coup de gras

Decided on July 1, 2011

Supreme Court, Kings County

HSBC Bank USA, N.A., AS INDENTURE TRUSTEE FOR THE REGISTERED NOTEHOLDERS OF RENAISSANCE HOME EQUITY LOAN TRUST 2007-2

against

Ellen N. Taher, et. al.

EXCERPT:

On plaintiff HSBC’s deadline day, January 7, 2011, the 60th day after issuing my November 8, 2010 decision and order, plaintiff’s counsel, Frank M. Cassara, Esq., of Shapiro, DiCaro & Barak, LLC, submitted to my chambers the required affirmation, pursuant to Chief Administrative Judge Pfau’s Administrative Order 548/10. Mr. Cassara, affirmed “under the penalties of perjury”:

[…]

The assignment of the subject mortgage and note to HSBC, by MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. (MERS), in the instant foreclosure action is without legal authority. MERS never possessed the TAHER note it allegedly assigned to plaintiff HSBC. Thus, plaintiff HSBC lacked standing to commence the instant foreclosure action. Therefore, the assignment is defective and the instant action is dismissed with prejudice.

Mr. Cassara’s affirmation, affirmed “under the penalties of perjury,” that to the best of Mr. Cassara’s “knowledge, information, and belief, the Summons and Complaint, and other papers filed or submitted to the [*4]Court in this matter contain no false statements of fact or law,” is patently false. Moreover, the Court is troubled that: the alleged representative of plaintiff HSBC, Christina Carter, who according to Mr. Cassara, “confirmed the factual accuracy and allegations set forth in the Complaint and any supporting affirmations filed with the Court, as well as the accuracy of the notarizations contained in the supporting documents filed therewith,” is not an employee of HSBC, but a robosigner employed by OCWEN LOAN SERVICING, LLC [OCWEN], whose signature on legal documents has at least three variations; the MERS to plaintiff HSBC assignment of the subject mortgage and note was executed by Scott W. Anderson, a known robosigner and OCWEN employee, whose signature is reported to have appeared in at least four different variations on mortgage assignments; and, the instant affidavit of merit was executed by Margery Rotundo, another robosigner, OCWEN employee and self-alleged employee of various other banking entities.

Last month, on May 19, 2011, in a case involving a defective MERS to HSBC assignment by a robosigner, Maine’s highest court, the Supreme Judicial Court, found that HSBC’s affidavits and the assignment of the note and mortgage by MERS to HSBC contained serious defects. The Maine Court held “that the affidavits submitted by HSBC contain serious irregularities that make them inherently untrustworthy.” (HSBC Mortg. Services, Inc. v Murphy, 19 A3d 815, 2011 ME 59, * 3). HSBC has a history of foreclosure actions before me with affidavits of merit executed by Margery Rotundo and MERS to HSBC assignments executed by Scott Anderson that “contain serious irregularities that make them inherently untrustworthy.” Moreover, Mr. Cassara was put on notice, in my November 8, 2010 decision and order, that “[t]he wrongful filing and prosecution of foreclosure proceedings which are discovered to suffer from these defects may be cause for disciplinary and other sanctions upon participating counsel.”

[…]

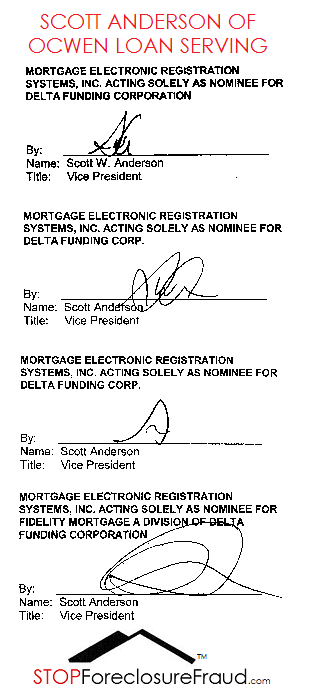

Robosigner Scott W. Anderson

While I have never personally met Mr. Anderson, his signatures have appeared in many foreclosure documents in this Court. His claims of wearing different corporate hats and the variations in the scrawls of initials used for his signature on mortgage documents has earned Mr. Anderson notoriety as a robosigner. Kimberly Miller, in her January 5, 2011-Palm Beach Post article, “State details foreclosure crisis,” wrote:

Sweeping evidence of the case the state attorney general’s office

has built in its pursuit of foreclosure justice for Florida homeowners is

outlined in a 98-page presentation complete with copies of allegedly

forged signatures, false notarizations, bogus witnesses and improper

mortgage assignments.

The presentation, titled “Unfair, Deceptive and Unconscionable

Acts in Foreclosure Cases,” was given during an early December

conference of the Florida Association of Court Clerks and Comptrollers

by the attorney general’s economic crimes division.

It is one of the first examples of what the state has compiled in

its exploration of foreclosure malpractice, condemning banks, mortgage

servicers and law firms for contributing to the crisis by cutting corners . . .

In page after page of copied records, the presentation meticulously

documents cases of questionable signatures, notarizations that could not

have occurred when they are said to have because of when the notary

stamp expires, and foreclosures filed by entities that might not have

had legal ability to foreclose.

It also focuses largely on assignments of mortgage [sic],

documents that transfer ownership of mortgages from one bank to

another. Mortgage assignments became an issue after the real estate

boom, when mortgages were sold and resold, packaged into securities

trusts and otherwise transferred in a labyrinthine fashion that made

tracking difficult.

As foreclosures mounted, the banks appointed people to create

assignments, “thousands and thousands and thousands” of which were signed weekly by people who may not [*6]have known what they were signing . . .

In another example, the signature of Scott Anderson, an employee

of West Palm Beach-based Ocwen Financial Corp., appears in four

styles on mortgage assignments . . .

Paul Koches, executive vice president of Ocwen, acknowledged

Tuesday that the signatures were not all Anderson’s, but that doesn’t mean

they were forged, he said. Certain employees were given authorization

to sign for Anderson on mortgage assignments, which Koches noted

do not need to be notarized.

Still, Ocwen has since stopped allowing other people to sign for

Anderson, Koches said.

Last September, the Ohio Court of Appeals, Second District, Montgomery County

(2010 WL 3451130, 2010-Ohio-4158, lv denied 17 Ohio St.3d 1532 [2011]), affirmed the denial of a foreclosure, sought by plaintiff HSBC, because of numerous irregularities. The Ohio Court, in citing four decisions by this Court [three of the four involved Scott Anderson as assignor] summarized some of this Court’s prior concerns with HSBC and Mr. Anderson, in observing, at * 11:

recent decisions in the State of New York have noted numerous

irregularities in HSBC’s mortgage documentation and corporate

relationships with Ocwen, MERS, and Delta. See, e.g., HSBC Bank

USA, N.A. v Cherry (2007), 18 Misc 3d 1102 (A) [Scott Anderson

assignor] and HSBC Bank USA, N.A. v Yeasmin (2010), 27 Misc 3d

1227 (A) (dismissing HSBC’s requests for orders of reference in

mortgage foreclosure actions, due to HSBC’s failure to provide proper

affidavits). See, also, e.g., HSBC Bank USA, N.A. v Charlevagne (2008),

20 Misc 3d 1128 (A) [Scott Anderson assignor] and HSBC Bank USA,

N.A. v Antrobus (2008), 20 Misc 3d 1127 (A) [Scott Anderson assignor]

(describing “possible incestuous relationship” between HSBC Bank,

Ocwen Loan Servicing, Delta Funding Corporation, and Mortgage

Electronic Registration Systems, Inc., due to the fact that the entities

all share the same office space at 1661 Worthington Road, Suite 100,

West Palm Beach, Florida. HSBC also supplied affidavits in support

of foreclosure from individuals who claimed simultaneously to be

officers of more than one of these corporations.).This Court reviewed Scott Anderson’s signature on the instant MERS to HSBC assignment of the TAHER mortgage and note and using ACRIS compared his signature with that used in assignments in the five prior Scott Anderson assignment foreclosure cases decided by this Court. Similar to the Florida Attorney General’s Economic Crimes Division findings, as reported above in the Kimberly Miller Palm Beach Post article, I also found four variations of Mr. Anderson’s signature in these six assignments. Each signature is actually a variation of Mr. Anderson’s initials, “SA.” The Court concludes that it must be a herculean task for Mr. Anderson to sign “Scott Anderson” or “Scott W. Anderson” in full.

Mr. Anderson’s first signature variation is found in: the January 19, 2007 assignment of the 48 Van Siclen Avenue (Block 3932, Lot 45, County of Kings) mortgage and note from DEUTSCHE BANK NATIONAL TRUST COMPANY AS TRUSTEE TO MTGLQ INVESTORS LP, by Scott W. Anderson as Senor Vice President of OCWEN, attorney-in-fact for DEUTSCHE BANK (Deutsche Bank Nat Trust Co. v Castellanos, 18 Misc 3d 1115 [A] [Sup Ct, Kings County 2007]), recorded on February 7, 2007 at CRFN 2007000073000; and, the June 13, 2007 assignment of the 3570 Canal Avenue (Block 6978, Lot 20, County of Kings) mortgage and note from MERS to HSBC, by Scott Anderson as Vice President of MERS, acting as nominee for DELTA (HSBC Bank USA, N.A. v Cherry, 18 Misc 3d 1102 (A) [Sup Ct, Kings County 2007]), recorded on August 13, 2007 at CRFN 2007000416732. In this signature variation the letter “S” is a cursive bell-shaped curve overlapping with the cursive letter “A.”

The second signature variation used for Mr. Anderson is in the May 1, 2007 assignment of the 572 Riverdale Avenue (Block 3838, Lot 39, County of Kings) mortgage and note from MERS to HSBC, by Scott Anderson as Vice President of MERS, acting as nominee for DELTA (HSBC Bank USA, N.A. v Valentin, 18 Misc 3d 1123 [A] [Sup [*7]Ct, Kings County 2008]) and HSBC Bank USA, N.A. v Valentin, 21 Misc 3d 1124 [A] [Sup Ct, Kings County 2008], affd as modified 72 AD3d 1027 [2010]), recorded on June 13, 2007 at CRFN 2007000306260. These decisions will be referred to as Valentin I and Valentin II. In this signature variation the letter “S” is a cursive circle around a cursive letter “A” with various loops.

The third signature variation used for Mr. Anderson is in the November 30, 2007 assignment of the 680 Decauter Street (Block 1506, Lot 2, County of Kings) mortgage and note from MERS to HSBC, by Scott Anderson as Vice President of MERS, acting as nominee for DELTA (HSBC Bank USA, N.A. v Antrobus, 20 Misc 3d 1127 [A] [Sup Ct, Kings County [2008]), recorded on January 16, 2008 at CRFN 2008000021186. In this signature variation, the initials are illegible. One cursive letter looks almost like the letter “O.” It is a circle sitting in a valley created by something that looks like the cursive letter “M.”

In the fourth signature variation, used for Mr. Anderson in the February 16, 2009 assignment in the instant case, the cursive letter “S,” which is circular with a loop on the lower left side abuts the cursive letter “A” to its right.

Moreover, in HSBC Bank USA, N.A. v Cherry, Mr. Anderson acted both as assignor of the mortgage and note to HSBC and then as servicing agent for assignee HSBC by executing the “affidavit of merit”for a default judgment. Because of this, in Valentin I, I required him to provide me with an affidavit about his employment history. In Valentin II the Court was provided with an affidavit by Mr. Anderson, sworn on March 14, 2008. Mr. Anderson, in his affidavit, admitted he was conflicted. I noted, at * 2, in Valentin II that:

The Court is troubled that Mr. Anderson acted as both assignor

of the instant mortgage loan, and then as the Vice President of Ocwen,

assignee HSBC’s servicing agent. He admits to this conflict, in ¶ 13,

stating that “[w]hen the loan went into default and then foreclosure in

2007, Ocwen, in it capacity as servicer, elected to remove the loan

from the MERS system and transfer title to HSBC.”

The stockholders of HSBC and the noteholders of the Trust [the

owner of the mortgage] probably are not aware that Mr. Anderson,

on behalf of the servicer, Ocwen, claims to have the right to assign

“toxic” nonperforming mortgage loans to them. It could well be that

Ocwen’s transfer of the instant nonperforming loan, as well as others, is

part of what former Federal Reserve Board Chairman Alan Greenspan

referred to in his October 23, 2008 testimony, before the House

Oversight Committee, as “a once in a century credit tsunami.”

Interestingly, the purported signature of Mr. Anderson in the March 14, 2008-Valentin II affidavit is a fifth signature variation. The Court is perplexed that in response to my order for Mr. Anderson to submit an affidavit with respect to his employment, Mr. Anderson was unable to sign either “Scott Anderson” or “Scott W. Anderson.” Instead, there is a fifth variation of scrawled initials. There is a big loop for the cursive letter “S,” which contains within it something that looks like the cursive letter “M” going into lines that look like the cursive letter “V,” with a wiggly line going to the right of the page.

Robosigner Margery Rotundo

In the instant action, Margery Rotundo executed the April 27, 2009 affidavit of merit and amount due. Ms. Rotundo has, in prior foreclosure cases before me, a history of alleging to be the Senior Vice President of various entities, including plaintiff HSBC, Nomura Credit & Capital, Inc. and an unnamed servicing agent for HSBC. In the instant action she claims to be the Senior Vice President of Residential Loss Mitigation of OCWEN, HSBC’s servicing agent.

In HSBC Bank USA, N.A. v Charlevagne (20 Misc 3d 1128 (A) [Sup Ct, Kings County 2008]), one of the cases in which Scott Anderson as Vice President of MERS assigned the mortgage and note to HSBC, I commented about Ms. Rotundo’s self-allegations of multiple employers, at * 1:

The renewed application of plaintiff, HSBC . . . for an order of

reference and related relief in this foreclosure action, in which all

defendants defaulted, for the premises located at 455 Crescent Street,

Brooklyn, New York (Block 4216, Lot 20, County of Kings) is again [*8]

denied without prejudice, with leave to renew upon providing the

Court with a satisfactory explanation to four concerns.

First, the original application for an order of reference and

related relief was denied with leave to renew, in my unpublished

decision and order of November 15, 2007, because the “affidavit of

merit” was not made by a party but by Margery Rotundo, who swore

that [she] was “Senior Vice President Residential Loss Mitigation of

OCWEN LOAN SERVICING, LLC [OCWEN], Attorney in Fact for

HSBC,”and the “Limited Power of Attorney” from HSBC to OCWEN

was defective. In the renewed application, Ms. Rotundo claims in her

January 9, 2008-“affidavit of merit and amount due,” that she “is the

Senior Vice President of Residential Loss Mitigation of HSBC BANK

USA, N.A., AS INDENTURE TRUSTEE FOR THE REGISTERED NOTEHOLDERS OF RENAISSANCE HOME EQUITY LOAN

TRUST 2005-3, RENAISSANCE HOME EQUITY LOAN ASSET-

BACKED NOTES, SERIES 2005-3.” In prior decisions, I found that

Ms. Rotundo swore: on October 5, 2007 to be Senior Vice President

of Loss Mitigation for Nomura Credit & Capital, Inc. (Nomura Credit

& Capital, Inc., 19 Misc 3d 1126 (A) [April 30, 2008]); and, on

December 12, 2007 to be Senior Vice President of an unnamed

servicing agent for HSBC (HSBC Bank USA, NA v Antrobus, 20

Misc 3d 1127 (A) [July 31, 2008]).

The late gossip columnist Hedda Hopper and the late United

States Representative Bella Abzug were famous for wearing many

colorful hats. With all the corporate hats Ms. Rotundo has recently

worn, she might become the contemporary millinery rival to both

Ms. Hopper and Ms. Abzug. The Court needs to know the employment

history of the peripatetic Ms. Rotundo. Did she truly switch employers

or did plaintiff have her sign the “affidavit of merit and amount due”

as its Senior Vice President solely to satisfy the Court?

In my Charlevagne decision and order I denied an order of reference without prejudice and granted leave to plaintiff HSBC to renew its application for an order of reference for the premises by providing the Court with several documents, including, at * 4, “an affidavit from Margery Rotundo describing her employment history for the past three years.” Subsequently, plaintiff HSBC’s counsel in Charlevagne, Steven J. Baum, P.C., never provided me with an affidavit from Margery Rotundo, but filed with the Kings County Clerk, on October 27, 2008, a stipulation of discontinuance and cancellation of the notice of pendency.

Robosigner Christina Carter

Mr. Cassara, plaintiff’s counsel affirmed that “On January 4, 2011 and January 5, 2011, I communicated with the following representative . . . of Plaintiff . . . Christina Carter . . . Manager of Account Management.” This is disingenuous. Ms. Carter is not employed by plaintiff, but by OCWEN. She executed documents as an officer of MERS and as an employee of OCWEN. Ms. Carter’s signature on documents is suspect because of the variations of her signature used.

This Court examined eight recent documents that exhibit three different variations of Christina Carter’s signature. The first signature variation is on her May 24, 2010 application with the Florida Department of State for a notary public commission. In this application she lists as her business address that of OCWEN, “1661 Worthington Road, West Palm Beach, FL 33409.” In her full signature the capital letters “C” in her first and last names are signed differently than in other recent documents reviewed by this Court.

In five other documents reviewed by the Court, Ms. Carter signs her initials with the second letter “C” looking like a cursive letter “L,” with a circular loop on the second letter “C.” Three of these documents are deeds of release to acknowledge mortgage satisfactions, filed with the Clerk of Court for Middlesex County, South District, State of Massachusetts. In the first document, signed on July 2, 2010, Ms. Carter signed as “Account Management, Manager” for OCWEN, for the premises at 158 Algonquin Trail, Ashland, Massachusetts, with the deed of release [*9]recorded on September 9, 2010, at document number 2010 00156681. In the second document, signed on July 7, 2010, Ms. Carter signed as “Account Management, Manager” for US BANK NATIONAL ASSOCIATION, AS TRUSTEE BY ITS ATTORNEY-IN-FACT OCWEN LOAN SERVICING, LLC, for the premises at 30 Kenilworth Street, Malden, Massachusetts, with the deed of release recorded on September 3, 2010, at document number 2010 01542078. In the third Middlesex County, Massachusetts document, signed on July 19, 2010, she signed as “Account Management, Manager” for OCWEN, for the premises at 10 Johnson Farm Road, Lexington, Massachusetts, with the deed of release recorded on September 9, 2010, at document number 2010 00156684. In the fourth document, signed on July 12, 2010, for the assignment of a mortgage for 1201 Pine Sage Circle, West Palm Beach, Florida, Ms. Carter signed as “Account Management, Manager” for NEW CENTURY MORTGAGE CORPORATION BY ITS ATTORNEY-IN-FACT OCWEN LOAN SERVICING, LLC (NEW CENTURY). This mortgage was assigned to DEUTSCHE BANK NATIONAL TRUST COMPANY, AS TRUSTEE FOR IXIS REAL ESTATE CAPITAL TRUST 2005-HE3 MORTGAGE PASS THROUGH CERTIFICATES, SERIES 2005-HE3 (DEUTSCHE BANK) and recorded on August 23, 2010 with the Palm Beach County Clerk at CFN 20100314054. Interestingly, both assignor NEW CENTURY and assignee DEUTSCHE BANK have the same address, c/o OCWEN, “1661 Worthington Road, Suite 100, West Palm Beach, FL 33409.” In the fifth document, Ms. Carter changes corporate hats. She signed, on September 8, 2010, an Oregon assignment of a mortgage deed of trust, for 20673 Honeysuckle Lane, Bend Oregon, as Vice President of MERS “ACTING SOLELY AS NOMINEE FOR CHAPEL MORTGAGE CORPORATION.” The assignment is to DEUTSCHE BANK NATIONAL TRUST COMPANY, AS TRUSTEE FOR IXIS REAL ESTATE CAPITAL TRUST 2006-HE2 MORTGAGE PASS THROUGH CERTIFICATES, SERIES 2006-HE2, whose address is c/o OCWEN, “1661 Worthington Road, Suite 100, West Palm Beach, FL 33409.” This was recorded on September 20, 2010 with the Clerk of Deschutes County, Oregon.

Ms. Carter, in the third variation of her signature, again only uses her initials, but the second letter “C” looks like the cursive letter “C,” not the cursive letter “L” with a circular loop. The Court examined two of these documents. The first document is a mortgage satisfaction, signed on June 15, 2010, and filed with the Clerk of Court for Middlesex County, South District, State of Massachusetts. Ms. Carter signed as “Account Management, Manager” for OCWEN, for the premises at 4 Mellon Road, Billerica, Massachusetts. The deed of release was recorded on July 19, 2010, at document number 2010 00031211. In the second document, a mortgage satisfaction for the premises at 13352 Bedford Meadows Court, Wellington, Florida, Ms. Carter signed on July 22, 2010, as “Account Management, Manager” for “HSBC BANK USA, NATIONAL ASSOCIATION AS TRUSTEE BY ITS ATTORNEY-IN FACT OCWEN LOAN SERVICING, LLC.” The document never states for whom HSBC is the Trustee.

This was recorded on September 10, 2010 with the Palm Beach County Clerk at CFN 20100339935.

Real Property Actions and Proceedings Law (RPAPL) § 1321 allows the Court in a foreclosure action, upon the default of defendant or defendant’s admission of mortgage payment arrears, to appoint a referee “to compute the amount due to the plaintiff.” Plaintiff HSBC’s application for an order of reference is a preliminary step to obtaining a default judgment of foreclosure and sale. (Home Sav. Of Am., F.A. v Gkanios, 230 AD2d 770 [2d Dept 1996]).

However, the instant action must be dismissed because plaintiff HSBC lacks standing to bring this action. MERS lacked the authority to assign the subject TAHER mortgage to HSBC and there is no evidence that MERS physically possessed the TAHER notes. Under the terms of the TAHER consolidation, extension and modification agreement, DELTA, not MERS, is the “Note Holder.” As described above, the consolidation, extension and modification agreement defines the “Note Holder” as the “Lender or anyone who succeeds to Lender’s rights under this Agreement and who is entitled to receive the payments.”

“Standing to sue is critical to the proper functioning of the judicial system. It is a threshold issue. If standing is denied, the pathway to the courthouse is blocked. The plaintiff who has standing, however, may cross the threshold and seek judicial redress.” (Saratoga County Chamber of Commerce, Inc. v Pataki, 100 NY2d 801 812 [2003], cert denied 540 US 1017 [2003]). Professor David Siegel (NY Prac, § 136, at 232 [4d ed]), instructs that:

[i]t is the law’s policy to allow only an aggrieved person to bring a

lawsuit . . . A want of “standing to sue,” in other words, is just another

way of saying that this particular plaintiff is not involved in a genuine

controversy, and a simple syllogism takes us from there to a “jurisdictional” [*10]

dismissal: (1) the courts have jurisdiction only over controversies; (2) a

plaintiff found to lack “standing”is not involved in a controversy; and

(3) the courts therefore have no jurisdiction of the case when such a

plaintiff purports to bring it.

“Standing to sue requires an interest in the claim at issue in the lawsuit that the law will recognize as a sufficient predicate for determining the issue at the litigant’s request.” (Caprer v Nussbaum (36 AD3d 176, 181 [2d Dept 2006]). If a plaintiff lacks standing to sue, the plaintiff may not proceed in the action. (Stark v Goldberg, 297 AD2d 203 [1st Dept 2002]).

The Appellate Division, Second Department recently instructed, with respect to standing in a foreclosure action, in Aurora Loan Services, LLC v Weisblum (___ AD3d ___, 2011 NY Slip Op 04184 [May 17, 2011]), at * 6-7, that:

In order to commence a foreclosure action, the plaintiff must

have a legal or equitable interest in the mortgage ( see Wells Fargo

Bank, N.A. v Marchione, 69 AD3d, 204, 207 [2d Dept 2009]). A

plaintiff has standing where it is both (1) the holder or assignee of

the subject mortgage and (2) the holder or assignee of the underlying

note, either by physical delivery or execution of a written assignment

prior to the commencement of the action with the filing of the complaint

(see Wells Fargo Bank, N.A. v Marchione, 69 AD3d at 207-209; U.S.

Bank v Collymore, 68 AD3d 752, 754 [2d Dept 2009].)

Assignments of mortgages and notes are made by either written instrument or the

assignor physically delivering the mortgage and note to the assignee. “Our courts have repeatedly held that a bond and mortgage may be transferred by delivery without a written instrument of assignment.” (Flyer v Sullivan, 284 AD 697, 699 [1d Dept 1954]).

In the instant action, even if MERS had authority to transfer the mortgage to HSBC, DELTA, not MERS, is the note holder. Therefore, MERS cannot transfer something it never proved it possessed. A “foreclosure of a mortgage may not be brought by one who has no title to it and absent transfer of the debt, the assignment of the mortgage is a nullity [Emphasis added].” (Kluge v Fugazy (145 AD2d 537, 538 [2d Dept 1988]). Moreover, “a mortgage is but an incident to the debt which it is intended to secure . . . the logical conclusion is that a transfer of the mortgage without the debt is a nullity, and no interest is assigned by it. The security cannot be separated from the debt, and exist independently of it. This is the necessary legal conclusion.” (Merritt v Bartholick, 36 NY 44, 45 [1867]. The Appellate Division, First Department, citing Kluge v Fugazy in Katz v East-Ville Realty Co. ( 249 AD2d 243 [1d Dept 1998]), instructed that “[p]laintiff’s attempt to foreclose upon a mortgage in which he had no legal or equitable interest was without foundation in law or fact.” (See U.S. Bank, N.A. v Collymore, 68 AD3d at 754).

MERS had no authority to assign the subject mortgage and note

Scott Anderson for MERS as assignor, did not have specific authority to sign the TAHER mortgage. Under the terms of the consolidation, extension and modification agreement, MERS is “acting solely as nominee for Lender [DELTA].” The alleged power of attorney cited in the Scott Anderson MERS to HSBC assignment, as described [*11]above, is a limited power of attorney from DELTA to OCWEN for the premises located at 14 Harden Street, Brooklyn, New York, not the subject premises. MERS is not mentioned or involved with this limited power of attorney. In both underlying TAHER mortgages MERS was “acting solely as a nominee for Lender,” which is DELTA. The term “nominee” is defined as “[a] person designated to act in place of another, usu. in a very limited way” or “[a] party who holds bare legal title for the benefit of others.” (Black’s Law Dictionary 1076 [8th ed 2004]). “This definition suggests that a nominee possesses few or no legally enforceable rights beyond those of a principal whom the nominee serves.” (Landmark National Bank v Kesler, 289 Kan 528, 538 [2009]). The Supreme Court of Kansas, in Landmark National Bank, 289 Kan at 539, observed that:

The legal status of a nominee, then, depends on the context of

the relationship of the nominee to its principal. Various courts have

interpreted the relationship of MERS and the lender as an agency

relationship. See In re Sheridan, 2009 WL631355, at *4 (Bankr. D.

Idaho, March 12, 2009) (MERS “acts not on its own account. Its

capacity is representative.”); Mortgage Elec. Registrations Systems,

Inc. v Southwest, 2009 Ark. 152 ___, ___SW3d___, 2009 WL 723182

(March 19, 2009) (“MERS, by the terms of the deed of trust, and its

own stated purposes, was the lender’s agent”); La Salle Nat. Bank v

Lamy, 12 Misc 3d 1191 [A], at *2 [Sup Ct, Suffolk County 2006]) . . .

(“A nominee of the owner of a note and mortgage may not effectively

assign the note and mortgage to another for want of an ownership

interest in said note and mortgage by the nominee.”)

The New York Court of Appeals in MERSCORP, Inc. v Romaine (8 NY3d 90 [2006]), explained how MERS acts as the agent of mortgagees, holding at 96:

In 1993, the MERS system was created by several large

participants in the real estate mortgage industry to track ownership

interests in residential mortgages. Mortgage lenders and other entities,

known as MERS members, subscribe to the MERS system and pay

annual fees for the electronic processing and tracking of ownership

and transfers of mortgages. Members contractually agree to appoint

MERS to act as their common agent on all mortgages they register

in the MERS system. [Emphasis added]

Thus, it is clear that MERS’s relationship with its member lenders is that of agent with the lender-principal. This is a fiduciary relationship, resulting from the manifestation of consent by one person to another, allowing the other to act on his behalf, subject to his control and consent. The principal is the one for whom action is to be taken, and the agent is the one who acts.It has been held that the agent, who has a fiduciary relationship with the principal, “is a party who acts on behalf of the principal with the latter’s express, implied, or apparent authority.” (Maurillo v Park Slope U-Haul, 194 AD2d 142, 146 [2d [*12]Dept 1992]). “Agents are bound at all times to exercise the utmost good faith toward their principals. They must act in accordance with the highest and truest principles of morality.” (Elco Shoe Mfrs. v Sisk, 260 NY 100, 103 [1932]). (See Sokoloff v Harriman Estates Development Corp., 96 NY 409 [2001]); Wechsler v Bowman, 285 NY 284 [1941]; Lamdin v Broadway Surface Advertising Corp., 272 NY 133 [1936]). An agent “is prohibited from acting in any manner inconsistent with his agency or trust and is at all times bound to exercise the utmost good faith and loyalty in the performance of his duties.” (Lamdin, at 136).

Thus, in the instant action, MERS, as nominee for DELTA, is DELTA’s agent for limited purposes. It only has those powers given to it and authorized by DELTA, its principal. Plaintiff HSBC failed to submit documents authorizing MERS, as nominee for DELTA, to assign the subject consolidation extension and modification mortgage to plaintiff HSBC. Therefore, MERS lacked authority to assign the TAHER mortgage, making the assignment defective. In Bank of New York v Alderazi (28 Misc 3d 376, 379-380 [Sup Ct, Kings County 2010]), Justice Wayne Saitta instructed that:

A party who claims to be the agent of another bears the burden

of proving the agency relationship by a preponderance of the evidence

(Lippincott v East River Mill & Lumber Co., 79 Misc 559 [1913])

and “[t]he declarations of an alleged agent may not be shown for

the purpose of proving the fact of agency.” (Lexow & Jenkins, P.C. v

Hertz Commercial Leasing Corp., 122 AD2d 25 [2d Dept 1986]; see

also Siegel v Kentucky Fried Chicken of Long Is. 108 AD2d 218 [2d

Dept 1985]; Moore v Leaseway Transp/ Corp., 65 AD2d 697 [1st Dept

1978].) “[T]he acts of a person assuming to be the representative of

another are not competent to prove the agency in the absence of evidence

tending to show the principal’s knowledge of such acts or assent to them.”

(Lexow & Jenkins, P.C. v Hertz Commercial Leasing Corp., 122 AD2d

at 26, quoting 2 NY Jur 2d, Agency and Independent Contractors § 26).

Further, several weeks ago, the Appellate Division, Second Department in Bank

of New York v Silverberg, (___ AD3d ___, 2011 NY Slip Op 05002 [June 7, 2011]), confronted the issue of “whether a party has standing to commence a foreclosure action when that party’s assignor—in this case, Mortgage Electronic Registration Systems, Inc. (hereinafter MERS)—was listed in the underlying mortgage instruments as a nominee and mortgagee for the purpose of recording, but was never the actual holder or assignee of the underlying notes.” The Court held, “[w]e answer this question in the negative.” Silverberg, similar to the instant TAHER matter, deals with the foreclosure of a mortgage with a consolidation, modification and extension agreement. MERS, in the Silverberg case and the instant TAHER action, never had title or possession of the Note and the definition of “Note Holder” is substantially the same in both consolidation, extension and [*13]modification agreements. The Silverberg Court instructed, at * 4-5:

the assignment of the notes was thus beyond MERS’s authority as

nominee or agent of the lender (see Aurora Loan Servs., LLC v

Weisblum, AD3d, 2011 NY Slip Op 04184, *6-7 [2d Dept 2011];

HSBC Bank USA v Squitteri, 29 Misc 3d 1225 [A] [Sup Ct, Kings

County, F. Rivera, J.]; ; LNV Corp. v Madison Real Estate, LLC,

2010 NY Slip Op 33376 [U] [Sup Ct, New York County 2010,

York, J.]; LPP Mtge. Ltd. v Sabine Props., LLC, 2010 NY Slip Op

32367 [U] [Sup Ct, New York County 2010, Madden, J.]; Bank of

NY v Mulligan, 28 Misc 3d 1226 [A] [Sup Ct, Kings County 2010,

Schack, J.]; One West Bank, F.S.B., v Drayton, 29 Misc 3d 1021

[Sup Ct, Kings County 2010, Schack, J.]; Bank of NY v Alderazi,

28 Misc 3d 376, 379-380 [Sup Ct, Kings County 2010, Saitta, J.]

[the “party who claims to be the agent of another bears the burden

of proving the agency relationship by a preponderance of the evidence”];

HSBC Bank USA v Yeasmin, 24 Misc 3d 1239 [A] [Sup Ct, Kings

County 2010, Schack, J.]; HSBC Bank USA, N.A. v Vasquez, 24

Misc 3d 1239 [A], [Sup Ct, Kings County 2009, Schack, J.]; Bank of

NY v Trezza, 14 Misc 3d 1201 [A] [Sup Ct, Suffolk County 2006,

Mayer, J.]; La Salle Bank Natl. Assn. v Lamy, 12 Misc 3d 1191 [A]

[Sup Ct, Suffolk County, 2006, Burke, J.]; Matter of Agard, 444 BR

231 [Bankruptcy Court, ED NY 2011, Grossman, J.]; but see U.S.

Bank N.A. v Flynn, 27 Misc 3d 802 [Sup Ct, Suffolk County 2011,

Whelan, J.]).

Moreover, the Silverberg Court concluded, at * 5, that “because MERS was never the lawful holder or assignee of the notes described and identified in the consolidation agreement, the . . . assignment of mortgage is a nullity, and MERS was without authority to assign the power to foreclose to the plaintiff. Consequently, the plaintiff failed to show that it had standing to foreclose.” Further, Silverberg the Court observed, at * 6, “the law must not yield to expediency and the convenience of lending institutions. Proper procedures must be followed to ensure the reliability of the chain of ownership, to secure the dependable transfer of property, and to assure the enforcement of the rules that govern real property.” [Emphasis added]

Therefore, the instant action is dismissed with prejudice.

The dismissal with prejudice of the instant foreclosure action requires the

cancellation of the notice of pendency. CPLR § 6501 provides that the filing of a notice of pendency against a property is to give constructive notice to any purchaser of real property or encumbrancer against real property of an action that “would affect the title to, or the possession, use or enjoyment of real property, except in a summary proceeding [*14]brought to recover the possession of real property.” The Court of Appeals, in 5308 Realty Corp. v O & Y Equity Corp. (64 NY2d 313, 319 [1984]), commented that “[t]he purpose of the doctrine was to assure that a court retained its ability to effect justice by preserving its power over the property, regardless of whether a purchaser had any notice of the pending suit,” and, at 320, that “the statutory scheme permits a party to effectively retard the alienability of real property without any prior judicial review.”

CPLR § 6514 (a) provides for the mandatory cancellation of a notice of pendency by:

The Court, upon motion of any person aggrieved and upon such

notice as it may require, shall direct any county clerk to cancel

a notice of pendency, if service of a summons has not been completed

within the time limited by section 6512; or if the action has been

settled, discontinued or abated; or if the time to appeal from a final

judgment against the plaintiff has expired; or if enforcement of a

final judgment against the plaintiff has not been stayed pursuant

to section 551. [emphasis added]

The plain meaning of the word “abated,” as used in CPLR § 6514 (a) is the ending of an action. “Abatement” is defined as “the act of eliminating or nullifying.” (Black’s Law Dictionary 3 [7th ed 1999]). “An action which has been abated is dead, and any further enforcement of the cause of action requires the bringing of a new action, provided that a cause of action remains (2A Carmody-Wait 2d § 11.1).” (Nastasi v Natassi, 26 AD3d 32, 40 [2d Dept 2005]). Further, Nastasi at 36, held that the “[c]ancellation of a notice of pendency can be granted in the exercise of the inherent power of the court where its filing fails to comply with CPLR § 6501 (see 5303 Realty Corp. v O & Y Equity Corp., supra at 320-321; Rose v Montt Assets, 250 AD2d 451, 451-452 [1d Dept 1998]; Siegel, NY Prac § 336 [4th ed]).” Thus, the dismissal of the instant complaint must result in the mandatory cancellation of plaintiff HSBC’s notice of pendency against the property “in the exercise of the inherent power of the court.”

In this Court’s November 8, 2010 decision and order, Mr. Cassara and his firm, as counsel for plaintiff HSBC, were put on notice about the new affirmation required to be submitted by plaintiff’s counsel in foreclosure actions, pursuant to Administrative Order 548/10. In foreclosure cases pending on October 20, 2010, such as the TAHER case, the affirmation is required to be filed with the Court when moving for either an order of reference or a judgment of foreclosure and sale or five business days before a scheduled auction. Chief Judge Lippman, according to the Office of Court Administrations’s October 20, 2010 press release, stated that, “[t]his new filing requirement will play a vital role in ensuring that the documents judges rely on will be thoroughly examined, accurate, and error-free before any judge is asked to take the drastic step of foreclosure.”

Plaintiff’s counsel was warned that defects in foreclosure filings “include failure of plaintiffs and their counsel to review documents and files to establish standing and other [*15]foreclosure requisites; filing of notarized affidavits which falsely attest to such review and to other critical facts in the foreclosure process; and robosigning’ of documents by parties and counsel.” Mr. Cassara affirmed “under the penalties of perjury,” on January 6, 2011, to the factual accuracy of the complaint, the supporting documents and notarizations contained therein and that the complaint and papers filed with the Court in the TAHER matter “contain no false statements of fact or law.” Further, plaintiff’s counsel was informed that “[t]he wrongful filing and prosecution of foreclosure proceedings which are discovered to suffer from these defects may be cause

for disciplinary and other sanctions upon participating counsel [Emphasis added].”

However, plaintiff HSBC did not have standing to bring the instant action and its

complaint is replete with false statements. For example, ¶ 1 alleges that HSBC has an office at “1661 Worthington Road, Suite 100, P.O. Box 24737, West Palm Beach, FL 33415.” This is actually OCWEN’s office. OCWEN’s zip code is 33409, not 33415. Also, how big is P.O. Box 24737? Is it big enough to contain an HSBC office? Further, ¶ 6 alleges that HSBC is the owner of the note, which it is not. MERS had no authority to assign the note owned by DELTA to HSBC. MERS was DELTA’s nominee for recording the TAHER-consolidated mortgage but it never possessed the underlying note. (See Bank of New York v Silverberg at * 4-5).

Three robosigners – Scott Anderson, Margery Rotundo and Christina Carter – are involved in this matter. Scott Anderson, who wears many corporate hats and has at least five variations of his initials scrawled on documents filed in this Court, is the alleged assignor of the subject mortgage and note to HSBC, despite lacking authority from DELTA. Both alleged assignor MERS and alleged assignee HSBC have the same address – 1661 Worthington Road, Suite 100, West Palm Beach, Florida 33409. The milliner’s delight Margery Rotundo executed the affidavit of merit for OCWEN. Then, Mr. Cassara relied upon Christina Carter as the representative of HSBC to confirm the accuracy of HSBC’s documents and their notarizations. However, she is not employed by HSBC. Is Mr. Cassara aware of the robosigning history of Mr. Anderson, Ms. Rotundo and Ms. Carter?

Putting aside HSBC’s lack of standing, MERS allegedly assigned the TAHER- consolidated mortgage and note to HSBC 169 days after defendant TAHER allegedly defaulted in her payments. If HSBC has a duty to make money for its stockholders, why is it purchasing nonperforming loans, and then wasting the Court’s time with defective paperwork and the use of robosigners? The Courts have limited resources, even more so in light of the recent cuts in the budget for fiscal year 2012 and the layoff of several hundred court employees by the Office of Court Administration. The Courts cannot allow itself, as Chief Judge Lippman said in OCA’s October 20, 2010 press release, “to stand by idly and be party to what we know is a deeply flawed process, especially when that process involves basic human needs – such as a family home – during this period of economic crisis.” [*16]

Last year, in HSBC Bank USA v Yeasmin, 24 Misc 3d 1239 [A], for a variety of reasons, I denied plaintiff’s renewed motion for an order of reference and dismissed the foreclosure action with prejudice. Plaintiff’s counsel in YeasminYeasmin, at * 8, that Mr. Westmoreland stated: submitted an affidavit by Thomas Westmoreland, Vice President of Loan Documentation for HSBC, in which he admitted to a lack of due diligence by HSBC. I observed in

in his affidavit, in ¶’s 4 – 7 and part of ¶ 10:

4. The secondary mortgage market is, essentially, the buying and

selling of “pools” of mortgages.

5. A mortgage pools is the packaging of numerous mortgage

loans together so that an investor may purchase a significant

number of loans in one transaction.

6. An investigation of each and every loan included in a particular

mortgage pool, however, is not conducted, nor is it feasible.

7. Rather, the fact that a particular mortgage pool may

include loans that are already in default is an ordinary risk

of participating in the secondary market . . .

10. . . . Indeed, the performance of the mortgage pool is the

measure of success, not any one individual loan contained

therein. [Emphasis added]

The Court can only wonder if . . . the dissemination of this

decision will result in Mr. Westmoreland’s affidavit used as evidence

in future stockholder derivative actions against plaintiff HSBC. It can’t

be comforting to investors to know that an officer of a financial

behemoth such as plaintiff HSBC admits that “[a]n investigation of

each and every loan included in a particular mortgage pool, however,

is not conducted, nor is it feasible” and that “the fact that a particular

mortgage pool may include loans that are already in default is an

ordinary risk of participating in the secondary market.”

Therefore, the continuation of this action by plaintiff HSBC, with its false

statements of facts, the use of robosigners, and the disingenuous affirmation of Mr. Cassara, appears to be frivolous. 22 NYCRR § 130-1.1 (a) states that “the Court, in its discretion may impose financial sanctions upon any party or attorney in a civil action or proceeding who engages in frivolous conduct as defined in this Part, which shall be payable as provided in section 130-1.3 of this Subpart.” Further, it states in 22 NYCRR § 130-1.1 (b), that “sanctions may be imposed upon any attorney appearing in the action or upon a partnership, firm or corporation with which the attorney is associated.”

22 NYCRR § 130-1.1(c) states that:

For purposes of this part, conduct is frivolous if: [*17]

(1) it is completely without merit in law and cannot be supported

by a reasonable argument for an extension, modification or

reversal of existing law;

(2) it is undertaken primarily to delay or prolong the resolution of

the litigation, or to harass or maliciously injure another; or

(3) it asserts material factual statements that are false.

It is clear that the instant motion for an order of reference “is completely without merit in law” and “asserts material factual statements that are false.” Further, Mr. Cassara’s January 6, 2011 affirmation, with its false and defective statements may be a cause for sanctions.

Several years before the drafting and implementation of the Part 130 Rules for

costs and sanctions, the Court of Appeals (A.G. Ship Maintenance Corp. v Lezak, 69 NY2d 1, 6 [1986]) observed that “frivolous litigation is so serious a problem affecting the

proper administration of justice, the courts may proscribe such conduct and impose sanctions in this exercise of their rule-making powers, in the absence of legislation to the contrary (see NY Const, art VI, § 30, Judiciary Law § 211 [1] [b] ).”

Part 130 Rules were subsequently created, effective January 1, 1989, to give the

courts an additional remedy to deal with frivolous conduct. These stand beside Appellate Division disciplinary case law against attorneys for abuse of process or malicious prosecution. The Court, in Gordon v Marrone (202 AD2d 104, 110 [2d Dept 1994], lv denied 84 NY2d 813 [1995]), instructed that:

Conduct is frivolous and can be sanctioned under the court rule if

“it is completely without merit . . . and cannot be supported by a

reasonable argument for an extension, modification or reversal of

existing law; or . . . it is undertaken primarily to delay or prolong

the resolution of the litigation, or to harass or maliciously injure

another” (22 NYCRR 130-1.1[c] [1], [2] . . . ).

In Levy v Carol Management Corporation (260 AD2d 27, 33 [1st Dept 1999]) the Court stated that in determining if sanctions are appropriate the Court must look at the broad pattern of conduct by the offending attorneys or parties. Further, “22 NYCRR

130-1.1 allows us to exercise our discretion to impose costs and sanctions on an errant party . . .” Levy at 34, held that “[s]anctions are retributive, in that they punish past conduct. They also are goal oriented, in that they are useful in deterring future frivolous conduct not only by the particular parties, but also by the Bar at large.”

The Court, in Kernisan, M.D. v Taylor (171 AD2d 869 [2d Dept 1991]), noted that the intent of the Part 130 Rules “is to prevent the waste of judicial resources and to deter vexatious litigation and dilatory or malicious litigation tactics (cf. Minister, Elders & Deacons of Refm. Prot. Church of City of New York v 198 Broadway, 76 NY2d 411; see Steiner v Bonhamer, 146 Misc 2d 10) [Emphasis added].” The instant action, with HSBC lacking standing and using robosigners, is “a waste of judicial resources.” This [*18]conduct, as noted in Levy, must be deterred. In Weinstock v Weinstock (253 AD2d 873 [2d Dept 1998]) the Court ordered the maximum sanction of $10,000.00 for an attorney who pursued an appeal “completely without merit,” and holding, at 874, that “[w]e therefore award the maximum authorized amount as a sanction for this conduct (see, 22 NYCRR 130-1.1) calling to mind that frivolous litigation causes a substantial waste of judicial resources to the detriment of those litigants who come to the Court with real grievances [Emphasis added].” Citing Weinstock, the Appellate Division, Second Department, in Bernadette Panzella, P.C. v De Santis (36 AD3d 734 [2d Dept 2007]) affirmed a Supreme Court, Richmond County $2,500.00 sanction, at 736, as “appropriate in view of the plaintiff’s waste of judicial resources [Emphasis added].”

In Navin v Mosquera (30 AD3d 883 [3d Dept 2006]) the Court instructed that when considering if specific conduct is sanctionable as frivolous, “courts are required to

examine whether or not the conduct was continued when its lack of legal or factual basis was apparent [or] should have been apparent’ (22 NYCRR 130-1.1 [c]).” The Court, in Sakow ex rel. Columbia Bagel, Inc. v Columbia Bagel, Inc. (6 Misc 3d 939, 943 [Sup Ct,

New York County 2004]), held that “[i]n assessing whether to award sanctions, the Court must consider whether the attorney adhered to the standards of a reasonable attorney (Principe v Assay Partners, 154 Misc 2d 702 [Sup Ct, NY County 1992]).”

In the instant action, plaintiff HSBC’s President and Chief Executive Officer (CEO) bears a measure of responsibility for plaintiff’s actions, as well as plaintiff’s counsel. In Sakow at 943, the Court observed that “[a]n attorney cannot safely delegate all duties to others.” Irene M. Dorner, President and CEO of HSBC, is HSBC’s “captain of the ship.” She should not only take credit for the fruits of HSBC’s victories but must bear some responsibility for its defeats and mistakes. According to HSBC’s 2010 Form 10-K, dated December 31, 2010, and filed with the U.S. Securities and Exchange Commission on February 28, 2011, at p. 255, “Ms. Dorner’s insight and particular knowledge of HSBC USA’s operations are critical to an effective Board of Directors” and Ms. Dorner “has many years of experience in leadership positions with HSBC and extensive global experience with HSBC, which is highly relevant as we seek to operate our core businesses in support of HSBC’s global strategy.” HSBC needs to have a “global strategy” of filing truthful documents and not wasting the very limited resources of the Courts. For her responsibility she earns a handsome compensation package. According to the 2010 Form 10-k, at pp. 276-277, she earned in 2010 total compensation of $2,306,723. This included, among other things: a base salary of $566,346; a discretionary bonus of $760,417; and, other compensation such as $560 for financial planning and executive tax services; $40,637 for executive travel allowance, $24,195 for housing and furniture allowance, $39,399 for relocation expenses and $3,754 for executive physical and medical expenses.

Therefore, the Court will examine the conduct of plaintiff HSBC and plaintiff’s counsel, in a hearing, pursuant to 22 NYCRR § 130-1.1, to determine if plaintiff HSBC, [*19]by its President and CEO, Irene M. Dorner, and plaintiff’s counsel Frank M. Cassara, Esq. and his firm Shapiro, DiCaro & Barak, LLC, engaged in frivolous conduct, and to allow plaintiff HSBC, by its President and CEO, Irene M. Dorner, and plaintiff’s counsel Frank M. Cassara, Esq. and his firm Shapiro, DiCaro & Barak, LLC a reasonable opportunity to be heard.

Accordingly, it is

ORDERED, that the motion of plaintiff, HSBC BANK USA, N.A., AS INDENTURE TRUSTEE FOR THE REGISTERED NOTEHOLDERS OF RENAISSANCE HOME EQUITY LOAN TRUST 2007-2, for an order of reference for the premises located at 931 Gates Avenue, Brooklyn, New York (Block 1632, Lot 57, County of Kings), is denied with prejudice; and it is further

ORDERED, that because plaintiff, HSBC BANK USA, N.A., AS INDENTURE TRUSTEE FOR THE REGISTERED NOTEHOLDERS OF RENAISSANCE HOME EQUITY LOAN TRUST 2007-2, lacks standing in this foreclosure action, the instant complaint, Index No. 9320/09 is dismissed with prejudice; and it is further

ORDERED, that the Notice of Pendency filed with the Kings County Clerk on April 16, 2009 by plaintiff, HSBC BANK USA, N.A., AS INDENTURE TRUSTEE FOR THE REGISTERED NOTEHOLDERS OF RENAISSANCE HOME EQUITY LOAN TRUST 2007-2, in an action to foreclose a mortgagefor real property located at 931 Gates Avenue, Brooklyn, New York (Block 1632, Lot 57, County of Kings), is cancelled and discharged; and it is further

ORDERED, that it appearing that plaintiff HSBC BANK USA, N.A., AS INDENTURE TRUSTEE FOR THE REGISTERED NOTEHOLDERS OF RENAISSANCE HOME EQUITY LOAN TRUST 2007-2, plaintiff’s counsel Frank M. Cassara, Esq. and his firm Shapiro, DiCaro & Barak, LLC engaged in “frivolous conduct,” as defined in the Rules of the Chief Administrator, 22 NYCRR § 130-1 (c), and that pursuant to the Rules of the Chief Administrator, 22 NYCRR § 130.1.1 (d), “[a]n award of costs or the imposition of sanctions may be made . . . upon the court’s own initiative, after a reasonable opportunity to be heard,” this Court will conduct a hearing affording: plaintiff HSBC BANK USA, N.A., AS INDENTURE TRUSTEE FOR THE REGISTERED NOTEHOLDERS OF RENAISSANCE HOME EQUITY LOAN TRUST 2007-2, by its President and Chief Executive Officer, Irene M. Dorner; plaintiff’s counsel Frank M. Cassara, Esq.; and, his firm Shapiro, DiCaro & Barak, LLC; “a reasonable opportunity to be heard” before me in Part 27, on Friday, July 15, 2011, at 2:30 P.M., in Room 479, 360 Adams Street, Brooklyn, NY 11201; and it is further

ORDERED, that Ronald David Bratt, Esq., my Principal Law Clerk, is directed to serve this order by first-class mail, upon: Irene M. Dorner, President and Chief Executive Officer of plaintiff, HSBC BANK USA, N.A., AS INDENTURE TRUSTEE FOR THE REGISTERED NOTEHOLDERS OF RENAISSANCE HOME EQUITY LOAN TRUST [*20]2007-2, 452 Fifth Avenue, New York, New York 10018; Frank M. Cassara, Esq., Shapiro DiCaro & Barak, LLC, 250 Mile Crossing Boulevard, Suite One, Rochester, New York 14624; and, Shapiro DiCaro & Barak, LLC, 250 Mile Crossing Boulevard, Suite One, Rochester, New York 14624.

This constitutes the Decision and Order of the Court.

ENTER

___________________________

HON. ARTHUR M. SCHACKJ. S. C.

[ipaper docId=59410573 access_key=key-cs4bqg6pw7e5l15r2he height=600 width=600 /]

Scott Anderson Signature Variance