Never underestimate the power of being a MERS member to create any document it wants to use in court at any given time.

ALSO, MERS DOES NOT HAVE MEMBERS! MERS IS A SHELL CORPORATION! THE ALLEGED “MEMBERS” ARE MEMBERS OF MERSCORP HOLDINGS, INC.

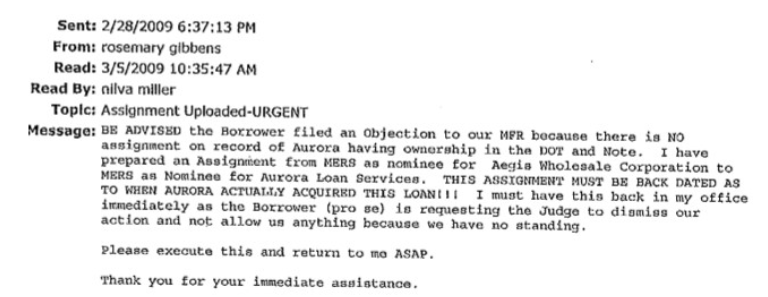

The email below:

BE ADVISED the Borrower filed an Objection to our MFR because there is NO assignment on record of Aurora having ownership in the DOT and Note. I prepared an assignment from MERS as nominee for Aegis Wholesale Corporation to MERS as Nominee for Aurora Loan Services. THIS ASSIGNMENT MUST BE BACK DATED AS TO WHEN AURORA ACTUALLY ACQUIRED THIS LOAN!!! I must have this back in my office immediately as the Borrower (pro se) is requesting the Judge to dismiss our action and not allow us anything because we have no standing.

Please execute this and return to me ASAP.

Thank you for your immediate assistance.

.

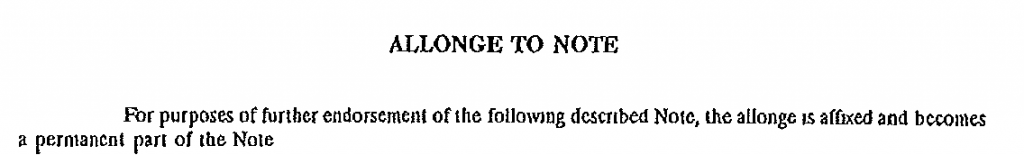

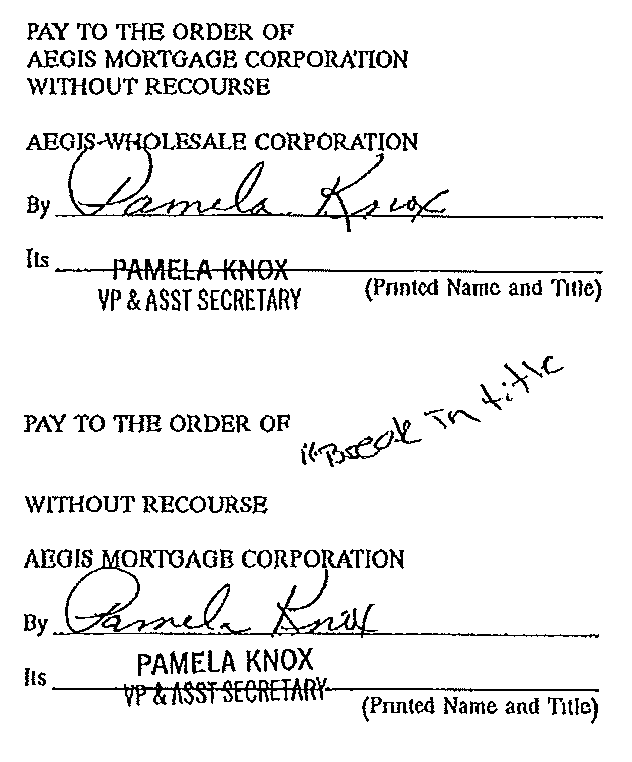

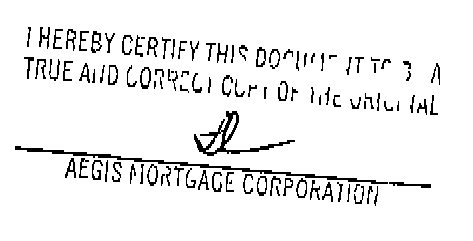

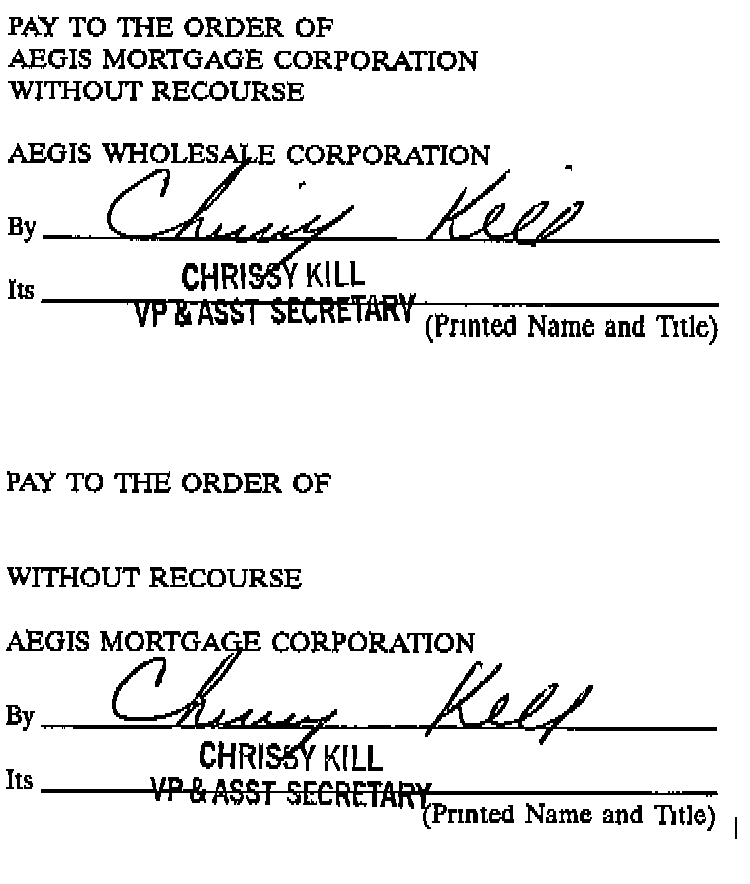

This case also has TWO DIFFERENT NOTES — here are the endorsements.

VERSION #2

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Fatal!!! if the assignment is not dated prior to filing the complaint, the bank has no standing. That means they were trying to steal the house.

I have showed the OCC this blank Note that was delivered to them at my request from Wells Fargo Bank. The loan was a VA loan that was placed into the MBS on Aug 6, 2003 by WaMu and after the blank Note was endorse and relinquished to Ginnie Mae the Note is non-negotiable, as WaMu cannot come back an assign it.

Plus to put a nail in the coffin WaMu was declared a “failed Bank” on Sept 25, 2008 and the break in title is even more realized because they did separate the Note from the debt, making the Note no longer a Note because it does not have a debt that is collectable.

Ginnie Mae has been flawed since it started back in 1971 with these securities that actually have no underlying collateral. MERS through one of the foreclosure mills out of St. Louis MO, and it head attorney of the Foreclosure Division was acting as an Assistance Secretary for MERS.

The OCC has know this since before the Independent (wink wink) Foreclosure Review Board, which was the key to knowing that all the government insured loans could not be modified or foreclosed because those in the securities all have blank (broken titles) Notes.

95% of government loans are in Ginnie Mae pools, and as they have the Notes relinquished without purchasing the debt, you have during 2009-2010 800,000 fraudulent foreclosure that cost US taxpayer $8 billion in False Claims of the FHA & VA loans.

They are trying to steal all the houses. No paperwork to foreclose period.

They are trying to steal all the houses. No paperwork to foreclose period. “Meeting on Foreclosure Rules” See attached,

State AGs settle with LPS for $113 million; only nobody knew

October 6, 2013 | Written for MSfraud.org

In February of this year, the state attorneys general settled with Lender Processing Services (LPS) for $113 million dollars in an El Paso district court. This settlement, like the larger nationally-recognized settlement, also relates to robo-signing and fabricated documents used to process illegal foreclosures. This settlement amount is to be split between a number of other state AGs. (See chart)

El Paso, Texas seems to be ground zero for the filing of some of the national mortgage lawsuits, but somehow these cases manage to stay off the mortgage fraud radar and questions what the AG is really doing in the “public interest” during his election year.

Apparently nobody knew about this settlement, and it has one attorney asking: “Where is the money?”

Attorney Richard Roman (pronounced: “Row-Mawn”) discovered STATE OF TEXAS v. LENDER PROCESSING SERVICES, INC.; LPS DEFAULT SOLUTIONS, INC., and DOCX, LLC was filed on February 1, 2013 and ended five days later on February 6 with an Agreed Judgment and Injunction.

Mr. Roman is currently in the process of intervening in another case, STATE OF TEXAS v. AHMSI, to make sure his client is not forgotten as an “afterthought”. It appears Roman’s filing struck a nerve over at the Asst. AG’s Office, who he claims seem eager to make sure his voice is never heard and his client never sees the inside of a courtroom.

For some reason, when mortgage fraud victims file complaints with various Texas Attorney General offices throughout Texas, every complaint we know of ends up in this office that is tucked away in the far west corner of the state – sometimes known as “North Juarez, Mexico”. It is not that the El Paso office possesses an advanced skill-set for mortgage fraud crimes committed by the banks.

When the Asst. AG was told in early 2005 that there was “certified evidence” to confirm both fraud and corruption going on inside a Texas foreclosure court, Mr. Daross responded: “Whenever someone mentions corruption in our courts, I tend not to listen.”

Welcome to Texas

Many of the second-tier bad actors who created the nation’s foreclosure crisis (including LPS), hitched a post in Texas. NBC News reported: “As Texas governor, Rick Perry spent tens of millions in taxpayer money to lure some of the nation’s leading mortgage companies to expand their business in his state, calling it a national model for creating jobs. But the plan backfired.”

It may be for that reason that Texas, like many other states, is basically devoid of foreclosure rulings in favor of its thousands of foreclosure crime victims. The judicial corruption, especially in the Dallas/Collin county corridor, has been confirmed by many lawyers, three judges, and most recently by a Texas law professor, who added that protection for the foreclosure-mills comes straight out of Washington. It seems the once tough “Don’t Mess with Texas” slogan has long been retired.

The $113 Million LPS settlement provides for “Remediation to Homeowners”, but we have yet to hear from a homeowner who benefitted from – or even knew about this settlement.

In his letter to El Paso’s assistant AG, James Daross, Mr. Roman is demanding proof that LPS paid the amounts contained in this settlement:

Dear Mr. Daross and Bischoff:

Please accept this email as my request for information pursuant to the Texas Public Information Act (“TPIA”) for the following information:

1. Copies of the quarterly reports detailing the efforts of LPS to fulfill the obligations placed upon it as described in the Section titled: “IV. 4.1 Remediation to Homeowners”, as part of the “Agreed Final Judgment and Injunction” in 2013DCV-0413, “The State of Texas v. Lender Processing Services, Inc.”;

2. Proof of payment by LPS to The State of Texas of $5,755.050 as a settlement in this matter;

3. Proof of payment of 7 million dollars in attorney’s fees awarded to the State of Texas, as well as $483,333.00 as additional attorney fees.

Provide me with the copying cost and I will see that it is paid expeditiously.

Richard A. Roman, Esq.

Texas has known forged and false documents have been used to steal homes from its own residents dating back to the 1990s, but until lately, the state didn’t seem bothered by all these state jail felonies being committed throughout the state en masse.

In the 2007 (pre-crisis) certified Texas Supreme Court transcript of the “Meeting on Foreclosure Rules”, Michael Barrett (now deceased), of the Texas foreclosure-mill Barrett-Burke, Castle, Daffin & Frappier, admits that the mandated paperwork required to lawfully execute a foreclosure simply does not exist in 90% of the cases:

“So finding a document that says, “I am the owner and holder, and I thereby grant to the servicer the right to foreclose in my name” is an impossibility in 90 percent of the cases.” (transcript page 27, line 16)

The remedy for when, as Mr. Barrett confirmed “There really isn’t such a document” (Page 27, line 8), was revealed by Judge Bruce Priddy (See State of Texas v. Judge Priddy D-1-GV-08-002311) when he added:

“They just create one for the most part sometimes, and the servicer signs it themselves saying that it’s been transferred to whatever entity they name as applicant”. (page 28, line 10)

First American Title added:

“Well, the other problem — Judge, this is Tim Redding. The other problem that I see — and, Tommy, you and I talk about it regularly – that we have a bunch of servicers that are corporations or trusts attempting to foreclose on behalf of other trusts using a power of attorney, and I don’t think that’s really proper. I mean, we all kind of turn a blind eye to it, but I think that’s an issue that’s out there that somebody could use to potentially attack a foreclosure.” (p. 33, line 5)

According to Mr. Barrett’s statements; that means 9 of every 10 foreclosure/eviction cases filed in Texas likely contain uttered documents, a/k/a state jail felonies. That is absolutely stunning! Many people might assume the Texas district attorneys, U.S. Attorneys, FBI, IRS, Texas Rangers, Secret Service, etc. would be investigating this multi-billion dollar criminal enterprise that has been operating in the state for close to twenty-years. But it appears the El Paso AG office is the lone ranger against this massive land grab and transference of wealth, and they don’t seem to want anyone to know. We applaud anyone who goes toe to toe with the banks, but where is the stipulated ‘remediation to homeowners’?

The case against Countrywide

Another obscure case discovered this week was filed in El Paso in 2009 by the State of Texas against Countrywide. The AG obtained an Agreed Final Judgment and Injunction on the same day the petition was filed. Among other things, the injunction places Restrictions on Initiation or Advancement of Foreclosure Process for Eligible Borrowers.

Here is the Docket, Petition and Agreed Judgment in State of Texas v. Countrywide Financial, Countrywide Home Loans and Full Spectrum Lending

Did the media not know about this case either?

Here is the Docket, Petition and Agreed Judgment in State of Texas v. Countrywide Financial, Countrywide Home Loans and Full Spectrum Lending

http://msfraud.org/LAW/Lounge/Tex.Sup.Ct%20_Task%20Force%20on%20Judicial%20Foreclosure%20Rules_create-documents.pdf

One must understand that Ginnie Mae in these situation has always been fatally flawed and the examples in this story and as I showed the OCC with the Jul 13, 2011 fax from Wells Fargo, was that the blank endorsement once physically relinquish to Ginnie Mae, make the Note invalid as it does not and will not ever contain a debt again.

Those documents above are non negotiable!

Cleaver is signing two Notes because if there is a problem with the loan they can act as if there was never a blank endorsement done. However if we know for a fact the loan was a government insured loan we can expose the fraud because all Note must be blank and relinquished to Ginnie Mae in order for the lender turned “issuer” to participate in the selling of Ginnie Mae MBS.

This is the basics to my whistle blower claim over 2yrs ago that still not being address.

The entire Aegis daisy chain went into Chapter 11 Bankruptcy in 2007 in Delaware. The attorney handling the “wind-down affairs” in Houston is Michael Balog. He has all but intimated that most of the original notes were shredded in many cases. Aegis was noted by this COTA Preparer as a high-risk, subprime lender that had an executory contract with MERSCORP, Inc.

FOLKS! MERS DOES NOT HAVE MEMBERS! MERS IS A SHELL CORPORATION!

THE ALLEGED “MEMBERS” ARE MEMBERS OF MERSCORP HOLDINGS, INC.

DO NOT BE FOOLED BY THIS LEGAL DOUBLESPEAK!

Every case in which more than one note is presented or a altered note, the following applies. And every time this happens, it should be reported to the Secret Service. See infra.

18 U.S. Code § 513

(a) Whoever makes, utters or possesses a counterfeited security of a State or a political subdivision thereof or of an organization, or whoever makes, utters or possesses a forged security of a State or political subdivision thereof or of an organization, with intent to deceive another person, organization, or government shall be fined under this title [1] or imprisoned for not more than ten years, or both.

(b) Whoever makes, receives, possesses, sells or otherwise transfers an implement designed for or particularly suited for making a counterfeit or forged security with the intent that it be so used shall be punished by a fine under this title or by imprisonment for not more than ten years, or both.

(c) For purposes of this section—

(1) the term “counterfeited” means a document that purports to be genuine but is not, because it has been falsely made or manufactured in its entirety;

(2) the term “forged” means a document that purports to be genuine but is not because it has been falsely altered, completed, signed, or endorsed, or contains a false addition thereto or insertion therein, or is a combination of parts of two or more genuine documents;

(3) the term “security” means—

(A) a note, stock certificate, treasury stock certificate, bond, treasury bond, debenture, certificate of deposit, interest coupon, bill, check, draft, warrant, debit instrument as defined in section 916(c) [2] of the Electronic Fund Transfer Act, money order, traveler’s check, letter of credit, warehouse receipt, negotiable bill of lading, evidence of indebtedness, certificate of interest in or participation in any profit-sharing agreement, collateral-trust certificate, pre-reorganization certificate of subscription, transferable share, investment contract, voting trust certificate, or certificate of interest in tangible or intangible property;

(B) an instrument evidencing ownership of goods, wares, or merchandise;

(C) any other written instrument commonly known as a security;

(D) a certificate of interest in, certificate of participation in, certificate for, receipt for, or warrant or option or other right to subscribe to or purchase, any of the foregoing; or

(E) a blank form of any of the foregoing;

(4) the term “organization” means a legal entity, other than a government, established or organized for any purpose, and includes a corporation, company, association, firm, partnership, joint stock company, foundation, institution, society, union, or any other association of persons which operates in or the activities of which affect interstate or foreign commerce; and

(5) the term “State” includes a State of the United States, the District of Columbia, Puerto Rico, Guam, the Virgin Islands, and any other territory or possession of the United States.

18 U.S.C. § 514

(a) Whoever, with the intent to defraud – (1) draws, prints, processes, produces, publishes, or otherwise makes, or attempts or causes the same, within the United States; (2) passes, utters, presents, offers, brokers, issues, sells, or attempts or causes the same, or with like intent possesses, within the United States; or (3) utilizes interstate or foreign commerce, including the use of the mails or wire, radio, or other electronic communication, to transmit, transport, ship, move, transfer, or attempts or causes the same, to, from, or through the United States, any false or fictitious instrument, document, or other item appearing, representing, purporting, or contriving through scheme or artifice, to be an actual security or other financial instrument issued under the authority of the United States, a foreign government, a State or other political subdivision of the United States, or an organization, shall be guilty of a class B felony. (b) For purposes of this section, any term used in this section that is defined in section 513(c) has the same meaning given such term in section 513(c). (c) The United States Secret Service, in addition to any other agency having such authority, shall have authority to investigate offenses under this section.

This alteration also deems the mortgage and note unenforceable and void under the UCC.

§ 3-407

(ii) an unauthorized addition of words or numbers or other change to an incomplete instrument relating to the obligation of a party.

(b) Except as provided in subsection (c), an alteration fraudulently made discharges a party whose obligation is affected by the alteration unless that party assents or is precluded from asserting the alteration.

Bob M I have made this claim to law enforcement that these Notes are a form of counterfeit. I would go as far to say the if a title is submitted to obtain possession, means that title is an extend of the Note and to me represents counterfeiting because it alters the ownership of the of the Note in the court’s eyes.

The fake lender in return takes that fake ownership and turns it into actual money went the foreclosure sale take place.