UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

In re:

Chapter 13

Cynthia Carrsow-Franklin

Debtor.

MEMORANDUM OF DECISION ON DEBTOR’S OBJECTION TO CLAIM OF WELLS FARGO BANK, NA

APPEARANCES: Garvey, Tirelli & Cushner, Ltd., by Linda M. Tirelli, for the debtor

Hogan Lovells US LLP, by David Dunn and Nocole E. Schiavo, for Wells Fargo Bank, NA

HON. ROBERT D. DRAIN, UNITED STATES BANKRUPTCY JUDGE

EXCERPT:

It appears from Mr. Kennerty’s deposition transcript, although his testimony on this point was at

times quite evasive, that during the period in question in 2010 he signed on average between 50 and

150 original documents a day in connection with Wells Fargo’s administration and enforcement of

defaulted loans. Deposition Transcript, dated October 15, 2012, of Herman John Kennerty (“Dep. Tr.”)

at 89?92. This was part of his duties as the Wells Fargo manager in charge of “default documents.” Id. at

44. In other words, on a daily basis Mr. Kennerty and his team, members of which he also testified

signed a like number of documents each day, id., processed a large volume of loan documents for

enforcement with very little thought about what they were doing. It is not clear that Mr. Kennerty fully

understood the legal consequences of signing these documents; for example, he testified when shown

the Assignment of Mortgage that he executed it not on behalf of the assigning party but, rather, on

behalf of the party “in getting the assignment,” although he also testified that “I’m – I’m not an

attorney, but the way I understand this document, it was assigning the mortgage, taking it out of MERS’

name and putting into Wells Fargo Bank’s name.” Id. at 93?4. It is clear, however, that he pretty much

signed whatever outside counsel working on the default put in front of him and that these documents

often included assignments, including the Assignment of Mortgage, drafted by Wells Fargo’s outside

enforcement counsel to fill in missing gaps in the record.

Thus, in describing the work of his “assignment team” Mr. Kennerty stated, “[I]f there was not

an assignment in there [that is, in Wells Fargo’s loan file] then they would – excuse me, they would

advise the attorney that we did not have it, that they would need to draft the – the appropriate

assignment.” Id. at 116. See also id. at 76 (“[I]f the assignment needed to be created they would have

advised the attorney, the requesting attorney to – that we did not have the assignment in the collateral

file, then they needed to draw up the appropriate document.”); id. at 121 (“Once it [that is, the

collateral file] was received then they would check to see if it was something that could be used or not

used; and, if it’s something that was in the file, but couldn’t be used then they would advise the

requesting attorney to go ahead and draft the actual document.”).

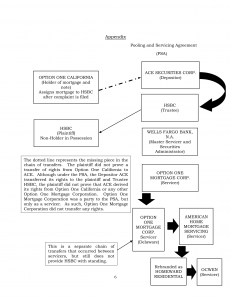

Because Wells Fargo does not rely on the Assignment of Mortgage to prove its claim, the

foregoing evidence is helpful to the Debtor only indirectly, insofar as it goes to show that the blank

indorsement, upon which Wells Fargo is relying, was forged. Nevertheless it does show a general

willingness and practice on Wells Fargo’s part to create documentary evidence, after?the?fact, when

enforcing its claims, WHICH IS EXTRAORDINARY.19

Moreover, Mr. Kennerty’s testimony does not stop at describing manufactured mortgage

assignments. He also testified that his “assignment team’s” duties were not limited to processing

assignments, including, when determined necessary, creating them; in addition, the “assignment team”

included people tasked with endorsing notes. Id. at 136. His testimony on this issue is critical and will

be quoted at length:

Q. Okay. Did your department endorse notes?

A. Yes.

Q. Okay. And how was it that your department would come to endorse

notes?

A. I don’t recall the specific process, but to the best of my recollection

there’s usually a – in – usually a – blank endorsement on – on the notes and there would

– and then based on that they would complete the endorsement.

Q. So when you say they would complete the endorsement, who is they?

A. I’m sorry. There was a – there – there were some processors that would

perform that task.

Q. Okay. When you say complete the endorsement, what do you mean by

that?

A. They would execute a note endorsement, a new note endorsement if

there was a blank one on there.

Q. And they would do that with the original note from the collateral file?

A. To the best of my recollection, yes.

Q. Okay. And at whose request would the processors perform that

function?

A. Again, to the best of my recollection, it would be done at the – either

the foreclosure attorney’s request or the bankruptcy attorney’s request.

Id. at 129?31.

Mr. Kennerty then testified about the process for receiving such requests from outside

enforcement attorneys and how one or two people in his department had the job of endorsing notes.

Id. at 131?32. When questioned about how often such requests were made, whether on a daily basis or

on rare occasions, Mr. Kennerty replied, “To the best of my recollection, it was on a regular basis.” Id. at

133. He also testified about the information system or systems at Wells Fargo where such requests

might be made and maintained.20 Id. at 133?34.

He then testified as follows:

Q. And the actual procedure for endorsing an original note, if you could

just walk me through that process. What would the processor do?

A. To the best of my recollection, they would – the request would come in.

Again, we would check to see if we had the collateral file. If we – if we had it and

depending on the status of the – of the loan itself, if we had the note then we could

check to see, you know, what was actually on the note to see what needed to be done.

If we did not have the collateral file then they would work – that processor would work

with the collateral file ordering team to reach out with the appropriate attorney or, I’m

sorry, the appropriate custodian to obtain the collateral file. And then they would look

to – once the file came in they would look to ensure that the original note was in there

and check to see if there was any endorsement on the back of the note.

Q. Okay. And if there wasn’t how would they go about – how would the

processor go about endorsing the note?

A. I don’t recall specifically how they completed that particular task.

Q. Was it a rubber stamp? Was it somebody signing? How was it?

A. To the best of my recollection, a stamp was involved but then it had to

be signed.

Q. Okay. And if an endorsement was coming from an entity that no longer

existed how would it be signed?

A. I do not recall.

Id. at 135?36 (emphasis added).

Later in his deposition, Mr. Kennerty was shown the two forms of the Note attached to Claim

Nos. 1?1 and No. 1?2, respectively, and testified that he did not know how or when the indorsements

were placed on them. Id. at 142?44. He did have this to say, however:

Q. Now, if any one of these endorsements were a rubber stamp and

produced by your department would there be a record of that somewhere?

Mr. Cromwell: Objection; misstates his testimony.

Witness. I – the term rubber stamp is a – not accurate because although the –

a stamp to produce the ‘pay to order of’ was used, the term to me, use of a rubber

stamp, means it was signed, there was a signature on the – on the stamp itself and that

– to my recollection, that was not the case.

Id. at 143?44. Mr. Kennerty said nothing more that was relevant to the issue of whether Wells Fargo

forged the blank ABN Amro indorsement, with the exception of stating that “I am not familiar with

Margaret Bezy,” id. at 143, who has not been identified as ever having been an employee of Wells Fargo

and presumably was an employee of ABN Amro.

[…]

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Recent Comments