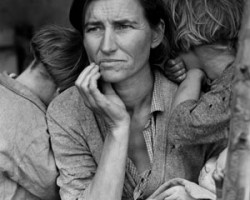

The Original Anti Recourse Laws For First Mortgages Were Written During The Great Depression

By Michael T. Pines

The L.A. Times published an article about Fannie and Freddie going after “Strategic Defaulters.” It states that these former “GSE’s” can sue a homeowner to collect money, implying people who walk away are “bad guys”.

http://www.latimes.com/business/realestate/la-fi-lew-20131013,0,7334270.story.

This is just plain wrong. I hate it when the mainstream press does that, and scares people. There is nothing legally FANNIE AND FREDDIE can do.

California is an “anti-deficiency” state. These laws were first enacted in the Great Depression in response to the exact same thing that is happening now. These laws prevent anyone from doing anything to collect a residential real estate loan other than foreclosing and taking the house. Most attorneys I talk to think it only applies to a purchase money, owner occupied, house, of 1-4 units. This is also wrong.

The law applies to residential real estate where the loan was a “purchase money” loan on 1-4 units or in some circumstances a refinance (many people incorrectly think the law doesn’t apply to a refinance at all.)

More importantly whenever a lender does a non-judicial foreclosure, which they always do in California on residential real estate, all they can get is the house. (California allows for either a judicial or non-judicial foreclosure, but non-judicial is used to foreclose on residential real estate without exception in California.)

The California Code of Civil Procedure provides:

580b. (a) No deficiency judgment shall lie in any event for the

following:

(2) Under a deed of trust or mortgage given to the vendor to

secure payment of the balance of the purchase price of that real

property or estate for years therein.

(3) Under a deed of trust or mortgage on a dwelling for not more

than four families given to a lender to secure repayment of a loan

which was in fact used to pay all or part of the purchase price of

that dwelling, occupied entirely or in part by the purchaser.

. . .

(c) No deficiency judgment shall lie in any event on any loan,

refinance, or other credit transaction (collectively, a “credit

transaction”) which is used to refinance a purchase money loan, or

subsequent refinances of a purchase money loan, except to the extent

that in a credit transaction, the lender or creditor advances new

principal (hereafter “new advance”) which is not applied to any

obligation owed or to be owed under the purchase money loan, or to

fees, costs, or related expenses of the credit transaction. Any new

credit transaction shall be deemed to be a purchase money loan except

as to the principal amount of any new advance. For purposes of this

section, any payment of principal shall be deemed to be applied first

to the principal balance of the purchase money loan, and then to the

principal balance of any new advance, and interest payments shall be

applied to any interest due and owing. The provisions of this

subdivision shall only apply to credit transactions that are executed

on or after January 1, 2013.

580d. No judgment shall be rendered for any deficiency upon a note

secured by a deed of trust or mortgage upon real property or an

estate for years therein hereafter executed in any case in which the

real property or estate for years therein has been sold by the

mortgagee or trustee under power of sale contained in the mortgage or

deed of trust.

. . .

What this means, is that no one can get anything from a homeowner except the house when they go into default. This is true whether it is a “strategic default” or a default caused by necessity.

Not only that, but big business walks away from property when it is “upside down” all the time. Yet another example of how one set of rules applies to the 1% and another to the rest of us.

Michael T. Pines

Michael has been a lawyer for over 30 years and has had a real estate license for over 20 years.

He handled litigation against the Resolution Trust Corporation (“RTC”) during the last real estate savings and loan crisis and has been able to see firsthand how history has repeated itself. He proactively positioned himself within the distressed real estate and assets environment, providing resolutions to buyers and asset holders. He is a successful trial attorney with many victories in front of judges and juries. Michael has argued hundreds of cases at all levels of the courts including the Supreme Court of California. In Barrington v. A.H. Robbins, Michael changed the law in the state of California regarding statutes of limitation.

He also successfully argued cases that resulted in published decisions at the Courts of Appeal. Michael handled complex real estate and insurance litigation involving the insolvency of Glacier General Assurance Company, Cal-Farm Insurance Company, Allied Insurance Company, and others. He recovered tens of millions of dollars for his clients in those cases and established himself as one of the few experts in “financial guarantee bonds” insuring real estate transactions.

Just a few years ago, Michael himself was a fraud victim of EMC Mortgage Corporation/J.P. Morgan Chase . In taking action, Michael discovered he was not alone, and the loan servicer was fined $28 million in early 2008 by the Federal Trade Commission (“FTC”). Michael was written up in the Salt Lake Tribune.

The banks and government hate him. See, www.4closurefraudpines.com

This article is for informational purposes only. It is not legal advice. You should seek counsel from a licensed attorney if you have legal questions.

image: evasvillage.org

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.