Naked Capitalism-

Five years ago this month, GMAC became the first mortgage servicer to announce that they would suspend foreclosure operations, due to irregularities in their document preparation. Within a few weeks every major mortgage servicer in America followed suit. This is usually called the robo-signing scandal, but to be more precise we gave it the name foreclosure fraud. It ended with the five leading servicers, including GMAC, signing the $25 billion National Mortgage Settlement.

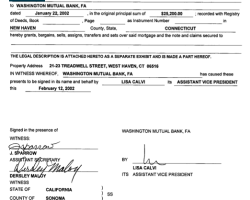

Except it didn’t end, and this past week I was handed inconvertible proof of that fact. The scenario is so fantastical that if I didn’t have a working knowledge of foreclosure fraud I wouldn’t have believed it. But it appears to be very real.

Bill Paatalo is a former cop who worked in the mortgage industry as a loan officer and, from 2002-2008, the President of Wissota Mortgage in the Midwest. Since 2009, after experiencing his own mortgage trouble through a loan with Washington Mutual, he became a licensed private investigator specializing in securitization and chain of title analysis. He testifies as an expert witness, working with foreclosure defense attorneys and pro se litigants.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

We battled with Bank of America for more than 5 years. We endured all the abuses and fraudulent activities and hassles that has been the experience of millions of Americans. B of A finally decided it could not corner us and feared a suit to quiet the title. It sold the “note and mortgage” to LSF9 Master Participation Trust (Servicer is Caliber Home Loans), who quickly applied for Mediation in prep for a foreclosure action. We believe we can show B of A did not have standing to foreclose and, therefore, believe the debt buyer does not have sanding. We’ve appealed to the Oregon AG to no avail. The system grinds forward with the threats, etc. We’re low income seniors and can hardly afford the cost of lawyers. Does anyone have advice on how we can proceed against the debt buyers. Thanks for any help available. –Dutch–

Greetings, Bank of America offered me a forebarance to repair storm dam. from Fed. disaster Sandy. The first two weeks into the FB they bsent “late notice” than ” two months late” then ” acceleration notice” All during the FB. one (1) month after FB BOA served me with a Foreclosure notice. I have evrything in writing, but the straw that broke my back was in their Summary Judgement motion, they said my defense was nothing more than a ” Delay Tactic”

They are very wrong, now we have a contest. Can we join forces?

Dutch,

Caliber is a debt collector. Go to Neil Garfeilds websites…a wealth of information.

Caliber does not own your debt. Google complaints about Caliber.