re: The Auditors-

The Financial Times reported late this week on the failure of Deutsche Bank to recognize $12bn of paper losses on complex derivative transactions during the financial crisis. The bank’s objective was to avoid a bailout by the German government.

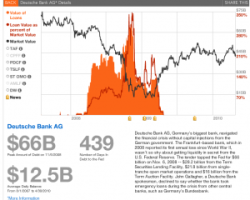

The bank may have avoided a bailout by the German government but, as information later obtained by Bloomberg and a team led by Phil Kuntz revealed, hundreds of banks, including Deutsche Bank, borrowed billions from the US Federal Reserve and various programs during this period.

The argument pushed by some columnists, and the bank itself, is that “all’s well that ends well” and the end justifies the means. Deutsche Bank survived without a German bailout and that’s a good thing. The global financial system was saved and investor confidence was maintained.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Who is kidding who? Confidence in this non deposit bank or any big bank is in question.