From Jeff L. Thigpen

MEDIA RELEASE

For Immediate Release

July 17, 2012

Contacts:

David.Rickard@DavidsonCountyNC.gov

jthigpe@co.guilford.nc.us

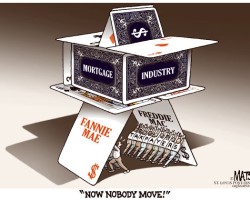

Registers of Deeds in Five NC Counties Take Issue with Fannie and Freddie’s Tax Exempt Status

Five Register of Deeds offices in North Carolina have written Attorney General Roy Cooper asking for a revised opinion on the tax exemption currently given to the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Association (Freddie Mac). Guilford, Davidson, Caldwell, Duplin, and Davie Counties signed on to the letter dated June 28th.

The Register of Deeds have asked for a review of a 1972 opinion from the Attorney General’s office that allowed Fannie and Freddie to claim exemption from excises taxes on land transactions as quasi judicial entities. This request comes after a US District Court in Michigan issued a decision in March that Fannie and Freddie were not exempted from paying excise taxes. Fannie and Freddie has been the subject of congressional investigations based on its role in the housing and financial crisis of 2008.

The letter sent to the Attorney General raises that central question under NC law:

Should Fannie Mae and Freddie Mac be considered private corporations or government entities entitled to an excise tax stamp exemption under N.C.G.S. 161-14 (b)?

“A lot has changed in the past 40 years and our letter seeks clarity and certainty on their status”, says Davidson County Register of Deeds David Rickard, a lead signor. “If Fannie and Freddie are traded on the New York stock exchange, why should taxpayers have to foot the bill for a tax exemption that no longer applies to them?”

The letter also states:

The revenue from the excise tax collected by Registers of Deeds is used by North Carolina counties to fund schools, police and fire fighters, and human services. These services are under increasing stress based on decreased property values based on our most recent financial crisis felt by families across our state.

Register of Deeds Jeff Thigpen, a co-signor, estimates a loss of potentially $65,000 in tax revenue for state and local governments based on land related transactions involving Fannie Mae alone during a six month period from October 2010 to June 2011. “State and local governments should not be giving financial aid to corporations responsible for our financial crisis when we are facing layoffs for those who teach our kids and keep us safe. At the least, we’d like clarification on the law. Policymakers could also begin taking corrective action to restore fiscal balance”.

In North Carolina, Registers of Deeds collect excise taxes during land transactions when deeds are presented for registration in county offices. The tax is levied on the transactions in real estate for all persons and organizations except federal, state, county, and municipal governments based on North Carolina General Statutes. The current state excise tax rate is $1 on each $500 of consideration of value in interest or property conveyed. The revenue from the excise tax goes to both state and county governments across North Carolina.

“This request is being made by both Democrat and Republican Registers of Deeds in urban and rural counties. We don’t view this concern as a partisan issue,” says Wayne Rash, Caldwell County Register of Deeds and current President of North Carolina Association of Register of Deed (NCARD). “Its most importantly about the law and tax fairness to the citizens we serve. We look forward to addressing it as quickly as possible”.

###

Additional Signor Contacts:

Wayne Rash, Caldwell County Register of Deeds

(828) 381-2612

Davis Brinson, Duplin County Register of Deeds

(910)296-2108

Brent Shoaf, Davie County Register of Deeds

(336) 753-6080