Why they should be FORCED.

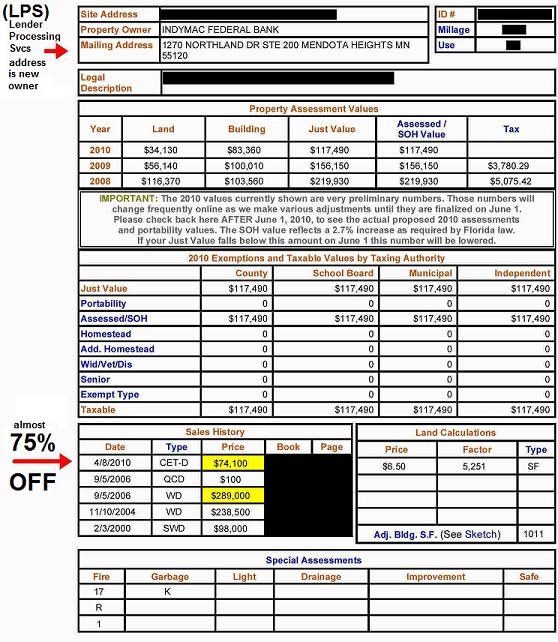

Take this home for example. It was originally sold for $289,000.

Prior to Final Judgment, property had two (2) assignments of mortgage for two entities same robo-signer for both via MERS.

At auction it was sold for a MAJOR discount at approx. 75% off. to Indymac via LPS Minnesota address in 2010. We know Indymac has been shut down way before this time.

Why couldn’t they work a deal like this when this person whom I personally know tried over and over to get a modification AT THE TIME?

They had a good job then and still have a good job today.

So why do they not want to work with the borrowers and reduce the principal to reflect today’s REAL and TRUE appraisal of the property?

Make sure you follow the transactions to understand what happened and why it makes no sense where this goes.

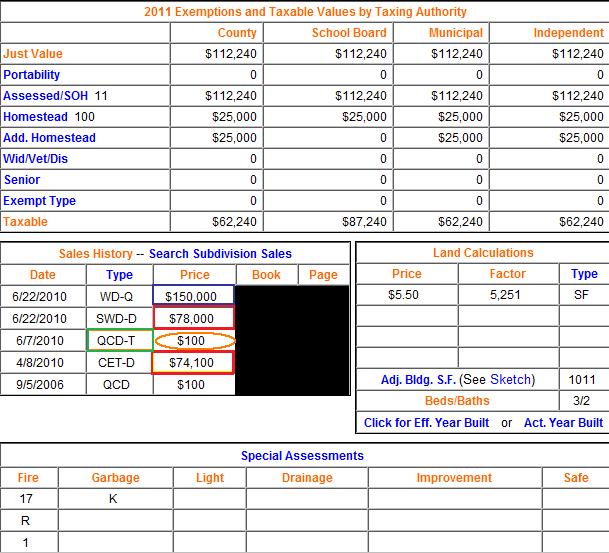

Now Here comes more funny business:

Still following?

- Property was Quit Claimed/Transferred To Freddie Mac for $100.00 (prepared by David Stern) but consideration shows only $10.00.

- Property then sold for $3900.00 more 13 days later $78,000

- SAME day flipped for $150,000

- Previous records are all gone [compare both images]

Don’t forget…

IS LPS’s Aptitude Solutions Software In Your County Courts & Land Records???

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Principal Reduction is key solution but, if we are fighting for the lenders to follow the law, how can we then propose to violate the law to make principal reduction happen. I understand that if the loan is actually owned by the servicer in question then fine, but, if the loan is securitized, then you would have to violate the contract rights of those investors that invested in that loan. Those investors could well be teachers in a pension in a midwest state? Have to find a better way to make it available.