A fresh start with bankruptcy? Big lenders keep squeezing money out of consumers whose debts were canceled by the courts

BUSINESS WEEK-

In a financial version of Night of the Living Dead, debts forgiven by bankruptcy courts are springing back to life to haunt consumers. Fueling these miniature horror stories is an unlikely market in which seemingly extinguished debts are avidly bought and sold.

The case of Van Rathavongsa illustrates how canceled debts regain vitality. The Raleigh (N.C.) factory worker pulled himself out from beneath a mountain of bills by means of a bankruptcy proceeding that wrapped up in 2002. One of the debts the judge canceled, or “discharged,” was $9,523 Rathavongsa owed to Capital One Financial (COF), the big credit-card company. But Capital One continued to report the factory worker’s discharged debt to credit bureaus as a live balance, according to documents filed in U.S. Bankruptcy Court in Raleigh.

Image source: Business Week

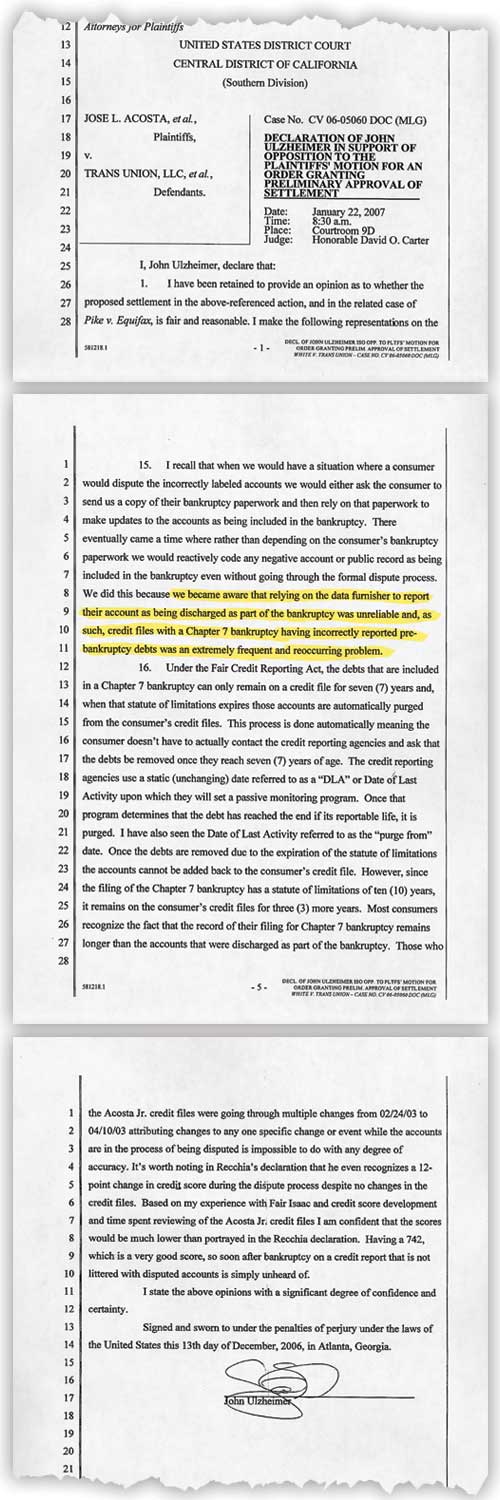

The document submitted by a former Equifax employee. It asserts that credit files with incorrectly reported pre-bankruptcy debts were “an extremely frequent and reoccurring problem.”

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.