If you recall it, I believe Mr. Barnhart is a Real Estate broker, so even the pros can be duped without even realizing this.

News-Press-

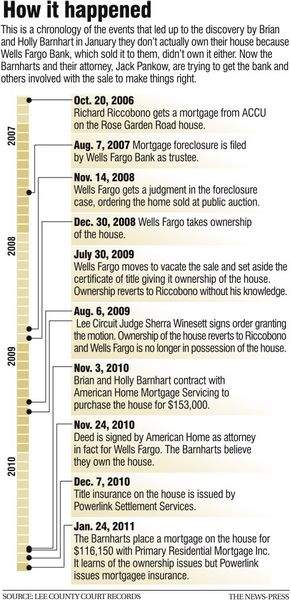

Brian and Holly Barnhart of Cape Coral – who were sold a house by Wells Fargo Bank even though the bank didn’t own the property – have filed a lawsuit alleging fraud and negligence.

The Barnharts, who emptied their life savings to buy the house for $153,000 cash and renovate it for another $80,000, bought the house in November.

But it turned out Wells Fargo had given the house back to its original owner …

This is a prime example of why chain of title assessments are necessary BEFORE purchasing any real estate, especially in areas where there are rampant issues of title defects possible due to the nature of the foreclosures. This adds a whole new meaning to caveat emptor, doesn’t it? I have title agents telling me that people are crazy to invest in REO’s right now … this case sheds light on this comment. Florida is a hot bed of erroneous foreclosure cases and I can more than likely identify chain of title defects just on cursory review alone. Not every title company understands what they’re getting themselves into when they insure the lender against previous defects and not too many homeowners understand that at closing, the title insurance you are paying for insures the lender and not them agianst defects in title. The buyers are left hanging like a chad on a voting ballot.