COMING TO YOU LIVE DIRECTLY FROM THE DUBIN LAW OFFICES AT HARBOR COURT, DOWNTOWN HONOLULU, HAWAII

LISTEN TO KHVH-AM (830 ON THE AM RADIO DIAL)

ALSO AVAILABLE ON KHVH-AM ON THE iHEART APP ON THE INTERNET

.

Sunday – September 30, 2018

Foreclosure Workshop #68: How To Draft Discovery Requests That Will Defeat Foreclosure (Part Two)

.

———————

As explained on last week’s show, too often foreclosure defense attorneys and pro se homeowners alike serve discovery requests in foreclosure cases that in boilerplate fashion rarely seek the kind of evidence crucial to defeating foreclosures.

Last week John Waihee and I suggested several advance techniques for relatively cheaply securing evidence capable of stopping a foreclosing plaintiff’s summary judgment attempts, as well as potentially producing a victory at trial, depending as usual upon who your trial judge is.

Our discussion last week centered around gathering documentary evidence to disprove a foreclosing plaintiff’s four bedrock contractual burdens of proving four essential elements of every foreclosure case: (1) a loan agreement, (2) a default, (3) a notice of default, and (4) standing to foreclose.

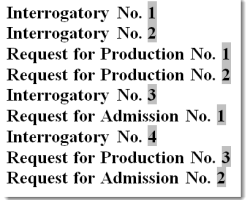

For each such set of discovery requests related to each such evidentiary requirement, we suggested a basic format beginning with a series of questions followed by individual requests for the documents and the witnesses supporting each intended answer.

This is known as a combined discovery request, consisting of an “interrogatory” numbered one through as many interrogatories as your jurisdiction allows to be served at one time (consider otherwise serving more than one set sequentially), combined with a “request for the production of documents” upon which the answer to each interrogatory is based.

After last week’s show, many listeners thanked us for those discovery suggestions, as a result of which we decided to add some additional recommendations this Sunday in a Part Two, in addition to those discussed on last week’s show which addressed such equally important discovery requests concerning loan agreements, default notices, general loan ledgers, and standing generally, now available on the past broadcast section of our website, www.foreclosurehour.com.

Today’s additional discovery strategies consist of ten advance discovery techniques that have actually stopped motions for summary judgment and won foreclosure cases for us, which are as follows:

1. In addition to yourself electronically searching for background information on Google, Lexis, and Westlaw resources the names of promissory note endorsers, robo mortgage assigners, robo notaries, and foreclosing plaintiff declarants, consider asking about and requesting in combined discovery requests their educational and employment background information and descriptions, including resumes and the contents of personnel files (with any required privacy redactions).

2. Consider asking about the existence and description of and demanding the production of employee training manuals used by your loan servicers, covering such topics as “boarding” of the loan records of prior loan servicers and TILA and RESPA requirements, in order to contradict the specific content of a loan servicer‘s representative’s declarations.

3. Consider asking about the existence and description of and demanding copies of all loan servicer agreements between your pretender lender(s) with Fannie Mae and Freddie Mac and HUD and any other Government related agency pertaining to such matters, not limited to, maintenance and destruction of original loan documents, selection and compensation of foreclosure attorneys, dates of retention, ownership of mortgage loans, and scope of authority.

4. Consider asking about the existence of all information pertaining to and demanding to know whose money initially funded your loan, including whether your loan was warehoused and table funded, and demanding the release of all such related documentation, including regarding the mortgage and lending licenses and corporate existence of all persons and entities involved in the original funding, and including those who received commissions when the loan was originally funded and when and for how much.

5. Consider asking about the existence and description of and demanding copies of all Fannie Mae and Freddie Mac and HUD Servicing Guidelines applicable to and/or used in the servicing of your loan by your loan servicer(s), including copies of all written communications between your loan servicer(s) and Fannie Mae and Freddie Mac and HUD regarding the servicing of loans during the time period of your loan.

6. Consider asking about the existence and description of and demanding copies of all rules, guidelines, correspondence, and trust pooling and servicing agreements and documents in any way restricting, authorizing, and/or in any way controlling your foreclosing trust’s or foreclosing plaintiff’s ability or authorization to approve loan modifications in terms of annual volume and dollar amounts and on whatever terms, including historically since the origination of your loan.

7. Consider asking about the existence and description of and demanding all documentation pertaining to the timing and deposit of your promissory note into securitized trust(s) claiming to own or to have owned your mortgage loan, together with all information and documentation pertaining to its placement in investment tranches and its trading history.

8. Consider asking about the existence and description of and demanding all documentation, including invoices and correspondence, pertaining to charges by attorneys and their staff and for attorneys’ fees and costs pertaining to all claimed administration and collection activities and mortgage enforcement costs related to your loan, and including such payment documentation and receipts.

9. Consider asking about the existence and description of and demanding all documentation pertaining to written correspondence and agreements between (a) your foreclosing plaintiff and/or your loan servicer(s) and (b) your loan broker pertaining to your mortgage loan and loan application, including loan solicitation, loan approval, loan escrow, loan funding, and/or the sale of your promissory note and mortgage.

10. Consider asking about the existence and description of and demanding all documentation pertaining to written correspondence and agreements, including correction manuals, prepared by your foreclosing plaintiff and/or your loan servicer(s) describing how to deal with omissions and deficiencies in a loan “collateral file” (note, mortgage, mortgage assignments, loan application, loan general ledger, default notices).

On this Sunday’s show, in addition to identifying and explaining the above ten advanced discovery techniques, we will also, time permitting, discuss why each is significant in terms of what you may uncover and how to use such information.

The above is not being presented in a sample canned format, for too many attorneys and pro se litigants succumb to just repetitiously cutting and pasting and signing form discovery requests found on the Internet without understanding or tailoring the discovery requests to their own individual set of facts.

The effective use of discovery in foreclosure cases depends on a perceptive understanding of what you are trying to achieve and how.

Moreover, you will likely be met with opposition in the form of objections based on lack of relevance despite the scope of relevance in discovery being extremely broad, and objections based on privacy or attorney-client privilege. The closer you get to evidence of fraud or evidence supporting dismissal, for instance, the more rigorous the objections to your discovery requests will become.

You can therefore anticipate needing to file motions to compel, explaining to the Court the importance and relevance of your discovery requests.

Additionally, while combined interrogatory and production of documents requests are relatively inexpensive to prepare and to serve, you may need to follow up by noticing oral depositions which usually result in completely defanging foreclosure plaintiffs, but which oral depositions can be very expensive depending on location and duration and transcript costs.

Gary Dubin

.

CALL IN AT (808) 521-8383 OR TOLL FREE (888) 565-8383

Have your questions answered on the air.

Submit questions to info@foreclosurehour.com

The Foreclosure Hour is a public service of the Dubin Law Offices

Past Broadcasts

EVERY SUNDAY

3:00 PM HAWAII

6:00 PM PACIFIC

9:00 PM EASTERN

ON KHVH-AM

(830 ON THE DIAL)

AND ON

iHEART RADIO

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.