In-House Counsel’s Role in the Structuring of Mortgage-Backed Securities

~

Steven L. Schwarcz, Duke Law School***

Shaun Barnes*

Kathleen G. Cully**

Abstract

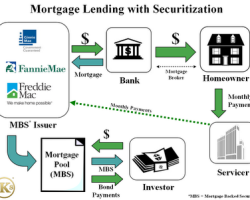

The authors introduce the financial crisis and the role played by mortgage-backed securities. Then describe the controversy at issue: whether, in order to own and enforce the mortgage loans backing those securities, a special-purpose vehicle “purchasing” mortgage loans must take physical delivery of the notes and security instruments in the precise manner specified by the sale agreement. Focusing on this controversy, the authors analyze (i) the extent, if any, that the controversy has merit; (ii) whether in-house counsel should have anticipated the controversy; and (iii) what, if anything, in-house counsel could have done to avert or, after it arose, to mitigate the controversy. Finally, the authors examine how the foregoing analysis can help to inform the broader issue of how in-house counsel should address complex legal transactions.

[ipaper docId=127286189 access_key=key-xthtvucqjksmxlyk3tw height=600 width=600 /]

This is not complicated when dealing with Ginnie Mae because they cannot buy or sell home mortgages but are handed over the blank endorse Notes, and this game is over. The debt does not follow the Notes because they are not purchase!

The is no debate as to once Ginnie Mae gets its hand onto the Notes there cannot be a debt called due. The in house counsel at some point should have realized this fact, yet let these foreclosures take place and that why the FHA had a $70 billion loan losses.

FHA along has given out $7 billion in false insurance claims which I have long ago reported this crime.

How attorneys could turn something as easy as A-B-C-D to $-#-!-T to profit by fraud!

It would seem a few States Supreme Courts are in disagreement with this Paper. Trying to whitewash the legal requirement of the multiple transferrence of the note and mortgage by ignoring the “to make it viable & legal” reasoning behind it… ie.. Bankruptcy Remoteness (legal).. and that being a prerequisite to deposit into the Trust before the Trust was “supposed” to be able to obtain (bought) it’s AAA rating(viable). One must remember that with a REMIC Trust the Form IS the substance.