COMING TO YOU LIVE DIRECTLY FROM THE DUBIN LAW OFFICES AT HARBOR COURT, DOWNTOWN HONOLULU, HAWAII

LISTEN TO KHVH-AM (830 ON THE AM RADIO DIAL)

ALSO AVAILABLE ON KHVH-AM ON THE iHEART APP ON THE INTERNET

.

Sunday – September 23, 2018

Foreclosure Workshop #67: How To Draft Discovery Requests That Will Defeat Foreclosure

.

———————

Too often foreclosure defense attorneys and pro se homeowners alike serve discovery requests in foreclosure cases that in boilerplate fashion rarely seek the kind of evidence crucial to defeating foreclosures.

On today’s show, John Waihee and I will suggest advance techniques for cheaply securing evidence capable of stopping a foreclosing plaintiff’s summary judgment attempts as well as producing a victory at trial.

To begin with, discovery requests in foreclosure cases should concentrate on gathering evidence to disprove a foreclosing plaintiff’s four bedrock contractual burdens of proving four essential elements of every foreclosure case: (1) a loan agreement, (2) a default, (3) a notice of default, and (4) standing to foreclose.

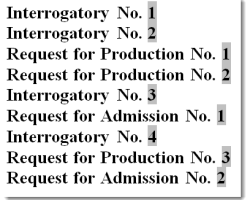

For each such set of discovery requests, the format is basically the same, beginning with a series of questions followed by individual requests for the documents and the witnesses supporting each intended answer.

This is known as a combined discovery request, consisting of an “interrogatory” numbered one through as many interrogatories as your jurisdiction allows to be served at one time (consider otherwise serving more than one set sequentially), combined with a “request for the production of documents” upon which the answer to each interrogatory is based.

The first evidentiary requirement (a loan agreement) might be simply considered a given in most cases, it being conceded that there was a signed loan agreement usually during an escrow closing, yet that is not always the case.

For example, occasionally English is not the first language of borrowers, yet no attempt is made to translate the contract terms into English, resulting in what is called a “contract of adhesion” where there was no meeting of the minds, hence no agreement, also potentially occurring where the terms generally technical in nature were as usual not explained to the borrowers, or where the borrowers as usual were not given time to read the documents they signed, or where promises were made to induce the signing that were relied on to the borrower’s detriment, but turned out to be false when made.

Your interrogatories therefore should ask about such specific circumstances surrounding the signing and who the witnesses were, where applicable, to determine if there was in fact an agreement.

The defense of contract of adhesion, although often prominent in contract cases generally, tends to be ignored in foreclosure cases except in instances deemed unconscionable, but can be expected to gain wider acceptance in future foreclosure cases if more borrowers raised the issue.

The second evidentiary requirement (a default) is often overlooked. Foreclosing plaintiffs are required to prove that a payment default occurred (or some other, non-monetary contractual requirement was violated by the borrower, with a different cure requirement and not usually the subject of a foreclosure action).

In securitized trust cases, due to the number of loan servicers involved, often each using a different incompatible software program, mistakes are frequently made, in some cases perhaps on purpose, resulting in unreliable data entries.

In other cases, the requirement of contemporary accounting is violated, foreclosing plaintiffs impermissibly offering as its general ledger proof of either ledgers prepared especially for the foreclosure litigation or incomplete or unreadable or lacking explanatory codes and so forth.

Your discovery requests should therefore ask for copies and when and where and by whom was the proffered general ledger prepared, the rules of evidence requiring personal firsthand evidence of same absent the application of stringent business record exceptions.

Retaining an accountant or CPA as an expert to review the accuracy of the loan general ledger is recommended, and could cost you as little as $500, yet that expert report might stop a foreclosure summary judgment on its own.

The third evidentiary requirement (a notice of default), discussed on several past shows, is often overlooked by borrowers, despite the fact that if a proper notice of default is not placed in evidence there can be no summary judgment and no foreclosure.

Foreclosing plaintiffs must prove that a proper notice of monthly payment default was served on a borrower defendant in a foreclosure action.

Such proof, often by more than more presumption, requires actual evidence that a proper default notice was sent on a given date, that it was received, and that its contents was consistent with the contractual requirements of the mortgage not including more than monthly payment arrearages and late fees, and including a properly timed right to cure, and accurate, usually such contractual requirements being found in Paragraphs 22 or 23 of the standard Fannie Mae and Freddie Mac universally utilized mortgage forms.

Interrogatories should therefore be served asking when, where, and by whom and on whose behalf were default notices prepared and sent and received, and what the content of those default notices was, whereas a borrower’s declaration of non-receipt is generally sufficient to prevent summary judgment as well as to prevail at trial.

And again, combined with such interrogatories should be a request for production of all documents that support the answer.

The fact that rarely are such purported notices sent by certified mail, return receipt requested, increases a foreclosing plaintiff’s burden of proof, disadvantaged also by the lack of adequate records as well as contradictory default notices available from prior loan servicers, who may for instance have sent a default notice moreover to the wrong address or on behalf of the wrong noteholder.

The fourth evidentiary requirement (standing to foreclosure), also discussed on past shows, has become the most lethal evidentiary weapon presently to defeat foreclosures today brought by securitized trustees whose paperwork is normally shoddy.

Such interrogatories should ask for a full description of the chain of ownership and possession of each promissory note and each mortgage and each note transfer and each mortgage assignment, when, where, and by whom, and the production of copies of each, identified by date and preparer, and documentary evidence of proof of each monetary payment for each transaction including the form of payment, the amount of payment, the payor and the payee, and where the transaction occurred. Follow the money!

In the case of securitized trusts, requests for date and time of deposit of notes and mortgages into the securitized trust by who whom specifically should be questioned, together with the production of transfer and receipt documents proving that such a deposit actually occurred, for otherwise the trustee has no standing to foreclose.

It is essential moreover that a borrower specifically request the production and inspection of the original “wet ink” promissory note, which most securitized trusts do not have and will recreate for a foreclosure case.

Due to the advances in photoshop technology, handwriting analysis has become an outmoded expertise. Consider hiring someone with the computer analyst credentials of a Dr. Kelley who has been on several of our past shows.

On today’s show we will explore in detail, time permitting, each such combined discovery request based on personal case experiences, as well as the timing strategies of when and when not to serve such discovery requests.

Finally, listeners are reminded that you still need to examine the evidentiary likes and dislikes of your individual jurisdiction and your individual judge, notwithstanding the law or common sense, as lawyering today, in the foreclosure field especially, takes place in state and federal judicial systems that too often resemble individual feudal fiefdoms.

There is no better research tool than using Lexis or Westlaw to review the foreclosure decisions if available of your individual judge.

Gary Dubin

.

CALL IN AT (808) 521-8383 OR TOLL FREE (888) 565-8383

Have your questions answered on the air.

Submit questions to info@foreclosurehour.com

The Foreclosure Hour is a public service of the Dubin Law Offices

Past Broadcasts

EVERY SUNDAY

3:00 PM HAWAII

6:00 PM PACIFIC

9:00 PM EASTERN

ON KHVH-AM

(830 ON THE DIAL)

AND ON

iHEART RADIO

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.