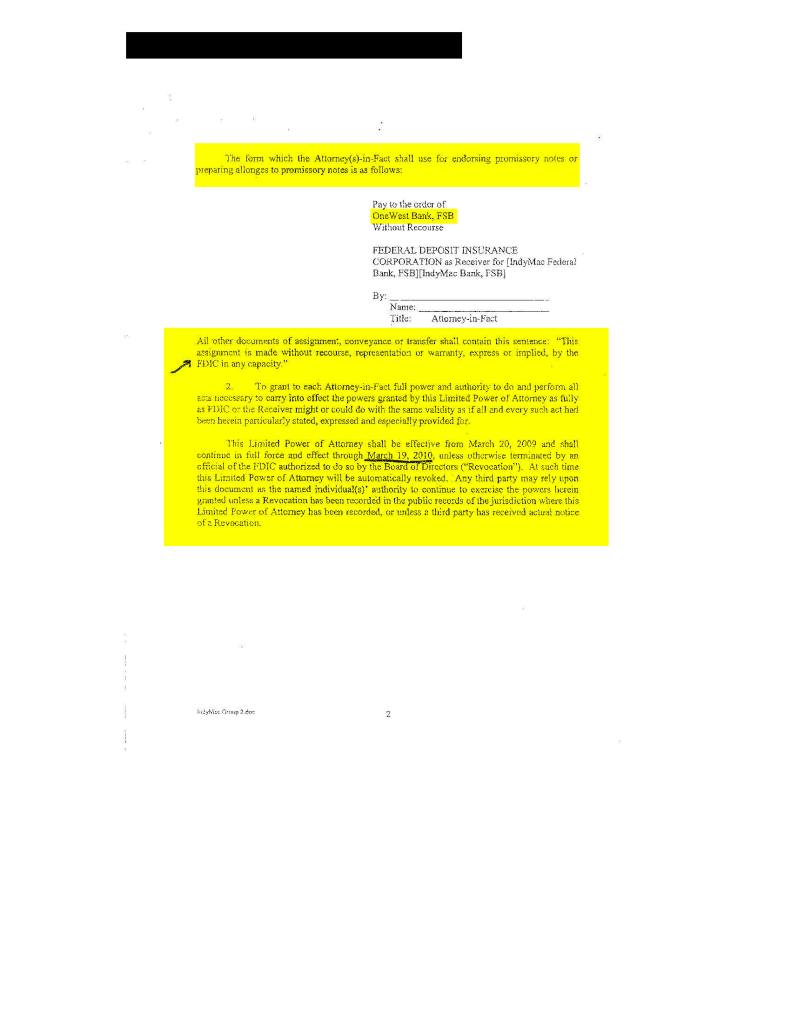

Subsequent to the Erica Johnson-Seck March 10, 2009 assignment of the subject mortgage “and all indebtedness secured thereby,” from MERS, as nominee for the then “living dead” INDYMAC, to assignee INDYMAC FED, there is another assignment of the subject mortgage “and all indebtedness secured thereby,” on March 30, 2011 by Wendy Traxler, as “Attorney in Fact” for “Federal Insurance Corporation [sic] as Receiver for IndyMac Bank, [*5]F.S.B.” to “Deutsche Bank National Trust Company, as Trustee of the Residential Asset Securitization Trust 2005-A6CB, Mortgage Pass-Through Certificates, Series 2005-F under the Pooling and Servicing Agreement dated May 1, 2005.” This assignment was recorded in the Office of the City Register of the City of New York, at CRFN 2011000132354, on April 12, 2011. No power of attorney is attached to the Wendy Traxler assignment nor is a power of attorney recorded. Moreover, Ms. Traxler, similar to Erica Johnson-Seck, executed the assignment in Austin, Texas. The Court is perplexed about why the FDIC assigned the subject mortgage and note if the assets of INDYMAC and its successor INDYMAC FED were assigned on March 19, 2009 to OneWest Bank, F.S.B.

Mr. Broyles, subsequent to this, on March 9, 2012, executed a new notice of pendency in the instant action for then almost three years deceased plaintiff, INDYMAC FED, and certified the additional notice of pendency as “an attorney licensed to practice in the State of New York, and a partner in the law firm of Fein, Such & Crane, LLP.” Moreover, despite representing the “living dead” INDYMAC FED, Mr. Broyles certified that the additional notice of pendency, “to his knowledge, information and belief, formed after an inquiry reasonable under the circumstances” is “not frivolous as defined in subsection (c) of section 130-1.1 of the Rules of the Chief Administrator [22 NYCRR 130-1.1 (c)].

Non-existent corporate plaintiff’s lack of jurisdiction

In the instant action, plaintiff INDYMAC FED ceased to exist prior to the commencement of the action. The FDIC, as outlined above, sold plaintiff INDYMAC FED to One West Bank, F.S.B., on March 19, 2009. Therefore, plaintiff INDYMAC FED could not obtain personal jurisdiction over defendant MEISELS because it lacked the capacity to commence the instant foreclosure on April 8, 2009, subsequent to its corporate demise. The Appellate Division, Second Department, in Westside Federal Sav. & Loan Ass’n v Fitzgerald (136 AD2d 699 [2d Dept 1988]), quoting Sheldon v Kimberly-Clark Corp. (105 AD2d 273, 276 [2d Dept 1984]), instructed that once a banking institution has been merged or absorbed by another banking institution “the absorbed corporation immediately ceases to exist as a separate entity, and may no longer be a named party in litigation.” (See Zarzcyki v Lan Metal Products, Corp., 62 AD3d 788, 789 [2d Dept 2009]).

Therefore, the “living dead” INDYMAC FED was unable to be named a party in litigation and obtain personal jurisdiction over defendant MEISELS. Thus, it follows that plaintiff INDYMAC FED clearly lacks standing. “Standing to sue is critical to the proper functioning of the judicial system. It is a threshold issue. If standing is denied, the pathway to the courthouse is blocked. The plaintiff who has standing, however, may cross the threshold and seek judicial redress.” (Saratoga County Chamber of Commerce, Inc. v Pataki, 100 NY2d 801 812 [2003], cert denied 540 US 1017 [2003]). Professor David Siegel (NY Prac, § 136, at 232 [4d ed]), instructs that:

[i]t is the law’s policy to allow only an aggrieved person to bring a

lawsuit . . . A want of “standing to sue,” in other words, is just another

way of saying that this particular plaintiff is not involved in a genuine

controversy, and a simple syllogism takes us from there to a “jurisdictional” [*6]

dismissal: (1) the courts have jurisdiction only over controversies; (2) a

plaintiff found to lack “standing”is not involved in a controversy; and

(3) the courts therefore have no jurisdiction of the case when such a

plaintiff purports to bring it.

“Standing to sue requires an interest in the claim at issue in the lawsuit that the law will

recognize as a sufficient predicate for determining the issue at the litigant’s request.” (Caprer v Nussbaum (36 AD3d 176, 181 [2d Dept 2006]). If a plaintiff lacks standing to

sue, the plaintiff may not proceed in the action. (Stark v Goldberg, 297 AD2d 203 [1st Dept 2002]).

The Appellate Division, Second Department instructed, in Aurora Loan Services, LLC v Weisblum (85 AD3d 95, 108 [2d Dept 2011]), that:

In order to commence a foreclosure action, the plaintiff must

have a legal or equitable interest in the mortgage ( see Wells Fargo

Bank, N.A. v Marchione, 69 AD3d, 204, 207 [2d Dept 2009]). A

plaintiff has standing where it is both (1) the holder or assignee of

the subject mortgage and (2) the holder or assignee of the underlying

note, either by physical delivery or execution of a written assignment

prior to the commencement of the action with the filing of the complaint

(see Wells Fargo Bank, N.A. v Marchione, 69 AD3d at 207-209; U.S. v Collymore, 68 AD3d 752, 754 [2d Dept 2009].)

With the lack of jurisdiction by the “living dead” plaintiff INDYMAC FED, the Court does not have to address the numerous defects in the alleged assignments of the subject MEISELS mortgage and note. However, in the instant action, even if MERS had authority to transfer the mortgage to INDYMAC FED, the “living dead” INDYMAC, at the time of the Erica Johnson-Seck assignment, not MERS, was the note holder. MERS cannot transfer something it never proved it possessed. A “foreclosure of a mortgage may not be brought by one who has no title to it and absent transfer of the debt, the assignment of the mortgage is a nullity [Emphasis added].” (Kluge v Fugazy (145 AD2d 537, 538 [2d Dept 1988]). Moreover, “a mortgage is but an incident to the debt which it is intended to secure . . . the logical conclusion is that a transfer of the mortgage without the debt is a nullity, and no interest is assigned by it. The security cannot be separated from the debt, and exist independently of it. This is the necessary legal conclusion.” (Merritt v Bartholick, 36 NY 44, 45 [1867]. The Appellate Division, First Department, citing Kluge v Fugazy in Katz v East-Ville Realty Co. ( 249 AD2d 243 [1d Dept 1998]), instructed that “[p]laintiff’s attempt to foreclose upon a mortgage in which he had no

legal or equitable interest was without foundation in law or fact.” (See U.S. Bank, N.A. v Collymore, 68 AD3d at 754). [*7]

Moreover, MERS had no authority to assign the subject mortgage and note. Erica

Johnson-Seck, for MERS as assignor, did not have specific authority to sign the MEISELS mortgage. Under the terms of the mortgage, MERS is “acting solely as a nominee for Lender [INDYMAC],” which ceased to exist prior to the assignment. Even if INDYMAC existed at the time of assignment, there is no power of attorney authorizing

the assignment. In the subject MEISELS mortgage MERS was “acting solely as a nominee for Lender,” which was the deceased INDYMAC. The term “nominee” is

defined as “[a] person designated to act in place of another, usu. in a very limited way” or “[a] party who holds bare legal title for the benefit of others.” (Black’s Law Dictionary 1076 [8th ed 2004]). “This definition suggests that a nominee possesses few or no legally enforceable rights beyond those of a principal whom the nominee serves.” (Landmark National Bank v Kesler, 289 Kan 528, 538 [2009])

The New York Court of Appeals in MERSCORP, Inc. v Romaine (8 NY3d 90 [2006]), explained how MERS acts as the agent of mortgagees, holding at 96:

In 1993, the MERS system was created by several large

participants in the real estate mortgage industry to track ownership

interests in residential mortgages. Mortgage lenders and other entities,

known as MERS members, subscribe to the MERS system and pay

annual fees for the electronic processing and tracking of ownership

and transfers of mortgages. Members contractually agree to appoint

MERS to act as their common agent on all mortgages they register

in the MERS system. [Emphasis added]

Thus, it is clear that MERS’s relationship with its member lenders is that of agent with the lender-principal. This is a fiduciary relationship, resulting from the manifestation of consent by one person to another, allowing the other to act on his behalf, subject to his

control and consent. The principal is the one for whom action is to be taken, and the agent is the one who acts.It has been held that the agent, who has a fiduciary relationship with the principal, “is a party who acts on behalf of the principal with the latter’s express, implied, or apparent authority.” (Maurillo v Park Slope U-Haul, 194 AD2d 142, 146 [2d Dept 1992]). “Agents are bound at all times to exercise the utmost good faith toward their principals. They must act in accordance with the highest and truest principles of morality.” (Elco Shoe Mfrs. v Sisk, 260 NY 100, 103 [1932]). (See Sokoloff v Harriman Estates Development Corp., 96 NY 409 [2001]); Wechsler v Bowman, 285 NY 284 [1941]; Lamdin v Broadway Surface Advertising Corp., 272 NY 133 [1936]). An agent “is prohibited from acting in any manner inconsistent with his agency or trust and is at all times bound to exercise the utmost good faith and loyalty in the performance of his duties.” (Lamdin, at 136).

Thus, in the instant action, MERS, as nominee for INDYMAC, was INDYMAC’S agent [*8]for limited purposes. It only has those powers given to it and authorized by INDYMAC, its principal. Even if plaintiff INDYMAC FED existed and had jurisdiction, its counsel, FS & C, failed to submit documents authorizing MERS, as nominee for the then deceased INDYMAC, to assign the subject mortgage and note to the “living dead”

plaintiff, INDYMAC FED. MERS lacked authority to assign the MEISELS mortgage, making the assignment defective.

The Appellate Division, Second Department in Bank of New York v Silverberg, (86

AD3d 274, 275 [2d Dept 2011]), confronted the issue of “whether a party has standing to

commence a foreclosure action when that party’s assignor—in this case, Mortgage Electronic Registration Systems, Inc. (hereinafter MERS)—was listed in the underlying mortgage instruments as a nominee and mortgagee for the purpose of recording, but was never the actual holder or assignee of the underlying notes.” The Court held, at 275, “[w]e answer this question in the negative.” MERS, in the Silverberg case and in the instant MEISELS’ action, never had title or possession of the note. The Silverberg Court instructed, at 281-282:

the assignment of the notes was thus beyond MERS’s authority as

nominee or agent of the lender (see Aurora Loan Servs., LLC v

Weisblum, AD3d, 2011 NY Slip Op 04184, *6-7 [2d Dept 2011];

HSBC Bank USA v Squitteri, 29 Misc 3d 1225 [A] [Sup Ct, Kings

County, F. Rivera, J.]; ; LNV Corp. v Madison Real Estate, LLC,

2010 NY Slip Op 33376 [U] [Sup Ct, New York County 2010,

York, J.]; LPP Mtge. Ltd. v Sabine Props., LLC, 2010 NY Slip Op

32367 [U] [Sup Ct, New York County 2010, Madden, J.]; Bank of

NY v Mulligan, 28 Misc 3d 1226 [A] [Sup Ct, Kings County 2010,

Schack, J.]; One West Bank, F.S.B., v Drayton, 29 Misc 3d 1021

[Sup Ct, Kings County 2010, Schack, J.]; Bank of NY v Alderazi,

28 Misc 3d 376, 379-380 [Sup Ct, Kings County 2010, Saitta, J.]

[the “party who claims to be the agent of another bears the burden

of proving the agency relationship by a preponderance of the evidence”];

HSBC Bank USA v Yeasmin, 24 Misc 3d 1239 [A] [Sup Ct, Kings

County 2010, Schack, J.]; HSBC Bank USA, N.A. v Vasquez, 24

Misc 3d 1239 [A], [Sup Ct, Kings County 2009, Schack, J.]; Bank of

NY v Trezza, 14 Misc 3d 1201 [A] [Sup Ct, Suffolk County 2006,

Mayer, J.]; La Salle Bank Natl. Assn. v Lamy, 12 Misc 3d 1191 [A]

[Sup Ct, Suffolk County, 2006, Burke, J.]; Matter of Agard, 444 BR [*9]

231 [Bankruptcy Court, ED NY 2011, Grossman, J.]; but see U.S.

Bank N.A. v Flynn, 27 Misc 3d 802 [Sup Ct, Suffolk County 2011,

Whelan, J.]).

Moreover, the Silverberg Court concluded, at 283, “because MERS was never the

lawful holder or assignee of the notes described and identified in the consolidation agreement, the . . . assignment of mortgage is a nullity, and MERS was without authority

to assign the power to foreclose to the plaintiff. Consequently, the plaintiff failed to show that it had standing to foreclose.” Further, Silverberg the Court observed, at 283, “the law must not yield to expediency and the convenience of lending institutions. Proper procedures must be followed to ensure the reliability of the chain of ownership, to secure the dependable transfer of property, and to assure the enforcement of the rules that govern real property [emphasis added].”

To further muddy the waters of the instant action, there is the issue of the March 30, 2011 assignment of the subject mortgage by Wendy Traxler, as attorney in fact for FDIC as Receiver for INDYMAC FED, more than two years after INDYMAC FED ceased to exist and the FDIC sold its assets to One West Bank, F.S.B. Even if the FDIC as Receiver could assign the subject mortgage, this assignment is defective because it lacks a power of attorney to Ms. Traxler. To have a proper assignment of a mortgage by an authorized agent, a power of attorney is necessary to demonstrate how the agent is vested with the authority to assign the mortgage. “No special form or language is necessary to effect an assignment as long as the language shows the intention of the owner of a right to transfer it [Emphasis added].” (Tawil v Finkelstein Bruckman Wohl Most & Rothman, 223 AD2d 52, 55 [1d Dept 1996]). (See Real Property Law § 254 (9); Suraleb, Inc. v International Trade Club, Inc., 13 AD3d 612 [2d Dept 2004]).

Further, preprinted at the bottom of both the defective Johnson-Seck and the defective Traxler assignments, under the notary public’s jurat, is the same language, “When recorded mail to: Fein, Such and Crane, LLP, 28 East Main St. Ste.1800, Rochester, NY 14614.”

Extraordinary circumstances warrant dismissal with prejudice

The chain of events in this action by the “living dead” plaintiff INDYMAC FED, with its failure to have personal jurisdiction, mandates dismissal of the instant action with prejudice. “A court’s power to dismiss a complaint, sua sponte, is to be used sparingly and only when extraordinary circumstances exist to warrant dismissal.” (U.S. Bank, N. A. v Emmanuel, 83 AD3d 1047, 1048 [2d Dept 2011]). The term “extraordinary circumstances” is defined as “[a] highly unusual set of facts that are not commonly associated with a particular thing or event.” (Black’s Law Dictionary 236 [7th ed 1999]).

It certainly is “a highly unusual set of facts” for a deceased plaintiff to not only commence an action and but to continue to prosecute the action. The events in the instant action are “not commonly associated with a” foreclosure action.

However, the Court is not precluding the correct owner of the subject MEISELS mortgage, whomever it might be, from commencing a new action, with a new index number, to foreclose on the MEISELS mortgage. The July 27, 2010 order of reference is vacated, pursuant to CPLR Rule 5015 (a) (4), for lack of jurisdiction by a non-existent plaintiff, INDYMAC FED. The Court’s dismissal with prejudice is not on the merits of the action.

[*10]Cancellation of subject notice of pendency

The dismissal with prejudice of the instant foreclosure action requires the

cancellation of the notices of pendency. CPLR § 6501 provides that the filing of a notice

of pendency against a property is to give constructive notice to any purchaser of real property or encumbrancer against real property of an action that “would affect the title to, or the possession, use or enjoyment of real property, except in a summary proceeding brought to recover the possession of real property.” The Court of Appeals, in 5308 Realty Corp. v O & Y Equity Corp.(64 NY2d 313, 319 [1984]), commented that “[t]he purpose of the doctrine was to assure that a court retained its ability to effect justice by preserving its power over the property, regardless of whether a purchaser had any notice of the pending suit,” and, at 320, that “the statutory scheme permits a party to effectively retard the alienability of real property without any prior judicial review.”

CPLR § 6514 (a) provides for the mandatory cancellation of a notice of pendency by:

The Court, upon motion of any person aggrieved and upon such

notice as it may require, shall direct any county clerk to cancel

a notice of pendency, if service of a summons has not been completed

within the time limited by section 6512; or if the action has been

settled, discontinued or abated; or if the time to appeal from a final

judgment against the plaintiff has expired; or if enforcement of a

final judgment against the plaintiff has not been stayed pursuant

to section 551. [emphasis added]

The plain meaning of the word “abated,” as used in CPLR § 6514 (a) is the ending of an action. “Abatement” is defined as “the act of eliminating or nullifying.” (Black’s Law Dictionary 3 [7th ed 1999]). “An action which has been abated is dead, and any further enforcement of the cause of action requires the bringing of a new action, provided that a cause of action remains (2A Carmody-Wait 2d § 11.1).” (Nastasi v Natassi, 26 AD3d 32, 40 [2d Dept 2005]). Further, Nastasi at 36, held that the “[c]ancellation of a notice of pendency can be granted in the exercise of the inherent power of the court where its filing fails to comply with CPLR § 6501 (see 5303 Realty Corp. v O & Y Equity Corp., supra at 320-321; Rose v Montt Assets, 250 AD2d 451, 451-452 [1d Dept 1998]; Siegel, NY Prac § 336 [4th ed]).” Thus, the dismissal of the instant complaint must result in the mandatory cancellation of the “living dead” plaintiff INDYMAC FED’s notices of pendency against the property “in the exercise of the inherent power of the court.”

Possible frivolous conduct by plaintiff’s counsel

Th commencement and continuation of the instant action by the “living dead” plaintiff INDYMAC FED, with its false statements of facts, the use of a robosigner and the disingenuous statements by Roger Stotts, Mr. Broyles and his firm, FS & C, appears to be frivolous. 22 NYCRR § 130-1.1 (a) states that “the Court, in its discretion may impose financial sanctions upon any party or attorney in a civil action or proceeding who engages in frivolous conduct as defined in this Part, which shall be payable as provided in section 130-1.3 of this Subpart.” Further, it states in 22 NYCRR § 130-1.1 (b), that “sanctions may be imposed upon any attorney appearing in the action or upon a partnership, firm or corporation with which the attorney is associated.” [*11]

22 NYCRR § 130-1.1 (c) states that:

For purposes of this part, conduct is frivolous if:

(1) it is completely without merit in law and cannot be supported

by a reasonable argument for an extension, modification or

reversal of existing law;

(2) it is undertaken primarily to delay or prolong the resolution of

the litigation, or to harass or maliciously injure another; or

(3) it asserts material factual statements that are false.

It is clear that the instant foreclosure action “is completely without merit in law” and “asserts material factual statements that are false.” Further, Mr. Broyles’ false and defective statements in the April 8, 2009 complaint and the June 2, 2009 certificate of conformity may be a cause for sanctions.

Several years before the drafting and implementation of the Part 130 Rules for

costs and sanctions, the Court of Appeals (A.G. Ship Maintenance Corp. v Lezak, 69 NY2d 1, 6 [1986]) observed that “frivolous litigation is so serious a problem affecting the

proper administration of justice, the courts may proscribe such conduct and impose sanctions in this exercise of their rule-making powers, in the absence of legislation to the contrary (see NY Const, art VI, § 30, Judiciary Law § 211 [1] [b] ).”

Part 130 Rules were subsequently created, effective January 1, 1989, to give the

courts an additional remedy to deal with frivolous conduct. These stand beside Appellate Division disciplinary case law against attorneys for abuse of process or malicious prosecution. The Court, in Gordon v Marrone (202 AD2d 104, 110 [2d Dept 1994], lv denied 84 NY2d 813 [1995]), instructed that:

Conduct is frivolous and can be sanctioned under the court rule if

“it is completely without merit . . . and cannot be supported by a

reasonable argument for an extension, modification or reversal of

existing law; or . . . it is undertaken primarily to delay or prolong

the resolution of the litigation, or to harass or maliciously injure

another” (22 NYCRR 130-1.1[c] [1], [2] . . . ).

In Levy v Carol Management Corporation (260 AD2d 27, 33 [1st Dept 1999]) the Court stated that in determining if sanctions are appropriate the Court must look at the broad pattern of conduct by the offending attorneys or parties. Further, “22 NYCRR

130-1.1 allows us to exercise our discretion to impose costs and sanctions on an errant party . . .” Levy at 34, held that “[s]anctions are retributive, in that they punish past conduct. They also are goal oriented, in that they are useful in deterring future frivolous conduct not only by the particular parties, but also by the Bar at large.”

The Court, in Kernisan, M.D. v Taylor (171 AD2d 869 [2d Dept 1991]), noted that the intent of the Part 130 Rules “is to prevent the waste of judicial resources and to deter vexatious litigation and dilatory or malicious litigation tactics (cf. Minister, Elders & Deacons of Refm. Prot. Church of City of New York v 198 Broadway, 76 NY2d 411; see Steiner v Bonhamer, 146 Misc 2d 10) [Emphasis added].” The instant action, with the “living dead” plaintiff INDYMAC FED: lacking personal jurisdiction and standing; using a robosigner; and, making false statements, is “a waste of judicial resources.” This conduct, as noted in Levy, must be deterred. [*12]In Weinstock v Weinstock (253 AD2d 873 [2d Dept 1998]) the Court ordered the maximum sanction of $10,000.00 for an attorney who pursued an appeal “completely without merit,” and holding, at 874, that “[w]e therefore award the maximum authorized amount as a sanction for this conduct (see, 22 NYCRR 130-1.1) calling to mind that frivolous litigation causes a substantial waste of judicial resources to the detriment of those litigants who come to the Court with real grievances [Emphasis added].” Citing Weinstock, the Appellate Division, Second Department, in Bernadette Panzella, P.C. v De Santis (36 AD3d 734 [2d Dept 2007]) affirmed a Supreme Court, Richmond County $2,500.00 sanction, at 736, as “appropriate in view of the plaintiff’s waste of judicial resources [Emphasis added].”

In Navin v Mosquera (30 AD3d 883 [3d Dept 2006]) the Court instructed that when considering if specific conduct is sanctionable as frivolous, “courts are required to

examine whether or not the conduct was continued when its lack of legal or factual basis was apparent [or] should have been apparent’ (22 NYCRR 130-1.1 [c]).” The Court, in Sakow ex rel. Columbia Bagel, Inc. v Columbia Bagel, Inc. (6 Misc 3d 939, 943 [Sup Ct,

New York County 2004]), held that “[i]n assessing whether to award sanctions, the Court must consider whether the attorney adhered to the standards of a reasonable attorney (Principe v Assay Partners, 154 Misc 2d 702 [Sup Ct, NY County 1992]).” In the instant action, counsel for the “living dead” plaintiff INDYMAC FED, Mr. Broyles and his firm, FS & C, bear a measure of responsibility for commencing and proceeding with an action on behalf of a non-existent plaintiff.

Therefore, the Court will examine the conduct of counsel for the “living dead” plaintiff INDYMAC FED, in a hearing, pursuant to 22 NYCRR § 130-1.1, to determine if plaintiff’s counsel Mark K, Broyles, Esq. and his firm, Fein Such & Crane, LLP, engaged in frivolous conduct, and to allow Mark K. Broyles, Esq. and his firm, Fein, Such & Crane, LLP, a reasonable opportunity to be heard.

Conclusion

Accordingly, it is

ORDERED, that the motion of defendant MENDEL MEISELS to vacate the July 27, 2010 order of reference, pursuant to CPLR Rule 5015 (a) (4), for the premises located at 2062 61st Street, Brooklyn, New York (Block 5528, Lot 33, County of Kings), for lack of personal jurisdiction by plaintiff INDYMAC FEDERAL BANK, FSB, is granted; and it is further

ORDERED, that because plaintiff INDYMAC FEDERAL BANK, FSB ceased to exist prior to the commencement of the instant action, the instant complaint, Index No. 8752/09 is dismissed with prejudice; and it is further

ORDERED, that the notices of pendency filed with the Kings County Clerk on April 9, 2009 and March 9, 2012, by plaintiff, INDYMAC FEDERAL BANK, FSB, in an action to foreclose a mortgage for real property located at 2062 61st Street, Brooklyn, New York (Block 5528, Lot 33, County of Kings), is cancelled and discharged; and it is further

ORDERED, that it appearing that counsel for plaintiff INDYMAC FEDERAL BANK, FSB, Mark K. Broyles, Esq. and his firm, Fein, Such & Crane, LLP engaged in “frivolous conduct,” as defined in the Rules of the Chief Administrator, 22 NYCRR

§ 130-1 (c), and that pursuant to the Rules of the Chief Administrator, 22 NYCRR [*13]

§ 130.1.1 (d), “[a]n award of costs or the imposition of sanctions may be made . . . upon the court’s own initiative, after a reasonable opportunity to be heard,” this Court will conduct a hearing affording: plaintiff’s counsel Mark K. Broyles, Esq.; and, his firm, Fein, Such & Crane, LLP; “a reasonable opportunity to be heard” before me in Part 27, on Monday, November 5, 2012, at 2:30 P.M., in Room 479, 360 Adams Street, Brooklyn, NY 11201; and it is further

ORDERED, that Ronald David Bratt, Esq., my Principal Law Clerk, is directed to serve this order by first-class mail, upon: Mark K. Broyles, Esq., Fein, Such & Crane, LLP, 28 East Main Street, Suite 1800, Rochester, New York 14614; and, Fein, Such & Crane, LLP, 28 East Main Street, Suite 1800, Rochester, New York 14614.

This constitutes the Decision and Order of the Court.

ENTER

___________________________

HON. ARTHUR M. SCHACKJ. S. C.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

![[NYSC] JUDGE SCHACK TAKES ON ROBO-SIGNER ERICA JOHNSON SECK: DEUTSCHE BANK v. HARRIS (2)](https://stopforeclosurefraud.com/wp-content/themes/gazette/thumb.php?src=wp-content/uploads/2010/10/Fraud_11.jpg&w=100&h=57&zc=1&q=90)

![[NYSC] JUDGE SCHACK TAKES ON ROBO-SIGNER ERICA JOHNSON SECK: DEUTSCHE BANK v. MARAJ (1)](https://stopforeclosurefraud.com/wp-content/themes/gazette/thumb.php?src=wp-content/uploads/2010/10/002_arthur_schack-300x300.jpg&w=100&h=57&zc=1&q=90)

I EVEN HAVE THEM SIGNING onbehalf of the FDIC!

I EVEN HAVE THEM SIGNING onbehalf of the FDIC!

Recent Comments