Decided on April 26, 2012

City Court of Poughkeepsie

Discover Bank, Plaintiff,

against

Gerardo Sura, Defendant.

CV-11-3421

Crystal S.A. Scott, Esq.

Cohen & Slamowitz, LLP

Attorneys for the Plaintiff

199 Crossways Park Drive

Woodbury, NY 11797

Gerardo Sura

Defendant pro se

Katherine A. Moloney, J.

The plaintiff seeks an Order granting summary judgment pursuant to C.P.L.R. §3212, on the grounds that there are no triable issues of fact to be decided at trial. Plaintiff’s motion is supported by the affidavit of Natasha Szczygiel, dated February 16, 2012, the affirmation of Crystal S.A. Scott, Esq. dated February 22, 2012, together with exhibits A through E. On March 14, 2012, the defendant, proceeding pro se, filed opposition to plaintiff’s motion, which was supported by the affidavit of Gerardo Sura, dated March 13, 2012. Now, upon reading the notice of motion, the supporting documents, defendant’s opposition, and plaintiff’s reply and due deliberation having been held thereon, this Court finds and determines the motion as follows:

FACTS & ARGUMENTS:

On or about October 21, 2011, plaintiff filed this lawsuit against the defendant seeking to recover a sum of money totaling $4,774.61 for failure to make payments on a credit card taken out by the defendant thereby breaching the terms of the signed contract. Service was effectuated upon the defendant by substitute service on or about November 3, 2011. On November 22, 2011 issue was joined, wherein defendant interposed a general denial of the allegations together with some affirmative defenses, including a request for verification of the debt. On January 9, 2012, a preliminary conference was held with the parties and preliminary conference stipulation and order was entered into. On March 1, 2012, the plaintiff filed the instant motion arguing that the defendant has breached the terms of a signed contract by failing to make payments on the credit card, and on the grounds of an account stated. In opposition to the motion, the defendant argues that there are material issues of fact in dispute for which plaintiff is not entitled to judgment as a matter of law. In particular, defendant argues, in part, that plaintiff has not produced a signed credit card agreement, there is no evidence that the defendant paid plaintiff anything, and the affidavit upon which plaintiff [*2]relies is based upon hearsay which is irrelevant or inadmissible. As such, defendant argues that plaintiff has failed to meet its burden of proof and summary judgment should be denied.

Page 1 of 5

The basis of plaintiff’s motion is that when defendant failed to make payments due under the terms of the agreement, it breached the contract thus allowing plaintiff to recover the amount unpaid. The contract submitted in support of plaintiff’s motion is not signed by the defendant nor is it dated. Plaintiff’s Motion for Summary Judgment, Exhibit A. The contract plaintiff provided to the court does not make reference to the defendant, Gerardo Sura. It consists of terms and conditions not specific to anyone other than the plaintiff, Discover Bank. Plaintiff’s Motion for Summary Judgment, Exhibit A. Plaintiff also argues that the statement sent to defendant with a payment due date of April 2, 2011 establishes that an account stated has been created, and that the defendant failed to make payments or dispute the debt entitling plaintiff to summary judgment. Plaintiff seeks to recover the amount of $4,774.61. The one monthly statement provided by plaintiff shows an unpaid balance of $4,620.47. Plaintiff’s Motion for Summary Judgment, Exhibit B. There are no series of monthly statements demonstrating payments or charges made on the credit card.

LEGAL ANALYSIS AND CONCLUSION:

It is well settled that “the drastic remedy of summary judgment is appropriate only where a thorough examination of the merits clearly demonstrates the absence of any triable issue of fact.” Vamattam v. Thomas, 205 AD2d 615 (2d Dept. 1994) citing Piccirillo v. Piccirillo, 156 AD2d 748 (2d Dept. 1989). The party seeking summary judgment must sufficiently establish the cause of action (or defense) and must tender evidentiary proof in admissible form to warrant the court, as a matter of law, to direct judgment in their favor. Bush v. St. Clare’s Hospital, 82 NY2d 738, 739 (1993) citing Zuckerman v. City of New York, 49 NY2d 557, 562 (1980). In short, the plaintiff bears the initial burden to show a prima facie case of entitlement to judgment by demonstrating the absence of any material issues of fact. Alverez v. Prospect Hospital et al., 68 NY2d 320 (1986); see North Fork Bank Corp. v. Graphic Forms Assoc., et al., 36 AD3d 676 (2d Dept. 2007).

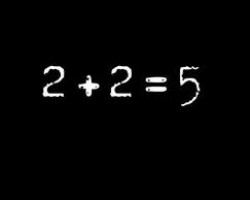

In order to establish a prima facie case of entitlement to summary judgment upon a breach of contract cause of action, the plaintiff must establish, in part, the existence of an agreement, the terms of that agreement, the performance by plaintiff of its obligations pursuant to the agreement and the nonperformance by defendant of its obligations. JMG Custom Homes, Inc. v. Ryan et al., 45 AD3d 1278, 1280 (4th Dept. 2007); see Groskin v. Seedman Merchandising Group, Inc., et al., 94 AD2d 786 (2d Dept. 1983). Here, plaintiff has failed to establish the existence of an agreement or even its terms. Exhibit A is unsigned, undated, and does not even make a reference to the defendant. Thus, Exhibit A, fails to satisfy the existence of an agreement between the parties, its terms or the performance of the parties’ obligations. As such, since the plaintiff failed to meet his burden of proof as to the existence of a contract, the burden never shifted to the defendant to come forward with evidentiary facts demonstrating the existence of a material issue of fact which would defeat summary judgment on the claim that the defendant breached a contract. Moezinia v. Baroukhian, 247 AD2d 452 (2d Dept. 1998). [*3]

Yet, plaintiff also claims that it is entitled to summary judgment based upon the legal theory of an account stated. An “account stated” is an agreement between the parties that the debt is valid and due [see Citibank v. Jones, 272 AD2d 815 (2000)]. Where the defendant receives and retains the plaintiff’s account without objecting to the amount due within a reasonable time, the plaintiff is entitled to summary judgment on the account stated, independent of the obligation. Citibank v. A.E. Caputo, 8 Misc 3d 131A (2d Dept. 2005); Werner v. Nelkin, 206 AD2d 422 (2d Dept. 1994). Plaintiff does not have to submit a signed copy of an agreement in order to prevail on a motion for summary judgment based upon the account stated, but the plaintiff must establish with some other legally admissible evidence an agreement between the parties that a certain balance remains due from one to the other, and the promise of the former to pay the balance. Sherman Acquisition Ltd. Partnership v. Thomas, 8 Misc 3d 130A (2d Dept. 2005); see, Schutz v. Morette, 146 NY 137 (1895). In order to establish a prima facie cause of action for an account stated, the plaintiff must demonstrate that the plaintiff mailed to the defendant a statement of account and that the defendant retained the statement for an unreasonable period of time without objecting thereto. Discover Bank v. Williamson, 14 Misc 3d 136A (2d Dept. 2007).

Yet, as noted above, plaintiff has submitted proof of one (1) statement with the defendant’s name on it. Plaintiff’s Motion for Summary Judgment, Exhibit B. Plaintiff claims that statements were mailed to defendant advising him of the delinquency of his account, but that the defendant failed to make the required payments. Szczygiel affidavit, dated Feb. 16, 2012, ¶ 14. Exhibit B is the charge-off statement plaintiff claims was sent to defendant and retained without objection. This statement shows a balance due different from the amount plaintiff seeks to recover thereby raising a question of material fact relative to the amount of the debt – one of the things defendant disputes in his answer.In reviewing the remaining evidence provided in support of plaintiff’s motion, this Court finds that there is no legally admissible evidence to support an account stated between the parties. There is nothing conclusive before this Court proving that the plaintiff rendered monthly statements to the defendant of the charges incurred on the credit card, rather plaintiff submitted just one (1) monthly statement and relies upon the affidavit of Ms. Szczygiel, who has no direct personal knowledge, but avers that periodic written statements of account were provided to the defendant, “which reveal each transaction for which the credit card was used to purchase goods, services or cash advances, including any finances charges imposed on unpaid balances on the account and other charges that might apply; that Defendant did fail to make payments on the credit card account in accordance with the terms of the agreement between Defendant Discover.” Szczygiel affidavit, dated Feb. 16, 2012, ¶ 4. Yet, Ms. Szczygiel provides none of the details she personally reviewed in said statements, nor does she submit to the Court the statements that show all of the information that she was able to glean from the business records reviewed – except for one (1) month with a balance that does not match the amount that plaintiff seeks to recover.

Moreover, nowhere in Ms. Szczygiel’s affidavit does she set forth that the business records she bases her information upon was transmitted by a person with personal knowledge. Ms Szcygiel did not identify herself as the custodian of the business records, nor did she identify by name or otherwise the type of person working for the business who had firsthand knowledge of the charges and initially received, recorded, or transmitted the information that ultimately appeared on the credit [*4]card statements. Rather, the affidavit merely sets forth that she personally reviewed the financial information concerning the Discover credit card in question and is personally familiar with the records, electronic date and account specific information belonging to Discover. Szczygiel affidavit, dated Feb. 16, 2012, ¶ 4 and 6 . The affidavit appears to be made upon information and belief, but more importantly, it is a statement made out of court, offered for the truth of the matter asserted, and therefore constitutes hearsay. Since there is no evidence exception to the hearsay rule applicable here making the evidence admissible, the plaintiff has failed to tender evidentiary proof in admissible form to warrant, as a matter of law, summary judgment in plaintiff’s favor. Zuckerman, supra at 562.

As such, this Court finds that the plaintiff has failed to show a prima facie case of entitlement to summary judgment by demonstrating the absence of any material issues of fact. Alverez v. Prospect Hospital et al., 68 NY2d 320 (1986); see North Fork Bank Corp. v. Graphic Forms Assoc., et al., 36 AD3d 676 (2d Dept. 2007).

THEREFORE, based upon the foregoing, it is now

ORDERED, that plaintiff’s motion for summary judgment is DENIED.

All parties are directed to appear before this Court for further proceedings on this matter on May ___, 2012 at 9:00 a.m.

Dated: April 26, 2012___________________________

Poughkeepsie, New YorkKatherine A. Moloney

CITY COURT JUDGE

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

falk credit card fraud is all over america.all someone need to see to look at the fraud is look at capital one bank that steal from american people all over america and no one stop them not even judges that rubber stamp the fraud for them[capital one]