DISTRICT COURT OF APPEAL OF THE STATE OF FLORIDA

FOURTH DISTRICT

DONNA MURRAY and MARC MURRAY,

Appellants,

v.

HSBC BANK USA, NATIONAL ASSOCIATION AS TRUSTEE FOR ACE SECURITIES CORP HOME EQUITY LOAN TRUST, SERIES 2006-OP1 ASSET BACKED PASS THROUGH CERTIFICATES,

Appellee.

No. 4D13-4316

[January 21, 2015]

Appeal from the Circuit Court for the Fifteenth Judicial Circuit, Palm Beach County; Howard Harrison, Judge; L.T. Case No. 502009CA005458XX.

Kunal A. Mirchandani and Joann M. Hennessey of Civil Justice Advocates, PL, Fort Lauderdale, for appellants.

Khari E. Taustin, Jeremy W. Harris, Masimba M. Mutamba, and Angela Barbosa Wilborn of Morris, Laing, Evans, Brock & Kennedy CHTD., West Palm Beach, for appellee.

MAY, J.

In this foreclosure puzzle, one of the pieces is missing. The borrowers appeal a final judgment of foreclosure following a non-jury trial. They argue the bank failed to prove standing. We agree and reverse.

The borrowers and Option One Mortgage Corporation, a California corporation (“Option One California”), executed a mortgage and note. When the borrowers missed their monthly payment, HSBC filed a two-count complaint seeking to foreclose the mortgage and reestablish the lost note. The original complaint, filed February 13, 2009, alleged that HSBC “owns and holds said note and mortgage.” The borrowers then filed their answer and affirmative defenses.

On April 3, 2009, Sand Canyon Corporation f/k/a Option One Mortgage Corporation (“Sand Canyon”) executed an assignment of the mortgage to HSBC. The assignment included an effective date of January 24, 2009. On April 6, 2010, HSBC voluntarily dismissed the lost note count and filed the original note and mortgage. The note was made payable to Option One California, but did not have an indorsement or allonge.

On October 5, 2010, Sand Canyon executed another assignment in favor of HSBC, with a stated effective date of April 23, 2007. On February 6, 2013, HSBC filed a second amended complaint alleging that HSBC was “a nonholder in possession with the rights of a holder and is entitled to enforce the terms of the Note and Mortgage, pursuant to Florida Statute 673.3011.” The case proceeded to a non-jury trial.

At trial, HSBC offered the testimony of a loan analyst with Ocwen Loan Servicing (“Ocwen”). HSBC also offered the pooling and servicing agreement (“PSA”), note, mortgage, demand letter, and payment history. HSBC did not admit the assignments into evidence.

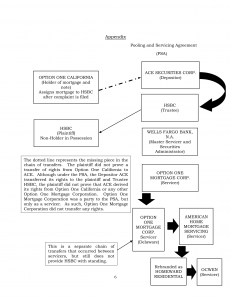

The main issue at trial concerned HSBC’s allegation that it was a nonholder in possession with the rights of a holder.1 The PSA and attached mortgage loan schedule both referenced the borrowers’ loan. The PSA had ACE Securities Corp. (“ACE”) as the Depositor, Option One Mortgage Corporation as the Servicer, Wells Fargo Bank, N.A. (“Wells Fargo”) as the Master Servicer and Securities Administrator, and HSBC as the Trustee. The effective date of the PSA was May 1, 2006; it does not reference Option One California.

The loan analyst testified that Option One Mortgage Corporation was a predecessor to American Home Mortgage Servicing (“AHMS”), which was rebranded as Homeward Residential, and subsequently purchased by Ocwen. Those companies serviced the loan from its inception and Ocwen was currently servicing the loan for HSBC. He also testified that AHMS acquired servicing rights from Option One Mortgage Corporation, a Delaware corporation (“Option One Delaware”).

After the trial, the court took the matter under advisement and had the parties submit memoranda. On November 4, 2013, the trial court entered a final judgment of foreclosure in favor of HSBC, from which the borrowers now appeal.

The borrowers argue the trial court erred in granting a final judgment of foreclosure because Option One California never transferred its rights to HSBC, directly or through ACE. They argue that HSBC failed to connect the dots between ACE and the last identifiable holder of the note, Option One California. HSBC responds that it proved its right to enforce the note as a nonholder in possession with the rights of a holder.

The dotted line represents the missing piece in the chain of transfers.

We have de novo review. Dixon v. Express Equity Lending Grp., LLLP, 125 So. 3d 965, 967 (Fla. 4th DCA 2013). “A crucial element in any mortgage foreclosure proceeding is that the party seeking foreclosure must demonstrate that it has standing to foreclose” when the complaint is filed. McLean v. JP Morgan Chase Bank Nat’l Ass’n, 79 So. 3d 170, 173 (Fla. 4th DCA 2012). “[S]tanding may be established from the plaintiff’s status as the note holder, regardless of any recorded assignments.” Id. “If the note does not name the plaintiff as the payee, the note must bear a special [i]ndorsement in favor of the plaintiff or a blank [i]ndorsement.” Id.

The plaintiff may also show “evidence of an assignment from the payee to the plaintiff or an affidavit of ownership to prove its status as the holder of the note.” Id. “Because a promissory note is a negotiable instrument and because a mortgage provides the security for the repayment of the note, the person having standing to foreclose a note secured by a mortgage may be . . . a nonholder in possession of the note who has the rights of a holder.” Mazine v. M & I Bank, 67 So. 3d 1129, 1130 (Fla. 1st DCA 2011).

A “person entitled to enforce” an instrument is: “(1) [t]he holder of the instrument; (2) [a] nonholder in possession of the instrument who has the rights of a holder; or (3) [a] person not in possession of the instrument who is entitled to enforce the instrument pursuant to s[ection] 673.3091 or s[ection] 673.4181(4).” § 673.3011, Fla. Stat. (2013). A “holder” is defined as “[t]he person in possession of a negotiable instrument that is payable either to bearer or to an identified person that is the person in possession.” § 671.201(21)(a), Fla. Stat. (2013). Thus, to be a holder, the instrument must be payable to the person in possession or indorsed in blank. See § 671.201(5), Fla. Stat. (2013).

HSBC did not qualify under section 673.3011(1) or (3). It was not a holder of the note because the note is payable to Option One California, and there is no blank indorsement. HSBC failed to produce any evidence to prove its status as the holder of the note at trial. Indeed, HSBC admitted it was not a holder of the note. HSBC was thus left to enforce the note under section 673.3011(2) as a nonholder in possession of the instrument with the rights of a holder. The issue then is whether HSBC is a nonholder in possession with the rights of a holder.

Anderson v. Burson, 35 A.3d 452 (Md. 2011), is instructive. There, the court held that the plaintiff was a nonholder in possession and analyzed whether it had rights of enforcement pursuant to a Maryland statute that employs the same language as section 673.3011, Florida Statutes. Anderson, 35 A.3d at 462. “A transfer vests in the transferee only the rights enjoyed by the transferor, which may include the right to enforce[ment],” through the “shelter rule.” Id. at 461–62.

A nonholder in possession, however, cannot rely on possession of the instrument alone as a basis to enforce it. . . . The transferee does not enjoy the statutorily provided assumption of the right to enforce the instrument that accompanies a negotiated instrument, and so the transferee “must account for possession of the unindorsed instrument by proving the transaction through which the transferee acquired it.” Com. Law § 3–203 cmt. 2. If there are multiple prior transfers, the transferee must prove each prior transfer. Once the transferee establishes a successful transfer from a holder, he or she acquires the enforcement rights of that holder. See Com. Law § 3–203 cmt. 2. A transferee’s rights, however, can be no greater than his or her transferor’s because those rights are “purely derivative.”

Id. (emphasis added) (internal citations omitted).

HSBC had to prove the chain of transfers starting with Option One California as the first holder of the note. The only document admitted that purported to transfer the note was the PSA. Although the note was included in the PSA, the parties to the PSA were ACE, Option One Mortgage Corporation, Wells Fargo, and HSBC; not Option One California.

The loan analyst testified that Option One California was acquired by AHMS, which rebranded to Homeward Residential, which was ultimately acquired by Ocwen. HSBC argues that since “Option One” is defined under the PSA as “Option One Mortgage Corporation or any successor thereto,” and Option One transferred its interest to HSBC through the PSA, HSBC had the rights of a holder. We disagree.

Even if Option One California, Option One Delaware, Option One Mortgage Corporation, and Option One Mortgage Corporation, a Maryland corporation, were all the same corporation, HSBC’s argument fails. Although Option One Mortgage Corporation was a party to the PSA, it was the Servicer. “Servicing” is defined in the PSA as “the act of servicing and administering the Mortgage Loans.” Nothing in the PSA established that the Servicer conveyed rights in mortgage loans to any party. Also, even though the loan analyst testified that through a chain of transfers Ocwen was the current servicer of the loan, it does not prove that HSBC had standing as a nonholder in possession with the rights of a holder.

The chain of transfers starts with Option One California as the original holder of the note. ACE, as the Depositor, transferred its rights in the note to HSBC through the PSA. However, there was no evidence that Option One California transferred its rights in the note to ACE. This is the missing piece of the puzzle. See Appendix. As HSBC cannot prove that ACE had any right to enforce the note, it cannot derive any right from ACE and is not a nonholder in possession of the instrument with the rights of a holder to enforce. §§ 673.2031, .3011, Fla. Stat. (2013). Put simply, HSBC failed to prove standing. We therefore reverse the final judgment of foreclosure.

Reversed and Remanded for entry of judgment in favor of appellants.

WARNER and TAYLOR, JJ., concur.

* * *

Not final until disposition of timely filed motion for rehearing.

footnote: 1 The trial court stated:

To me, that’s the only issue in the case; can this Court enter a judgment on what you say is that possession is enough without the [i]ndorsement.

In every other respect they have it. They got the mortgage. They got the records. They got the servicing. They got the whole thing. They just don’t have the [i]ndorsement, and is that fatal?

In other words do you have to go and get, and then start over again? That’s the question. I don’t know the answer.