Decided on May 2, 2013

THE Bank of New York AS TRUSTEE FOR THE CERTIFICATEHOLDERS CWALT, INC. ALTERNATE LOAN TRUST 2005-58 MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2005-58, Plaintiff,

against

Swenda A. Cepeda, et. al., Defendants.

10596/08

Appearances:

Plaintiff

Jennifer R. Brennan, Esq.

Frenkel Lembert Weiss Weisman & Gordon, LLP

Bay Shore NY

Defendant

Swenda A. Cepeda, pro se

Brooklyn NY

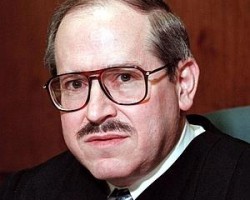

Arthur M. Schack, J.

The following papers numbered 1 – 1 read on this motion:Papers Numbered:Notice of Motion/Exhibits___________________________1

________________________________________________________________________

In this foreclosure action, plaintiff, THE BANK OF NEW YORK AS TRUSTEE

FOR THE CERTIFICATEHOLDERS CWALT, INC. ALTERNATE LOAN TRUST 2005-58 MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2005-58 (BNY),

moves to: vacate an order of reference issued by another Justice of the Supreme Court, Kings County for the premises, located at 45 Cumberland Street, Brooklyn, New York (Block 2030, Lot [*2]2, County of Kings), filed in the Kings County Clerk’s Office on July 9, 2009; and, have the Court issue a new order of reference for the subject premises. On June 26, 2012, that Justice of the Supreme Court granted the instant motion “on default subject to review by the foreclosure department.” Subsequently, that Justice of the Supreme Court, in an order dated February 26, 2013, recused himself from the instant action. The instant motion and underlying papers were sent to me as the new IAS Justice for this foreclosure action.

After a thorough review of plaintiff’s papers, the Court finds that plaintiff BNY cannot prove that it owns the subject mortgage and note. Therefore, plaintiff BNY has no right to foreclose and the Court dismisses the instant action and cancels the notices of pendency. As will be explained, the instant motion is granted to the extent of vacating the 2009 order of reference, but the instant action is dismissed without prejudice.

Defendant SWENDA A. CEPEDA (CEPEDA) borrowed $588,5000.00 from COUNTRYWIDE BANK, N.A. (COUNTRYWIDE) on September 26, 2005. The mortgage to secure the note was recorded by MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. (MERS), “acting solely as a nominee for Lender [COUNTRYSIDE]” and “FOR PURPOSES OF RECORDING THIS MORTGAGE, MERS IS THE MORTGAGEE OF RECORD,” in the Office of the City Register of the City of New York, New York City Department of Finance, on November 9, 2005, at City Register File Number (CRFN) 2005000623741.

Defendant CEPEDA allegedly defaulted in his mortgage loan payments with the September 1, 2007 payment. Subsequently, on March 27, 2008, 209 days after defendant CEPEDA defaulted, M. Kelly Michie, 1st Vice President of MERS, “acting solely as a nominee of Countrywide Bank, N.A.” assigned the nonperforming CEPEDA mortgage and note to plaintiff BNY. This was recorded in the Office of the City Register of the City of New York, New York City Department of Finance, on May 23, 2008, at CRFN 2008000210182.

Plaintiff BNY, four days after the MERS assignment to plaintiff BNY, on March 31, 2008, commenced the instant action with the filing of the subject summons, complaint and original notice of pendency. As noted above, another Justice of the Supreme Court, Kings County, appointed a referee who on or about November 10, 2009 executed a report. According to ¶ 6 of the attorney’s affirmation in support of the instant motion:

Plaintiff seeks to vacate the prior order of this court because plaintiff is unable to confirm that a proper review of the records was made and a proper notary taken when the prior affidavit, executed by Keri Selman in support of the previous order, was signed. Plaintiff is unable to confirm said information because the records, sufficient to demonstrate such compliance conclusively, were not maintained at that time. Therefore, submitted herewith is a new affidavit, in support of an order of reference, which was executed after a review of the business records and in compliance with notary requirements.

Ms. Selman has a documented history as a robosigner. While in the instant action she executed the affidavit of merit for the original motion for an order of reference on May 15, 2008 as Assistant Vice President of plaintiff BNY, she has executed other documents presented to this [*3]Court as “foreclosure specialist of Countrywide Home Loans, Inc.,” “Assistant Vice President of MERS” and “Vice President of Countrywide Home Loans.”

On November 16, 2007, I denied an application for an order of reference in Bank of New York a Trustee for the CertificateHolders of CWABS, Inc. Asset-Backed Certificates, Series 2008 v Nunez, et. al., Index No. 10457/07, in which the same Ms. Selman, in her affidavit of merit, claimed to be “Vice President of COUNTRYWIDE HOME LOANS, Attorney in fact for BANK OF NEW YORK.” In my decision in The Bank of New York, as Trustee for the Certificateholders CWALT, Inc. Alternative Loan Trust 2006-OC1 Mortgage Pass-Through Certificates, Series 2006-OC1 v Mulligan (28 Misc 3d 1226 [A] [Sup Ct Kings County 2010]), at * 4, I was presented with an affidavit of merit, dated August 23, 2007, from Ms. Selman, in which she claimed to be “a foreclosure specialist of Countrywide Home Loans, Inc. Servicing Agent for BANK OF NEW YORK, AS TRUSTEE FOR THE CERTIFICATEHOLDERS CWALT, INC. ALTERNATIVE LOAN TRUST 2006-OC1 MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2006-OC1.” In Bank of New York as Trustee for Certificateholders CWABS, Inc. Asset-Backed Certificate Series 2006-22 v Myers (22Misc 3d 1117 [A] [Sup Ct, Kings County 2009]), I found that Ms. Selman assigned the subject mortgage to plaintiff BNY on June 28, 2008 as Assistant Vice President of MERS, nominee for Homebridge Mortgage Bankers Corp., and five days later executed an affidavit of merit as Assistant Vice President of plaintiff BNY.

Therefore, the Court agrees with plaintiff BNY to vacate the other Supreme Court Justice’s original 2009 order of reference. However, with respect to that branch of the instant motion to issue a new order of reference, plaintiff has several problems.

First, plaintiff BNY fails to demonstrate how the assignment of the subject mortgage and note from MERS to BNY is valid. As will be explained, there is no authority for M. Kelly Michie, 1st Vice President of MERS, “acting solely as a nominee of Countrywide Bank, N.A.,” to assign the subject mortgage and note.

Second, the affidavit of merit attached to the instant motion is not executed by an officer of plaintiff BNY, but by Elysha James Armbruster, Assistant Vice President of Bank of America, N.A., who claims, in ¶ 1 of his affidavit of merit, that “I am authorized to sign this affidavit on behalf of Bank of America, N.A. as successor by merger to BAC Home Loans Servicing LP (“BANA”), as an officer of BANA, the servicing agent forplaintiff.” There is no valid power of attorney provided by plaintiff BNY to demonstrate how BANA is plaintiff BNY’s servicing agent. Further, attached to exhibit C of the instant motion is the Referee’s Report of November 11, 2009. Schedule C attached to the Referee’s Report is an affidavit, dated September 17, 2009, by Mary Kist, Vice President of “BAC Home Leans Servicing, L.P., attorney in fact [for plaintiff BNY] pursuant to a power of attorney recorded in Kings County on 1/9/09 as CRFN No. 2009000008160.” I checked the official ACRIS (Automated City Register Information System) website of the New York City Department of Finance and discovered that this power of attorney, dated August 15, 2005, was originally recorded on October 31, 2005 in Lockport, New York, in the Office of the Niagara County Clerk at Liber 3337, Page 123 and subsequently in ACRIS on January 9, 2009. However, the power of [*4]attorney is from The Bank of New York, “as Trustee under the Pooling and Servicing Agreements” to “Countrywide Home Loans Servicing LP and its authorized officers” to execute foreclosure documents. There is no mention of BAC Home Loans Servicing, LP or BANA in this recorded power of attorney.

Third, plaintiff’s counsel presents the Court in the instant motion with an affirmation by counsel, that on December 11, 2012 “I received a communication from the

following representative . . . of plaintiff . . . Elysha James Armbruster, Assistant Vice President Bank of America, NA servicer for Plaintiff,” confirming the accuracy of the documents and the notarizations, pursuant to Administrative Order 431/11 of the Chief Administrative Judge.” Absent a valid power of authority, Mr. Armbruster is not a representative of plaintiff BNY.

In a foreclosure action, a plaintiff must plead and prove as part of its prima facie case its ownership of the mortgage and note. The Court, in Campaign v Barba (23 AD3d 327 [2d Dept 2005]), instructed that “[t]o establish a prima facie case in an action to foreclose a mortgage, the plaintiff must establish the existence of the mortgage and the mortgage note, ownership of the mortgage, and the defendant’s default in payment [Emphasis added].” (See Witelson v Jamaica Estates Holding Corp. I, 40 AD3d 284 [1d Dept 2007]; Household Finance Realty Corp. of New York v Wynn, 19 AD3d 545 [2d Dept 2005]; Sears Mortgage Corp. v Yahhobi, 19 AD3d 402 [2d Dept 2005]; Ocwen Federal Bank FSB v Miller, 18 AD3d 527 [2d Dept 2005]; U.S. Bank Trust Nat. Ass’n

Trustee v Butti, 16 AD3d 408 [2d Dept 2005]; First Union Mortgage Corp. v Fern, 298 AD2d 490 [2d Dept 2002]; Village Bank v Wild Oaks, Holding, Inc., 196 AD2d 812 [2d Dept 1993]). Further, “foreclosure of a mortgage may not be brought by one who has no title to it.” (Kluge v Fugazy, 145 AD2d 537, 538 [2d Dept 1988]). The Appellate

Division, First Department, citing Kluge v Fugazy, in Katz v East-Ville Realty Co., (249 AD2d 243 [1d Dept 1998]), instructed that “[p]laintiff’s attempt to foreclose upon a mortgage in which he had no legal or equitable interest was without foundation in law or fact.” Thus, “to commence a foreclosure action, the plaintiff must have a legal or equitable interest in the mortgage (see Wells Fargo Bank, N.A. v Marchione, 69 AD3d 204, 207 [2d Dept 2009]).” (Aurora Loan Services, LLC v Weisblum, 85 AD2d 95, 108 [2sd Dept 2011]).

MERS, in the instant action, lacks authority to assign the subject mortgage. The subject COUNTRYWIDE mortgage, executed on September 26, 2005 by defendant CEPEDA, states on page 1 that “MERS is a separate corporation that is acting solely as a nominee for Lender [COUNTRYWIDE] and LENDER’s successors and assigns.” Further, it states “FOR PURPOSES OF RECORDING THIS MORTGAGE, MERS IS THE MORTGAGEE OF RECORD.” The word “nominee” is defined as “[a] person designated to act in place of another, usu. in a very limited way” or “[a] party who holds bare legal title for the benefit of others.” (Black’s Law Dictionary 1076 [8th ed 2004]). “This definition suggests that a nominee possesses few or no legally [*5]enforceable rights beyond those of a principal whom the nominee serves.” (Landmark National Bank v Kesler, 289 Kan 528, 538 [2009]). The Supreme Court of Kansas, in Landmark National Bank, 289 Kan at 539, observed that:

The legal status of a nominee, then, depends on the context of

the relationship of the nominee to its principal. Various courts have

interpreted the relationship of MERS and the lender as an agency

relationship. See In re Sheridan, 2009 WL631355, at *4 (Bankr. D.

Idaho, March 12, 2009) (MERS “acts not on its own account. Its

capacity is representative.”); Mortgage Elec. Registrations Systems,

Inc. v Southwest, 2009 Ark. 152 ___, ___SW3d___, 2009 WL 723182

(March 19, 2009) (“MERS, by the terms of the deed of trust, and its

own stated purposes, was the lender’s agent”); La Salle Nat. Bank v

Lamy, 12 Misc 3d 1191 [A], at *2 [Sup Ct, Suffolk County 2006]) . . .

(“A nominee of the owner of a note and mortgage may not effectively

assign the note and mortgage to another for want of an ownership interest

in said note and mortgage by the nominee.”)

The New York Court of Appeals in MERSCORP, Inc. v Romaine (8 NY3d 90 [2006]), explained how MERS acts as the agent of mortgagees, holding at 96:

In 1993, the MERS system was created by several large

participants in the real estate mortgage industry to track ownership

interests in residential mortgages. Mortgage lenders and other entities,

known as MERS members, subscribe to the MERS system and pay

annual fees for the electronic processing and tracking of ownership

and transfers of mortgages. Members contractually agree to appoint

MERS to act as their common agent on all mortgages they register

in the MERS system. [Emphasis added]

Thus, it is clear that MERS’ relationship with its member lenders is that of agent with the lender-principal. This is a fiduciary relationship, resulting from the manifestation of consent by one person to another, allowing the other to act on his behalf, subject to his control and consent. The principal is the one for whom action is to be taken, and the agent is the one who acts.It has been held that the agent, who has a fiduciary relationship with the principal, “is a party who acts on behalf of the principal with the latter’s express, implied, or apparent authority.” (Maurillo v Park [*6]Slope U-Haul, 194 AD2d 142, 146 [2d Dept 1992]). “Agents are bound at all times to exercise the utmost good faith toward their principals. They must act in accordance with the highest and truest principles of morality.” (Elco Shoe Mfrs. v Sisk, 260 NY 100, 103 [1932]). (See Sokoloff v Harriman

Estates Development Corp., 96 NY 409 [2001]); Wechsler v Bowman, 285 NY 284

[1941]; Lamdin v Broadway Surface Advertising Corp., 272 NY 133 [1936]). An agent

“is prohibited from acting in any manner inconsistent with his agency or trust and is at all times bound to exercise the utmost good faith and loyalty in the performance of his duties.” (Lamdin at 136).

Thus, in the instant action, MERS, as nominee for COUNTRYWIDE, is an agent of COUNTRYWIDE for limited purposes. It only has those powers given to it and authorized by its principal, COUNTRYWIDE. Plaintiff BNY failed to submit documents authorizing MERS, as nominee for COUNTRYWIDE, to assign the subject mortgage to plaintiff BNY. Therefore, MERS lacked authority to assign the CEPEDA mortgage and note, making the assignment to plaintiff BNY defective. In Bank of New York v Alderazi, 28 Misc 3d 376 [Sup Ct Kings County 2010], Justice Saitta, at 379-380, explains:

A party who claims to be the agent of another bears the burden

of proving the agency relationship by a preponderance of the evidence

(Lippincott v East River Mill & Lumber Co., 79 Misc 559 [1913])

and “[t]he declarations of an alleged agent may not be shown for

the purpose of proving the fact of agency.” (Lexow & Jenkins, P.C. v

Hertz Commercial Leasing Corp., 122 AD2d 25 [2d Dept 1986]; see

also Siegel v Kentucky Fried Chicken of Long Is. 108 AD2d 218 [2d

Dept 1985]; Moore v Leaseway Transp/ Corp., 65 AD2d 697 [1st Dept

1978].) “[T]he acts of a person assuming to be the representative of

another are not competent to prove the agency in the absence of evidence

tending to show the principal’s knowledge of such acts or assent to them.”

(Lexow & Jenkins, P.C. v Hertz Commercial Leasing Corp., 122 AD2d

at 26, quoting 2 NY Jur 2d, Agency and Independent Contractors § 26).

Plaintiff has submitted no evidence to demonstrate that the

original lender, the mortgagee America’s Wholesale Lender, authorized

MERS to assign the secured debt to plaintiff [the assignment was [*7]

executed by the multi-hatted Keri Selman].

In the instant action, MERS, as nominee for COUNTRYWIDE, not only had no authority to assign the CEPEDA mortgage, but no evidence was presented to the Court to demonstrate COUNTRYWIDE’s knowledge or assent to the assignment by MERS to plaintiff BNY.

In Bank of New York v Silverberg (86 AD3d 274 [2d Dept 2011]), the Court

instructed, at 281-282:

the assignment of the notes was thus beyond MERS’s authority as

nominee or agent of the lender (see Aurora Loan Servs., LLC v

Weisblum, AD3d, 2011 NY Slip Op 04184, *6-7 [2d Dept 2011];

HSBC Bank USA v Squitteri, 29 Misc 3d 1225 [A] [Sup Ct, Kings

County, F. Rivera, J.]; ; LNV Corp. v Madison Real Estate, LLC,

2010 NY Slip Op 33376 [U] [Sup Ct, New York County 2010,

York, J.]; LPP Mtge. Ltd. v Sabine Props., LLC, 2010 NY Slip Op

32367 [U] [Sup Ct, New York County 2010, Madden, J.]; Bank of

NY v Mulligan, 28 Misc 3d 1226 [A] [Sup Ct, Kings County 2010,

Schack, J.]; One West Bank, F.S.B., v Drayton, 29 Misc 3d 1021

[Sup Ct, Kings County 2010, Schack, J.]; Bank of NY v Alderazi,

28 Misc 3d 376, 379-380 [Sup Ct, Kings County 2010, Saitta, J.]

[the “party who claims to be the agent of another bears the burden

of proving the agency relationship by a preponderance of the evidence”];

HSBC Bank USA v Yeasmin, 24 Misc 3d 1239 [A] [Sup Ct, Kings

County 2010, Schack, J.]; HSBC Bank USA, N.A. v Vasquez, 24

Misc 3d 1239 [A], [Sup Ct, Kings County 2009, Schack, J.]; Bank of

NY v Trezza, 14 Misc 3d 1201 [A] [Sup Ct, Suffolk County 2006,

Mayer, J.]; La Salle Bank Natl. Assn. v Lamy, 12 Misc 3d 1191 [A]

[Sup Ct, Suffolk County, 2006, Burke, J.]; Matter of Agard, 444 BR

231 [Bankruptcy Court, ED NY 2011, Grossman, J.]; but see U.S.

Bank N.A. v Flynn, 27 Misc 3d 802 [Sup Ct, Suffolk County 2011,

Whelan, J.]).

Moreover, the Silverberg Court concluded, at 283, that “because MERS was never the lawful holder or assignee of the notes described and identified in the consolidation agreement, the . . . assignment of mortgage is a nullity, and MERS was without authority to [*8]assign the power to foreclose to the plaintiff.” Further, the Silverberg Court observed, at 283, that “the law must not yield to expediency and the convenience of lending institutions. Proper procedures must be followed to ensure the reliability of the chain of ownership, to secure the dependable transfer of property, and to assure the enforcement of the rules that govern real property [Emphasis added].”

Real Property Actions and Proceedings Law (RPAPL) § 1321 allows the Court in a foreclosure action, upon the default of defendant or defendant’s admission of mortgage payment arrears, to appoint a referee “to compute the amount due to the plaintiff” and plaintiff BNY’s application for an order of reference is a preliminary step to obtaining a default judgment of foreclosure and sale. (Home Sav. Of Am., F.A. v Gkanios, 230 AD2d 770 [2d Dept 1996]). However, plaintiff BNY fails to meet the clear requirements of CPLR § 3215 (f) for a default judgment:

On any application for judgment by default, the applicant

shall file proof of service of the summons and the complaint, or

a summons and notice served pursuant to subdivision (b) of rule

305 or subdivision (a) of rule 316 of this chapter, and proof of

the facts constituting the claim, the default and the amount due

by affidavit made by the party . . . Where a verified complaint has

been served, it may be used as the affidavit of the facts constituting

the claim and the amount due; in such case, an affidavit as to the

default shall be made by the party or the party’s attorney. [Emphasis added].

Plaintiff BNY fails to submit “proof of the facts” in “an affidavit made by the

party.” (Blam v Netcher, 17 AD3d 495, 496 [2d Dept 2005]; Goodman v New York City Health & Hosps. Corp. 2 AD3d 581[2d Dept 2003]; Drake v Drake, 296 AD2d 566 [2d Dept 2002]; Parratta v McAllister, 283 AD2d 625 [2d Dept 2001]; Finnegan v Sheahan,

269 AD2d 491 [2d Dept 2000]; Hazim v Winter, 234 AD2d 422 [2d Dept 1996]).

Instead, plaintiff BNY submits an affidavit of merit by Elysha James Armbruster, who alleges “I am authorized to sign this affidavit on behalf of Bank of America, N.A. as successor by merger to BAC Home Loans Servicing LP (“BANA”), as an officer of BANA, the servicing agent for plaintiff” and fails to submit a valid power of attorney for that express purpose.

With plaintiff BNY unable to prove that it owns the CEPEDA mortgage and note, the Court dismisses the instant foreclosure action without prejudice and cancels the notice of pendency. CPLR § 6501 provides that the filing of a notice of pendency against a property is to give constructive notice to any purchaser of real property or encumbrancer against real property of an [*9]action that “would affect the title to, or the possession, use or enjoyment of real property, except in a summary proceeding brought to recover the possession of real property.” The Court of Appeals, in 5308 Realty Corp. v O & Y Equity Corp. (64 NY2d 313, 319 [1984]), commented that “[t]he purpose of the doctrine was to assure that a court retained its ability to effect justice by preserving its power over the property, regardless of whether a purchaser had any notice of the pending suit,” and, at 320, that “the statutory scheme permits a party to effectively retard the alienability of real property without any prior judicial review.”

CPLR § 6514 (a) provides for the mandatory cancellation of a notice of pendency by:

The Court, upon motion of any person aggrieved and upon such

notice as it may require, shall direct any county clerk to cancel

a notice of pendency, if service of a summons has not been completed

within the time limited by section 6512; or if the action has been

settled, discontinued or abated; or if the time to appeal from a final

judgment against the plaintiff has expired; or if enforcement of a

final judgment against the plaintiff has not been stayed pursuant

to section 551. [emphasis added]

The plain meaning of the word “abated,” as used in CPLR § 6514 (a) is the ending of an action. “Abatement” is defined as “the act of eliminating or nullifying.” (Black’s Law Dictionary 3 [7th ed 1999]). “An action which has been abated is dead, and any further enforcement of the cause of action requires the bringing of a new action, provided that a cause of action remains (2A Carmody-Wait 2d § 11.1).” (Nastasi v Natassi, 26 AD3d 32, 40 [2d Dept 2005]). Further, Nastasi at 36, held that the “[c]ancellation of a notice of pendency can be granted in the exercise of the inherent power of the court where its filing fails to comply with CPLR § 6501 (see 5303 Realty Corp. v O & Y Equity Corp., supra at 320-321; Rose v Montt Assets, 250 AD2d 451, 451-452 [1d Dept 1998]; Siegel, NY Prac § 336 [4th ed]).” Thus, the dismissal of the instant complaint must result in the mandatory cancellation of plaintiff BNY’s notice of pendency against the property “in the

exercise of the inherent power of the court.”

Accordingly, it is

ORDERED, that the motion of plaintiff, THE BANK OF NEW YORK AS TRUSTEE FOR THE CERTIFICATEHOLDERS CWALT, INC. ALTERNATE LOAN TRUST 2005-58 MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2005-58, to: vacate an order of reference issued by another Justice of the Supreme Court, Kings County, for the premises, located at 45 Cumberland Street, Brooklyn, New York (Block 2030, Lot 2, County of Kings), [*10]filed in the Kings County Clerk’s Office on July 9, 2009; and, have the Court issue a new order of reference for the subject premises, is granted to the extent that the order of reference issued by that other Justice of the Supreme Court, Kings County, for the premises, located at 45 Cumberland Street, Brooklyn, New York (Block 2030, Lot 2, County of Kings), filed in the Kings County Clerk’s Office on July 9, 2009, is granted, and it is further

ORDERED, that the instant action, Index Number 10596/08, is dismissed without

prejudice; and it is further

ORDERED that the Notices of Pendency in this action, filed with the Kings

County Clerk on March 31, 2008 and March 24, 2011, by plaintiff, THE BANK OF NEW YORK AS TRUSTEE FOR THE CERTIFICATEHOLDERS CWALT, INC.

ALTERNATE LOAN TRUST 2005-58 MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2005-58, to foreclose on a mortgage for real property located

at 45 Cumberland Street, Brooklyn, New York (Block 2030, Lot 2, County of Kings), are cancelled.

This constitutes the Decision and Order of the Court.

ENTER

________________________________HON. ARTHUR M. SCHACK

J. S. C.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

this is the judge that refues to let banksters and their fraud steal people homes god bless this brave judge ,that have the courage to stand for justice.bank of ny mellon and bank of america fraudstears that steal people homes tru out america must be stop and any court that have a case in front of it from bank of new york and bank of america must look very carfuly at all their paper work in order to stop this fradulent crimes against the american people.courts must be on the side of fairness and justice not on the side of fraud

I agree JIMI God Bless ” THE HONORABLE JUDGE SCHACK” On a second note please email me with docs of proof of robo docs for this party J C San Pedro. Send to Shelleystotalbodyworks@comcast.net Many Thanks