Wall Street on Parade-

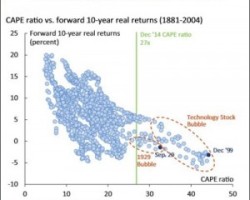

Yesterday, an agency of the Federal government, the U.S. Treasury’s Office of Financial Research (OFR), released a study warning that by three separate measures the U.S. stock market is approaching dangerous “two-sigma thresholds” which can lead to “quicksilver markets.” Translation: we could be heading for a big crash.

A two-sigma threshold is when market valuation metrics move at least two standard deviations above the historical mean. The study notes that “valuations approached or surpassed two-sigma in each major stock market bubble of the past century.” Think 1929, 2000 and 2007. A quicksilver market, as defined by the study, is when stable markets turn on a dime and “change rapidly and unpredictably.”

Read the detailed article here:

U.S. Treasury Drops a Bombshell Yesterday: “Quicksilver Markets”

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.